Refinish Paint Market Outlook:

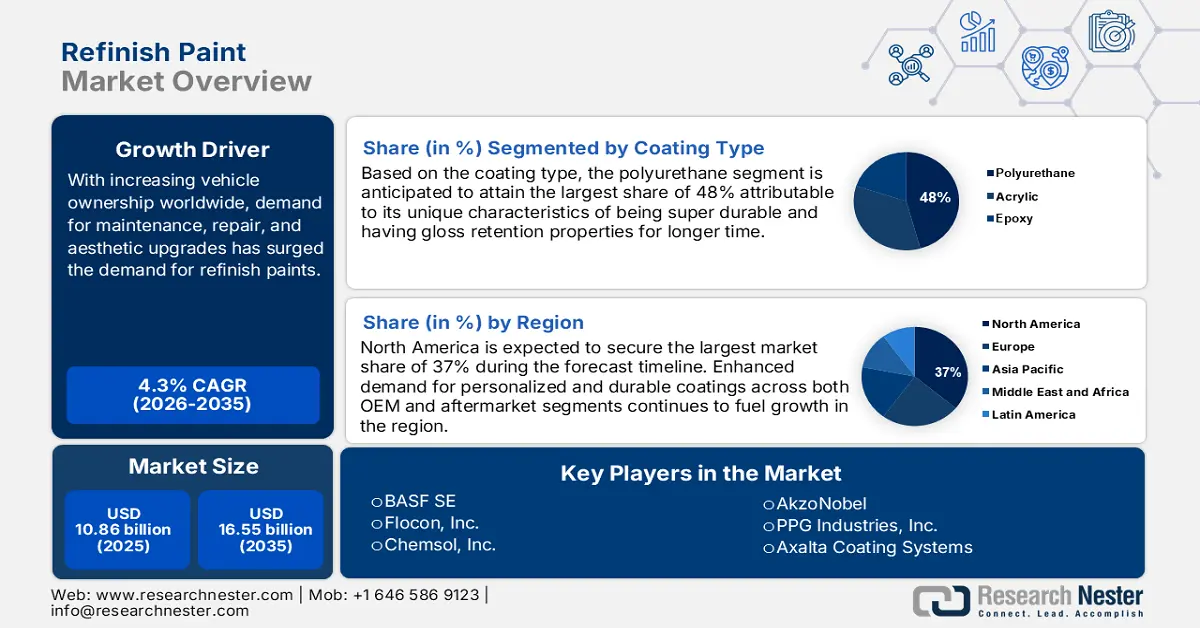

Refinish Paint Market size was over USD 10.86 billion in 2025 and is projected to reach USD 16.55 billion by 2035, witnessing around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of refinish paint is evaluated at USD 11.28 billion.

The growing number of vehicle owners is accelerating the growth of the market. Vehicles are subjected to a variety of external elements over time, including sunlight, rain, snow, and road debris, which can cause surface damage, paint fading, and chipping. Because of this wear and tear, the need for high-quality refinish coatings rises as car owners try to preserve the value and aesthetic appeal of their assets. Another motivating aspect is the desire for personalization and modification among car owners. A growing demand exists for automobiles that allow people to show their unique style and stand out from the crowd.

Furthermore, advances in vehicle paint technology have resulted in coatings that are more easily maintained and cleaned. Modern paint compositions are less likely to fade, spot, or stain, so frequent cleaning procedures will make it easier to maintain your car's flawless appearance. Therefore, these factors are accelerating the market growth.

Key Refinish Paint Market Insights Summary:

Regional Highlights:

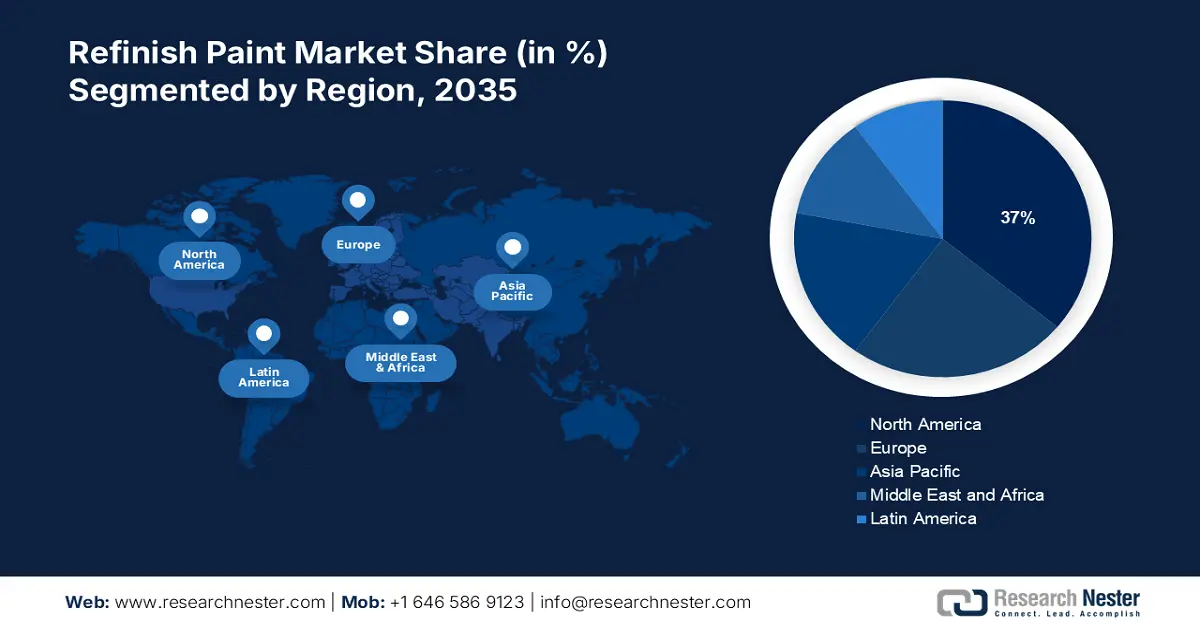

- North America refinish paint market will secure over 37% share by 2035, driven by the region’s large car industry and rising demand for eco-friendly coatings.

- Asia Pacific market will account for 26% share by 2035, attributed to rapid vehicle growth and infrastructure upgrades in the region.

Segment Insights:

- The polyurethane segment in the refinish paint market is set for substantial growth through 2035, fueled by superior durability and environmental benefits of polyurethane paints.

- The automotive segment in the refinish paint market is projected to achieve a 40% share by 2035, attributed to consistent demand for vehicle repair and smart coating technology.

Key Growth Trends:

- Rising Number of Accidents and Collisions

- Growing Demand for Customization and Aesthetic Preferences in the Vehicles

Major Challenges:

- Increased Competition Among Manufacturers may Hinder the Growth of the Market.

- Toxic Materials in Some of the Refinish Pants Available in the Market may Hamper the Growth of the Market.

Key Players: PPG Industries Inc., BASF SE, Axalta Coating Systems, AkzoNobel, Sherwin-Williams Company, RPM International Inc, Axalta Coating Systems Ltd., Cotronics Corporation, Chemsol, inc., Flocon, Inc.

Global Refinish Paint Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.86 billion

- 2026 Market Size: USD 11.28 billion

- Projected Market Size: USD 16.55 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Refinish Paint Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Number of Accidents and Collisions - According to a survey, 1.35 million people worldwide lose their lives while driving every year. Almost 3,700 individuals worldwide lose their lives in crashes involving automobiles, buses, motorbikes, bicycles, lorries, or pedestrians every day. Therefore, the growing number of accidents worldwide is expanding the market. Refinish paint, also referred to as touch-up paint, is a remedy for the exterior coating of cars that need to be fixed or repainted in response to a variety of complex situations brought on by accident damage or years of aging (such as coating cracking, discoloration, loss of gloss, yellowing, etc.).

-

Growing Demand for Customization and Aesthetic Preferences in the Vehicles - Automotive refinish paint ensures that repaired areas blend in smoothly with the rest of the car by enabling a faultless finish. The vehicle's original appearance is restored, and its overall aesthetic appeal is enhanced, due to the excellent shine and color match provided by this premium paint. Manufacturers of refinish paint provide a large selection of colors, finishes, and effects so that consumers can customize their cars. Car owners and enthusiasts can create a distinctive vehicle that stands out on the road by using automotive refinish paint to obtain their chosen look, whether it's a metallic finish, pearl effect, or matte appearance. Therefore, the growing trend toward aesthetics and customization is bolstering the refinish paint market growth.

- Growing Shift Towards Eco-friendly and Low-VOC (Volatile Organic Compounds) Paint Products - New environmentally friendly coatings that are made with low volatile organic compounds (VOCs) are being introduced in line with stricter laws and a growing public awareness of environmental issues. These coatings greatly limit dangerous material emissions, which improves air quality and lessens environmental impact. Businesses and manufacturers that put an emphasis on environmentally friendly solutions present themselves as ethical and ecologically aware, which appeals to regulators and customers alike. Customers and stakeholders will be more likely to trust the industry as a result of this dedication to sustainability, which also improves its reputation.

Challenges

-

Supply Chain Disruptions - The market for refinish paint was impacted by the COVID-19 outbreak in two ways. Lockdowns and lower vehicle usage, on the one hand, caused a decline in demand for cosmetic repairs and refinishing services, which had a negative impact on the industry. Challenges were further compounded by supply chain interruptions and economic instability. Therefore, this factor may impede the growth of market.

-

Increased Competition Among Manufacturers may Hinder the Growth of the Market.

- Toxic Materials in Some of the Refinish Pants Available in the Market may Hamper the Growth of the Market.

Refinish Paint Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 10.86 billion |

|

Forecast Year Market Size (2035) |

USD 16.55 billion |

|

Regional Scope |

|

Refinish Paint Market Segmentation:

Coating Type Segment Analysis

Polyurethane segment in the refinish paint market is expected to hold the largest share of 48% during the forecast period. The growth can be attributed to their superior durability and gloss retention properties, making them a preferred choice for automotive refinishing. Paints made of polyurethane are known for their extraordinary durability. In contrast to conventional acrylic or enamel paints, polyurethane creates a strong, weatherproof barrier surrounding your car that can endure UV radiation, rain, and extremely hot or cold conditions. This resilience results in a finish that lasts longer and keeps its shine and color integrity over time, thereby lowering the frequency of touch-ups or repaints. Polyurethane is a crucial component of automotive paints and coatings technology, which are used by many of the world's top automakers. Polyurethane paints provide the automobile sector with an environmentally friendly alternative in an era that is focused on sustainability and minimizing environmental effect. Polyurethane paints, in contrast to conventional solvent-based paints, are water-based and release fewer volatile organic compounds (VOCs) when applied.

End-use Segment Analysis

Automotive segment in the refinish paint market is expected to hold a share of 40% during the forecast period. The segment is driving due to the consistently high demand for vehicle repair and customization. The majority of automobiles on the road are passenger cars, and as such, they are exposed to a number of outside variables that can cause wear and tear, including weathering, accidents, and regular use. The growing number of passenger cars is also accelerating the growth of the market. For instance, almost 62 million passenger automobiles were produced globally in 2022. Also, a new and emerging technology that has the potential to completely transform the auto industry is called smart coatings. These coatings have the ability to change color, clean themselves, and shield vehicles from harm, among other interactions with their environment.

Our in-depth analysis of the global market includes the following segments:

|

Coating Type |

|

|

Product Type |

|

|

Application |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Refinish Paint Market Regional Analysis:

North American Market Insights

North American refinish paint market is poised to hold a share of 37% during the forecast period. The North American market is highly significant due to its large car industry, high rate of vehicle ownership, and well-established network of collision centers and auto repair shops. For instance, in the United States, there were over 282 million registered automobiles as of 2021. Just 4.3 million of these were owned by the government. The need for refinish paint products in the nation is also fueled by a growing trend toward bespoke paint jobs and a preference for eco-friendly coatings. Tight environmental laws also encourage the use of waterborne and low-VOC coatings. Continuous technical breakthroughs, strong infrastructure, and a competitive environment with the presence of significant global manufacturers and suppliers all contribute to the U.S. market's supremacy.

APAC Market Insights

Refinish paint market in Asia Pacific is poised to hold a share of 26% by the end of 2035. Due to a significant rise in the number of cars in the area in recent years, Asia Pacific is predicted to develop at the fastest rate and have the highest share of the market. The need for car refinishes products is further increased by the developing countries' ongoing efforts to upgrade their road infrastructure. Also, increase in disposable incomes and urbanization is bolstering the growth of market.

Refinish Paint Market Players:

- PPG Industries Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Axalta Coating Systems

- AkzoNobel

- Sherwin-Williams Company

- RPM International Inc

- Axalta Coating Systems Ltd.

- Cotronics Corporation

- Chemsol, inc.

- Flocon, Inc.

Recent Developments

- October 2023 - PPG Urethane Low-Gloss Protective Coating The premium, low-gloss urethane protective coating GLADIATORTM XC Matte Extreme coating is being introduced by PPG's SEM products company. It can be used in a variety of industries and applications, such as automotive, light industrial, marine, RVs, emergency vehicles, and recreational equipment.

- December 2022 - China saw the release of BASF's ColorBrite® Airspace Blue ReSource basecoat, which was accredited by REDcert² via a biomass balancing methodology. Since their formal launch in Europe in May of this year, BASF's biomass balancing car OEM coatings have not before been offered in Asia. A customer in China has received the first batch of ColorBrite® Airspace Blue ReSource basecoat. The product's carbon footprint can be reduced by about 20% with this basecoat product. A third-party external sustainability consultant evaluates the savings figure.

- Report ID: 5965

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Refinish Paint Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.