Radio Station Equipment Market Outlook:

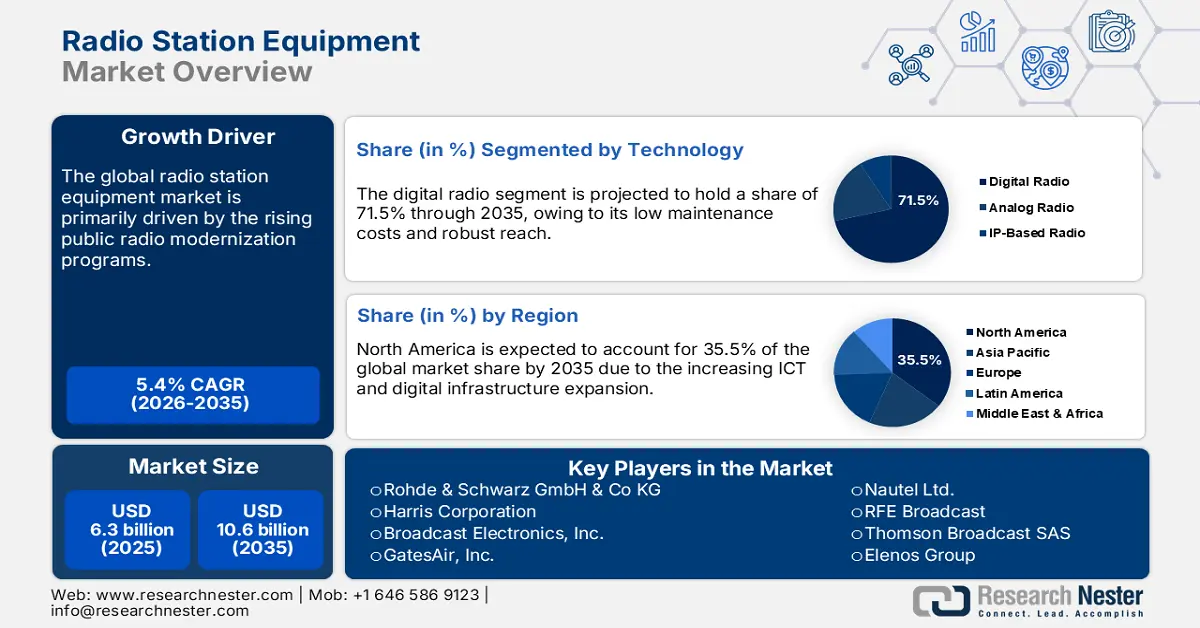

Radio Station Equipment Market size was USD 6.3 billion in 2025 and is estimated to reach USD 10.6 billion by the end of 2035, expanding at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of radio station equipment is assessed at USD 6.6 billion.

The radio station equipment trade is closely related to the global electronics and telecommunications supply chain. The rising production and flow of specialized raw materials and components are expected to increase the sales of radio station equipment. The Observatory of Economic Complexity (OEC) states that in 2023, global broadcasting equipment trade was valued at USD 619 billion, marking a 6.04% rise from USD 583 billion in 2022. Over the last five years, this segment has expanded at an average annual growth rate of 6.57%. In addition, in 2023, China (USD 307 billion), Vietnam (USD 83.2 billion), and Chinese Taipei (USD 27.2 billion) emerged as the largest exporters of broadcasting equipment, while the United States (USD 117 billion), Hong Kong (USD 60.8 billion), and China (USD 42 billion) ranked as the top importers. This indicates that Asian countries are estimated to drive the production of radio station raw materials and components, while Western countries rely on imports.

Key Radio Station Equipment Market Insights Summary:

Regional Insights:

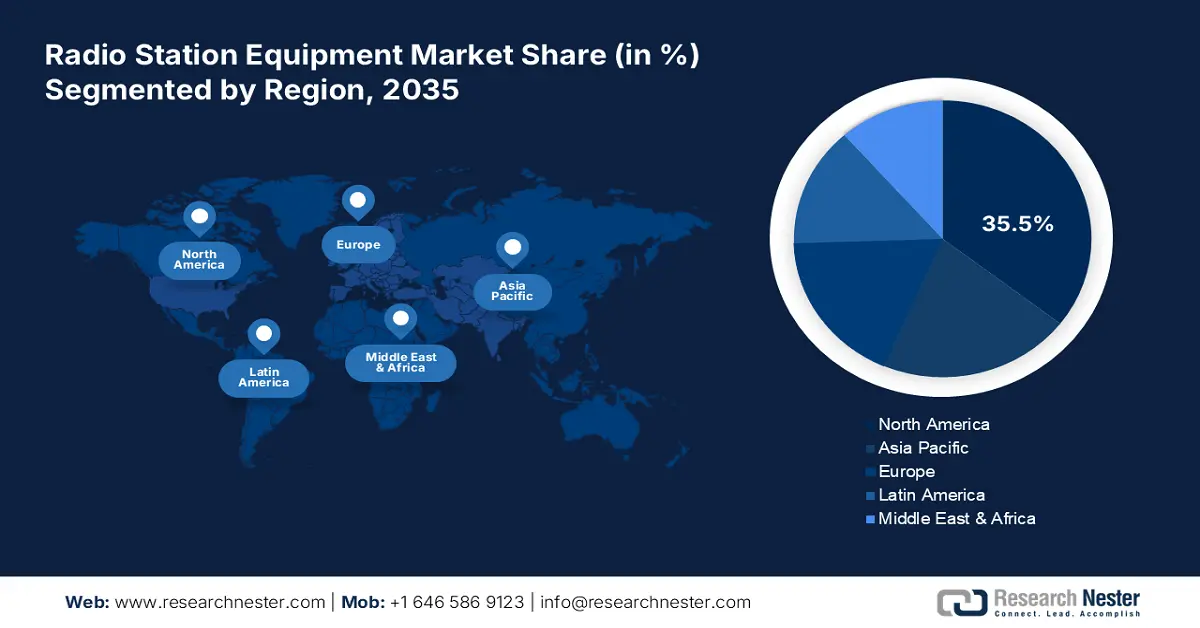

- The North America Radio Station Equipment Market is projected to command 35.5% of the global share by 2035, spurred by rapid infrastructure upgrades and extensive government initiatives supporting digital broadcasting transformation.

- Europe is anticipated to secure a notable revenue share through 2035, stimulated by widespread adoption of digital audio broadcasting and strong investments in IP-based radio integration and public safety communication systems.

Segment Insights:

- The studio equipment segment is forecasted to account for 45.1% of the Radio Station Equipment Market share by 2035, driven by rising demand for high-quality audio production and the proliferation of digital broadcasting platforms.

- The digital radio segment is estimated to capture 71.5% share throughout 2026–2035, owing to the expanding adoption of DAB, DRM, and HD Radio technologies enhancing listener experience with interactive and superior-quality audio content.

Key Growth Trends:

- Government support and public radio modernization programs

- Technological modernization and demand for digital broadcasting

Major Challenges:

- High cost of advanced equipment

- Competition from digital streaming platforms

Key Players: Rohde & Schwarz GmbH & Co KG, Harris Corporation (L3Harris Technologies), Broadcast Electronics, Inc., GatesAir, Inc., Nautel Ltd., RFE Broadcast, Thomson Broadcast SAS, Elenos Group, Comrex Corporation, ABE Elettronica S.p.A., Visionary Solutions Inc., Datavideo Technologies Co., Ltd., All India Radio (Prasar Bharati) – Tech Division, MySat Broadcast Sdn Bhd, Sonifex Ltd., Hitachi Kokusai Electric Inc., NEC Corporation, Panasonic Industry Co., Ltd., Toshiba Infrastructure Systems & Solutions Corp., Icom Incorporated.

Global Radio Station Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.3 billion

- 2026 Market Size: USD 6.6 billion

- Projected Market Size: USD 10.6 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: India, Australia, Vietnam, Singapore, Taiwan

Last updated on : 8 October, 2025

Radio Station Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Government support and public radio modernization programs: The government-backed modernization programs are expected to drive investments for radio station infrastructure expansions. The increasing popularity of digital technologies is likely to fuel the sales of advanced radio station solutions. For instance, in India, the government's Broadcasting Infrastructure and Network Development (BIND) scheme, approved in January 2023 with an outlay of USD 341.96 billion for implementation up to 2025–26, is set to transform the country's broadcasting segment. The program is developed to strengthen Doordarshan and All India Radio (AIR) by upgrading broadcast infrastructure, modernizing studios, and using new technologies.

- Technological modernization and demand for digital broadcasting: As radio stations move from analog-only broadcast toward digital radio (DAB / DAB+ / DRM / HD Radio), they need new transmitters, encoding/decoding equipment, digital multiplexing, receiver compatibility, and, in some cases, spectral reallocation. Also, technology convergence, i.e., online streaming + over the air, requires hybrid hardware/software. For instance, since April 2023, the National Broadcasting & Telecommunications Commission in Thailand has been pushing the transition of analog radio to digital radio. As part of its master plan, NTBC is prioritizing the digital radio shift, which is slated for implementation from 2025 to 2030.

- Increase in the number of radio stations and expanded coverage: Governments often want to extend radio reach into rural, border, and remote districts to improve connectivity, information access, emergency broadcasting, and public safety. This necessitates investment in new transmitters, towers, antennas, power infrastructure, and maintenance. Where private radio access is low, government or public broadcaster interventions tend to create large-scale equipment purchases. For instance, the Indian government inaugurated 91 new 100 W FM transmitters across 18 states and 2 union territories, aiming for remote and border regions. This aims to extend radio connectivity and reach millions who previously had limited access. Such initiatives are expected to push the production of next-gen transmitters, antennas, and studio automation software.

Challenges

- High cost of advanced equipment: Modern radio broadcasting equipment relies on digital, IP-based, and HD-compatible systems, which are expensive. Small and community radio stations often struggle to try out high-end transmitters, audio processors, and automation systems. The high upfront investment and ongoing maintenance costs can restrict adoption, especially in developing countries where budgets are fixed, slowing the overall growth of the market.

- Competition from digital streaming platforms: The rapid increase of online streaming services, podcasts, and satellite radio is changing audience behavior, reducing the traditional FM/AM radio listener base. Broadcasters must invest in additional equipment to support simulcasting or online streaming, which adds complexity and cost. This shift also pressures radio stations to regularly upgrade equipment to sustain, creating a barrier for smaller players and challenging overall market expansion.

Radio Station Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 6.3 billion |

|

Forecast Year Market Size (2035) |

USD 10.6 billion |

|

Regional Scope |

|

Radio Station Equipment Market Segmentation:

Product Type Segment Analysis

The studio equipment segment is projected to hold 45.1% of the market share through 2035, as it is an important component of the market, encompassing tools essential for content creation, editing, and live broadcasting. Its growth can be attributed to the rising demand for high-quality audio production and the shift towards digital broadcasting. Advancements in digital audio workstations (DAWs), audio interfaces, and microphones have improved the potential of radio stations to produce superior content. Additionally, the introduction of internet radio and podcasting has increased the need for professional-grade studio equipment to meet the expectations of a tech-savvy audience.

Technology Segment Analysis

The digital radio segment is poised to capture 71.5% of the global radio station equipment market share throughout the forecast period, due to technological advancements and evolving listener preferences. This growth is fueled by the increasing adoption of Digital Audio Broadcasting (DAB), Digital Radio Mondiale (DRM), and HD Radio technologies, which offer superior audio quality and additional features such as song metadata and interactive content. For instance, according to the World DAB report of October 2024, digital radio has exceeded FM and AM listenership, accounting for over 74.3% of all radio listening, compared with just 25.7% for AM/FM listeners in the U.K., largely due to the popularity of smart devices. This rising preference for digital formats is fueling the demand for compatible radio station equipment, contributing to segment growth.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radio Station Equipment Market - Regional Analysis

North America Market Insights

North America market is estimated to account for 35.5% of the global revenue share by 2035. The rapid infrastructure upgrades and digital radio transition are likely to fuel the sales of radio station equipment and devices. The favorable government initiatives and spending are also expected to boost the overall market growth. In the U.S., the Federal Communications Commission’s (FCC) USD 42.45 billion Broadband Equity, Access, and Deployment (BEAD) Program and the National Telecommunications and Information Administration’s (NTIA) Digital Equity Act are actively fueling the expansion of rural and community broadcasting through grants for equipment upgrades, spectrum allocation, and IP-based radio system integration. This is expected to boost market growth in the coming years.

The U.S. is expected to lead the sales of radio station equipment during the forecast period owing to increasing investments in digital radio infrastructure. This growth is further supported by the Biden-Harris administration's announcement of a USD 420 million funding opportunity in May 2024 to encourage wireless equipment innovation, aiming to advance open network adoption in the U.S. and abroad. The surging demand for high-quality audio content and the shift towards digital platforms are driving broadcasters to invest in modern equipment, thereby driving market expansion. In addition, the introduction of smart devices and internet radio is contributing to the growing need for advanced broadcasting technologies.

The rising investments in community radio networks and the modernization of rural stations are likely to fuel the Canada market. The digital transformation is also expected to fuel the sales of new broadcasting technologies in the years ahead. Innovation, Science and Economic Development (ISED) has allocated CAD 325.5 million under the Universal Broadband Fund, which is set to boost the hybrid FM-IP infrastructure expansion in underserved areas. Moreover, the supportive government policies and funding are likely to fuel the adoption of advanced radio station solutions across the country.

Europe Market Insights

The Europe radio station equipment market is estimated to capture a significant revenue share throughout the assessed period as the rapid shift to digital audio broadcasting is poised to fuel the trade of advanced radio station technologies. The IP-based radio integration and public safety communication upgrades are also fueling the demand for radio station equipment and devices. The U.K., Germany, and France are the most profitable marketplaces owing to rising investments in broadcasting modernization.

The market in Germany is rapidly growing as broadcasters invest heavily in DAB and digital radio infrastructure, supporting high audio quality and coverage. The integration of AI technologies for automation, content scheduling, and audience analytics is increasing the demand for advanced studio and transmission equipment. Additionally, equipment manufacturers are innovating to grant modern, efficient, and scalable solutions, forcing radio stations to upgrade existing systems. Together, these trends are driving steady market expansion across Germany.

U.K. market is expanding steadily, supported by stronger government backing and the rise of community radio. In 2025, the government assigned an additional USD 804,282 to the Community Radio Fund, bringing the total funding to USD 1.3 million. This financial boost supports stations to invest in essential equipment, staff training, and content development, thereby improving service quality and audience engagement. Relaxed advertising rules are also promoting revenue, enabling further upgrades and innovation. Together, these measures are driving higher demand for modern radio station equipment across the U.K.

APAC Market Insights

Asia Pacific market is poised to hold a remarkable share from 2026 to 2035. The digitization trend is set to drive innovations in radio station technologies in the coming years. The 5G broadcasting integration and increasing demand for regional radio content are estimated to open high-earning opportunities for key players. The increasing use of radio technology in emergency services and defense is boosting the demand for advanced equipment and devices. Furthermore, Australia, Taiwan, Singapore, and Vietnam are improving ICT hardware policies to enhance radio communication networks for rural outreach and smart city transitions. Overall, the Asia Pacific is a profitable marketplace for radio station equipment manufacturers.

The radio station equipment market in China is experiencing rapid growth, driven by the country's rapid digital transformation and demand for superior audio quality. This expansion is driven by the adoption of digital broadcasting technologies, such as Digital Audio Broadcasting, and the growing popularity of internet radio and podcasting platforms. For instance, China's podcasting audience is projected to reach 150 million in 2025, up from less than 700,000 five years ago, pointing out a significant shift towards digital audio consumption. These trends are propelling broadcasters to invest in advanced radio station equipment to fulfill the evolving demands of the digital media landscape.

The radio station equipment market in India is witnessing remarkable growth, fueled by government initiatives and the expansion of both community and private radio sectors. The radio station equipment market in India is being bolstered by strong government intervention and private sector expansion. Moreover, the Government has launched the Supporting Community Radio Movement in India scheme with a budget of USD 6 million, aimed at supporting both the present and newly established Community Radio Stations. This initiative grants financial assistance for equipment, capacity building, and operational support, helping stations to expand their reach and enhance broadcast quality. By developing infrastructure and sustainability, the scheme is set to drive demand for advanced radio station equipment across India.

Key Radio Station Equipment Market Players:

- Rohde & Schwarz GmbH & Co KG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Harris Corporation (L3Harris Technologies)

- Broadcast Electronics, Inc.

- GatesAir, Inc.

- Nautel Ltd.

- RFE Broadcast

- Thomson Broadcast SAS

- Elenos Group

- Comrex Corporation

- ABE Elettronica S.p.A.

- Visionary Solutions Inc.

- Datavideo Technologies Co., Ltd.

- All India Radio (Prasar Bharati) – Tech Division

- MySat Broadcast Sdn Bhd

- Sonifex Ltd.

- Hitachi Kokusai Electric Inc.

- NEC Corporation

- Panasonic Industry Co., Ltd.

- Toshiba Infrastructure Systems & Solutions Corp.

- Icom Incorporated

The industry giants are influencing the sales of radio station equipment across the world. The leading companies are employing several organic and inorganic marketing strategies to hold a dominant position in the global landscape. They are also focusing on digital modulation and DRM support. While some are investing in portable radio tech and smart frequency control. These tactics are aiding them in boosting their revenue shares. Furthermore, strategic partnership with other players and collaborations with raw material suppliers is set to offer positive growth for key market players.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Rohde & Schwarz teamed up with News-Press & Gazette Co. (NPG) to implement a major upgrade to its broadcast infrastructure using the THU9evo liquid-cooled, high-power transmitter. This installation delivers greater transmission efficiency, enhanced reliability, and lower operating costs.

- In March 2025, NEC Corporation developed and launched software for virtualized radio access network (vRAN) base stations. The company plans to offer this software to telecom operators in Japan and abroad, targeting the deployment of over 50,000 vRAN base stations by fiscal year 2026.

- Report ID: 7850

- Published Date: Oct 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radio Station Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.