Psoriasis Therapeutics Market Outlook:

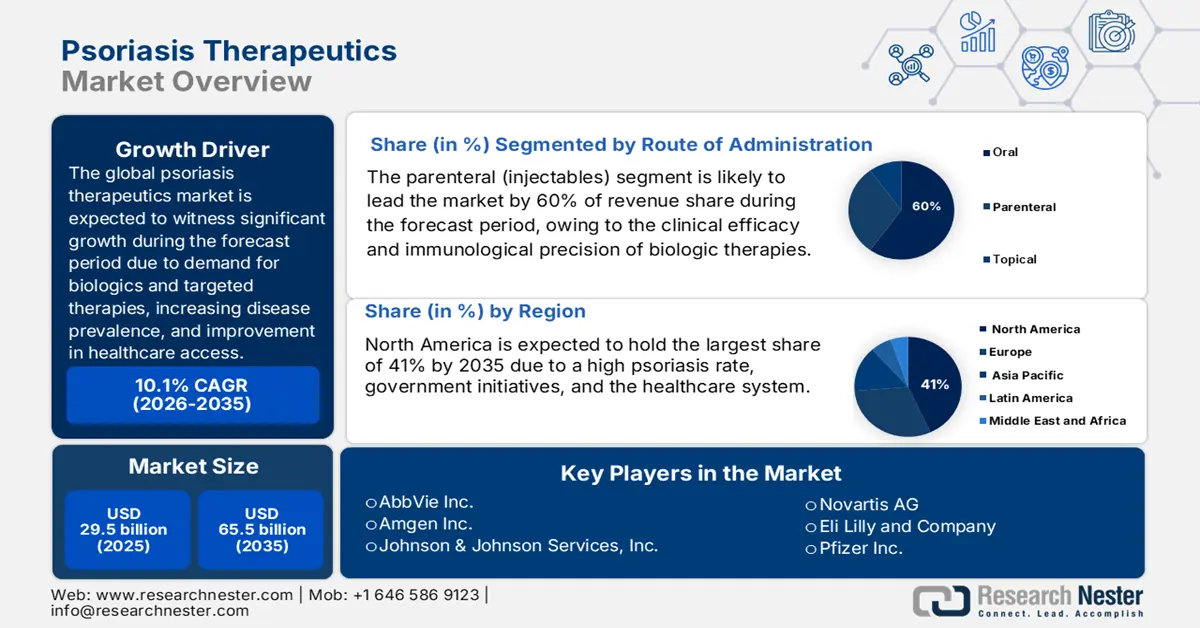

Psoriasis Therapeutics Market size is expected to be valued at approximately USD 29.5 billion in 2025, and is projected to reach around USD 65.5 billion by the end of 2035, rising at a CAGR of approximately 10.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of psoriasis therapeutics is anticipated at USD 32.5 billion.

The global psoriasis treatment market is increasing due to demand for biologics and targeted therapies, increasing disease prevalence, improvement in healthcare access, and investments from multiple public and private agencies in dermatological R&D. The National Psoriasis Foundation 2025 report stated that nearly 125 million people worldwide are affected by psoriasis, which is considered about 2-3% of the population of the world. Among these, about 30% suffer from psoriatic arthritis. More than 8 million patients suffer from psoriasis in the United States alone.

The supply chain of the psoriasis treatment market is growing increasingly; it needs the procurement of biologic raw materials, sophisticated manufacturing, and cold chain logistics to preserve drug potency. New therapeutics that provide better results, with biologics and targeted therapies that reduce side effects, require heavy investment by manufacturers in research and development. Treating companies, biotechnology firms, and universities innovating together reduce the time for bringing novel treatments to market. Additionally, the regulatory agencies are supporting the market by simplifying approval processes for breakthrough therapies. Advancements in treatment technologies, improved diagnostic modalities, and awareness of patients and providers help in the expansion of the psoriasis therapeutics market.

Key Psoriasis Therapeutics Market Insights Summary:

Regional Insights:

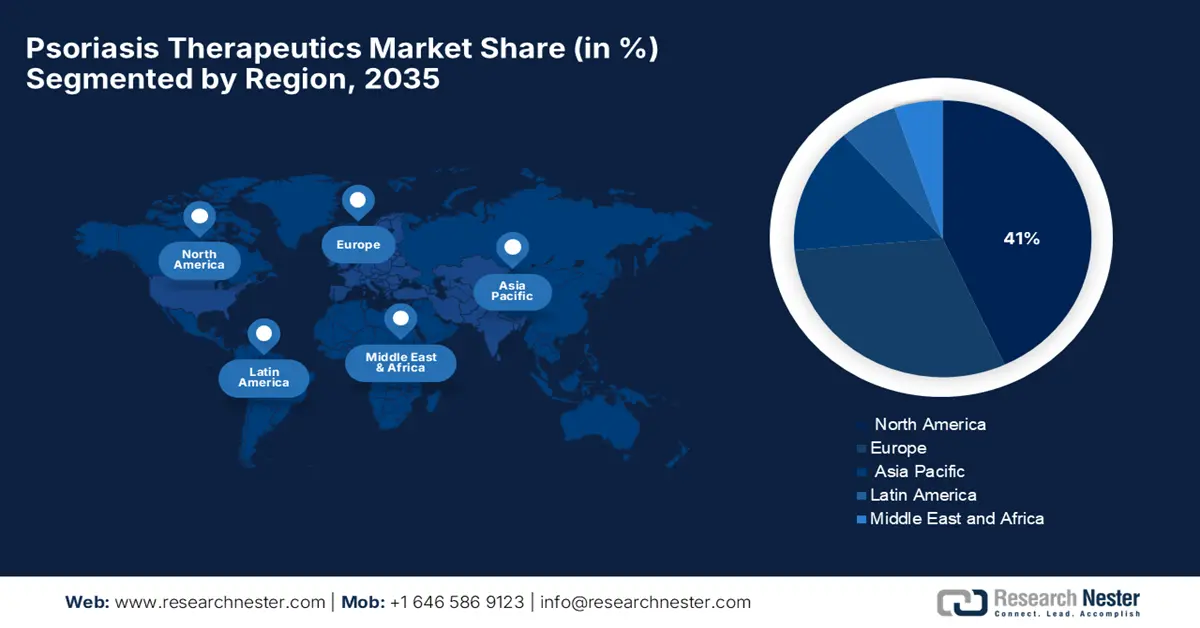

- North America is anticipated to dominate the Psoriasis Therapeutics Market by 2035, accounting for around 41% share, owing to supportive government initiatives, advanced healthcare infrastructure, and favorable reimbursement policies.

- The Asia-Pacific region is poised to expand at the fastest pace during 2026–2035, attributed to rising psoriasis awareness, government incentives for R&D, and increasing adoption of biologic treatments.

Segment Insights:

- The parenteral (injectables) segment is estimated to command a 60% share of the psoriasis therapeutics market by 2035, fueled by the clinical efficacy, targeted immunological action, and long-lasting effects of biologic therapies.

- Interleukin inhibitors, particularly IL-23 and IL-17 antagonists, are expected to lead the drug class segment through 2026–2035, driven by their precise inflammatory pathway targeting and superior safety and efficacy profiles.

Key Growth Trends:

- Expanding biologic and small molecule therapies with precision medicine potential

- Advancements in site-specific and combination therapies

Major Challenges:

- Complex treatment personalization due to disease heterogeneity

- Limited vaccine uptake among immunocompromised patients

Key Players: AbbVie Inc., Amgen Inc., Johnson & Johnson Services, Inc., Novartis AG, Eli Lilly and Company, Pfizer Inc., Merck & Co., Inc., AstraZeneca plc, UCB S.A., Boehringer Ingelheim International GmbH, Celgene Corporation (Bristol‑Myers Squibb), LEO Pharma A/S, Sun Pharmaceutical Industries Ltd., Biocon Limited, Galderma S.A.

Global Psoriasis Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.5 billion

- 2026 Market Size: USD 32.5 billion

- Projected Market Size: USD 65.5 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: India, China, South Korea, Brazil, Australia

Last updated on : 5 September, 2025

Psoriasis Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Expanding biologic and small molecule therapies with precision medicine potential: The increasing number of biologics targeting various inflammation pathways and the emerging oral small molecule inhibitors are changing the treatment of moderate to severe psoriasis. There is a huge chance of most of the psoriasis patients developing psoriatic arthritis, the need for therapeutic interventions that suit the individual basis is keeping the engine of innovation and investment rolling for the psoriasis therapeutics market. With the increase in precision medicine, the developers of new drugs are focusing on genetic profiling and biomarkers so that treatments can be adapted for their efficacy. Furthermore, the impact of patient dual-action therapy trials can improve patient outcomes and enrich treatment options is promising.

- Advancements in site-specific and combination therapies: The demand for targeted and combined therapies, such as calcipotriol/betamethasone formulations, for difficult-to-treat sites of psoriasis, such as the scalp, nails, and genitalia, is pushing the psoriasis treatment market upward. As per a report by The National Psoriasis Foundation, the incidence of psoriasis in African Americans is 1.5% as opposed to 3.6% in Caucasians. Meanwhile, innovative approaches in topical as well as systemic treatments emerge due to the restrictive nature of traditional methods, aiding the growth of the psoriasis treatment market. Meanwhile, the limitations of traditional therapies drive innovation in both topical and systemic options, fostering growth in the psoriasis treatment market.

- Expansion of dual-action therapies: The increasing awareness of psoriatic arthritis as a multifaceted complication of psoriasis increases the need for dual-action therapies to treat both skin and joints. Immunotherapy with biologics such as anti-TNF and IL-17 inhibitors is increasingly favored for competitively performing dual action, fueling pharma innovation and advancing the market for psoriasis therapies. Additionally, clinical guidelines are increasingly recommending integrated therapies for the management of both dermatologic and rheumatologic manifestations. Furthermore, the long-term efficacy and safety of the therapies are well established, promoting wider adoption by the health system.

Historical Change in Systemic Treatments for Psoriasis (PsO) and Psoriatic Arthritis (PsA)

|

Year |

PsO, Total No. |

Conventional Systemic Treatments* |

Biologics† |

PsA, Total No. |

Conventional Systemic Treatments‡ |

Biologics† |

|

2011 |

135,305 |

15,535 (11.5%) |

80 (0.06%) |

808 |

384 (47.5%) |

98 (12.1%) |

|

2012 |

136,590 |

16,172 (11.8%) |

165 (0.1%) |

893 |

440 (49.3%) |

115 (12.9%) |

|

2013 |

139,269 |

16,752 (12.0%) |

369 (0.3%) |

1,013 |

463 (45.7%) |

169 (16.7%) |

|

2014 |

137,685 |

17,325 (12.6%) |

513 (0.4%) |

1,202 |

537 (44.7%) |

242 (20.1%) |

|

2015 |

139,746 |

18,394 (13.2%) |

666 (0.5%) |

1,397 |

611 (43.7%) |

313 (22.4%) |

|

2016 |

142,842 |

19,219 (13.5%) |

999 (0.7%) |

1,503 |

671 (44.6%) |

420 (27.9%) |

|

2017 |

144,344 |

20,093 (13.9%) |

1,522 (1.1%) |

1,790 |

780 (43.6%) |

582 (32.5%) |

|

2018 |

146,059 |

20,850 (14.3%) |

2,513 (1.7%) |

2,000 |

821 (41.1%) |

732 (36.6%) |

Source: NLM July 2023

Challenges

- Complex treatment personalization due to disease heterogeneity: Psoriasis has multiple phenotypes and clinical severity, and demands appropriate treatment plans. The lack of standardized biomarkers, alongside limited guidance based on genomic profiles, hinders the selection of suitable treatments, further impacting patient adherence in the psoriasis treatment market. Such heterogeneity remains a major challenge for pharmaceutical companies and clinicians alike when developing and bringing to market a procedure or product.

- Limited vaccine uptake among immunocompromised patients: Low execution of vaccinations among psoriatic patients on biologics and JAK inhibitors makes the latter vulnerable to infections, thus complicating final treatment outcomes in the psoriasis treatment market. Doubts on the efficacy and safety of vaccines in the immunosuppressed lead to hesitancy. This gap in preventive care increases risks and contributes to a challenge in managing comorbidities and keeping a patient healthy during the administration of long-term psoriasis therapeutics.

Psoriasis Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 29.5 billion |

|

Forecast Year Market Size (2035) |

USD 65.5 billion |

|

Regional Scope |

|

Psoriasis Therapeutics Market Segmentation:

Route of Administration Segment Analysis

The parenteral (injectables) sub-segment is projected to hold the highest share of 60% for the psoriasis therapeutics market within the forecast period. The segment has been growing due to the clinical efficacy and immunological precision of biologic therapies. According to the NLM 2024 report, 2% to 3% of the people across the globe have a psoriasis disorder that has driven the tremendous growth of the parenteral (injectables) therapeutic sub-segment. Injectable biologics are still preferred for treating moderate to severe psoriasis, despite their high cost and administration barriers. This preference is further reinforced by the long-lasting effects and targeted action of injectable biologics.

Drug Class Segment Analysis

Interleukin inhibitors, especially IL-23 and IL-17 antagonists, are the highest registered subsegment in the psoriasis therapeutics market within the drug classes segment, due to precise targeting of inflammatory pathways, rapid onset of action, and lasting skin clearing. Their advanced safety profiles and established real-world effectiveness only make them more dominant across the globe in the treatment of psoriasis. Strategic uptake is further sped up in Asia Pacific markets, including Japan, with expanded indications being available and better healthcare infrastructure assisting volume growth.

Treatment Modality Segment Analysis

The biologics segment holds the highest market share in the treatment modality segment due to transformative efficacy in moderate-to-severe psoriasis, physician trust, and reimbursement frameworks. As biologics are the pillar and hallmark of treatment for psoriasis nowadays, lifecycle extensions through the launches of new biologics or biosimilars garner attention to strengthen market penetration and sustenance of treatments in both existing and emerging markets. Additionally, continuous clinical trials and pipeline innovations targeting novel cytokines such as IL-23 and TYK2 are expected to further expand the scope and competitiveness of the biologics segment.

Our in-depth analysis of the global psoriasis therapeutics testing market includes the following segments:

|

Segment |

Sub-segments |

|

Drug Class |

|

|

Treatment Modality |

|

|

Route of Administration |

|

|

Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Psoriasis Therapeutics Market - Regional Analysis

North America Market Insight

North America market is expected to hold the highest market share with 41% market share within the forecast period due to government initiatives and the healthcare system. Government initiatives are elevating patient care and inclusion, along with increasing disease awareness, which provides a strong marketing opportunity for the psoriasis treatments. The presence of major pharmaceutical players and advanced healthcare infrastructure further accelerates product development and rapid commercialization in the region. Additionally, favorable reimbursement policies and widespread adoption of specialty dermatology services continue to reinforce North America's leadership in the global market.

U.S. is driven by increased cases of psoriasis and psoriatic arthritis, broader regulatory approvals for emerging biologics and small molecule therapies, and increased use of telemedicine. The sustained growth of the market could be attributed to increased patient awareness, a supportive reimbursement landscape for therapies, and heavy R&D investments. According to a report by NLM August 2023, in the U.S. psoriasis market, systemic treatments, particularly biologics, are primarily used for moderate-to-severe cases involving ≥10% body surface area, due to their superior efficacy. Additionally, topical treatments typically serve as adjunct therapies rather than standalone options for these patients.

The market in Canada is experiencing growth due to the increasing incidence of the disease and the launch of new biologics. As per a report by NLM in June 2025, in retrospective research involving 154 patients with moderate-to-severe plaque psoriasis treated with bimekizumab among seven outpatient dermatology clinics across Canada, it was revealed that 84% of patients were still on bimekizumab, suggesting good adherence and market potential. This high continuation rate highlights both the clinical effectiveness and patient satisfaction with advanced biologic therapies, reinforcing Canada's expanding role in the global psoriasis treatment landscape.

Asia Pacific Market Insight

The Asia-Pacific psoriasis therapeutics market is the fastest-growing and is expected to hold a considerable market share during the forecast period, due to more opportunities with the spread of psoriasis awareness and improvement in healthcare infrastructure, along with more adoption of advanced biologic treatment. Furthering growth in this market is the supply of government schemes and incentives to support research and development. Growing patient demand, together with government initiatives in big countries including India, China, and Japan, is further fueling the growth of the market, establishing the region as one of the fastest-growing markets globally.

The psoriasis therapeutics market in China is rapidly growing due to biologics and emerging small-molecule therapies. According to a report by NLM in May 2024, in an approximate count of 6.3 million people suffering from psoriasis, with roughly 80-90% carrying plaque psoriasis as a subtype, there is an increased demand for systemic treatment in moderate and severe cases. With the increase in funding from both government and private bodies, growing opportunities for R&D look to address the unmet medical needs while fueling market growth.

India has been growing steadily due to increased disease awareness and treatment advancements. As per a study done by NLM in August 2022, out of 207 adults, only 52% of patients reported satisfaction with their current psoriasis therapy, with compliance as low as 35%, and 64% acknowledged that living with plaque psoriasis significantly impacted their lives. Although biologic treatments work well, yet are expensive, so most patients still use traditional therapies. Increased government support and funding for affordable treatment and clinical guidelines will foster the evolution of market demand, addressing some of its unmet needs and improving disease management in populations of diverse backgrounds.

Europe Market Insight

The psoriasis therapeutics market in Europe is witnessing rapid growth and is expected to hold a steady market share during the forecast period. The market is driven by the increasing use of new-age small-molecule therapies and modern biologics. As per a report by NLM, March 2023, PSO was diagnosed in 301,639 patients in the last 5 years, and it showed that most of the patients were not treated with systemic medications, and only 2% of patients were treated with biologics. Market expansion is backed by key factors, including a strong healthcare infrastructure, increased patient awareness, and an enabling regulatory framework. Furthermore, increased R&D spending and improved patient accessibility are imperative facets that enhance treatment options and disease control across the region.

UK is witnessing growth in the country, owing to the strong healthcare system and rising application of biologics. The key drivers include ongoing advancements in R&D, supportive governmental initiatives, and heightened patient awareness. PDE4 inhibitors, TNF inhibitors, and interleukin inhibitors are among the drug classes. Additionally, increasing investments in personalized medicine and targeted therapies are enhancing treatment outcomes and patient quality of life. The National Health Service (NHS) plays a crucial role in facilitating access to innovative therapies through reimbursement and patient support programs.

The psoriasis therapeutics market in Germany is increasing as advanced biologics and targeted therapies fulfill complex patient needs and shape the market. The choices in treatment are dominated by considerations of safety, especially in those patients who have comorbidities such as inflammatory bowel disease. Moreover, collaborations between academic institutions and pharmaceutical companies are accelerating the development of new drugs. Growing awareness campaigns are also helping to reduce stigma and encourage earlier diagnosis and treatment adherence across the country.

Historical Demographic and Clinical Characteristics of PSO Patients in Europe

|

Variable |

2017 |

2018 |

2019 |

2020* |

|

Number of patients |

241,552 |

269,856 |

293,905 |

301,639 |

|

Age, years |

57.0 ± 17.0 |

57.3 ± 17.0 |

57.8 ± 17.0 |

57.9 ± 14.3 |

|

Male gender |

126,000 (52.2%) |

140,283 (52.0%) |

152,717 (52.0%) |

156,589 (51.9%) |

|

Rheumatoid Arthritis (RA) |

2,795 (1.2%) |

3,262 (1.2%) |

3,656 (1.2%) |

3,991 (1.3%) |

|

Ankylosing Spondylitis (AS) |

477 (0.2%) |

591 (0.2%) |

696 (0.2%) |

765 (0.3%) |

|

Psoriatic Arthritis (PsA) |

8,187 (3.4%) |

9,275 (3.4%) |

10,376 (3.5%) |

11,211 (3.7%) |

|

Inflammatory Bowel Disease (IBD) |

2,026 (0.8%) |

2,476 (0.9%) |

2,868 (1.0%) |

3,116 (1.0%) |

|

- Crohn’s Disease (CD) |

610 (0.3%) |

752 (0.3%) |

856 (0.3%) |

936 (0.3%) |

|

- Ulcerative Colitis (UC) |

876 (0.4%) |

1,073 (0.4%) |

1,249 (0.4%) |

1,380 (0.5%) |

|

Uveitis |

25 (0.0%) |

29 (0.0%) |

30 (0.0%) |

34 (0.0%) |

|

Enthesopathies |

1,636 (0.7%) |

2,001 (0.7%) |

2,366 (0.8%) |

2,554 (0.8%) |

|

Cardiovascular Disease (CVD) |

14,288 (5.9%) |

18,091 (6.7%) |

21,730 (7.4%) |

24,387 (8.1%) |

|

Osteoporosis |

15,178 (6.3%) |

18,054 (6.7%) |

20,944 (7.1%) |

22,875 (7.6%) |

|

Depression |

42,611 (17.6%) |

51,223 (19.0%) |

59,577 (20.3%) |

64,555 (21.4%) |

|

Diabetes |

30,765 (12.7%) |

36,116 (13.4%) |

41,412 (14.1%) |

44,594 (14.8%) |

Source: NLM March 2023

Key Psoriasis Therapeutics Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amgen Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Eli Lilly and Company

- Pfizer Inc.

- Merck & Co., Inc.

- AstraZeneca plc

- UCB S.A.

- Boehringer Ingelheim International GmbH

- Celgene Corporation (Bristol‑Myers Squibb)

- LEO Pharma A/S

- Sun Pharmaceutical Industries Ltd.

- Biocon Limited

- Galderma S.A.

The market for psoriasis therapeutics is highly competitive, led by pharma giants such as AbbVie, Amgen, J&J, and Novartis, and recently, with the increasing participation of companies from India such as Sun Pharma and Biocon. Japan-based companies such as Takeda generally operate through wider portfolios in immunology. The main strategic initiatives comprise intensive investments in biologics and inhibitors of interleukin or TYK2, expansion via biosimilars and label extensions, and integration of digital health.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Johnson & Johnson announced their submission of a New Drug Application (NDA) to the FDA seeking the first approval of icotrokinra. This drug is targeted for oral peptide that selectively blocks the IL-23 receptor for the treatment of adults and pediatric patients

- In April 2023, A U.S. appeals court upheld Amgen’s patents on Otezla (apremilast), blocking generic versions from Sandoz and Zydus until February 2028. Before trial, both Sandoz and Zydus acknowledged that their generic versions of Otezla infringe the asserted claims of U.S. Patent No. 7,427,638.

- Report ID: 8068

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Psoriasis Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.