Projector Market Outlook:

Projector Market size was valued at USD 12.6 billion in 2025 and is projected to reach USD 19 billion by the end of 2035, rising at a CAGR of 4.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of projector is evaluated at USD 13.1 billion .

The global projector market is experiencing steady expansion owing to the rising demand for immersive visual experiences across various sectors such as education, corporate, entertainment, and home-theater environments. In this regard, companies are making heavy investments in innovations such as laser and LED light sources, ultra-short‑throw and portable form factors, smart connectivity, higher resolutions, and energy-efficient, low-maintenance designs, all to meet evolving customer requirements. Mechasys in August 2025 reported that it achieved a USD 23 million investment to boost the deployment of its third-generation XR projector, which enhances precision and productivity in construction projects worldwide. In addition, the firm also underscored that this projector enables true 1:1 scale layout with millimetric accuracy, and the funding will support expansion in manufacturing, global distribution, thereby driving international growth and adoption.

Furthermore, the market is extremely benefited from the governmental supportive policies, which are consistently stimulating growth through the establishment of smart‑classrooms and digital‑education initiatives. In this context, the report from Samagra Shiksha, as of November 2025, the Gyankunj Smart Classroom initiative introduced by the Government of Gujarat is modernizing classrooms with projectors, whiteboards, laptops, IR cameras, and other multimedia content to enhance both teaching and learning experiences. Simultaneously, the program is implemented in more than 3,000 classrooms across 1,609 government schools, and it improves lesson delivery and boosts student engagement through these digital tools. Hence, the initiative will boost demand for interactive projectors in schools and public institutions.

Key Statistics of the Gyankunj Smart Classroom Initiative as of November 2025

|

Parameter |

Value |

|

Schools Covered |

1,609 Government Primary Schools |

|

Classrooms Implemented |

3,173 Classrooms (Std. V to VIII) |

|

Teachers Trained |

399,910 |

|

Students Benefited |

11,481,607 |

|

Phases of Implementation |

Phase 1: 3,173 classrooms |

|

Key Components Supplied |

Projector, Interactive Whiteboard, Laptop, IR Camera, Speakers, Wi-Fi Router, Multimedia Content |

|

Districts Covered |

33 districts and 242 blocks |

Source: Samagra Siksha

Key Projector Market Insights Summary:

Regional Highlights:

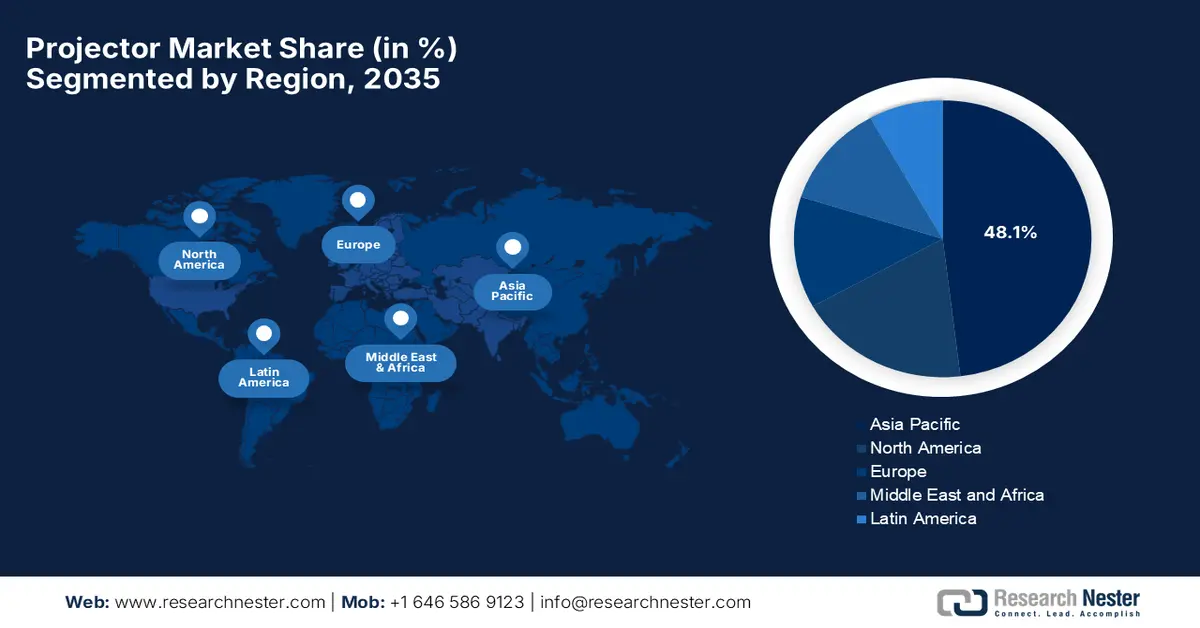

- Asia Pacific is projected to secure about 48.1% of the projector market’s revenue share by 2035, underpinned by government-led efforts to enhance educational and professional infrastructure.

- North America is set to strengthen its presence by 2035, supported by institutional procurement cycles and long-term audiovisual integration contracts.

Segment Insights:

- The LED projectors segment is forecast to capture 55.4% of the overall share by 2035 in the projector market, owing to durability, longer run time, and low maintenance.

- The 4K Ultra HD segment is anticipated to expand substantially by 2035, impelled by rising demand for home-theater experiences, gaming, cinema-style visuals, and high-definition content.

Key Growth Trends:

- Rising demand in home entertainment solutions

- Advancements in projection technology

Major Challenges:

- Technological obsolescence

- Intense competition & pricing pressures

Key Players: Epson (Seiko Epson Corporation) (Japan), Sony Corporation (Japan), BenQ Corporation (Taiwan), Optoma Technology, Inc. (Taiwan), Panasonic Corporation (Japan), LG Electronics Inc. (South Korea), ViewSonic Corporation (U.S.), NEC Display Solutions, Ltd. (Japan), Christie - Christie Digital Systems USA, Inc. (U.S. / Canada), Barco N.V. (Belgium), Canon Inc. (Japan), Acer Inc. (Taiwan), Vivitek / Delta Electronics (Taiwan), JVC Kenwood Corporation (Japan), Sharp Corporation / Sharp-NEC Display Solutions (Japan)

Global Projector Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.6 billion

- 2026 Market Size: USD 13.1 billion

- Projected Market Size: USD 19 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Indonesia, United Arab Emirates, Mexico

Last updated on : 8 December, 2025

Projector Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand in home entertainment solutions: There has been a rising popularity of home theaters, which is readily driving business in the international projector market. The innovations in terms of compact and portable projectors with wireless streaming capabilities are attracting a wider audience group who are looking for high-quality visuals at home. In August 2024, Samsung Electronics introduced its premiere 9 and the premiere 7 ultra-short throw projectors, which are aiming to bring a premium home cinema experience directly to living spaces. The company notes that these projectors feature laser technology, 4K resolution, and HDR10+ support, and deliver vivid colors and AI-driven picture optimization. Furthermore, the projector also has built-in Dolby Atmos speakers that provide immersive audio, thereby allowing users to enjoy a complete high-quality home entertainment solution.

- Advancements in projection technology: Continuous technological innovation is directly fueling the growth of the market since it is offering enhanced image quality and connectivity. Developments such as laser and LED light sources, 4K and 8K resolution projectors, ultra-short-throw models, and interactive features make projectors more attractive for educational, corporate, and entertainment applications. LG Electronics, in January 2025, introduced its two lifestyle projectors at CES 2025, which are the PF600U and the CineBeam S (PU615U). The PF600U is a CES Innovation Award-winning 3-in-1 device that combines a projector, Bluetooth speaker, and LED mood lamp to create space-efficient entertainment for living spaces. Meanwhile, the CineBeam S is the smallest 4K ultra short throw projector that delivers vivid 4K visuals and ultra-short throw projection, hence positively contributing to market expansion.

- Projector exports and emerging market potential: The aspect of significant export activities is an important revenue contributor for the projector market. This global demand is efficiently driven by trends such as the rise of remote work, hybrid learning models. Testifying to this, Jordan Exports in April 2024 disclosed that in 2022, worldwide exports of monitors and projectors under HS 8528 totaled around USD 101.5 billion, wherein the projectors constituted a smaller but growing segment, particularly in terms of high-resolution models such as 4K projectors. The report observed the key markets to be the U.S., Germany, and the U.K. Jordan’s exports of projectors remain minimal but show potential in markets such as the UAE, where imports from Jordan grew significantly in 2022. Hence, the presence of this consistent demand is expected to elevate the market potential in the upcoming years.

Global Trade of Projectors in 2022: Export and Import Values, Jordan’s Contribution

|

Product Description |

2022 World Exports |

Top Exporter (Value) |

Top Importer (Value) |

Jordan's Exports (2022) |

Jordan's Global Share |

|

Projectors for automatic data processing |

USD 2.4 billion |

Netherlands (USD 543.4 million) |

Netherlands (USD 551.2 million) |

USD 62,000 |

0.0026% |

|

Projectors (excl. TV receiver, not for computer use) |

USD 2.3 billion |

China (USD 1.5 billion) |

United States (USD 677.7 million) |

USD 334,000 |

0.0148% |

Source: Jordan Exports

Challenges

- Technological obsolescence: The projector market faces severe challenges from these rapid technological changes, wherein the devices become quickly outdated due to advancements in display technologies, such as laser, LED, and 4K/8K resolutions. Therefore, manufacturers must be innovative to meet consumer expectations for a higher image quality, portability, and connectivity features. Hence, this can result in short product lifecycles, inventory management concerns, and expensive R&D, which in turn can severely affect market stability. In addition, integrating new technologies such as smart connectivity and augmented reality necessitates higher investment as well as strong technical expertise, creating barriers for smaller companies that are operating in this field.

- Intense competition & pricing pressures: The global market is considered to be extremely competitive, wherein numerous players are offering a wide range of products at varying price points. The existence of this price sensitivity among both consumers and businesses can create continuous pressure on manufacturers to reduce costs, along with quality maintenance and performance. This competition is not limited to traditional projectors; it is also witnessed in terms of interactive displays, large-screen TVs, and digital signage solutions that increasingly serve as substitutes. Therefore, this competitive environment forces companies to constantly make investments in innovation, marketing, further straining the margins. Furthermore, the emerging entities with low-cost offerings can disrupt market dynamics, particularly in developing regions.

Projector Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 12.6 billion |

|

Forecast Year Market Size (2035) |

USD 19 billion |

|

Regional Scope |

|

Projector Market Segmentation:

Technology Segment Analysis

The LED projectors category is anticipated to lead the projector market, capturing 55.4% of the total share by the end of the forecast duration, owing to the durability, longer run time, and lower maintenance. The segment’s growth is also fueled by its suitability for smaller lifestyle-focused as well as corporate environments. In July 2025, Maxnerva Technology Service Ltd. announced the launch of its InFocus Apex Series projectors, which include the LED Apex Challenger and apex master, at IFA Berlin. The firm notes that both of these models are Google TV certified, comprising smart multimedia playback, autofocus, image correction, and access to streaming services such as Netflix, Amazon Prime, and Disney+. Furthermore, these projectors are priced affordably at €349 (USD 405) and €549 (USD 637), respectively, with high-quality audio and brightness, hence contributing to overall market growth.

Resolution Segment Analysis

In terms of resolution, the 4 K Ultra HD segment is anticipated to grow at a considerable rate in the market by the end of 2035. The growth of the subsegment is highly propelled by rising demand for home‑theater experiences, gaming, cinema-style visuals, and high‑definition content (4K/8K) supports this shift. Simultaneously, the premium, high-resolution projectors meet the expectations of consumers who are upgrading from TVs or monitors. For instance, in May 2025, Epson announced that it is showcasing 4K 3-chip 3LCD laser projectors at InfoComm 2025 in Orlando, highlighting immersive projection experiences across various applications. It also mentioned the lineup, which includes EB-PQ series 4K projectors (8,000–20,000 lumens), PowerLite L Series with short-throw and high-brightness options, the ultra-short-throw PowerLite 810E/815E, EB-PU Pro Series for large venues, and interactive brightlink 770Fi displays.

Portability Segment Analysis

Within the conclusion of the discussed timeframe, the ultra-short-throw projectors segment is likely to grow with a lucrative share in the projector market. These UST projectors offer space-saving, easy installation, and suitability for small living rooms or meeting rooms, making them suitable for both home‑theater users and corporate, educational customers. Since the urban living spaces are shrinking and multi-use rooms home-cum-office, living-cum-entertainment become common, UST projectors are expected to gain a strong share. In October 2023, ViewSonic announced the launch of the LS832WU, which is an ultra-short-throw laser projector especially designed for installation applications. It features a 0.25 throw lens, 5,000 ANSI lumens, WUXGA resolution, and up to 30,000 hours of lamp-free usage. Furthermore, the projector also supports remote management via Crestron, AMX, Extron, and PJ Link, thereby delivering bright, vivid images for creative and unobtrusive large-space projections.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Resolution |

|

|

Portability |

|

|

Application |

|

|

Distribution Channel |

|

|

Price |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Projector Market - Regional Analysis

APAC Market Insights

In the global projector market, the Asia Pacific is expected to command about 48.1% of the revenue stake during the forecast period. The region’s leadership in this region is effectively propelled by government-led initiatives to expand educational and professional infrastructure. Simultaneously, the existence of large-scale projects in universities, vocational training centers, and corporate campuses drives regional sales in this field. For instance, in April 2025, BenQ India announced the launch of the GV50 smart FHD laser portable projector, which is designed to deliver cinema-quality visuals on a 120” screen with 1080p resolution, Rec. 709 color accuracy, HDR/HLG support, and a bright 500 ANSI lumens. The projector also features a laser light source with up to 30,000 hours of lifetime, powerful 18W 2.1ch speakers, and intelligent screen adaptation technologies such as auto-focus, auto 2D keystone correction, and obstacle avoidance, hence making it suitable for standard market growth.

China’s projector market is positively influenced by regional industrial planning and urban development initiatives. The country’s market also benefits from provincial governments, which often fund large-scale installations in cultural and civic centers. Simultaneously, the strong presence of local projector manufacturers also shapes competitive pricing structures and distribution strategies in China. In July 2025, Seiko Epson Corporation and Bose Corporation together announced a collaborative development of projectors by integrating Epson’s projection technology with Bose’s audio expertise, creating a series that is designed to deliver immersive audiovisual experiences. The company mentions that the first lineup, featuring Sound by Bose technology, will launch in the U.S. and China, wherein the partnership aims to elevate home entertainment by providing synchronized, high-performance audio and visuals.

India is emerging as one of the largest and most influential landscapes for the market, which is closely linked to public investment in smart classrooms, training facilities, and government infrastructure projects. Tier-2 and Tier-3 cities in the country are witnessing gradual deployment, wherein the municipal projects, coupled with the entertainment sector, often dictate the specifications and scale of projector installations. In June 2025, PVR Cinemas partnered with Cinionic to upgrade 500 screens across India to Barco Series 4 4K RGB laser projection, making it the first in India’s exhibition chain to achieve 100% laser projection. In this context, Barco states that its Barco Series 4 projectors emphasize sustainability by reducing energy consumption, eliminating consumables, and extending operational life. In addition, Cinionic’s cloud services are also enhancing efficiency through remote monitoring, ensuring minimal downtime and optimized performance.

North America Market Insights

North America is likely to gain the most prominent position in the global projector market, strongly influenced by institutional procurement patterns, particularly in higher education and corporate training sectors. Also, the long-term contracts for audiovisual infrastructure in universities and professional environments are shaping purchase cycles. The region also benefits from government regulations on energy efficiency, which are also affecting installation standards, influencing choices for large-scale deployments. In October 2025, Sharp reported that it had refreshed its professional projector lineup with the new A and V Series LCD laser models, which efficiently deliver high brightness and flexible installation options for multiple environments. The firm notes that its A Series emphasizes extreme brightness, dust-free reliability with an IP5X-sealed LCD system, and virtually maintenance-free operation, whereas the V Series focuses on cost-effective integration with legacy lens compatibility.

The U.S. is augmenting its leadership in the market on account of both public and private sector investments in infrastructure modernization. Additionally, the country is witnessing a heightened demand for rental and event-based projectors, which are supporting conferences along with temporary installations. In August 2024, Extron announced that it had reached USD 25 million in educational technology grants over the past 15 years by providing audiovisual equipment and software to schools across the region. The firm also notes that these grants help equip classrooms with AV solutions, which include switching systems, wireless collaboration tools, and streaming media processors, thereby enhancing the learning experience. Furthermore, all of this equipment, software, training, and support provided are free of charge, which contributes to the growth of projector installations by supporting digital learning environments.

Canada is constantly growing in the market, primarily shaped by regional institutional policies, particularly in education boards and corporate campuses. The country’s market is also fueled by seasonal fluctuations, due to budget cycles and fiscal year planning, which influences procurement timing. In addition, the urban expansion projects and the growth of co-working spaces have also created new deployment opportunities. In August 2025, the Government of Canada announced that it made an investment of USD 89,000 through the Canada Cultural Spaces Fund to modernize the Creative City Centre in Regina, which includes the purchase and installation of projectors, screens, audio systems, and professional lighting. Hence, these upgrades will enhance accessibility, audience experience, and technical capabilities across the Centre’s gallery, performance, classroom, and recording spaces.

Europe Market Insights

Europe has gained immense exposure in the worldwide projector market, facilitated by harmonized regulatory standards and cross-border tenders. Besides, public institutions, research centers, and international conference hubs drive the demand for high-capacity, long-life installation projectors. In addition, the regional supply chains, along with logistics considerations, are also playing a pivotal role in market dynamics. In January 2024, Optoma announced that it introduced the ZK810T and ZK810TST, which are its first fixed-lens 4K UHD laser projectors suitable for education and corporate installations. This series delivers high brightness, precise colour reproduction, and full motorised lens shift, short-throw options, and 24/7 operation. Furthermore, the firm notes that the product is built with an IP5X-sealed optical engine and ensures long-term reliability across demanding environments, hence denoting a positive market outlook.

Germany is maintaining its dominance in the regional market and is structured around industrial, academic, and municipal procurement policies. Simultaneously, the regional funding programs for education and corporate infrastructure upgrades influence project timelines, whereas the trade associations often guide standardization requirements for audiovisual installations. For instance, in April 2025, ZEISS introduced its latest VELVET 4K digital planetarium projector in Halle or Saale, showcasing an ultra-high 5,000,000:1 contrast ratio and Rec. 2020 RGB laser color reproduction for lifelike astronomical visuals. It is designed and manufactured in Germany, and the system features the firm’s true black projection technology, orientation-free installation, and long-life solid-state lasers enabling up to a decade of operation with guaranteed support and replacement parts.

The U.K. has strong potential in the projector market, which is shaped by public sector initiatives and procurement processes that often involve competitive bidding, with an emphasis on long-term support contracts and compliance with environmental standards. In January 2022, Samsung Electronics introduced the freestyle, which is a lightweight portable projector launched in the country ahead of CES 2022, thereby offering a flexible entertainment solution that projects onto virtually any surface with a 180-degree rotating cradle. The firm highlighted that the device features auto-keystone, auto-leveling, and auto-focus for consistently sharp, correctly aligned images up to 100 inches, along with 360-degree sound and compatibility with USB-PD external batteries for mobility. Furthermore, combining a projector, smart speaker, and ambient lighting functions, the Freestyle includes Samsung smart TV features, making it a multifunctional portable display for on-the-go use.

Key Projector Market Players:

- Epson (Seiko Epson Corporation) (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sony Corporation (Japan)

- BenQ Corporation (Taiwan)

- Optoma Technology, Inc. (Taiwan)

- Panasonic Corporation (Japan)

- LG Electronics Inc. (South Korea)

- ViewSonic Corporation (U.S.)

- NEC Display Solutions, Ltd. (Japan)

- Christie - Christie Digital Systems USA, Inc. (U.S. / Canada)

- Barco N.V. (Belgium)

- Canon Inc. (Japan)

- Acer Inc. (Taiwan)

- Vivitek / Delta Electronics (Taiwan)

- JVC Kenwood Corporation (Japan)

- Sharp Corporation / Sharp-NEC Display Solutions (Japan)

- Epson - Seiko Epson Corporation is the dominant leader in this field, largely due to its proprietary 3LCD technology, deep manufacturing expertise, and broad product lineup spanning education, business, home cinema, and large-venue segments. Simultaneously, Epson’s global reach, strong channel relationships allowed it to set industry standards, securing its position at the top of this competitive landscape.

- Sony holds a most prominent role in the premium projector segment, which is known especially for its SXRD (Silicon X-tal Reflective Display) technology used in high-end home cinema and professional projection. The company is emphasizing superior contrast performance, cinematic image quality, and advanced laser light engines. In addition, Sony leverages its strong reputation in consumer electronics, imaging, and entertainment ecosystems to solidify customer trust.

- BenQ is a major global force, particularly in terms of consumer and education projectors, supported by its mastery of DLP technology and strong price-performance positioning. Besides, the company’s strategy focuses mainly on fast innovation cycles, gaming-optimized projectors, and color-accurate home-theater models under its CinematicColor branding. Furthermore, BenQ also benefits from its relationship with parent company Delta Electronics, allowing for competitive advantages.

- Optoma stands out as a specialized projector manufacturer with a strong focus on portable, home entertainment, and short-throw solutions, all built on DLP architectures. Simultaneously, the company’s product strategy deeply emphasizes compact designs, LED or laser light sources, as well as versatile installation options. Furthermore, Optoma has an expanding global channel network and rich feature-rich models, maintaining a solid competitive position in both consumer and education markets.

- Panasonic is recognized as the key powerhouse in the professional and large-venue projector sectors, which is known for delivering ultra-reliable, high-brightness laser projectors widely used in corporate events, museums, theme parks, and rental-staging environments. The company’s focus on durability, heat management, and long-life optical engines is efficiently strengthening its appeal among integrators and enterprise clients. In addition, Panasonic has a strong service infrastructure and partnerships in entertainment and education, enhancing its competitive landscape over the forecasted years.

Below is the list of some prominent players operating in the global market:

The global projector market is dominated by a combination of electronics giants along with specialized AV manufacturers, wherein the pioneers are leveraging consumer-focused home-theater projectors to high-end professional and large-venue systems. The players, such as Epson, Panasonic, and Sony, are leading in terms of robust R&D, profitable partnerships, and delivering reliable 3LCD and laser-based projectors for both business and entertainment uses. In July 2024, Panasonic Connect announced that it had entered a strategic capital partnership with ORIX Corporation to establish a new company that would operate its projector business, with ORIX holding an 80% stake and Panasonic Connect retaining 20%. Hence, this move aims to elevate the market potential by combining the firm’s established technological expertise and worldwide consumer base with ORIX’s investment strength and experience in scaling up businesses.

Corporate Landscape of the Projector Market:

Recent Developments

- In November 2025, the National Museum of Natural Science’s Space Theater in Taichung will have upgraded to six Christie Griffyn 4K35-RGB pure laser projectors, transforming its 23-meter dome into Taiwan’s most advanced planetarium, which delivers ultra-bright, wide-gamut RGB laser visuals with 360-degree 4K projection.

- In December 2024, AAXA Technologies introduced the new M8 ultra short-throw projector, which features the company’s shortest throw distance to date for highly flexible placement. Designed for tight spaces and versatile setups, the M8 delivers large, clear images from extremely close range.

- Report ID: 8280

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Projector Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.