Quantum Computing Market Outlook:

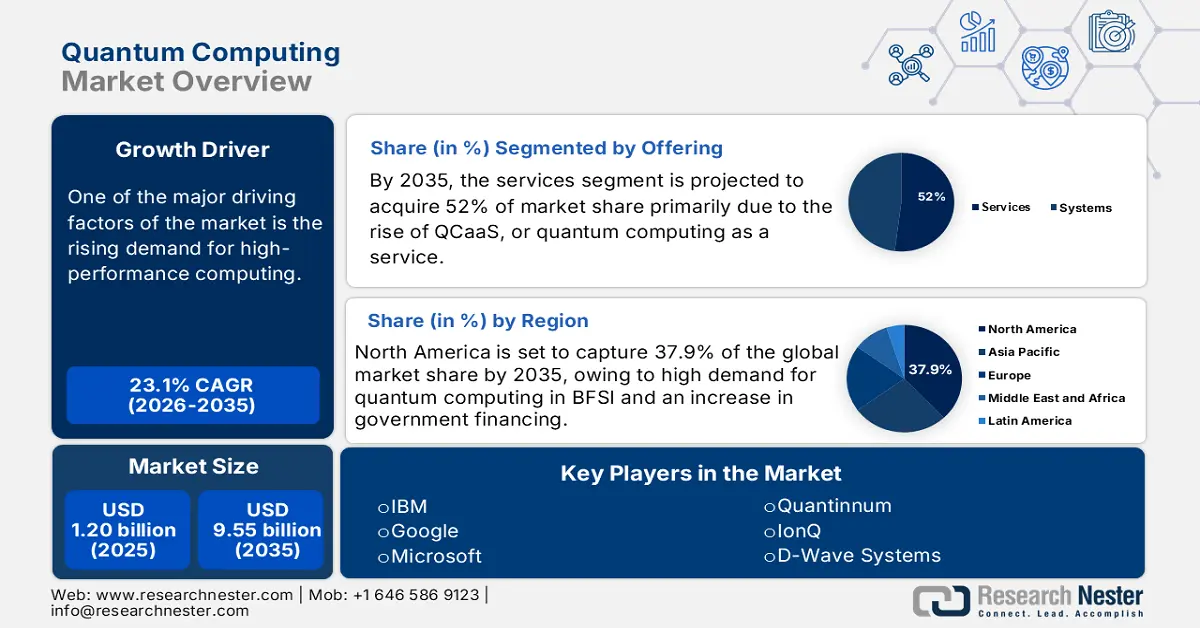

Quantum Computing Market size was over USD 1.20 billion in 2025 and is projected to reach USD 9.55 billion by 2035, witnessing a CAGR of around 23.1% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of quantum computing is evaluated at USD 1.47 billion.

The surge in demand for high-performance computing is one of the most pivotal factors fostering the market growth. The conventional computers are approaching the limit of Moore’s Law, making it highly complicated to garner any further speed in computation. However, the latest quantum computers are utilizing superposition that can process intricate algorithms exponentially faster than any conventional systems. As organizations are seeking computational power for the AI model training, quantum computing is appearing as a stopgap solution, rendering adequate solutions and rapidly fueling the investment from both the government and private sectors.

Quantum computing hardware has evolved with including improvements in the coherence time and error detection. Prominent players such as IBM and Rigetti are making scalable superconducting qubits. The occurrence of the fault-tolerant architecture has also preceded the practical use cases and further filled the gap between commercial and experimental systems. Furthermore, it has also included innovations in quantum interconnects by lowering the decoherence issues.

Key Quantum Computing Market Insights Summary:

Regional Insights:

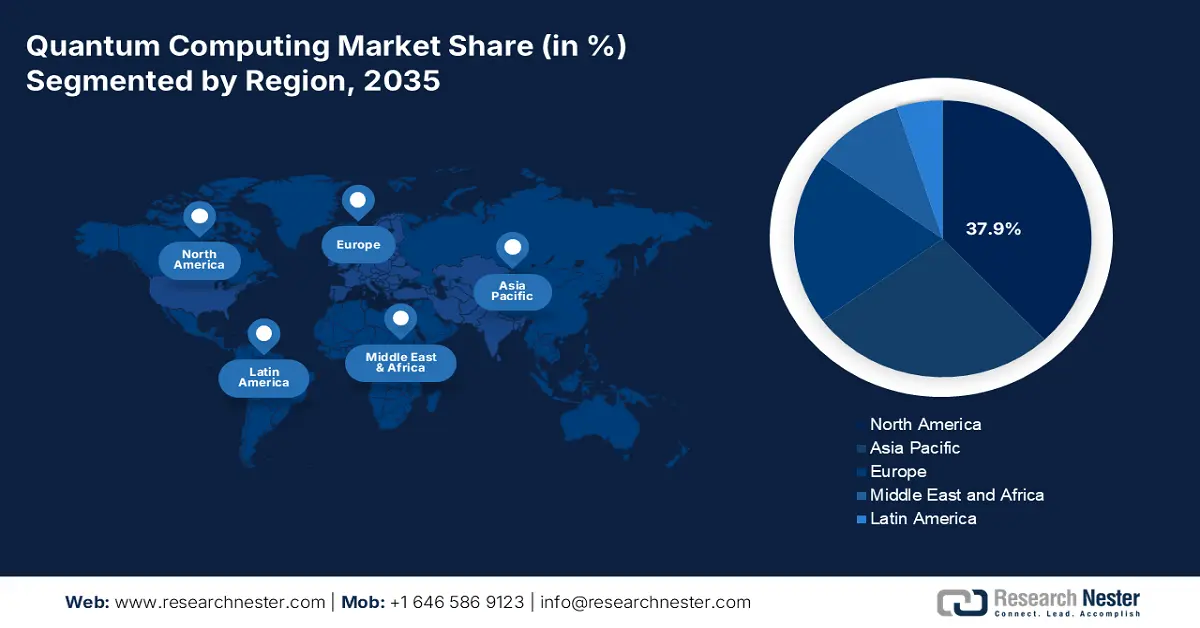

- The North America quantum computing market is projected to secure a 37.9% share by 2035, propelled by expanding government funding and the increasing adoption of quantum technologies in BFSI.

- Asia Pacific is expected to capture 26.9% of the market share by 2035, owing to rising R&D investments and the advancement of cloud quantum initiatives in nations like China and Japan.

Segment Insights:

- The services systems segment of the Quantum Computing Market is estimated to command a 52% share by 2035, driven by the growing prevalence of QCaaS that enables broad access to quantum tools without heavy infrastructure costs.

- The optimisation segment is anticipated to hold 33% of the market share by 2035, supported by increasing deployment across banking and logistics applications leveraging quantum algorithms for complex problem-solving.

Key Growth Trends:

- Expanding government funding and national quantum initiatives

- Surge in usage of quantum computing in drug discovery and healthcare

Major Challenges:

- Exorbitant cost of the quantum hardware development

- Limited scalability and manufacturing challenges

Key Players: IBM, Google, Microsoft, Quantinuum, IonQ, D-Wave Systems, Atos, Quix Quantum, Fujitsu, NEC Corporation, Xanadu Quantum Technologies, Quantum Motion, Q-CTRL, Samsung Electronics, Qkrishi.

Global Quantum Computing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.20 billion

- 2026 Market Size: USD 1.47 billion

- Projected Market Size: USD 9.55 billion by 2035

- Growth Forecasts: 23.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.9% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Canada, South Korea, Australia, France

Last updated on : 7 October, 2025

Quantum Computing Market - Growth Drivers and Challenges

Growth Drivers

- Expanding government funding and national quantum initiatives: Global governments are acknowledging quantum computing as a crucial asset for national security as well as competitiveness. Some of the exemplary programs are multi-year quantum infrastructure investments from China and the U.S. National Quantum Initiative Act. These programs not only speed up the academic and commercial R&D but also propel collaborations between a number of universities, startups, and national laboratories. Additionally, under the Quantum Technologies Flagship in 2025, the EU has allocated USD 1.07 billion to support the work of many researchers.

- Surge in usage of quantum computing in drug discovery and healthcare: The inclusion of quantum computing has been proven to be highly efficient and has revolutionized medical research. Researchers are simulating molecular structures in no time, which is further lowering the cost of drug discovery. Trailblazing companies such as Pfizer and Biogen have already harnessed from power of quantum computing and are collaborating with IT firms such as Google Quantum AI to speed up precision medicine. As the healthcare transitions for the better approaches market players are designing advanced therapeutics.

- Surge in adoption in financial modeling and risk optimization: The financial sector is appearing as one of the leading adopters of quantum technologies for streamlining risk analysis and complex modeling. Banks such as JPMorgan and Barclays are investing significantly in quantum research to upgrade trading and fraud detection processes. The rise in usage of quantum machine learning, or QML, is further upgrading the data pattern recognition capabilities. According to the World Economic Forum in April 2025, government in UK is committed to investing USD 162 million in quantum technology to handle money laundering and tackle crime.

Challenges

- Exorbitant cost of the quantum hardware development: The quantum computing systems are highly expensive to design. For instance, superconducting qubits need large fridges, and their ion trap systems need ultra-high vacuum. These components cost humongous, making the large-scale deployment very unfeasible for most organizations. The challenges with the cost even go beyond hardware to finding skilled labor and long-term maintenance of the systems.

- Limited scalability and manufacturing challenges: One of the greatest engineering challenges is to scale quantum processors from just a few dozen qubits to millions. The lack of scalable fabrication processes hampers commercialization and restricts availability to large research organizations rather than mainstream enterprises.

Quantum Computing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23.1% |

|

Base Year Market Size (2025) |

USD 1.20 billion |

|

Forecast Year Market Size (2035) |

USD 9.55 billion |

|

Regional Scope |

|

Quantum Computing Market Segmentation:

Offering Type Analysis

The services systems segment of the quantum computing market is projected to grasp a leading 52% market share by the end of 2035. The growth is led by the rise of QCaaS, or quantum computing as a service. QCaaS allows companies of all sizes to gain access to quantum computing tools, software, and hardware without having to invest in expensive infrastructure. In 2021, Oxford Quantum Circuits launched the first commercially available QCaaS-based quantum computer in the UK. This launch embarks as a crucial point in the efforts to completely comprehend the potential of quantum computing.

Application Segment Analysis

The optimisation segment is anticipated to register 33% of the market share. The segment growth can be attributed to the rising adoption in various industries such as banking and logistics. Quantum computing can process numerous possibilities via entanglement and render a transformative advantage in solving these problems. With the help of quantum computing optimization, the logistics sector is transforming, which is solving scheduling and routing issues for delivery trucks, public transit, and tour vehicles.

End-user Segment Analysis

The banking and finance sector is predicted to garner the largest share owing to rising usage for risk assessment and fraud detection. By swiftly analyzing humongous datasets and imitating a plethora of market scenarios, quantum computers aid the financial institutions in mushrooming returns while lowering the risk, while remarkably enhancing decision-making efficiency. Similarly, in logistics and supply chain management, quantum computing enables companies to optimize routing and demand forecasting in real time. This capability lowers operational costs, increases delivery efficiency, and improves overall supply chain resilience.

Our in-depth analysis of the quantum computing market includes the following segments:

|

Segment |

Subsegments |

|

Offering |

|

|

Technology |

|

|

Application |

|

|

Deployment |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Quantum Computing Market - Regional Analysis

North America Market Insights

The North America quantum computing market is expected to account for a leading share of 37.9% by the end of 2035. The growth is driven by high demand for quantum computing in BFSI and an increase in government financing. The U.S. Department of Energy announced USD 11 million in funding for six cooperative initiatives to better understand whether, when, and how quantum computing can push the boundaries of computational research. The National Quantum Initiative is leveraging research and development, which is providing the way for wider quantum service deployment.

The market in Canada is witnessing robust growth due to academic excellence and innovation in the private sector. The involvement of the private sector is crucial, and companies such as D Wave have spurred the market optimism. In July 2024, the Government of Canada invested USD 18.4 million in quantum computing in Waterloo. This investment will further augment the market growth, offering lucrative opportunities for the market players.

Asia Pacific Market Insights

Asia Pacific is poised to garner 26.9% of the market share by 2035. The growth is attributed to consistent investments in R&D and growing cloud quantum initiatives in countries such as China and Japan. To illustrate, in April 2023, RIKEN, the National Institute of Advanced Industrial Science and Technology, the National Institute of Information and Communications Technology, Osaka University, Fujitsu Limited, and Nippon Telegraph and Telephone Corporation announced the development of Japan's first superconducting quantum computer. This development represents a big step toward quantum computing.

The government in China is prioritizing quantum technology under its 14th 5-year plan and has allocated USD 15 billion to aid quantum research and development. Additionally, the private players in the country are actively participating in adopting a quantum computing ecosystem and developing interoperable hardware to facilitate broader access for the researchers. This growth can also be attributed to the burgeoning demand for quantum computing solutions across various sectors, including finance, cryptography, and materials science.

Europe Market Insights

Europe's quantum computing market is on a robust growth trajectory, supported by strategic investments, collaborative efforts, and a strong focus on research and development. Companies like IBM and startups such as PsiQuantum are making significant strides in developing quantum technologies, further fueling market growth. In Germany, various industries such as pharmaceuticals and automotive are seeking quantum computing solutions to address simulations and various machine learning challenges. According to the International Trade Administration, USD 3 billion has been invested in the country for fostering development in quantum computing till 2026.

In the UK, the growth of the market is driven by academic and industrial collaboration. For instance, the University of Sussex plays a pivotal role in advancing quantum research and fostering innovation. Collaborations between academia and industry are crucial for translating theoretical advancements into practical applications, thereby accelerating the development of quantum technologies.

Key Quantum Computing Market Players:

- IBM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft

- Quantinuum

- IonQ

- D-Wave Systems

- Atos

- Quix Quantum

- Fujitsu

- NEC Corporation

- Xanadu Quantum Technologies

- Quantum Motion

- Q-CTRL

- Samsung Electronics

- Qkrishi

By 2024, the market for quantum computing is likely to reach a staggering USD 1.65 billion with significant government support, robust R&D activities, and the existence of American behemoths like Google and IBM. Businesses are employing strategic initiatives, like cloud-based QCaaS, facilitating more accessibility to this technology. Businesses in the Asia-Pacific area, such as Qkrishi and Samsung, are focusing on specific applications, whereas collaborations such as the one between AIST and Fujitsu Limited in Japan are advancing hardware innovation.

Recent Developments

- In May 2025, International Business Machines Corporation (IBM) announced the introduction of the Quantum System, featuring a 156-qubit processor, making it possible for 100,000 businesses to implement quantum solutions by 2025.

- In February 2025, D-Wave Quantum Inc. introduced the Advantage2 quantum computer, which offers improved enterprise application optimization through the Leap Cloud Service to resolve computationally challenging issues that are beyond the capabilities of traditional computers.

- Report ID: 4910

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Quantum Computing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.