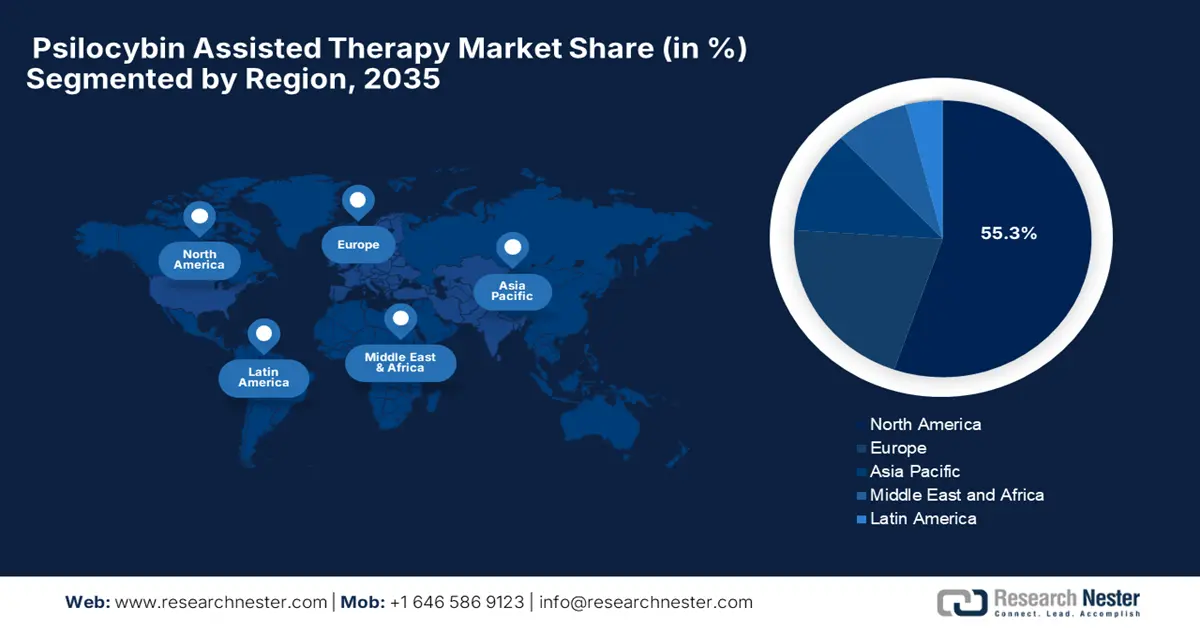

Psilocybin Assisted Therapy Market - Regional Analysis

North America Market Insights

North America is dominating the psilocybin assisted therapy market and is anticipated to hold the market share of 55.3% by the end of 2035. The rising federal funding, regulatory reforms, and clinical acceptance are the key factors behind this leadership. In January 2025, the clinical study by the Journal of Affective Disorders tested a single 25 mg dose of psilocybin in 15 U.S. veterans with severe treatment-resistant depression. The study found that at three weeks, 60% showed significant improvement and 53% achieved remission, wherein effects lasted up to 12 weeks for many, which suggests psilocybin can be efficacious in veterans.

The U.S. psilocybin assisted therapy market is growing due to federal investment, enhanced patient demand, and increased institutional adoption. Testifying to this, CPR in June 2023 revealed that Colorado legalized psilocybin mushrooms and some other psychedelics for adults 21 and older through Proposition 122, passed in November 2022, which began decriminalizing possession, use, and cultivation earlier in 2023. It also stated that a Natural Medicine Advisory Board is working on creating rules to ensure safe, equitable, and culturally responsible access.

Canada is gaining enhanced exposure in the psilocybin assisted therapy market owing to the proactive funding initiatives for psilocybin-assisted therapy and the federal government's investments in research. As evidence in June 2023, the country’s government has invested nearly USD 3 million to fund three clinical trials studying psilocybin-assisted psychotherapy for alcohol use disorder, treatment-resistant depression, and end-of-life psychological distress in cancer patients. Besides, this research aims to evaluate the safety and effectiveness of psilocybin combined with psychotherapy as a treatment option, hence suitable for standard market growth.

Healthcare Expenditures for Treatment of Mental Disorders Among U.S. Adults

|

Category |

Subcategory |

Amount (in billion USD) |

Percentage of Total (%) |

|

Total Healthcare Expenditures |

Adults 18 and older |

USD 106.50 |

100 |

|

Adults 18–64 |

USD 88.40 |

83 |

|

|

Adults 65 and older |

USD 18.10 |

17 |

|

|

Expenditures by Gender |

Females |

USD 61.50 |

57.7 |

|

Males |

USD 45.00 |

42.3 |

|

|

Expenditures by Type of Service |

Ambulatory visits |

USD 44.21 |

41.5 |

|

Prescription drugs |

USD 31.78 |

29.8 |

|

|

Emergency room, hospital stays, home health care, and others |

USD 30.54 |

28.7 |

|

|

Expenditures by Payment Source |

Private insurance |

USD 33.87 |

31.8 |

|

Medicaid |

USD 27.61 |

25.9 |

|

|

Medicare |

USD 20.38 |

19.1 |

|

|

Out-of-pocket payments |

USD 15.62 |

14.7 |

|

|

Other sources |

USD 9.06 |

8.5 |

Source: AHRQ, 2022

APAC Market Insights

Asia Pacific is the fastest-growing region in the psilocybin assisted therapy market accelerated by the progressive policy shifts, rising mental health prevalence, and investments in psychedelic-assisted treatments. India, Australia, and Japan are the predominant leaders in the Asia Pacific region. Japan’s openness in regulatory and integration in clinical practices has aided in institutionalizing psilocybin therapy, whereas with the large patient pool, India has catalyzed domestic manufacturing of psilocybin APIs. The region is shaped by rising acceptance among clinical researchers, unmet mental health needs, and increased funding from ministries of health.

Australia has emerged as the leader in the regional psilocybin assisted therapy market, backed by government support and regulatory shifts, which is establishing greater potential for this sector to revolutionize. In February 2023, the Therapeutic Goods Administration finalized the re-scheduling of psilocybin and MDMA in the Poisons Standard, allowing their controlled medical use. From July 1, 2023, psychiatrists authorized under the TGA’s Authorised Prescriber scheme can legally prescribe psilocybin for treatment-resistant depression and MDMA for post-traumatic stress disorder.

India is experiencing rapid growth in the psilocybin assisted therapy market, extensively supported by healthcare providers who are integrating psychedelic-assisted treatments with psychotherapy and government initiatives. In February 2025, MoHFW reported that the government has prioritized mental health as a major concern, launching programs such as the National Mental Health Programme, Tele MANAS, and the National Suicide Prevention Strategy, which accelerate accessibility, early intervention, and stigma reduction, thereby driving adoption among a wider audience group.

Initiatives and Policies in Advancing Mental Healthcare in India

|

Initiative/Policy |

Description |

Year |

|

National Suicide Prevention Strategy |

Focuses on suicide reduction via early intervention, crisis support, and awareness |

Launched 2022 |

|

Tele MANAS |

National tele-mental health helpline and app providing 24/7 counselling and referrals |

Launched 2022 |

Source: MoHFW

Europe Market Insights

The psilocybin assisted therapy market in Europe is growing rapidly on account of rising mental health prevalence, regulatory leniency, and strategic national health policies. Public-private research collaborations and hospital-based network trials are also incorporated in the region. In August 2025, the PsyPal clinical trial received the enrollment of its first patient at the University Medical Center Groningen. This multi-site, EU-funded study, supported by specialized centers across the region and pharmaceutical partner Avextra Pharma, aims to evaluate psilocybin’s potential to reduce depression and anxiety.

Germany holds the maximum share in the psilocybin assisted therapy market in Europe owing to its robust research ecosystem. For instance, in August 2025, Germany became the first EU country to approve psilocybin therapy for patients with treatment-resistant depression outside clinical trials, under a compassionate use framework. Besides, this program allows adult patients who have not responded to at least two standard antidepressants and cannot participate in clinical trials to access psilocybin therapy at two specialized centers: the Central Institute for Mental Health (CIMH) in Mannheim and the OVID Clinic Berlin.

The U.K. holds a strong position in the psilocybin assisted therapy market, facilitated by the increasing interest in alternative treatments for mental health conditions such as treatment-resistant depression. Besides the growing clinical trials, researchers are exploring the efficacy and safety of psilocybin when combined with psychotherapy, providing an encouraging opportunity for pioneers in this field. These studies are supported by pharmaceutical-grade formulations from companies such as COMPASS Pathways, hence positively influencing market growth.