Pressure Vessels Market Outlook:

Pressure Vessels Market size was over USD 27 billion in 2025 and is estimated to reach USD 56.7 billion by the end of 2035, expanding at a CAGR of 8.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of pressure vessels is assessed at USD 29.3 billion.

The international pressure vessels market comprises severe components across different industries, including renewables, power generation, chemicals, along with oil and gas. These vessels are significantly designed to safely contain liquids or gases under high pressure, and the market’s growth is underpinned by the evolving global energy shift, stringent safety regulations, and industrial demands. According to an article published by the IEA Organization in 2025, there has been a surge in the worldwide energy demand by 2.2% as of 2024, denoting a notably faster rate than the yearly average of 1.3% as observed in 2023. This growth has taken place partially owing to critical weather conditions, which are predicted to add 0.3% points to the 2.2% upliftment. Moreover, the growth in energy depends on a variety of sources, which is continuously propelling the market across different nations.

Global Energy Demand Growth Share by Source (2024)

|

Source Type |

Share % |

|

Renewables |

38 |

|

Natural Gas |

28 |

|

Coal |

15 |

|

Oil |

11 |

|

Nuclear |

8 |

Source: IEA Organization

Furthermore, the adoption of advanced materials, the Internet of Things (IoT) and digitalization, renewables and the hydrogen economy, as well as customized and modular designs, are other factors that are driving the pressure vessels market growth and expansion. As per an article published by the U.S. Department of Energy (DOE) in October 2025, the existence of the Manufacturing Demonstration Facility, which is a 110,000 square foot infrastructure, is readily focused on escalating the development of energy technologies. In addition, operational activities at this facility have resulted in over USD 1 billion in follow-on economic work, and it is readily continuing to offer standard service for researchers in the energy technology space. Besides, as stated in the January 2025 NLM article, the international advanced material market has been estimated to be valued at USD 500 billion in 2023, and is further forecasted to reach USD 700 billion by the end of 2028, thus proliferating the market’s upliftment.

Key Pressure Vessels Market Insights Summary:

Regional Highlights:

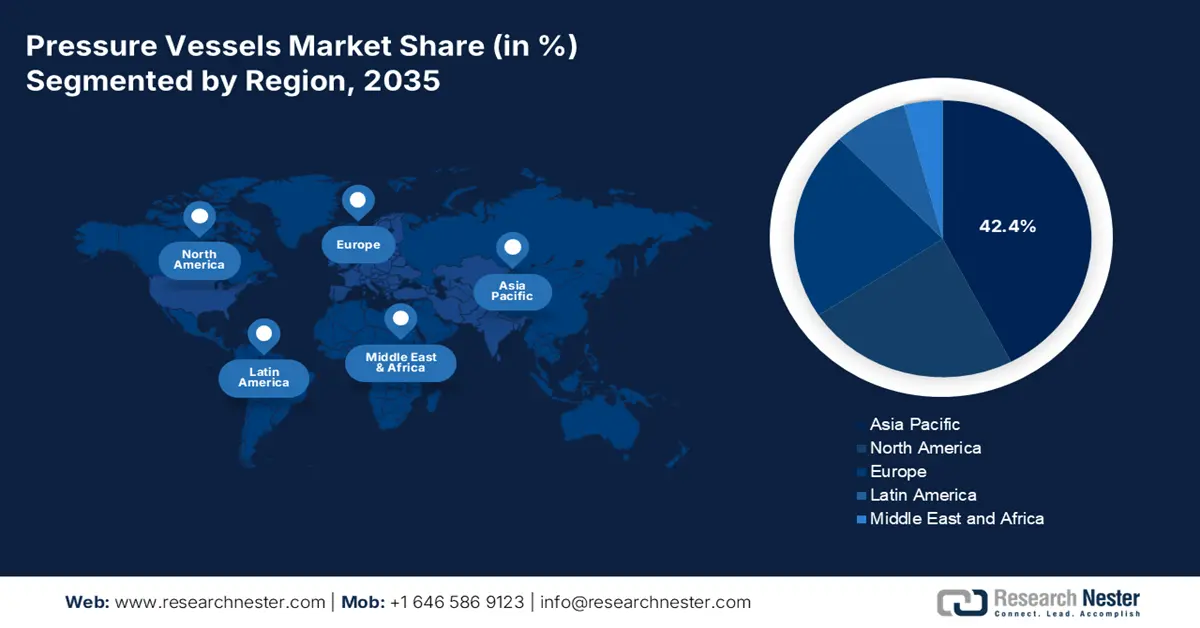

- Asia Pacific is projected to capture a leading 42.4% share by 2035 in the pressure vessels market, supported by semiconductor-led capital investments alongside strong petrochemical and sustained chemical industry expansion.

- Europe is expected to emerge as the fastest-growing region during 2026–2035, accelerated by modernization of nuclear and thermal infrastructure combined with energy transition initiatives and chemical processing advancements.

Segment Insights:

- The steel alloys sub-segment under the material category is forecast to secure a dominant 70.5% share by 2035 in the pressure vessels market, attributed to its high strength, durability, toughness, and enhanced weldability and corrosion resistance under extreme operating conditions.

- The welded vessels segment by manufacturing process is projected to hold the second-largest share over 2026–2035, benefitting from fabrication flexibility, economic efficiency, and reliable performance in high-pressure industrial environments.

Key Growth Trends:

- Increase in nuclear power

- Industrial expansion in the Asia Pacific

Major Challenges:

- Strict regulatory compliance and certification

- Increased capital and maintenance expenses

Key Players: Mitsubishi Heavy Industries, IHI Corporation, Kobe Steel, Ltd., Doosan Enerbility Co., Ltd., Hyundai Engineering & Construction, Linde Engineering, Siemens Energy, Kelvion, Alfa Laval, Mersen, Babcock International Group, Wood plc, McDermott, Babcock & Wilcox, Chart Industries, Paul Mueller Company, Worthington Industries, Larsen & Toubro, ISGEC Heavy Engineering, KNM Group Berhad, Civmec

Global Pressure Vessels Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27 billion

- 2026 Market Size: USD 29.3 billion.

- Projected Market Size: USD 56.7 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: India, China, Brazil, Saudi Arabia, Vietnam

Last updated on : 19 December, 2025

Pressure Vessels Market - Growth Drivers and Challenges

Growth Drivers

- Increase in nuclear power: The aspect of governments generously investing in clean energy projects and nuclear reactors is demanding innovative vessels for efficiency and safety, which is driving the pressure vessels market globally. According to an article published by the World Nuclear Organization in September 2025, nuclear reactors tend to generate an overall 2,667 TWh of electricity as of 2024, denoting a 66 TWh increase from 2,601 TWh in 2023. This is considered the highest ever generation from nuclear within a year, gradually surpassing the previous record of 2,660 TWh. Besides, by the end of 2024, the operable nuclear power plants' capacity have been 398 GWe, further denoting an increase by 6 GWe from the 392 GWe as of 2023, thereby proliferating the market’s growth an expansion.

- Industrial expansion in the Asia Pacific: The increased industrialization in Southeast Asia, India, and China has fueled the demand for the pressure vessels market, particularly for manufacturing, power, and petrochemicals. As stated in an article published by the International Monetary Fund Organization in November 2024, the growth of industrial services has taken into consideration half of the region’s workers, denoting an increase from 22%. This particular transition is projected to escalate with further extension of global trade for modernized services, including communication technology, information, and finance, along with business outsourcing. Therefore, with increased focus on upliftment by including workers in industries, the market is poised to experience growth and development within the region.

- Growth of the chemistry industry: The rise in the demand for petrochemicals and specialty chemicals has necessitated high-pressure separators and reactors, which is fueling the pressure vessels market internationally. As per an article published by Invest India Government in March 2025, the petrochemical and chemical industry in India readily contributes more than 9% to the manufacturing gross value addition, along with 7% to overall exports. Additionally, the industry’s market valuation is worth USD 220 billion as of 2024, which is further expected to reach USD 300 billion by the end of 2028. Moreover, the upcoming chemicals manufacturing facility is projected to grow by 11% to 12% as well as 7% to 10% by the end of 2040. Therefore, with this continuous growth in the industry, the market’s demand is gradually increasing.

Challenges

- Strict regulatory compliance and certification: The pressure vessels market operates under extreme conditions, making safety paramount. Compliance with international codes such as the ASME Boiler and Pressure Vessel Code in the U.S., the PED, which is part of Europe’s Pressure Equipment Directive, and national standards in Asia requires extensive testing, documentation, and certification. This regulatory burden increases costs and slows down time-to-market for manufacturers. Smaller firms often struggle to meet these requirements, limiting competition and innovation. Additionally, evolving environmental and safety regulations demand continuous redesigns and retrofits, creating uncertainty for long-term investments, thus causing a hindrance in the market’s growth.

- Increased capital and maintenance expenses: The pressure vessels market is considered to be capital-intensive assets, requiring specialized materials, such as steel alloys and composites, and advanced fabrication techniques. Initial investment costs are high, often exceeding per large vessel, depending on the application. Beyond procurement, maintenance costs are substantial due to mandatory inspections, non-destructive testing, and periodic replacements of components. In industries such as oil and gas, along with chemicals, downtime for vessel maintenance can lead to millions in lost revenue, making lifecycle costs a critical concern. Furthermore, the adoption of advanced monitoring technologies, including IoT sensors and predictive analytics, adds to upfront expenses, even though they reduce long-term risks.

Pressure Vessels Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 27 billion |

|

Forecast Year Market Size (2035) |

USD 56.7 billion |

|

Regional Scope |

|

Pressure Vessels Market Segmentation:

Material Segment Analysis

The steel alloys sub-segment, which is part of the material segment, is anticipated to hold the highest share of 70.5% in the pressure vessels market by the end of 2035. The sub-segment’s upliftment is highly driven by the provision of necessary toughness, durability, and high strength to safely withstand high temperatures and pressures. In addition, this permits alloying elements, such as vanadium, molybdenum, and chromium, and offers specific performance, enhanced weldability, and corrosion resistance for severe conditions. According to an article published by the OECD in May 2025, there has been a substantial increase in steelmaking capacity of almost 6.7%, which is 165 million metric tons. Besides, Asia-economy is projected to account for 58% of the newest capacity, which is led by a generous increase in India and the People’s Republic of China. Therefore, owing to this advancement, there is a huge growth opportunity for the sub-segment internationally.

Manufacturing Process Segment Analysis

Based on the manufacturing process, the welded vessels segment in the pressure vessels market is expected to garner the second-largest share during the forecast period. The segment’s growth is highly fueled by its versatility, cost-effectiveness, and ability to withstand high-pressure environments. The welding process allows manufacturers to fabricate vessels of varying sizes and shapes, making them suitable for diverse applications in chemicals, oil and gas, and power generation. The process ensures structural integrity by fusing steel plates and alloys into seamless units, reducing the risk of leakage under extreme operating conditions. Welded vessels are particularly favored in industries requiring large-scale containment, such as refineries and petrochemical plants, where modular and forged alternatives may be cost-prohibitive.

Application Segment Analysis

By the end of the stipulated timeline, the oil and gas sub-segment, part of the application segment, is projected to cater to the third-largest share in the pressure vessels market. The sub-segment’s development is propelled by pressure vessels being indispensable in upstream, midstream, and downstream operations, serving functions such as separation, storage, refining, and heat exchange. In upstream exploration, separators and scrubbers manage multiphase flows, while midstream LNG projects rely on cryogenic vessels for safe transport. Downstream refineries use reactors and boilers extensively to process crude oil into refined products. The sector’s reliance on high-pressure containment makes vessels critical for operational safety and efficiency. Growth in offshore drilling, shale gas exploration, and LNG infrastructure continues to drive demand, particularly in North America, the Middle East, and Asia-Pacific.

Our in-depth analysis of the pressure vessels market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

Manufacturing Process |

|

|

Application |

|

|

Product Type |

|

|

Pressure Rating |

|

|

End use Process Equipment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pressure Vessels Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the pressure vessels market is anticipated to garner the highest share of 42.4% by the end of 2035. The market’s upliftment in the region is highly fueled by semiconductor-based capital formation, along with the support provided by petrochemical and sustained chemical expansion. According to a data report published by the IBEF Organization in August 2025, the chemical industry in India is diversified and widely categorized into fertilizers, polymers, petrochemicals, agrochemicals, specialty chemicals, and bulk chemicals by covering over 80,000 commercial products. Based on this, the nation readily contributes 7% of its GDP, and the sector accounts for Rs. 21,50,750 crore (USD 250 billion) as of 2024. This is expected to increase to USD 300 billion by the end of 2028, along with Rs. 86,03,000 (USD 1 trillion) by 2040, thereby creating an optimistic outlook for the market.

China in the pressure vessels market is growing significantly, owing to the presence of semiconductor-driven supply chains and upscaled petrochemicals and chemicals that depend on storage, separation, and integrity vessels for reaction. As per an article published by the USCC Government in November 2025, in terms of production localization, 50% of the domestic market share in semiconductors has been targeted, of which only 16.6% has been achieved. Simultaneously, 14% of the country’s market share has been targeted, of which 11% has been added as of 2022. Besides, the country has been successful in gaining international competitiveness in foundational chips, which are readily defined as semiconductors fabricated on 28-nanometer process nodes. Moreover, different targets are set for controlled machines and robotics to ensure a smooth semiconductor supply chain, which, in turn, is suitable for boosting the pressure vessels market.

Controlled Machines and Robotics Targeted Through Semiconductor in China (2025)

|

Components |

Controlled Machines |

Robotics |

|

Objective Type |

Production Localization |

Production Localization |

|

Target |

80% domestic share, along with indigenous spindles, guide rails, and ball screws by 2025. |

70% domestic share by 2025, as well as 1 to 2 topmost international companies. |

|

Details |

An estimated 33% of the domestic share and domination by international organizations. |

52% domestic market share, 30% overall indigenous, as well as 80% to 90% within mid-tier, along with 1 organization. |

Source: USCC Government

India in the pressure vessels market is also growing due to an increase in contribution to the national GDP, diversification across different products, and rapid growth in both chemicals and specialty chemicals. As stated in a data report published by the Department of Chemicals and Petrochemicals in 2024, the value addition in the chemicals industry is projected to reach USD 29.7 billion as of 2024, along with a growth rate of 3.2% between 2024 and 2029. Besides, in this particular industry, 100% FDI in the country is permitted under the automatic route, with exceptions in a few hazardous chemicals. Moreover, the industry generously spends on research and development to the extent of 2% to 3% of the overall turnover, against 9% to 105 by multi-national organizations in overseas nations, thereby creating an optimistic outlook for the overall market.

Europe Market Insights

Europe in the pressure vessels market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is extremely driven by the modernization of nuclear and thermal assets, energy transition projects, and chemical processing. According to an article published by the JCR Publications in December 2025, the region accounts for 7.5% of the global solar thermal technology capacity, with over 3,000 MWth of manufacturing capacity. Additionally, extra-regional exports of solar water heaters are continuing to grow, and meanwhile, the excess domestic trade surplus has amounted to approximately EUR 16 million as of 2024. Besides, as per the June 2025 Eurostat article, the renewable energy sources utilization in cooling and heating is continuing to increase in the region, reaching 26.2% as of 2023. This particular share further increased by 1.2% points in comparison to 25.0% in 2022, thus denoting an optimistic outlook for the overall pressure vessels market.

Germany in the pressure vessels market is gaining increased traction due to the aspect of leadership, advanced process safety standards, and chemical base in industrial decarbonization technologies. As per an article published by the Clean Energy Wire Organization in January 2025, the country’s legally binding 2030 climate target of diminishing emissions by almost 65%, along with huge investments, is required to get the domestic manufacturing industry on a standard pathway for the required emission reductions. Meanwhile, as per the December 2023 Federal Ministry for Economic Affairs and Energy article, the Government of the Federal Republic of Germany and the United Nations Industrial Development Organization (UNIDO) partnered for the Global Matchmaking Platform and the Net Zero Industry. Based on this partnership, the country readily committed to EUR 23 million in seed funding, which denotes a positive impact on the market’s growth.

Poland in the pressure vessels market is also developing due to regional sustainability compliance, modernization of chemical assets, and industrial expansion. As stated in an article published by the Poland State Government in June 2025, there has been an increase in the country’s energy efficiency by 1.5% as of 2023, in comparison to 2022, and the yearly cumulative growth rate accounted for 1.1% in 2022. Besides, the primary energy intensity of GDP reduced by an average of 3.8% every year, while the final energy intensity of GDP also decreased by 2.8% every year. However, the fastest energy efficiency rate optimization has been witnessed in the industry, accounting for 2.6% per year. Therefore, with this increased focus on the aspect of energy efficiency, there is a huge growth opportunity for the market to flourish in the overall country.

North America Market Insights

North America in the pressure vessels market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly propelled by investments in the energy industry, stringent safety codes, and an increase in the replacement demand. Besides, according to an article published by the National Academy of Engineering in March 2024, the overall per capita utilization of steel in the U.S. is almost 800 kg, which is 1,800 lb per person. Moreover, the goods-producing industries in the overall region comprise 17.6% of the gross domestic product (GDP) as of 2023, along with 70.9% of manufacturing. In addition, manufacturing accounts for only 10.9% of the GDP, and the government expenditure caters to 38.5%. Therefore, all these factors are highly responsible for fueling the market’s growth and expansion in the region.

The pressure vessels market in the U.S. is gaining increasing exposure, owing to the EPA’s Risk Management Program and OSHA’s PSM, significantly incentivizing upgradation and strong integrity management. As per an article published by the C&EN Organization in December 2025, the chemical output in the country is expected to bolster by 0.7% by the end of 2025, denoting a 0.3% surge since 2024. Moreover, as stated in an article published by the Trade Government in 2024, the country is responsible for exporting more than USD 494 billion worth of chemicals as of 2022. In addition, as one of the leaders in chemical production, almost 13% of the world’s chemicals are derived from the country. Meanwhile, the sector includes 14,000 establishments that readily produce more than 70,000 products. Additionally, the domestic chemical manufacturing sector indirectly employed more than 902,300 employees, thereby denoting a massive contribution to the market’s growth.

The pressure vessels market in Canada is also growing due to expansion in the chemical industry, clean energy and government sustainability programs, regulatory and safety compliance, along with materials innovation and advanced manufacturing. As stated in the 2024 Natural Resources Canada report, the actual GDP for the energy, forestry, mining, and mineral sub-sectors catered to an estimated 11%, along with 49% of the overall regional goods, and 1.7 million indirect and direct employment opportunities. In terms of governmental spending, there has been the allocation of USD 14.1 billion for the upcoming 5 years, along with USD 4.1 billion yearly thereafter. Besides, to readily promote a massive utilization of clean fuels, NRCan has administered the USD 1.5 billion Clean Fuels Fund to uplift the clean fuel production capacity in the country, thereby proliferating the market’s exposure.

Key Pressure Vessels Market Players:

- Mitsubishi Heavy Industries (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IHI Corporation (Japan)

- Kobe Steel, Ltd. (Japan)

- Doosan Enerbility Co., Ltd. (South Korea)

- Hyundai Engineering & Construction (South Korea)

- Linde Engineering (Germany)

- Siemens Energy (Germany)

- Kelvion (Germany)

- Alfa Laval (Sweden)

- Mersen (France)

- Babcock International Group (United Kingdom)

- Wood plc (United Kingdom)

- McDermott (U.S.)

- Babcock & Wilcox (U.S.)

- Chart Industries (U.S.)

- Paul Mueller Company (U.S.)

- Worthington Industries (U.S.)

- Larsen & Toubro (India)

- ISGEC Heavy Engineering (India)

- KNM Group Berhad (Malaysia)

- Civmec (Australia)

- Mitsubishi Heavy Industries is one of the leading suppliers of large-scale industrial equipment, including boilers, nuclear reactors, and chemical process vessels. The company leverages advanced metallurgy and engineering expertise to deliver ASME-compliant vessels for power generation and petrochemical industries, making it a dominant player in Asia and beyond.

- IHI Corporation readily specializes in high-pressure vessels and reactors used in oil & gas, chemical, and energy sectors. With decades of engineering experience, IHI focuses on sustainability and advanced fabrication technologies, positioning itself strongly in the high-pressure segment of the global market.

- Kobe Steel, Ltd. significantly manufactures pressure vessel plates and components, supplying critical materials for boilers, reactors, and storage tanks. Its expertise in alloy steels and stainless steels ensures durability and compliance with international standards, supporting chemical and energy industries worldwide.

- Doosan Enerbility Co., Ltd. is a major supplier of heavy industrial equipment, including nuclear and thermal power plant vessels. The company emphasizes sustainability and advanced manufacturing, integrating digital monitoring and eco-friendly technologies into its pressure vessel offerings.

- Hyundai Engineering & Construction offers engineering, procurement, and construction (EPC) services for large-scale industrial projects, including chemical plants and power facilities. Its role in the pressure vessels market is tied to turnkey project delivery, ensuring compliance with global codes and integrating vessels into complex industrial systems.

Here is a list of key players operating in the global pressure vessels market:

The international pressure vessels market is moderately consolidated, with notable players from the U.S., Asia, and Europe dominating high-value projects. Organizations are investing in advanced alloys, composite materials, and modular vessel designs to meet stricter safety and sustainability standards. Strategic initiatives include digital monitoring systems, IoT-enabled predictive maintenance, and additive manufacturing for critical components. Regional expansion into Asia-Pacific and the Middle East ensures proximity to fast-growing chemical and energy hubs. Besides, in February 2024, NYK successfully placed an order with Kosaba Shipbuilding Corporation for a crew-based transfer vessel, which is projected to be utilized for transporting technicians to maintain and conduct offshore wind power generation facilities off Japan, thereby making it suitable for bolstering the pressure vessels market globally.

Corporate Landscape of the Pressure Vessels Market:

Recent Developments

- In September 2025, Hexcel Corporation declared the introduction of a Type IV carbon overwrap pressure vessel, which has been engineered by collaborating with HyPerComp Engineering Inc. and further utilizing its very own high-performance HexTow IM11-R/12K carbon fiber.

- In January 2024, Sealmatic India Ltd. notified that it has successfully gained a standard milestone with its newest certification of ASME U Stamp for pressure vessels, which readily serves as a hallmark of compliance and quality within the industry.

- In June 2023, Larsen & Toubro (L&T) significantly augmented its commitment to Saudi Arabia’s vision of a diversified and self-sustaining economy by boosting its ultimate focus on offering wide-ranging solutions to consumers.

- Report ID: 2691

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pressure Vessels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.