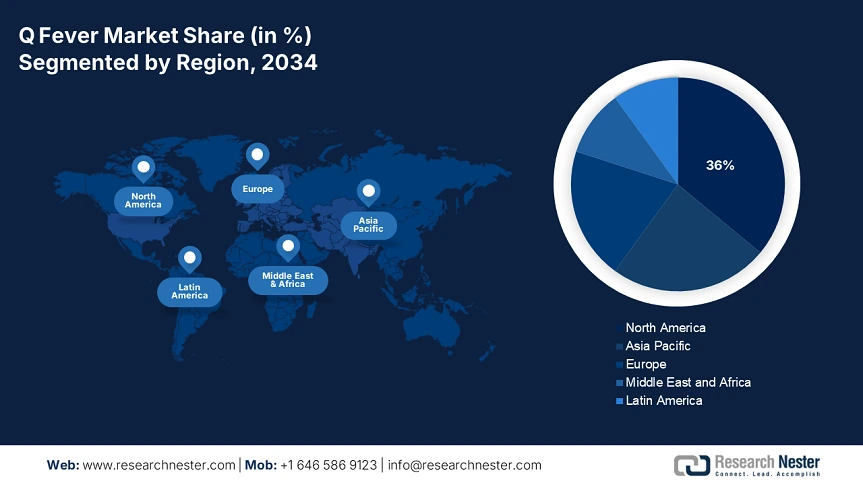

Q Fever Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global Q fever market with a share of 36% by the end of 2034. The growth is motivated by the growing prevalence of zoonotic disease and increases in government health care spending. The U.S. is the focus because of robust CDC surveillance and diagnostics, expansions in Medicare/Medicaid coverage, and NIH-supported research. Canada is experiencing moderate growth led by increased provincial healthcare spending. Notable trends in these markets include the emergence of vaccines, the establishment of additional livestock sector regulations, and the expansion of telemedicine in lieu of rural diagnosis.

The U.S. Q fever market is being buoyed by outbreaks reported by the CDC. Medicare expanded reimbursement for serology tests. Medicaid covers 44% of low-income patients. The requirement for livestock to be vaccinated is one of the significant drivers. The Q fever market in Canada is influenced by the PHAC's funded zoonotic disease program. Ontario is at the forefront of patient coverage. Vaccine research is funded with USD 29 M via CIHR (Canadian Institute of Health Research). Rural telemedicine uptake (Health Canada) supports timely diagnostics.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global Q fever market by the end of 2034. The increasing levels of zoonotic infections, elevated government spending on healthcare, and heightened awareness of Q fever diagnosis and treatment are shaping the Q fever market. Government spending continues to grow significantly for Q fever mitigation through vaccination and better diagnostics. For instance, in Japan, the government earmarked 11% of its healthcare spending to Q Fever in 2024. The government in China's spending alone has increased by 14% over the past five years. Following in the footsteps similar to Japan and China, the Government's spending on Q Fever increased by 17% from 2015 to 2023. India Q fever market reported that 2 million patients were reported to have received treatment in 2023. The Government spending in Malaysia has doubled over the past decade. The increased levels of rural healthcare access and contact through outreach programs and increased integration into infectious disease management frameworks contribute to growth. In addition, molecular diagnostic tools are being adopted, and antibiotic therapy approaches are becoming more and more standard of care.

Europe Market Insights

The Europe Q fever market is estimated to garner a notable industry value from 2025 to 2034. The growth is driven by increasing acute and chronic Q Fever incidences and increasing government healthcare expenditures. The market's expansion is further bolstered by the increasing recognition of healthcare services and the growing use of diagnostic serology tests. Policies made by the government around early diagnosis and managing Q Fever as a long-term illness are strong influencers in demand. Most recently, in the year 2023, several European countries increased government funding in their health care budgets to specifically combat zoonotic diseases such as Q Fever. There is increased awareness around the public health consequences of Q Fever. The European Medicines Agency (EMA) and the European Health Data Space have provided funding for the R&D of therapeutic and antibiotic treatments and vaccines. Furthermore, collaborations between public health authorities and pharmaceutical manufacturers operating across countries' borders (member states) facilitate regulatory processes and cut down approval times for new products. The upward trends in precision medicine and the implementation of better surveillance systems suggest even better market performance overall.

Germany is projected to have the largest Q fever market share in 2034. The growth is largely attributable to significant funding at the federal level and an advanced healthcare delivery system. The German government is investing heavily in zoonotic disease studies. Germany has the opportunity for high-level early recognition rates of Q Fever. In addition, the collective pharmaceutical industry is very active in funding R&D partnerships because of government support and additional incentives.

The UK Q fever market is positioned to be the second-largest market by revenue share. The UK also emphasizes rural health access and directs vaccination drives, as well as strong partnerships with pharmaceutical. Policy initiatives further support market growth by facilitating early treatment and general patient monitoring.

Q Fever Market Analysis for Other Countries

|

Region/Country |

Key Government Initiatives |

Budget Allocation (%) |

Notable Trends |

|

France |

Q-FRA Alert Initiative, HAS-led rural diagnostic deployment |

7% (in 2023) |

€2.1B invested in surveillance; vaccine trials |

|

Italy |

Agricultural reform, biosecurity upgrades (led by AIFA & Ministry of Health) |

~6.2% (est.) |

Veterinary screening in agrarian zones |

|

Spain |

AEMPS-led livestock health reforms and regional Q Fever response units |

~5.8% (est.) |

Biosecurity modernization; cross-border livestock screening |

|

Russia |

Russian Association of Pharmaceutical Manufacturers' surveillance expansion |

~5.5% (est.) |

Data gaps persist; increased investment in rural vet clinics since 2022 |

|

NORDIC Countries |

National Zoonotic Response Plans (Norway, Sweden, Denmark); health digitization initiatives |

~6.7% (avg.) |

Strong diagnostics interoperability; early adopter of ECDC-aligned screening protocols |