Purified Terephthalic Acid Market Outlook:

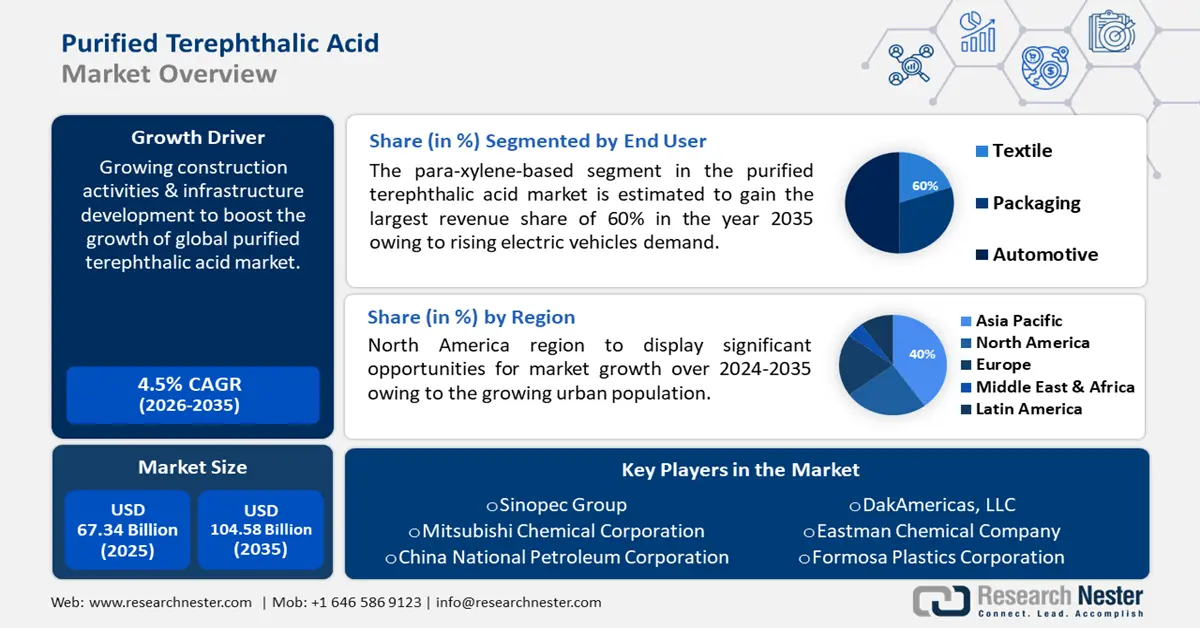

Purified Terephthalic Acid Market size was over USD 67.34 billion in 2025 and is poised to exceed USD 104.58 billion by 2035, witnessing over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of purified terephthalic acid is estimated at USD 70.07 billion.

The major element to support the expansion of the purified terephthalic market is the rising encouragement for the adoption of bio-based feedstock to eradicate the use of crude oil to manufacture PTA due to its adverse effect on the environment. For instance, oil & gas operations are poised to influence over 14% of total energy-related emissions across the world, which further indicates about 5 billion tonnes of greenhouse gas emissions. Hence, with the growing utilization of bio-based feedstock, the purified terephthalic acid market is set to rise.

Furthermore, governments across the world have launched various strict regulations to influence sustainability. Therefore, this factor is also predicted to dominate the bio-based feedstock growth which would ultimately boost the demand for purified terephthalic acid. Additionally, government strict regulations are also encouraging the growth in the recycling of polyethylene terephthalate plastics. As a result, this factor might also drive the market revenue.

Key Purified Terephthalic Acid Market Insights Summary:

Regional Highlights:

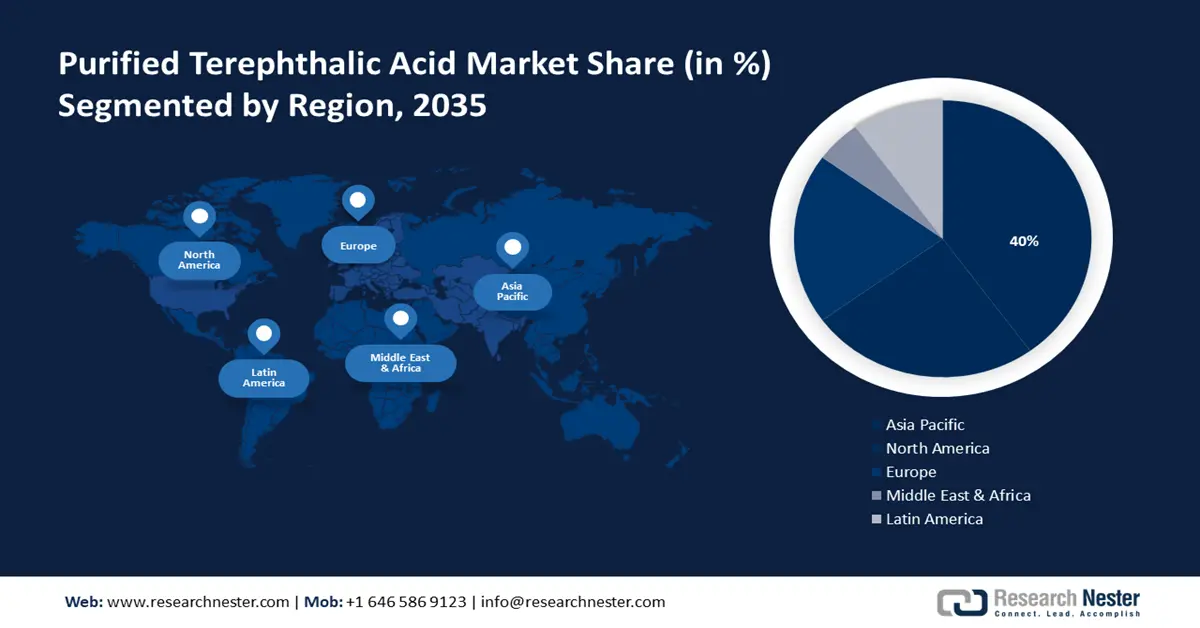

- Asia Pacific purified terephthalic acid market will dominate more than 40% share by 2035, fueled by rising urbanization boosting demand for textiles, packaging, and automobiles.

- North America market will exhibit notable growth during 2026-2035, attributed to increasing disposable income, cosmetics adoption, and rising oil production.

Segment Insights:

- The para-xylene-based segment in the purified terephthalic acid market is expected to achieve a 60% share by 2035, driven by technological innovations improving production efficiency and rising demand globally.

- The automotive segment in the purified terephthalic acid market is expected to capture a 50% share by 2035, attributed to rising demand for durable, high-performance automotive interior materials derived from PTA.

Key Growth Trends:

- Surging demand for Polyethylene Terephthalate (PET) resin in the packaging sector

- Growing construction activities and infrastructure development

Major Challenges:

- Surging demand for Polyethylene Terephthalate (PET) resin in the packaging sector

- Growing construction activities and infrastructure development

Key Players: Reliance Industries Limited, Sinopec Group, Indorama Ventures Public Company Limited, China National Petroleum Corporation, Mitsubishi Chemical Corporation, Eastman Chemical Company, Jiangsu Sanfangxiang Group Co., Ltd., Formosa Plastics Corporation, SABIC (Saudi Basic Industries Corporation), DakAmericas, LLC.

Global Purified Terephthalic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 67.34 billion

- 2026 Market Size: USD 70.07 billion

- Projected Market Size: USD 104.58 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, South Korea, Japan, Germany

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 16 September, 2025

Purified Terephthalic Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Surging demand for Polyethylene Terephthalate (PET) resin in the packaging sector - The rising e-commerce trend has increased demand for online food which has further boosted the growth of the packaging sector. For instance, in 2027, over the globe, over 3 billion people are predicted to order meals online. Moreover, the rising consumer busy lifestyle is additionally projected to dominate the demand for packaging since their demand for prepacked food.As a result, the use of PET resin is also surging. This is because PET resin is favored for its ability to be recycled at high temperatures. Hence, this demand for PET is also predicted to drive the market demand for PTA to control the inflammable properties of PET. Therefore, the purified terephthalic acid market is predicted to expand.

- Growing construction activities and infrastructure development - The construction industry is greatly dependent on polyester-based materials for applications including geotextiles, roofing membranes, and insulation which has further dominated the demand for PTA.Polyester materials have high tensile strength, resistivity to weather, and a great durable nature which makes them suitable for several construction purposes. Hence, with the growing infrastructure development projects in the world, the construction sector is expected to be a key contributor to the purified terephthalic acid market demand growth.

- Growing need for sustainable textile practices - The textile industry is experiencing significant growth over the decades. However, this sector is also responsible for the huge wastage of natural resources. Additionally, the chemical dyes utilized in the manufacturing of textiles may further lead to harming water resources and soil. As a result, the demand for sustainable practices in the textile industry is growing.This demand is specifically high among consumers since they are becoming aware of the pollution consequences of textile production. As a result, the recycling of textiles is rising. Hence, the purified terephthalic acid market is predicted to rise since, it plays a crucial role in the production of recycled PET fibers.

Challenges

-

Fluctuating raw material prices - The production of PTA makes use of raw materials including paraxylene, which is however derived from crude oil. Hence, fluctuations in the prices of crude oil are predicted to significantly affect the manufacturing costs of PTA, therefore creating challenges in pricing and profit margins. Moreover, the PTA industry, similar to several chemical manufacturing sectors, faces growing scrutiny regarding its environmental impact.The production of PTA generates by-products, and concerns related to emissions, waste disposal, and energy consumption pose challenges. Adhering to stringent environmental regulations and adopting sustainable practices is essential. Hence, this factor is anticipated to hinder the expansion of market over the years to come.

- Environmental Concerns and Sustainability is poised to be a challenge in development of purified terephthalic acid market.

- Overcapacity Issues restricting the market growth

Purified Terephthalic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 67.34 billion |

|

Forecast Year Market Size (2035) |

USD 104.58 billion |

|

Regional Scope |

|

Purified Terephthalic Acid Market Segmentation:

Type Segment Analysis

The para-xylene-based segment in the purified terephthalic acid market is estimated to gain the largest revenue share of 60% in the year 2035. Ongoing technological innovations are playing an important role in enhancing the efficiency of para-xylene-based PTA production. Enhanced manufacturing operations influence cost efficiencies and boost output, making para-xylene-based PTA manufacturers highly competitive in the global market. Hence, technological innovations are predicted to be key growth drivers, allowing producers to achieve the rising demand for para-xylene-based PTA in various applications.

Investments in technology have led to a 12% improvement in the para-xylene-based PTA production process efficiency globally, causing an increase in annual production capacities. Furthermore, the growing population is also estimated to encourage segment growth over the coming years. Consequently, this segment growth is predicted to influence market growth.

End User Segment Analysis

The automotive segment is expected to hold 50% share of the global purified terephthalic acid market by the year 2035. The major factor driving the segment growth is because they offer high performance and durability, to satisfy consumer expectations of quality in automotive interiors. Consumers are demanding automobiles with robust and long-lasting interior components which is why the automotive sector is necessitating the use of purified terephthalic acid-based materials for applications including fabrics for seats and carpets. It is stated that 78% of consumers consider performance features, which include durability and quality when making decisions about vehicle purchases.

Improvement in automotive interior design, such as innovative fabrics and materials derived from PTA, encourages a more adequate and contented driving experience. Moreover, rising demand for electric vehicles is also estimated to encourage the growth of the segment. Therefore, this segment is anticipated to experience a surge which is further projected to dominate the growth of the market between the years 2024 and 2035.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Purified Terephthalic Acid Market Regional Analysis:

APAC Market Insights

The purified terephthalic acid market in the Asia Pacific region is projected to hold the largest market share of 40% by the end of 2035. The region's burgeoning urbanization is contributing to boosting the consumption of textiles, packaging materials, and automobiles. Hence, the growing urban population influences the demand for purified terephthalic acid-based products. Asia Pacific has more than half of the world's population, and the urban population in the region is expected to reach 54% by 2030.

The Asia Pacific region's purified terephthalic acid market is additionally dominated by the thriving textile and packaging industries, robust automotive production, investments in petrochemical infrastructure, the shift towards eco-friendly products, and the demographic dynamics of a growing population and urbanization. The growing recognition of the importance of protection of the environment is influencing end-user choices, initiating to a rise in demand for eco-friendly materials. Furthermore, this region also has the presence of several manufacturers for the market. All these elements ultimately result in regional market expansion.

North American Market Insights

The purified terephthalic acid market in the North America region is projected to have notable growth over the forecast period. The main element to encourage the market expansion is growing disposable income which is additionally influencing them to demand frozen food. Moreover, the adoption of cosmetics is also estimated to encourage market expansion.

Furthermore, surging investment in AI and data analytics is also influencing enhanced production processes. Additionally, the production of oil is also rising in the region leading rise in the production process of purified terephthalic acid. Therefore, these two factors might also encourage the growth of the purified terephthalic acid market.

Purified Terephthalic Acid Market Players:

- Reliance Industries Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sinopec Group

- Indorama Ventures Public Company Limited

- China National Petroleum Corporation

- Mitsubishi Chemical Corporation

- Eastman Chemical Company

- Jiangsu Sanfangxiang Group Co., Ltd.

- Formosa Plastics Corporation

- SABIC (Saudi Basic Industries Corporation)

- DakAmericas, LLC

Recent Developments

- Sinopec International (China) Petroleum Services Company Ltd. through its subsidiary, acquired a 35% stake in Zhenhua Oil. With this acquisition Sinopec is expected to strengthens its upstream operations and expand its presence in the oilfield services market.

- Sinopec and Saudi Aramco announced a joint venture in China to manufacture, own, and function fuel storage and distribution facilities. Sinopec might leverage its extensive domestic network with Aramco's global expertise, to enhance fuel security and supply in China.

- Report ID: 5588

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Purified Terephthalic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.