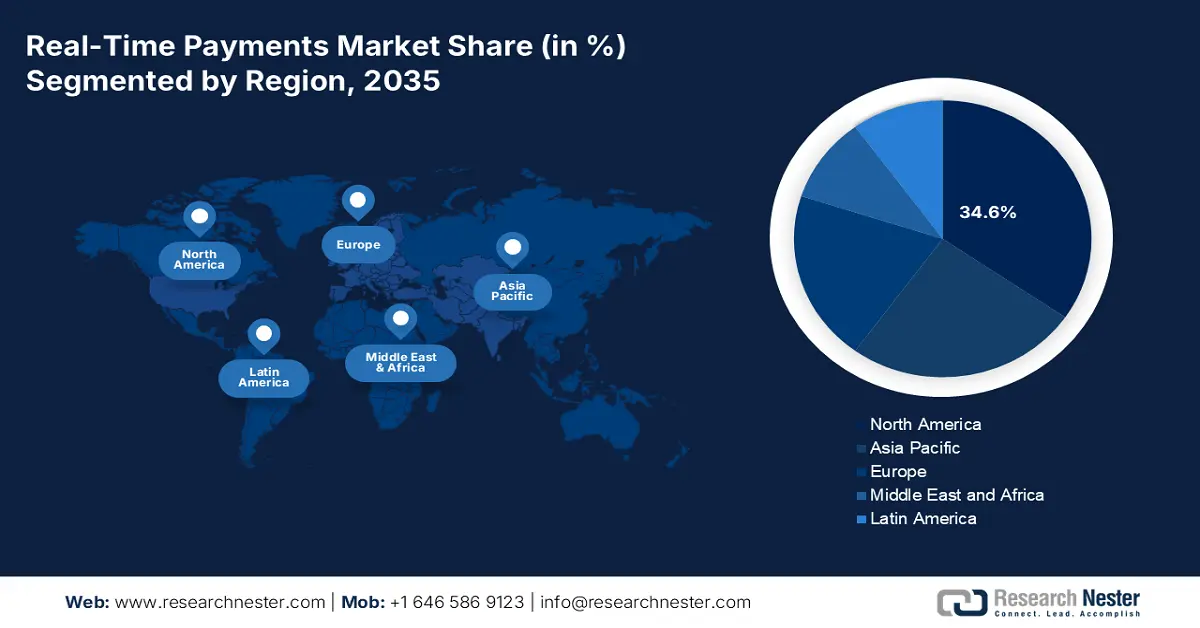

Real-Time Payments Market - Regional Analysis

North America Market Insight

The North America real-time payments market is anticipated to gain a revenue share of 34.6% in 2035. The growth is supported by strong digital infrastructure as well as government support. The RTP market also benefits from the expansion of 5G. Additionally, consumer demand for instant payments and “buy now, pay later” will also support market growth, particularly in the e-commerce space. In Canada, ISED has invested in alleviating digital inequities in the country by subsidizing the service and helping with the addition of around 1.5 million + households connected to broadband in 2023. Furthermore, the adoption of AI for fraud detection by banks and government ICT spending is significant to the market expansion.

The U.S. market for Real-Time Payments is rapidly maturing, propelled by the expansion of The Clearing House’s RTP network into numerous new banks and credit unions. Both RTP and FedNow have enabled widespread access to instant payments for banks and credit unions throughout the U.S. Consumer and business demand for payments to be spent and settled quicker, on a 24/7 schedule, is increasing. The shift is also supported by fintech innovation, as digital wallets and applications become increasingly ubiquitous and integrate real-time payments. In the business sector, real-time payments support B2B payment flows and enable businesses to have real-time control of cash flow.

Real-time payments in Canada are anticipated to grow rapidly as Payments Canada moves forward with its modernization plans to introduce the Real-Time Rail (RTR) system. Additionally, regulatory support for open banking and the development of digital financial services are fostering a more competitive and innovative payment ecosystem. Fintechs have begun to integrate and partner with traditional financial institutions to provide real-time payment offerings in the consumer-to-consumer and business payment space. As well, interest in cross-border RTP, especially with the U.S., and interest in digital transformations across a variety of industries, is creating strong momentum for real-time payments in Canada.

Asia Pacific Market Insight

The Asia Pacific real-time payments space is projected to account for 33.3% of total global revenue in 2035. The growth is fueled by an increase in smartphone penetration, government-backed offerings, and 5G rollout. It is also encouraging that some governments are providing some level of regulatory support to the industry in terms of growth and adoption. In addition, India's real-time payment market is the fastest growing, driven by the rising acceptance of Unified Payments Interface (UPI) and an increasing reliance on AI to detect fraud.

India has rapidly become one of the fastest-growing markets for real-time payments in the world, mainly propelled by government initiatives such as the UPI, which has ushered in a digital revolution within the payment ecosystem in India, enabled by real-time transfers of bank account funds at very little cost and available to consumers and merchants 24/7. All this has contributed to the growth of infrastructure by the deep penetration of smartphones in India, a large unbanked and underbanked population who are rapidly transitioning to digital, and government initiatives encouraging a shift toward cashless payments.

The real-time payments sector in China is flourishing because mobile payment platforms such as Alipay and WeChat Pay have embedded real-time payment systems into daily life. The Chinese government’s digital economy strategy, coupled with a robust fintech ecosystem, has resulted in a robust market in which real-time payments are provided even for small amounts. Moreover, the development of the Digital Yuan (e-CNY) supports the infrastructure for instant payments.

Europe Market Insight

The Europe real-time payments market is on track for growth, citing regulatory support, a strong push towards digitalization, and demand from consumers for speed and convenience. A major driver is the initiative of the European Union by way of the SEPA Instant Credit Transfer (SCT Inst) that promotes real-time payments in euros across member states. Regulatory support builds credibility and trust in real-time payment systems and fosters consistency and interoperability of real-time payment systems. Users and businesses in Europe have rapidly adopted digital and contactless payments largely due to the increased growth of e-commerce, mobile banking, and innovation from fintech companies.

The real-time payments market in France is expected to grow due to the increasing digital transformation of the banking and financial services industry. The French government and regulatory bodies are supporting the adoption of instant payments through policy initiatives. In addition, rising consumer demand for faster and frictionless payment experiences, particularly with e-commerce payments and peer-to-peer transfer payments, is prompting banks and fintechs to invest in infrastructure for real-time payments.

Germany is also seeing strong growth in its real-time payments market, fueled by a tech-savvy population, a solid banking market, and a growing preference for digital payments. Widespread adoption of SEPA Instant Payments has further facilitated the rollout of instant payment solutions across banks. Growing B2B payments and government payments with faster settlement needs are also motivating institutions to emerge and update their processes to include real-time capabilities. This is to improve operational efficiency while also addressing customer satisfaction.