Radar Detector Market Outlook:

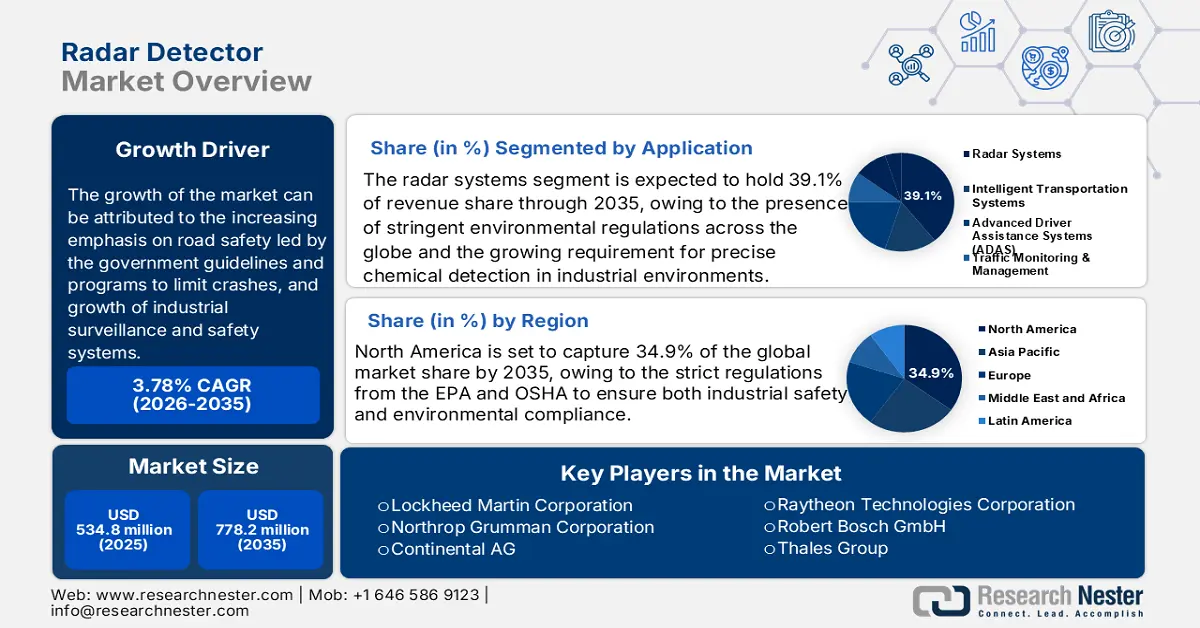

Radar Detector Market size was valued at USD 534.8 million in 2025 and is projected to reach USD 778.2 million by the end of 2035, rising at a CAGR of 3.78% during the forecast period, i.e., 2026-2035. In 2026, the industry size of radar detectors is estimated at USD 556.1 million.

The main growth factor for the radar detector market is the increasing emphasis on road safety, led by the government guidelines and programs to limit crashes. For instance, the World Health Organization indicates that an estimated 1.19 million people die each year in road crashes. Consequently, this has increased the demand for radar detectors among commercial fleets and law enforcement agencies. This further supports the market by integrating radar technologies into intelligent transportation systems. Additionally, there has been strong demand for radar detectors in B2B applications, especially for fleets and public safety. Simultaneously, types of regulatory issues remain present, especially in places where radar detectors are illegal or restricted, prompting manufacturers to invest in stealth technology that limits the ability of law enforcement to track vehicles equipped with radar detection systems.

Ongoing opportunities appear to be evolving from both premium and developing markets: where the high-end user is requesting sophisticated capabilities (i.e. multi-band radar detection, laser blocking, and integrated dash cameras) while the emphasis in developing geographical markets (i.e. Asia and Latin America) is to meet the increasing need for affordable and efficient radar detection systems that will later be demanded as a required consumer accessory due to growing automobile use, and the increase of awareness around road safety. Those same manufacturers are also beginning to integrate radar detectors into vehicle systems, but aftermarket systems will still lead in sales, demonstrating that value-added services is a priority. All of these thoughts foreshadow a more interconnected, intelligent, and user-centric radar detector market.

Key Radar Detector Market Insights Summary:

Regional Highlights:

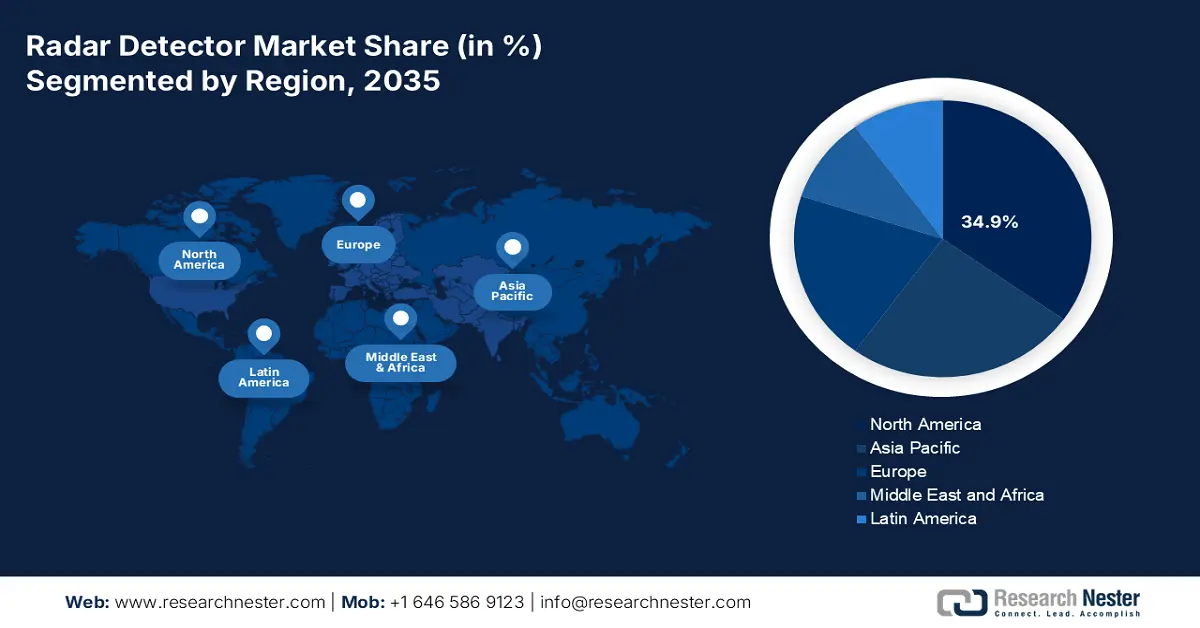

- North America in the radar detector market is projected to secure the largest share of 34.9% by 2035, owing to stringent EPA and OSHA safety regulations, robust industrial investments, and rising adoption of IoT-enabled radar detection systems.

- Asia Pacific is anticipated to capture a 29% revenue share by 2035, fueled by rapid urbanization, smart city development, and increasing accessibility of radar detectors through e-commerce platforms.

Segment Insights:

- The radar systems segment in the radar detector market is projected to account for a 39.1% revenue share by 2035, propelled by stringent environmental regulations, AI integration in radar signal processing, and expanding use in autonomous vehicles.

- The defense & aerospace segment is anticipated to capture around 34% revenue share by 2035, driven by rising defense budgets, advancements in radar technologies for threat detection, and the growing importance of precision radar in aerospace safety systems.

Key Growth Trends:

- Growth of industrial surveillance and safety systems

- Expansion of green chemistry

Major Challenges:

- Stringent rules and regulations

- Exorbitant cost of cybersecurity

Key Players: Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Robert Bosch GmbH, Continental AG, Thales Group, Denso Corporation, Mitsubishi Electric Corporation, Hitachi, Ltd., Attowave Co., Ltd., Hyundai Mobis Co., Ltd., Bharat Electronics Limited, Keltron (Kerala State Electronics), Malaysian Electronics Corporation (MEC), Codan Limited

Global Radar Detector Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 534.8 million

- 2026 Market Size: USD 556.1 million

- Projected Market Size: USD 778.2 million by 2035

- Growth Forecasts: 3.78% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 1 October, 2025

Radar Detector Market- Growth Drivers and Challenges

Growth Drivers

- Growth of industrial surveillance and safety systems: Chemical manufacturers are increasingly spending on the development of more sophisticated real-time monitoring technology. These systems help signal unauthorized movement in hazardous perimeter areas and increase compliance and safety. Therefore, it is forecasted that the demand for market-integrated radar detection systems, particularly co-deployed with sensors and AI-enabled alarm systems, will grow for facilities designated as high-risk according to the recommendations of OSHA and under the EU SEVESO III directives.

- Developments in chemical recycling technologies: Chemical recycling methods such as depolymerization and pyrolysis are significantly increasing demand for higher resolution plant monitoring systems. In addition, radar detectors are being utilized in hazard zone mapping and in thermal process regulation in these modern recycling systems. For example, Dow Chemical and BASF have stated in independent press releases that they used radar-based sensing technologies to track volatile environments for circular chemical processing. This advancement further expands the number of widely accepted radar detectors.

- Expansion of green chemistry: As chemical producers move toward bio-based solvents, surfactants, and polymers, plant safety and compliance processes are being restructured to manage new kinds of products. Radar detectors are often used to ensure safe management of storage tanks and cargo pipelines. Besides this, the move to renewable feedstocks will add additional complexity to operations, further increasing demand for radar detectors. Furthermore, as producers implement modular and distributed production setups to accommodate smaller-batch specialty bio-based chemicals, radar detectors help maintain real-time monitoring. The transition to renewable feedstocks adds another layer of scrutiny from regulators centered around materials handling, traceability, and environmental compliance purview, and encourages facilities to adopt newer and more automated sensing technologies.

Challenges

- Stringent rules and regulations: The radar detector market is restricted by numerous rules and regulations in many different locations. Many areas either make radar detectors illegal or have strict controls on radar detectors due to concerns over speeding promotion and interfering with law enforcement. This legal ambiguity poses a risk to manufacturers, resulting in consumer reluctance and little tolerance for consumers who follow the rules but do not install a radar detector on their vehicle. Regulating restrictions and requirements also may be a factor in limiting the number of radar detectors available through retail and online channels, as it forces the companies to navigate the compliance regulatory framework while exposing them to more risk of market entry and innovation.

- Exorbitant cost of cybersecurity: With radar detectors becoming more connected, including GPS, Bluetooth, Wi-Fi, and app-based systems, cybersecurity needs have become increasingly important. Each of these security components adds to producers' costs, and in an environment where net profit margins are narrow, this can raise the production cost of devices and lower production profit. For start-ups or small companies, keeping pace with the necessary cybersecurity protocols can create an emerging environment of untenable costs in doing business, especially in mid- and low-cost market segments. These increased cybersecurity costs will ultimately be handed down to consumers, creating higher prices that can ultimately deter customers who are price-sensitive and create overall stagnation in the radar detector industries.

Actual U.S. Military Spending in 2022 (Billions USD)

|

Category |

Table Line Item |

Allocation |

Amount (USD) |

|

NIPA National Defense Expenditure |

Consumption expenditures |

100% |

732.4 |

|

|

Gross investment |

100% |

192.6 |

|

Military Medical Insurance |

Military medical insurance |

100% |

5.7 |

|

|

Veterans’ life insurance |

100% |

0.8 |

|

Veterans-Related Expenses* |

Veterans’ benefits |

100% |

153.3 |

|

|

Other |

25% |

26.1 |

|

Space Consumption and Gross Investment Expenditure |

Space |

40% |

15.2 |

|

Grants to Foreign Countries |

Grants to foreign countries |

33% |

29.4 |

|

Net Interest Attributed to Military* |

Net interest attributed to the military |

— |

381.4 |

|

|

Total |

|

1,536.9 |

Source: Monthly Review

Radar Detector Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.78% |

|

Base Year Market Size (2025) |

USD 534.8 million |

|

Forecast Year Market Size (2035) |

USD 778.2 million |

|

Regional Scope |

|

Radar Detector Market Segmentation:

Application Segment Analysis

The radar systems segment is expected to hold a dominant 39.1% revenue share by the end of 2035. The growth is led by the presence of stringent environmental regulations across the globe and the growing requirement for precise chemical detection in industrial environments. Radar systems provide better range, accuracy, and versatility than various detection systems making them very important in auto safety, law enforcement, and industrial monitoring. Recent developments in radar signal processing, multi-band, and the incorporation of AI algorithms increase radar performance and reduce false alerts. These advancements have contributed to and driven the demand in the market. Furthermore, the rising use of radar-based solutions in connected and autonomous vehicles are another contributor to market growth.

End-user Segment Analysis

The defense & aerospace segment is likely to hold around 34% revenue share owing to the growing investment in radar technologies for the detection of chemical threats. Additionally, high tech radar detection is front and center in many industries around the world, contributing to required functions with respect to threat detection, surveillance, navigation, as well as missile guidance. Further, the demands placed on systems in order to develop more advanced defense systems for improving national security, and the increasing global budgets for defense, support the requirement for higher performance radar detectors. Similarly, precision radar systems in aerospace applications are essential in a very real sense, as they directly contribute to the safe and efficient operation of aircraft including their collision avoidance systems and air traffic control systems. Advanced radar technologies in terms of detection range, accuracy and electronic warfare provide excellent continuity for this sector.

Frequency Band Segment Analysis

X band remains the most prominent type because it is primary use in law enforcement and military radar systems, making it the most in demand for detection devices. X band gives a good return as it has good range and reasonable resolution for measuring speed and tracking. Furthermore, radar guns in X band are populous worldwide, ensuring detectors have high demand in detecting these radar signals in the sense of range configuration. The relatively low cost of production and matured technology contributes to its supremacy. Furthermore, X band radar detectors detect a large range of radar signals and have versatility for both consumer and utility uses.

Our in-depth analysis of the global radar detector market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End User |

|

|

Technology |

|

|

Frequency Band |

|

|

Product Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Radar Detector Market - Regional Analysis

North America Market Insights

North America market is expected to account for the largest share of 34.9% by the end of 2035. Strict regulations from the EPA and OSHA to ensure both industrial safety and environmental compliance are foreseen to drive market demand for radar detectors. The strong chemical manufacturing sector and significant government investments in the U.S. make it lead the way in the industry. Moreover, a growing use of IoT-enabled radar detectors in the pharmaceuticals and petrochemicals sectors is boosting the demand for radar detectors. Besides this, an increasing focus on workplace safety indirectly supports the demand for radar detectors in the region.

The U.S. radar detector market is being propelled within the chemical industry as there is an increased demand for radar detectors for applications such as environmental monitoring, industrial safety, and pharmaceutical quality assurance. The demand for radar detectors is greatest in the petrochemical industry to monitor volatile organic compounds (VOCs). A big driver of demand for radar detectors is the growth of 5G infrastructure requiring radar detectors, particularly for high-frequency applications. Consumers are now requesting highly advanced radar detectors with GPS and cellular connectivity for real-time alerts. The aftermarket is quite large, which also continues to fuel the growth of the market as well because new products are consistently being developed by local and international manufacturers.

Also, market in Canada is generating activity due to its own focus on sustainable chemical processes. In Canada, the high consumer awareness for road safety and the increase in usage of advanced driver assistance systems (ADAS) are expanding the demand for radar detectors as well. However, with some regulations and restrictions, consumers are considering the increase of vehicles on the road and the impact of harsh weather conditions to invest in reliable detection systems and avoid speeding fines.

Asia Pacific Market Insights

The Asia Pacific region is expected to have a significant revenue share of 29% during the forecast period, supported by growing disposable income and an expanding middle-class population in countries such as China and India. Additionally, smart city initiatives and the overall improvement of road infrastructure will accelerate the growth of the market. Furthermore, e-commerce platforms also enhance the accessibility of radar detecting devices' accessibility across the region.

The market for radar detectors in India is expanding rapidly, primarily due to the rapid growth in vehicle ownership and aggressive enforcement of traffic laws throughout the country's highways. As there has been an increase in disposable income brought on caused by the growth of the middle class in the country, radar detectors are now considerably more affordable and convenient to purchase with the growing boom of e-commerce. India's growing consumer mentality is leading more consumers to search for more affordable products with more features and ability to cope with a variety of road and traffic conditions. In addition, government policies which focus on road safety and laws against civil disobedience has increased interest in potential radar detection methods available in personal and commercial vehicles.

China's market growth is driven by fast-tracked urbanization, as well as the dramatic increase in vehicle ownership over the past decade. The government has imposed strict enforcement of traffic laws, and has launched several programs geared at maintaining and improving road safety, including smart city initiatives. The established domestic manufacturing (OEM) and automotive aftermarket industry can supply this demand effectively. Furthermore, radar detectors that offer GPS and app integration have gained popularity among Chinese consumers as their interests in connected devices increases. The growing middle-class and improved road infrastructure will help allow the growth of the radar detection market.

Europe Market Insights

Europe has a major stake in the radar detector market. This is due to strict traffic enforcement, a large number of speed cameras, and more awareness of road safety within various regions. France, Germany, and other European countries provide opportunities for advanced radar detectors that would follow requirements of the region. Additionally, with the automotive industry very mature and connected vehicle networks improving in subscribes, the region should see an increase in demand for radar detectors. It is also important to note that, while there may be restrictions on the regulatory side, consumers will continue to spend money on reliable speed detection systems, as a way of being safe on the roads.

The market for radar detectors in France is expanding due to the proliferation of speed cameras and speed enforcement using radar enforcement technology by authorities. French customers look for radar detectors that combine accuracy with ease-of-use features, such as multi-band detection and GPS-enabled products. In some regions resulting from legal restrictions on the use of radar detectors, the demand for radar detectors in those regions where restrictions were minimal and/or the enforcement regime was primarily focused on speed has remained strong in most areas. As the focus on road safety and penalties for traffic violations have increased, consumers have purchased radar detection solutions to avoid fines and enhance their situational awareness while driving.

Germany's market growth is attributed to the strong automotive industry in their country and consumer demand created for premium-grade radar detectors that employ high-tech modern devices. Some locations have restrictions in place for the use of radar detectors, but many drivers will purchase these devices for highway driving or travel to international areas where enforcement may differ. German auto industry trends regarding vehicle safety and innovation have increased consumer demand for the purchase of a high-performance radar detection system versus a standard system. German consumers considering radar detectors are looking for multi-band detection, specifically designed to integrate and operate with operating vehicle safety technologies.

Key Radar Detector Market Players:

- Lockheed Martin Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Robert Bosch GmbH

- Continental AG

- Thales Group

- Denso Corporation

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Attowave Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Bharat Electronics Limited

- Keltron (Kerala State Electronics)

- Malaysian Electronics Corporation (MEC)

- Codan Limited

The radar detector market fueled by rapid technological advancements and the growing need for chemical safety regulations is highly competitive. Key market players in U.S. like Lockheed Martin and Raytheon are at the forefront, offering AI-integrated radar systems. Over in Europe, companies such as Bosch and Thales are making strides with IoT-enabled detectors. Likewise, Japanese and South Korean firms like Denso and Attowave are prioritizing 5G compatibility. Moreover, Indian and Malaysian companies are focusing on providing cost-effective solutions, while Australia’s Codan is ramping up the global competition. Below, is a table showcasing the top 15 global manufacturers in the market, highlighting their estimated market share.

Recent Developments

- In September 2021, Escort announced the introduction of MAXcam 360c, a high-performance radar detector integrated with a dash camera offering AI-assisted false alert filtering and access to the Drive Smarter app.

- In April 2021, Continental AG introduced its sixth-generation long-range and surround radar sensors, designed for automotive ICT applications. These sensors, set for production in 2025, share a hardware-software platform, reducing costs by 20%.

- Report ID: 1047

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Radar Detector Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.