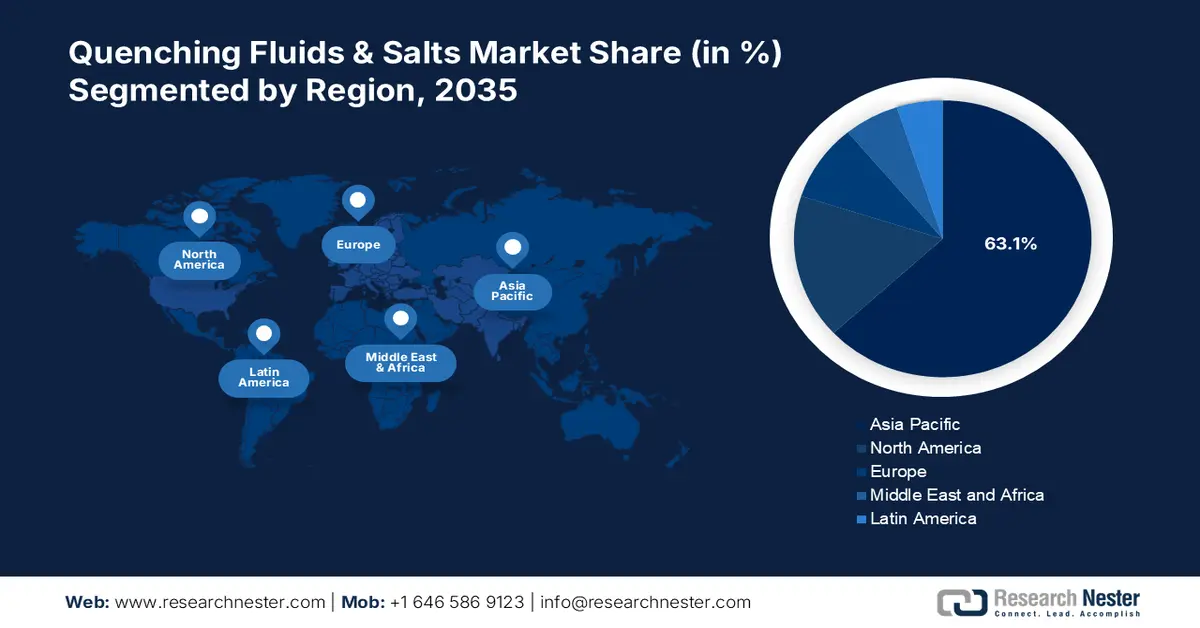

Quenching Fluids & Salts Market - Regional Analysis

North America Market Insights

North America is the most rapidly growing region in the quenching fluids & salts market, driven by the encouragement and benefits of expanding foreign businesses into the region. In addition, commercial heat treatment facilities are likely to increase their rate since the demand for quenching products, supportive government initiatives, and advantageous economic policies for commercial projects will escalate the market share for quenching fluids & salts.

The primary growth driver for the market in the U.S. is spurred by the presence of industry giants dealing in the production and growth of quench fluids. For instance, in November 2024, ExxonMobil announced reported third-quarter 2024 earnings of USD 8.6 billion. Improved earnings highlight the highest production of liquids with 3.2 million barrels per day and 10% above the prior year-to-date.

The quenching fluids & salts market in Canada is evolving at a steady pace attributable to manufacturing capacity in quenching systems. For instance, in August 2024, CAN-ENG Furnaces International Ltd, Niagara Falls, ON, Canada provided mesh belt furnace systems, CAN-ENG PET SCADA systems, and integrated controls. This oil quench and salt quench system was designed with low energy consumption, no part mixing, minimum damage to parts minimal distortion potential, and high uptime productivity.

Asia Pacific Market Insights

Asia Pacific quenching fluids & salts market is poised to capture revenue share of around 63.1% by the end of 2035. Moreover, electric vehicle sales are picking up pace due to the high penetration of the trend in electric-driven vehicles It is also stimulating the development of infrastructure required for them. Furthermore, governments in the region are implementing favorable policies to develop a healthy ecosystem for quenching fluids.

The major characteristic of the India landscape for the quenching fluids & salts market is the increasing demand from manufacturers for sophisticated materials with specific thermal and mechanical properties. Thus, they are focusing on developing quenching solutions to fulfill these changing demands. In addition, the aim rests upon fabricating new quenching technology with cost-effectiveness and scalability.

The China landscape is transforming through the rising demand for aerospace parts in various emerging economies. In addition, increasing per capita income and enhanced air travel are likely to have a positive effect on the quenching fluids & salts market in the country. Furthermore, local governments are aimed at improving their public transportation systems in a bid to curb air pollution levels.