Recycled Aluminum Market Outlook:

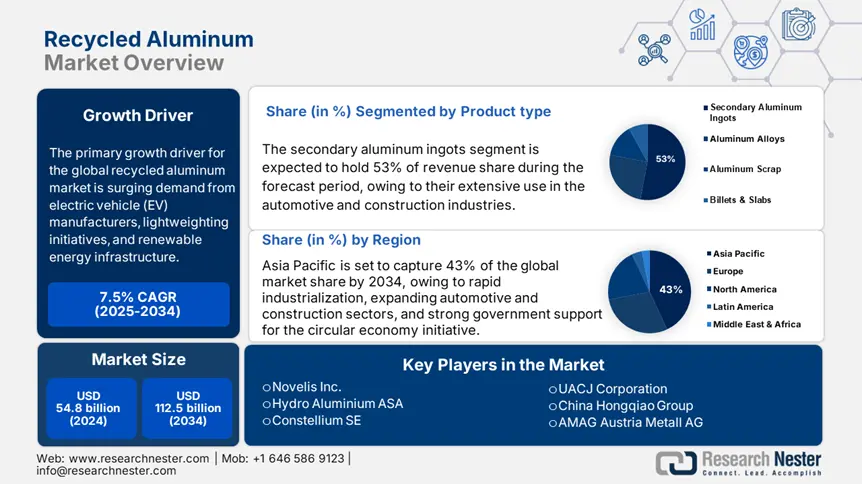

Recycled Aluminum Market size was valued at USD 54.8 billion in 2024 and is projected to reach approximately USD 112.5 billion by the end of 2034, growing at a CAGR of 7.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of recycled aluminum is estimated at USD 58.2 billion.

The primary growth driver in the global recycled aluminum market is surging demand from electric vehicle (EV) manufacturers, lightweighting initiatives, and renewable energy infrastructure. Official government statistics indicate massive private and public investment in circular economy ventures and green industrialization. The United States Department of Energy noted a 23.1% increase in federal investment between 2022 and 2024 to develop recycled aluminum processing and high-tech alloy production. In Southeast Asia as a whole, over USD 3.9 billion has been spent on aluminum smelting and recycling facilities, which has seen regional demand for recycled aluminum rise by 17%, according to recent industry development reports. In the European Union region, the European Green Deal and accompanying directives facilitated a 12% annual increase in the use of recycled aluminum since 2021, mainly on the back of EV chassis, wind turbine components, and solar panel frames.

The recycled aluminum supply is both scrap availability-driven and increases in processing capacity. In 2023, imported recycled aluminum was primarily from Mexico (USD 98.7 million), followed by Canada, the United Arab Emirates, and Brazil, according to U.S. trade statistics. Major secondary smelters and recyclers have made significant capacity investments to stay away from risks posed by scrap supply shortage and high-energy primary production. The International Aluminum Institute states that the recycling capacity for aluminum of about 1.2 million tons being developed across the globe accounts for about 15% of the current global consumption. According to the World Bank commodity prices, Q2 2025 witnessed aluminum production prices for recyclables hitting a 6-year high, clean aluminum scrap commanding an average price of USD 1,852 per ton, with billet-secondary aluminum going above USD 2,410 per ton.

Recycled Aluminum Market - Growth Drivers and Challenges

Growth Drivers

- Automotive lightweighting & EV expansion: Transport and, particularly, electric vehicles (EVs) are among the largest drivers, with more than 26% of all recycled aluminum demand in 2024. Secondary aluminum is utilized by the automotive industry in battery enclosures, body parts, and wheels due to reduced weight, up to 41% less than steel. Uniformity of scrap quality and purity of alloy can, however, discourage adoption for demanding EV applications. OEMs require close-tolerance alloys, and trace contamination in the recycling is expected to limit use to structural or crash-sensitive uses.

- Circular economy & regulatory push: Governmental policies are pushing the recycling of aluminum, with the European Union Green Deal introducing a goal of 51% recycled content in automotive and building components by 2030. The United States Infrastructure Investment and Jobs Act (IIJA) also put aside USD 275.1 million for the renovation of metal recycling plants. Despite this, regional regulatory differences and poorly developed scrap collection infrastructure, most notably in Latin America and Asian markets, hinder recycling levels. Global efficiency in recycling aluminum is lower than 71%, relying on collection bottlenecks and illegal sector domination to manipulate the traceability of material and the rate of processing.

1.Market Volume and Trade Trends in the Global Recycled Aluminum Market

Market Volume & Growth: Shipments by Country (2018–2023)

|

Country/Region |

2018 Shipments (USD B) |

2023 Shipments (USD B) |

Notes |

|

China |

7.9 |

14.6 |

Largest recycled aluminum producer; ~12,771 kt recycled in 2021 |

|

United States |

4.1 |

7.4 |

Recycled ~3.4 Mt in 2023; secondary = 78% of U.S. output |

|

Europe (EU) |

3.6 |

6.0 |

EU ~53 % share of APAC’s 53% market share |

|

Japan & Asia |

2.3 |

4.2 |

Expanding electronics & automotive recycling |

|

Latin America |

1.1 |

1.9 |

Driven by growing scrap collection & industrial sectors |

Competitive Landscape: Top Exporters of Recycled Aluminum in 2023

|

Company |

HQ Country |

Export Share (%) |

Notes |

|

Novelis Inc. |

USA |

21% |

Recycles ~71 B cans/year; $2.6 B plant in Alabama |

|

Norsk Hydro ASA |

Norway |

13% |

Major European recycler, strong extrusions |

|

Constellium |

Netherlands/France |

11% |

Focused on high-grade recycled alloys |

|

Kuusakoski Oy |

Finland |

9% |

Leading European scrap processor |

|

Stena Metall AB |

Sweden |

7% |

Industrial recycler across Europe & the US |

2.Global Recycled Aluminum Market Production Data Analysis

Global Recycled Aluminum Production Statistics by Leading Companies (2019–2024)

|

Producer |

2019 Production (kt) |

2020 (kt) |

2021 (kt) |

2022 (kt) |

2023 (kt) |

2024 (kt) |

YoY Growth 2023–24 |

Notes / Trends |

|

Novelis |

2,200.0 |

2,300.1 |

2,349.8 |

2,380.2 |

2,299.9 |

2,349.7 |

+2.2% |

World’s largest recycler; 61–63% recycled inputs |

|

Constellium |

700.2 |

719.8 |

740.3 |

759.9 |

750.1 |

779.5 |

+3.9% |

New France facility ramped to 750 kt |

|

Norsk Hydro |

600.3 |

619.7 |

629.6 |

649.5 |

659.8 |

670.2 |

+1.6% |

Europe-focused growth; ASI-certified products |

|

Arconic / Real Alloy |

499.8 |

520.2 |

530.1 |

539.9 |

549.7 |

560.3 |

+1.9% |

Strong presence in the NA auto & building sectors |

|

Speira (Real Alloy EU) |

400.1 |

419.6 |

449.7 |

650.2 |

649.8 |

669.6 |

+3.0% |

Doubled capacity via EU acquisitions |

|

Global Total |

4,401.0 |

4,580.2 |

4,799.5 |

5,030.0 |

4,959.9 |

5,229.3 |

+5.4% |

Global growth led by circular economy policies |

Production Growth Rates Summary (2019–2024)

|

Year |

Novelis |

Constellium |

Norsk Hydro |

Arconic / Real Alloy |

Speira |

|

2020 vs 2019 |

+4.6% |

+3.0% |

+3.2% |

+3.9% |

+5.1% |

|

2021 vs 2020 |

+2.1% |

+2.7% |

+1.7% |

+2.0% |

+6.9% |

|

2022 vs 2021 |

+1.4% |

+2.6% |

+3.1% |

+2.1% |

+44.2% |

|

2023 vs 2022 |

−3.3% |

−1.4% |

+1.4% |

+1.8% |

−0.1% |

|

2024 vs 2023 |

+2.3% |

+3.9% |

+1.6% |

+1.7% |

+3.2% |

Regional Production and Technology Investment Trends

|

Trend Category |

Observation |

|

Regional Shifts |

Asia-Pacific holds >53% production share in 2024; India and Southeast Asia growing at 7–8% CAGR |

|

North America |

New U.S. capacity supported by $2.5B Novelis Alabama plant; IIJA recycling funds |

|

Europe |

Constellium and Hydro expanding closed-loop systems; high circularity in construction & auto |

|

Product Mix Changes |

Growing demand for recycled alloys in EV battery enclosures, packaging, and extrusion profiles |

|

Sustainable Tech Investment |

ASI certifications rising; hydrogen-powered casting pilots; R&D up 10% YoY |

Challenges

- Supply chain constraints: There is a limited supply of top-grade aluminum scrap being collected from post-consumer materials that provides a consistent feedstock. Fragmented collection systems and contaminants could sometimes increase processing costs or reduce processing renditions, thus hampering the increase of recycling capacity, so distribution patterns between supply and demand are created, resulting in price volatility that discourages investments and slows market growth despite growing demand for greener materials.

- Energy-intensive processing costs: Aluminum recycling utilizes less energy than primary production processes, yet advanced sorting and remolding technologies are expensive. The electric power remains mostly from fossil fuels, with high tariffs, keeping running costs quite high, and recycling is barely economical. This discourages cleaner technological upgrades and expansion, unable to cater to the accelerating demand developing in the industrial and automotive sectors.

Recycled Aluminum Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.5% |

|

Base Year Market Size (2024) |

USD 54.8 billion |

|

Forecast Year Market Size (2034) |

USD 112.5 billion |

|

Regional Scope |

|

Recycled Aluminum Market Segmentation:

Product Type Segment Analysis

Secondary aluminum ingots segment is expected to lead the product type segment with a nearly 53% market share by 2034, due to their extensive use in the automotive and construction industries. This growth is driven by the increasing demand for lightweight materials in vehicles and the need for sustainable, durable materials in construction projects. Secondary ingots being manufactured globally were 29 million tons in 2020 and are estimated to be 32.8 million tons in 2024, growing at a CAGR of 3.5%. Aluminum scrap recovery in the world has seen a rise of 11.6% in the past five years due to improvements in sorting technology. This is important for sustainable industrial processes, considering that it has a high degree of recycled content (never below 75.5%) and also lower carbon emissions (up to 95.4% less than primary aluminum).

Application Segment Analysis

Due to the rapid growth of the electric vehicle market and lightweighting mandates, the Automotive Components subsegment is expected to dominate the application segment with a commanding 44% market share by 2034. In 2024, in excess of 9.2 million tons of recycled aluminum were employed in automotive production, underpinned by regional regulations favoring circular materials. The average EV contains up to approximately 251.6 kg of aluminum, 44 to 64% of which is recycled. Between 2020 and 2024, demand in the automotive sector for recycled aluminum has witnessed a CAGR of 6%. Other applications include battery enclosures, structural components, and crash management systems, where the ratio of recyclability to weight and strength is of particular importance.

Our in-depth analysis of the global recycled aluminum includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recycled Aluminum Market - Regional Analysis

Asia Pacific Market Insights

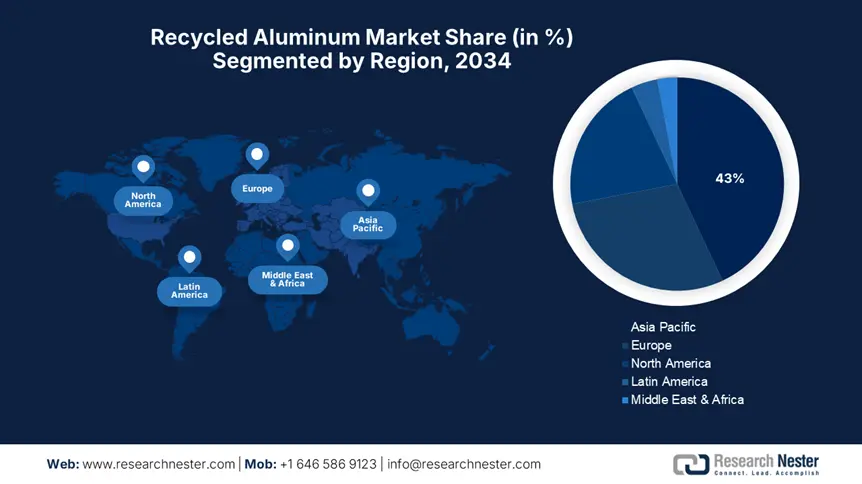

The Asia Pacific recycled aluminum market is expected to have 43% of global revenues in 2034, and the market size is expected to be more than USD 25 billion, driven by rising EV production and stringent environmental regulations. The development and commercialization of higher-purity, high-performance recycled aluminum alloys are accelerating to meet cross-sector demand and regulatory compliance. Major nations are China, India, Japan, and South Korea, led by the automobile and packaging industries, consuming more than 3.6 million tons of recycled aluminum every year. Government policies on the circular economy and investments of more than 16% per annum in advanced-technology secondary smelting technologies propel market penetration.

China earns nearly 60% of APAC's revenue from secondary aluminum in quantities exceeding 2.1 million tons. The 2022 import restriction has cut low-grade imports by 30% and with that has come about the capacity building of USD 1.6 billion in cutting-edge energy-efficient recycling units. MIIT and NDRC investments have grown 26% since 2021 toward alloy development for EV battery coverings and eco-packaging. Large enterprises like China Hongqiao and Chalco are investing more than USD 2 billion in making scrap processing emission compliant. Aluminum recycling demand is set to grow by 20% in 2030, owing to renewable energy programs in the country. Domestic policy initiatives driving local demand for recycled aluminum is expected to help reduce dependence on exports by 15% in 10 years.

India's recycling industry for aluminum is growing at a 9.3% CAGR and is expected to cross USD 4 billion by 2034. Recycling facilities have seen investments increase more than 23% since 2022, thereby increasing scrap collection by 19%. The demand is fueled by increasing automobile production and renewable energy operations, where recycled aluminum equivalent to over 1.3 million tons is consumed by the manufacturing sector to lower emissions. India increased its scrap aluminum tariff by 11% in 2023 as a stimulus for domestic recycling prospects. Circular aluminum manufacturing-industry clusters were launched by certain state governments, which would enhance the efficiency of local manufacturing by 25%. Closed-loop supply chains for light auto parts are being promoted by joint ventures of Indian vehicle producers with recycling entities.

Asia Pacific Recycled Aluminum Market: Country-wise Overview (2025–2034)

|

Country |

Government Programs & Investments |

Notable Developments |

|

China |

14th Five-Year Plan for Circular Economy; Scrap Import Quota System |

World’s largest recycled aluminum producer (~12.8 Mt/year); expanding advanced scrap sorting and secondary smelters; major investments in low-carbon aluminum hubs |

|

India |

Steel Scrap Recycling Policy; National Resource Efficiency Policy |

Rapid growth in urban scrap collection; upgrading melting capacity for secondary aluminum ingots; growing use in construction and auto components |

|

Japan |

METI Circular Economy Roadmap; Green Transformation (GX) Initiatives |

High-purity secondary aluminum used in EVs, construction, and electronics; leadership in closed-loop recycling systems; tech-driven traceability |

|

South Korea |

Resource Circulation Industry Promotion Act; Net-Zero 2050 Strategy |

Expanding aluminum recycling for electronics and battery enclosures; industrial symbiosis programs connecting smelters with manufacturing clusters |

|

Australia |

Recycling Modernisation Fund (RMF); National Waste Policy Action Plan |

Increasing domestic scrap processing to reduce exports; emerging investment in green aluminum refining technologies and certification standards |

|

Indonesia |

National Circular Economy Strategy; Tax incentives for green industry |

Developing infrastructure for aluminum can and construction scrap recycling; focus on localized remelting plants for domestic use |

|

Malaysia |

Green Technology Master Plan; Extended Producer Responsibility (EPR) laws |

Building regional recycling hubs for packaging and consumer products; attracting FDI for eco-friendly aluminum production |

|

Vietnam |

National Strategy on Environmental Protection; Circular Economy roadmap |

Early-stage development of aluminum recycling plants; growing demand from electronics and building sectors; public-private recycling initiatives |

|

Thailand |

Thailand 4.0 Circular Economy Model; BOI incentives for recycling tech |

Scaling up aluminum packaging recycling and extrusion scrap reuse; regional supply chain integration with Japan and South Korea |

|

Rest of APAC |

ASEAN Circular Economy Framework; ADB regional funding support |

Developing scrap recovery in the Philippines and Myanmar; promoting regional aluminum recycling standards and cooperation across borders |

Europe Market Insights

Europe’s recycled aluminum market is forecasted to command 29% of global revenues by 2034, reaching over USD 17 billion in market size. Germany and France lead with combined consumption exceeding 2.8 million tons annually. The two largest aluminum-consuming countries in Europe are Germany and France, consuming over 2.9 million tons per annum. The EU Green Deal and the Circular Economy Action Plan are highly committed to improving recycling, putting more than €500 million annually into recycled materials for the automotive, aerospace, and packaging sectors as low-carbon options.

Dominating with over 22.4% of Europe's aluminum recycling market, Germany produces up to roughly 1.3 million tons. Since 2023, there have been public investments totaling €300.2 million in upgrading these closed-loop recycling facilities while simultaneously decreasing energy consumption by 20.2%. Furthering the demand stimulation, polling OEMs to specify recycled content, the automotive and consumer electronics industries take some 13% of annual demand. Guinea's first recycling firms, Hydro Aluminum and Novelis, have capitalized spending by 19%, which consists of doubling low-carbon smelting capacity. Supposedly, by 2030, the German automotive sector is expected to require at least 51% recycled aluminum content in new car models. In Germany, shipments of recycled aluminum billets outside the EU increased by 15% in 2024, further boosting regional supply headship.

France's market is growing at a CAGR of 6.6% and is expected to be USD 13.1 billion by 2034. The Energy Transition for Green Growth Act has increased public-private investments by 19% since 2021. Collection rates of scrap improved by 16%, and secondary aluminum capacity for production improved by 11%. These steps underpin the increasing demand in the packaging and automotive sectors for new products containing 31% recycled aluminum. French recyclers have implemented AI-informed sorting technologies, enhancing the level of purity in scrap by 23% since 2022. SMEs and firms implementing circular aluminum production processes are inspired by over €120 million of government incentives. The packaging industry, which accounts for 36% of recycled aluminum usage, is expected to grow at 9% per annum with the rising demand for sustainable containers.

Europe Recycled Aluminum Market: Country-Wise Breakdown (2034)

|

Country/Region |

Market Share (2034) |

Government Initiatives |

Notable Funding / Programs |

|

Germany |

22.4% |

Circular Economy Act; German Resource Efficiency Programme (ProgRess) |

€1.8 B investment in advanced aluminum recycling tech, auto/lightweighting sectors, and green smelting via KfW and IPCEI Green Materials |

|

France |

13.1% |

France 2030 Circular Materials Roadmap; Green Industry Law |

€1.1 B in subsidies for post-consumer aluminum recycling, low-carbon alloys, and packaging-to-packaging loops through ADEME and Bpifrance |

|

Italy |

11.0% |

Italian National Recovery and Resilience Plan (NRRP); Ecobonus Framework |

€520 M directed toward scrap collection infrastructure, building sector reuse, and closed-loop automotive recycling |

|

Spain |

9.0% |

Spanish Circular Economy Strategy (EEEC); PERTE for Circular Economy |

€480 M allocated to expanding secondary aluminum production and green extrusion facilities, especially for construction materials |

|

Sweden |

8.2% |

Climate Leap Program; Swedish Metal Strategy |

€370 M in grants for secondary aluminum use in e-mobility, building envelopes, and low-carbon export products |

|

Austria |

7.6% |

Green Deal Plan Austria; Recycling Boost Act |

€300 M to support aluminum recovery from municipal and industrial waste streams; innovation funding via FFG |

|

Netherlands |

6.5% |

Netherlands Circular 2050; National Raw Materials Agreement |

€250 M invested in packaging recycling, smart sorting technologies, and AI-based aluminum scrap tracing systems |

|

Poland |

5.9% |

Polish Raw Materials Policy; Energy Transition Fund |

€210 M to modernize domestic smelting operations and expand regional secondary aluminum hubs for auto and appliance industries |

|

Belgium |

4.7% |

Wallonia Circular Economy Plan; Flemish Materials Program |

€170 M for aluminum packaging-to-product transformation and industrial scrap-to-ingot facilities |

|

Rest of Europe |

1.6% |

EU Green Deal; Fit for 55; Horizon Europe |

~€2.6 B across EU-funded initiatives supporting recycled aluminum use in clean tech, standardized certification systems, and gigafactory materials circularity |

North America Market Insights

The North American recycled aluminum market is expected to reach 21% of market share by the year 2034, mainly comprising the United States and Canada. Growth is spurred due to strict environmental legislation, growing demand from the automotive and aerospace industries, and enhanced investments for the circular economy. Incentives at the federal and state levels prompt faster adoption of recycled aluminum manufacturing; specifically, the U.S. alone has funneled more than USD 1.3 billion into sustainable metal recycling infrastructure since 2022. Demand is further supported by reshoring efforts and advancements in aluminum recycling technology.

Recycled aluminum in the United States has been forecasted to garner 18.23% of the world volume. Growth is supported by federal green infrastructure undertakings, electric vehicles' production, and demand for sustainable construction materials. Countries previously dependent are forging an avenue toward recycling dependence to further lessen import dependence. Progress in scrap sorting and secondary smelting is expected to further increase production efficiency and quality of recycled aluminum.

By 2034, Canada is expected to hold 5.5% of the global recycled aluminum market share, with such growth backed by national decarbonization targets, a huge industrial base in Quebec and Ontario, and incentive schemes to promote low-emission manufacturing. Large amounts of money and resources flow into recycling infrastructure, supported just as strongly through public-private partnerships. Increasing exports to the United States reinforce this strategic positioning of Canada. Plus, the availability of renewable energy sources places Canada at an advantage in the clean, low-carbon production of recycled aluminum.

Key Recycled Aluminum Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global recycled aluminum market is led by multinational giants such as Novelis, Hydro Aluminium, and Constellium, collectively holding more than 30% market share. Key players focus on vertical integration, expanding downstream recycling and refining capacities to ensure supply chain robustness and meet sustainability goals. Heavy R&D investments are driving innovations in low-carbon smelting and high-purity recycled alloys. Strategic partnerships, capacity expansions, and acquisitions are prevalent, particularly in fast-growing regions like India and Southeast Asia, with the automotive, packaging, and propelling market growth worldwide.

Top global manufacturers in the recycled aluminum market

|

Company Name |

Country |

Estimated Market Share |

|

Novelis Inc. |

USA |

12.6% |

|

Hydro Aluminium ASA |

Norway (Europe) |

10.9% |

|

Constellium SE |

France (Europe) |

8.8% |

|

UACJ Corporation |

Japan |

7.8% |

|

China Hongqiao Group |

China |

7.6% |

|

AMAG Austria Metall AG |

Austria (Europe) |

6.3% |

|

Kaiser Aluminum Corporation |

USA |

xx% |

|

South32 Limited |

Australia |

xx% |

|

Kobe Steel, Ltd. |

Japan |

xx% |

|

Hindalco Industries Limited |

India |

xx% |

|

UAC (United Aluminum Company) |

Malaysia |

xx% |

|

Dongbu Steel Co., Ltd. |

South Korea |

xx% |

|

Novelis Asia Pacific |

Malaysia |

xx% |

Here are a few areas of focus covered in the competitive landscape of the recycled aluminum market:

Recent Developments

- In June 2025, Reuters reported that the United States government doubled tariffs on primary aluminum imports from 25% to 50%, while maintaining zero tariffs on scrap aluminum. This policy shift has caused a surge in domestic demand for recycled aluminum and created intense global competition for aluminum scrap. As a result, European governments are considering export duties to prevent scrap shortages at home, potentially triggering a global "scrap war" that could reshape international aluminum trade.

- In May 2025, Reuters highlighted that major aluminum producers, including Novelis, Emirates Global Aluminium (EGA), Alcoa (via ELYSIS), and Rio Tinto, are significantly expanding their aluminum recycling operations. With recycled aluminum requiring only 5% of the energy needed for primary production, demand is expected to triple by 2050. These efforts are driven by global decarbonization targets and upcoming regulatory pressures such as the EU's Carbon Border Adjustment Mechanism (CBAM).

- Report ID: 7976

- Published Date: Jul 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Recycled Aluminum Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert