Radiometric Detectors Market Outlook:

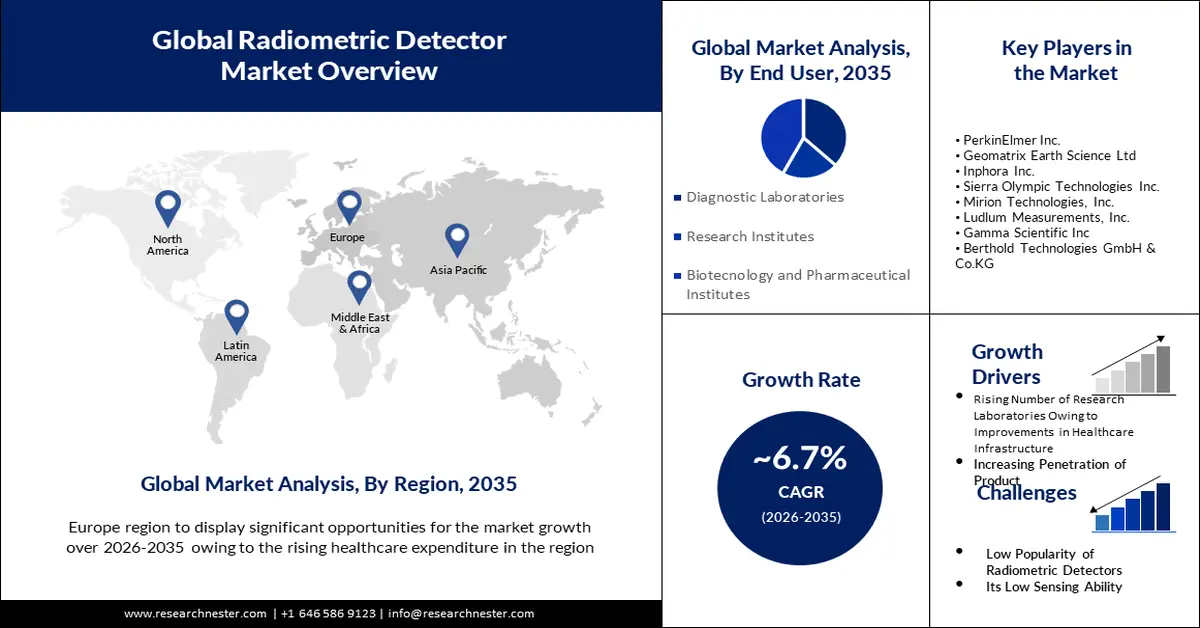

Radiometric Detectors Market size was over USD 3.79 billion in 2025 and is poised to exceed USD 7.25 billion by 2035, witnessing over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of radiometric detectors is evaluated at USD 4.02 billion.

The growth of the market can be attributed to the rising number of research laboratories resulting from improvements in healthcare infrastructure, and the increase in penetration of the product across the globe. According to a report by the World Health Organization (WHO), global spending on health grew continually between 2000 and 2019 and reached a value of USD 8.3 trillion, or 10% of global GDP.

Along with these, growing awareness levels regarding automated in-built sensors and user-friendly interfaces that can be used in radiometric detectors are also expected to drive market growth in the forthcoming years. Furthermore, escalating usage of these detectors in the pharmaceutical and chemical industries is projected to offer lucrative opportunities to the market in the near future. The global market for radiometric detectors is expanding as a result of ongoing innovation. Most radiometric detector companies operate with a sense of urgency and a customer-centric mindset in the post-pandemic period. Attempts to reduce costs along different links in the value chain so that items can be sold for a profit. However, in the long run, production modernization and expansion together with ongoing innovation and customer-focused initiatives will continue to be major success drivers.

Key Radiometric Detectors Market Insights Summary:

Regional Highlights:

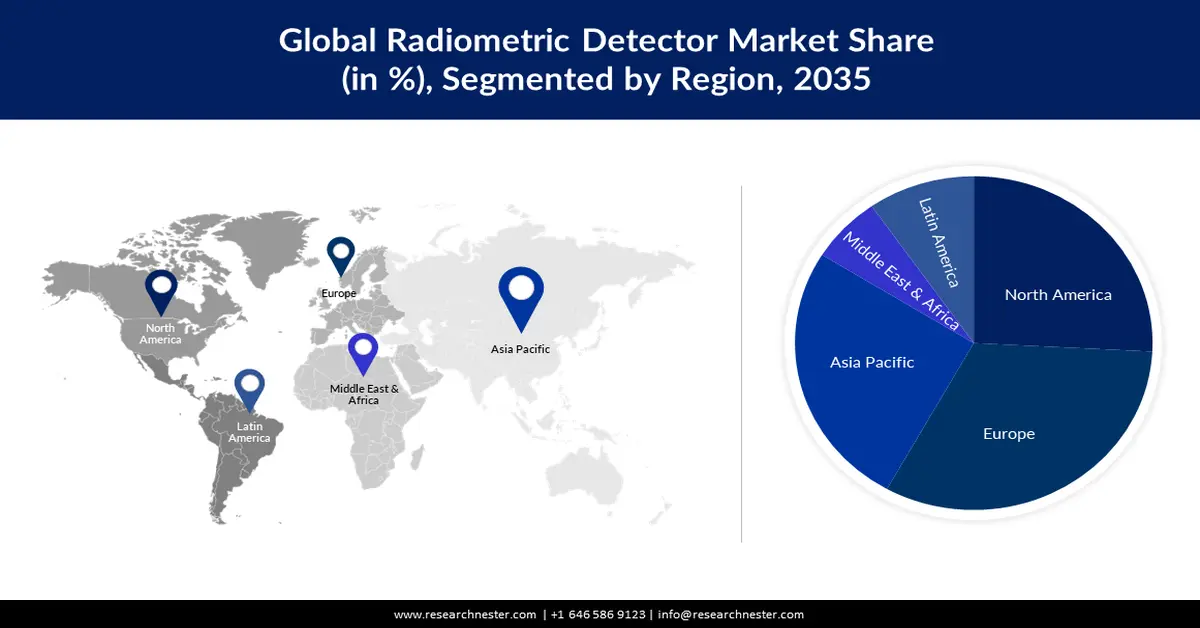

- North America is anticipated to secure a 36% share of the radiometric detectors market by 2035, sustained by the rising number of research laboratories and diagnostic centers in the region.

- Asia Pacific is projected to capture a substantial share by 2035, underpinned by escalating investments in nuclear and radiation-based technologies across major countries in the region.

Segment Insights:

- The UV/IR detection segment is expected to command the largest share by 2035 in the radiometric detectors market, supported by its extensive use in measuring electromagnetic radiations within defined spectral ranges.

- The research institutes segment is poised to attain the largest share by 2035, fostered by increasing governmental and corporate investments in research and development aimed at strengthening global healthcare infrastructure.

Key Growth Trends:

- Rising Number of Research Laboratories Owing to Improvements in Healthcare Infrastructure

- Increasing Penetration of the Product

Major Challenges:

- Low Popularity of Radiometric Detectors

Key Players: Gigahertz-Optik, Inc., PerkinElmer Inc., Geomatrix Earth Science Ltd, Inphora Inc., Sierra Olympic Technologies Inc., Mirion Technologies, Inc., Ludlum Measurements, Inc., Gamma Scientific Inc, Berthold Technologies GmbH & Co.KG.

Global Radiometric Detectors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.79 billion

- 2026 Market Size: USD 4.02 billion

- Projected Market Size: USD 7.25 billion by 2035

- Growth Forecasts: 6.7%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 20 November, 2025

Radiometric Detectors Market - Growth Drivers and Challenges

Growth Drivers

- Rising Number of Research Laboratories Owing to Improvements in Healthcare Infrastructure – Growing number of research laboratories owing to the improvement in healthcare infrastructure is expected to drive the growth of the global market. Moreover, increasing investment by market players and the governments of various regions in the enhancement of the healthcare sector is the factor driving the growth of the market. For instance, Million Technologies and Canberra Industries partner with academic and research institutions to develop new technologies and applications for radiometric detectors for healthcare.

- Increasing Penetration of the Product – Another factor driving the growth of the global radiometric detectors market is the increasing penetration of the product. For instance, one of the products increasingly used in the market is the Thermo Scientific RadEye PRD Personal Radiation Detector. The product has been recognized by industry experts such as the National Institute of Standards and Technology (NIST) and has received positive customer reviews.

- Increasing Investment in Research and Development Activities – Growing investment by the government of various regions and multiple market players in research and development activities is expected to drive the growth of the global market in the forecast period. In 2021, Mirion Technologies, Inc., a leader in the radiation detection and measurement industry, announced a significant investment in its research and development capabilities. The company will invest more than USD 25 million in research and development activities to develop new products and technologies for the radiation detection and measurement market.

- Stringent Regulatory Requirement - Regulatory requirements for radiometric detectors are increasing as radiation safety concerns grow. For instance, the International Atomic Energy Agency (IAEA) has established guidelines for the use of radiation detection equipment in various applications. This has increased the demand for high-quality, reliable radiometric detectors that comply with these regulations.

Challenges

- Low Popularity of Radiometric Detectors – The first and foremost challenge that comes in the way of this market is the low popularity of radiometric detectors. Many people around the globe are aware of this product and supporting the product however, there are also a huge amount of people who are not in support of this technology yet owing to its disadvantages which might hamper the market in the future.

Radiometric Detectors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 3.79 billion |

|

Forecast Year Market Size (2035) |

USD 7.25 billion |

|

Regional Scope |

|

Radiometric Detectors Market Segmentation:

Application (Proximity Detection, RGB Color Sensing, Gesture Recognition, Light Sensing, UV/IR Detection)

The market is segmented by application into proximity detection, RGB color sensing, gesture recognition, light sensing, and UV/IR detection. Out of these, the UV/IR detection segment is anticipated to hold the largest share in the global radiometric detectors market on account of the high utilization of the device for measuring electromagnetic radiations from visible light. Apart from this, radiometric detectors are also used for spectral broadband irradiance measurements within a defined spectral range, which is also predicted to drive the growth of the market segment in the future.

End-user (Diagnostic Laboratories, Research Institutes, Pharmaceutical Institutes)

The market is segmented and analyzed for demand and supply by end users into Diagnostic Laboratories, research institutes, biotechnology, and pharmaceutical institutes. Out of which, the research institute segment is expected to have the largest market share in the forecast period. Owing to the increase in investment and funds by the government of various regions and market players in the research and development activities to enhance the healthcare infrastructure around the globe is the factor driving the growth of this segment. For instance, the Central and State Government of India’s budgeted expenditure on the health sector reached almost 2 percent of GDP in FY23 against 1.6 percent in FY21

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radiometric Detectors Market - Regional Analysis

Europe Market Forecast

North America industry is poised to hold largest revenue share of 36% by 2035, impelled by increasing number of research laboratories and diagnostic centers in the region.Moreover, the market in North America is expected to grab the largest share during the forecast period ascribing to the increasing number of research laboratories and diagnostic centers in the region. It is evaluated that there are more than 10,000 new imaging centers businesses in the United States in 2022. In addition, the strong footprint of market players is also projected to boost the growth of the market in the region.

APAC Market Statistics

Asia Pacific region is expected to share remarkable growth in the forecast period. Radiation detectors are used to measure radiation and have a wide range of applications in fields such as healthcare, nuclear power plants, and environmental monitoring. The Asia-Pacific region has many countries investing in nuclear and radiation-based technologies, creating demand for radiometric detectors. China, India, and Japan are some of the largest markets for radiometric detectors in the Asia-Pacific region. These countries are investing heavily in nuclear and other radiation-based technologies, boosting the growth of the radiometric detector market. Other countries in the region, such as South Korea and Australia, are also in great demand for radiometric detectors.

North American Market Forecast

The market in North America is expected to grab a significant share during the forecast period. This can be attributed owing to the increasing number of research laboratories and diagnostic centers in the region. It is evaluated that there are more than 10,000 new imaging centers businesses in the United States in 2022. In addition, the strong footprint of market players is also projected to boost the growth of the market in the region.

Radiometric Detectors Market Players:

- Gigahertz-Optik, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PerkinElmer Inc.

- Geomatrix Earth Science Ltd

- Inphora Inc.

- Sierra Olympic Technologies Inc.

- Mirion Technologies, Inc.

- Ludlum Measurements, Inc.

- Gamma Scientific Inc

- Berthold Technologies GmbH & Co.KG

Recent Developments

- Mirion Technologies, Inc. Completed the acquisition of Computerized Imaging Reference Systems, Inc. (“CIRS”), which is a leading company that offers medical imaging and radiation therapy phantoms for the medical industry.

- Berthold announced the launch of non-contact radiometric level measurement technology for improving efficiency during cement production.

- Report ID: 3927

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radiometric Detectors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.