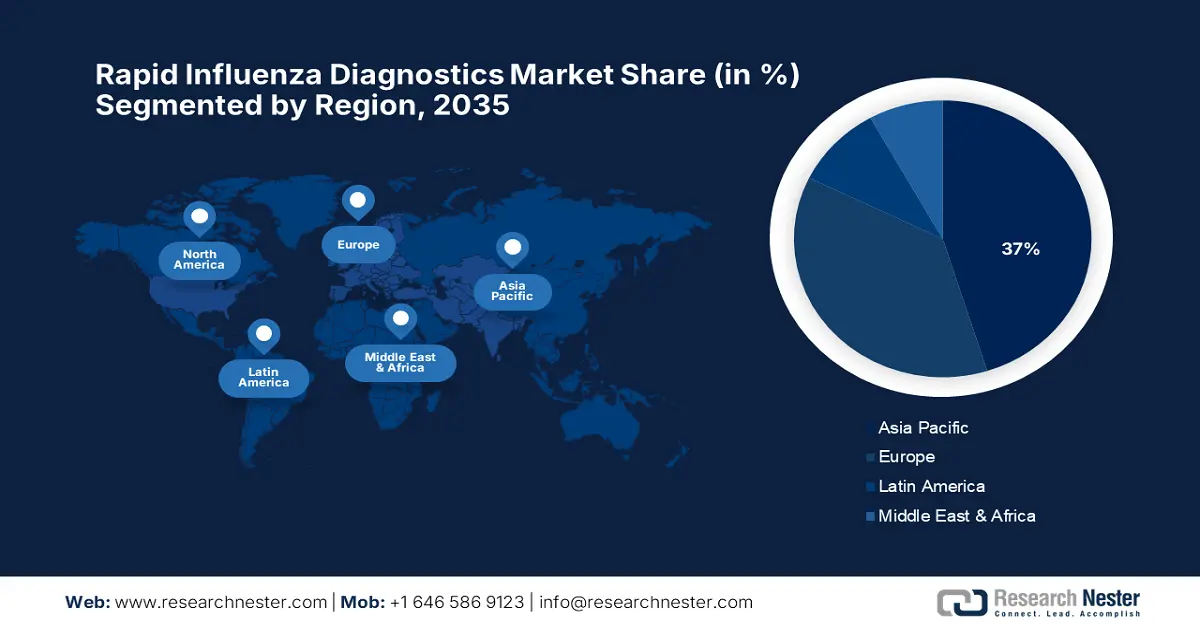

Rapid Influenza Diagnostics Market - Regional Analysis

North America Market Insight

The market in North America is expected to hold the highest market share of 37% during the forecast period, owing to advanced healthcare infrastructure and increased awareness for early disease detection. According to the America Hospital Association 2025 report, the U.S. market is being supported by a large healthcare network with 6,093 hospitals, thereby enabling the interface of rapid diagnostics. Out of these, 5,112 are community hospitals, thus making testing infrastructure highly available at the regional level. Having rapid influenza diagnostic tests in place across a wide network of hospitals ensures they can be efficiently scaled and quickly deployed in both urban and rural settings.

The market in the U.S. is growing due to government initiatives for influenza control and key diagnostic companies playing principal roles in it. According to the 2025 America Hospital Association report, the market within the U.S. is strongly supported by an extensive healthcare infrastructure, which includes 920 state and local government community hospitals, enhancing access to diagnostic services within public systems. The nation's hospitals accommodate high patient volumes-especially during the peak flu season, with 913,136 staffed beds in all. Therefore, there is an increasing demand for rapid influenza diagnostic tests, supported by the flexibility and preparedness of the healthcare system in the country.

The rapid influenza diagnostics market in Canada is growing due to increasing population aging and demand for point-of-care testing during flu seasons. As per a report by the Government of Canada published in July 2024, with the recent record USD 200 billion investment in health care for more than 10 years, the country demonstrates its clear commitment to promoting patient health and improving accessibility. By extending Canada Health Act deductions to include diagnostic services, the country emphasizes the need for equitable and free access to essential testing. This policy now encourages provinces to strengthen public diagnostic infrastructure, supporting the broader adoption of rapid influenza diagnostics.

Europe Market Insight

The rapid influenza diagnostics market of Europe is expected to hold the fastest-growing market within the forecast period due to the rise in healthcare spending and the increasing use of more advanced technologies for diagnostics. Besides, all countries in the region recorded a higher healthcare spending per inhabitant in 2022, supporting growth in diagnostic services. As per a report by Eurostat published in November 2025, Latvia, Romania, and Lithuania have seen the maximum increases in healthcare expenditure, with increases of 140.5%, 125.6%, and 123.1%. In Bulgaria and Czechia, the expenditures more than doubled, pushing the markets further. Sweden had the least increase of about 13.8%, thus providing consistent support to diagnostic advances.

The rapid influenza diagnostics market in the UK is expected to be the fastest-growing market within the forecast period due to public health surveillance upgrades and increased focus on diagnostic testing. Gradual increases in awareness among doctors and patients alike have led to higher demand for faster, more precise influenza diagnostics. In addition, investments in healthcare infrastructure, along with the integration of point-of-care testing in clinical settings, support the widespread adoption of rapid diagnostic technology. Further growth results from efforts to reduce hospital burdens during acute winter periods and improve patient outcomes.

The rapid influenza diagnostics market in Germany is growing due to support from the government for managing infectious diseases, and a strong healthcare infrastructure leads to the growth. As per a report by Eurostat in November 2025, the healthcare spending in Germany was highest among the EU countries, standing at an estimated €489 billion in 2022. This high expenditure allows hospitals and clinics all over the nation to adopt state-of-the-art diagnostic technologies. Additionally, the growing public awareness and focus on early diagnosis consequently create a higher demand for rapid testing.

Healthcare Expenditure for the Rapid Influenza Diagnostics Market for Europe

|

Country |

Government Schemes |

Compulsory Schemes & Saving Accounts |

Other Financing Agents |

Curative & Rehabilitative Care |

Medical Goods (Non-specified) |

Other Functions (Including Unknown) |

Hospitals |

|

EU (¹²) |

30.0 |

51.3 |

18.7 |

51.9 |

17.8 |

30.3 |

36.4 |

|

Belgium |

21.0 |

54.1 |

24.9 |

54.2 |

12.8 |

33.0 |

39.0 |

|

Bulgaria |

15.9 |

47.6 |

36.5 |

51.5 |

33.0 |

15.5 |

36.7 |

|

Denmark |

84.6 |

0.0 |

15.4 |

59.4 |

10.4 |

30.1 |

44.9 |

|

Germany |

11.7 |

75.0 |

13.3 |

51.8 |

17.8 |

30.3 |

26.9 |

|

Ireland |

76.8 |

0.6 |

22.7 |

56.6 |

11.3 |

32.0 |

38.2 |

|

Greece |

30.2 |

31.7 |

38.1 |

58.4 |

12.9 |

28.7 |

45.3 |

|

Spain |

70.3 |

3.7 |

26.0 |

57.6 |

21.4 |

21.0 |

46.0 |

|

France |

4.3 |

80.4 |

15.3 |

51.7 |

19.1 |

29.2 |

38.9 |

|

Italy |

74.3 |

0.0 |

25.6 |

53.4 |

20.2 |

26.5 |

43.5 |

Source: Eurostat, November 2024

Asia Pacific Market Insight

The rapid influenza diagnostics market in the Asia Pacific is expected to grow steadily over the forecast period, driven by increasing awareness of influenza outbreaks, with growing access to diagnostic tools. Additionally, investments in healthcare infrastructure and government initiatives against infectious diseases provide additional market growth opportunities. Furthermore, the increased incidence of respiratory infections in a large patient population demands more timely and accurate testing for influenza. Better healthcare delivery, particularly in rural and underserved areas, also promotes the progress of rapid diagnostic technologies on a steady basis across the region.

The rapid influenza diagnostics market in China is growing due to expanding healthcare reforms and frequent outbreaks of respiratory infections. As per a report by NLM May 2025, the China National Influenza Center demonstrated a study that the average nucleic acid testing positive rate for influenza virus (IFV) among influenza and related illness (ILI) cases in Fujian Province during the last 10 years was 14.7%, further reinforcing the pressing need for accurate and timely diagnostic tools. This translates to the need for efficient, rapid influenza diagnostics in the effective management and control of flu outbreak situations. Added government support and improved health care access continue to be the incentives behind market growth.

The influenza diagnostics market in India is growing due to the large population base, growing disease burden, and the improvement of rural health centers walk along. The early detection and curing of diseases have gained erroneous glories in the public, as further stimulation is lent to investments in public healthcare programs. Government-level operation in strengthening disease surveillance and enhancing the potential to access diagnostic services considerably increases demand for rapid testing technologies. An increased presence of domestic diagnostic manufacturers further improves the affordability and availability of rapid influenza testing in both urban as well as rural areas.