Premise Cable Market Outlook:

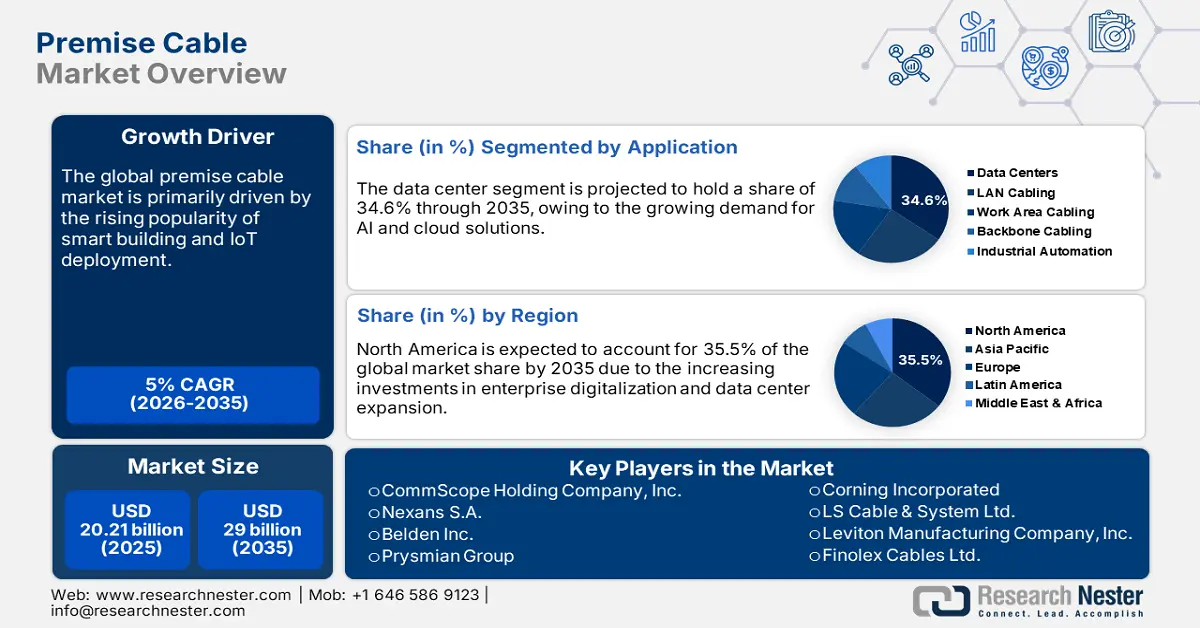

Premise Cable Market size was USD 20.21 billion in 2025 and is estimated to reach USD 29 billion by the end of 2035, expanding at a CAGR of 5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of premise cables is evaluated at USD 21 billion.

The stable supply chain of copper, polyethylene, and polyvinyl chloride (PVC) propels the global trade of premise cables. Chile, Peru, and China are the top suppliers of the raw materials. The consistent production and commercialization of copper at stable prices directly fuel the sales of premise cables. The U.S. Geological Survey (USGS) estimates that approximately 1.1 million tons of recoverable copper were produced in U.S. mines in 2024. The estimated value of this copper content was USD 10 billion, which was marginally more than the USD 9.83 billion in 2023. The public and private partnerships aimed at technological advancements in cable shielding, fire resistance, and signal integrity are opening lucrative doors for premise cable manufacturers. Investments geared toward enhancing fire safety compliance and electromagnetic compatibility are set to boost the deployment of premise cables in large-scale enterprises.

The trends we are witnessing indicate a clear pathway toward fiber optic cables, because of improved bandwidth and transmission distances, before signal loss. Network management powered by AI and automation tend to also be used for performance optimization, maintenance forecasting, and security management; however, the industry is still sluggish because companies are still dealing with upfront deployment costs of new networks, backwards compatibility issues with older infrastructures, and growing concern over security issues due to today's network interdependence. In summary, I see a very healthy premise cable market directly attributable to the changing technology that will accommodate today’s required consistency of high-speed connections.

Premise Cable Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for high-speed data transmission: The global shift toward digital infrastructure and high-speed connectivity, especially with 5G and cloud adoption, is fueling the demand for high-performance premise cables. The National Institute of Standards and Technology (NIST) mandates that structured cabling systems must meet rising bandwidth demands, particularly for data centers and enterprise networks. The ongoing infrastructure expansions and upgradation in Asia Pacific and North America are expected to double the revenues of premise cable manufacturers in the coming years. In addition, the increasing popularity of Power over Ethernet (PoE) is expected to fuel the demand for premise cables.

- Smart building and IoT deployment: The increasing demand for smart homes and buildings is anticipated to propel the sales of premise cables in the years ahead. The integration of IoT into commercial and residential buildings is set to boost the deployment of high-performance premise cables. The increasing adoption of smart sensors, HVAC systems, and security devices in modern home ecosystems is estimated to directly fuel the demand for premise cables. The smart building mandates that require advanced cable infrastructure for building management systems (BMS) are also contributing to the overall market growth.

- Focus on eco-friendliness and sustainability: With growing consciousness of environmental impact, both manufacturers and consumers are looking for products with more sustainable replacements. The consumer and manufacturer's choice of using more sustainable materials, components, and designs to reduce a company's carbon footprint recognizes the impact of green cabling in the premise cable market. The trend is advanced with government legislation or a corporate sustainability program that endorses the promotion of green cabling products and services. It allows for more sustainable and eco-friendly design opportunities to help meet regulatory aspirations and service an identified opportunity from new customers to seek products that have environmentally conscience capabilities or features. This is beneficial to innovate, grow, partner, and plan financially, and achieve mutual objectives for our environmentally conscious customers.

Challenges

- Pricing pressures from raw material volatility: The fluctuations in the costs of raw materials are expected to hamper the sales of premise cables. The price volatility of copper and polymer significantly affects the cost structure of premise cables. This instability creates margin pressures and limits bulk procurement in long-term infrastructure contracts.

- Infrastructure gaps: The inadequate infrastructure in some of the developing regions is expected to lower the sales of premise cables. The limited investments for commercial and educational building expansion are also restricting the large-scale premise cable deployment. Thus, premise cable manufacturers are expected to earn low profits in price-sensitive markets.

Premise Cable Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2026-2037 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 20.21 billion |

|

Forecast Year Market Size (2035) |

USD 29 billion |

|

Regional Scope |

|

Premise Cable Market Segmentation:

Cable Type Segment Analysis

The copper UTP segment is projected to capture 39.5% of the global premise cable market share by 2035. The copper unshielded twisted pairs (UTP) are the most sought-after cable type owing to their long-term cost benefits and ease of installation. The strong compatibility with legacy systems is also increasing the deployment of copper UTP cables. These cables support up to 10 Gbps transmission at short distances, which drives their demand in commercial structures. This was driven by their compliance with updated fire and performance codes. Compared to cable types such as fiber optics and shielded cable assemblies, UTP cables are much cheaper to manufacture and install, which is great for both large and small commercial projects. Many existing network devices are compatible with UTP cabling, lengthening its attractive cost profile with low long-term costs to the end-user.

Application Segment Analysis

The data centers are estimated to account for 34.6% of the global premise cable market share throughout the forecast period. The increasing demand for cloud services, AI, and IoT expansion in data centers is propelling the installation of premise cables. Cloud services are reliant on reliable, fast connections that can send user data, process it on remote servers, and retrieve it later. AI apps will include many variables, large datasets of information, and real-time interactions that require low latency and high bandwidth. Likewise, IoT technology's ongoing growth creates constantly monitored streams of data, which must be managed efficiently in the backdrop of the networks. This underscores that data centers are expected to fuel the trade of premise cables during the study period.

End User Segment Analysis

The commercial real estate subsegment is dominating the premise cable market. The need for reliable high-speed internet, integrated security systems, Internet of Things devices, and automation features require large-scale installations of premise cable in the commercial real estate market. In addition, the continuous construction and modernization of commercial real estate environments also plays a part in the demand for reliable and scalable cabling solutions.

Our in-depth analysis of the premise cable market includes the following segments:

|

Segment |

Subsegment |

|

Cable Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Premise Cable Market - Regional Analysis

North America Market Insights

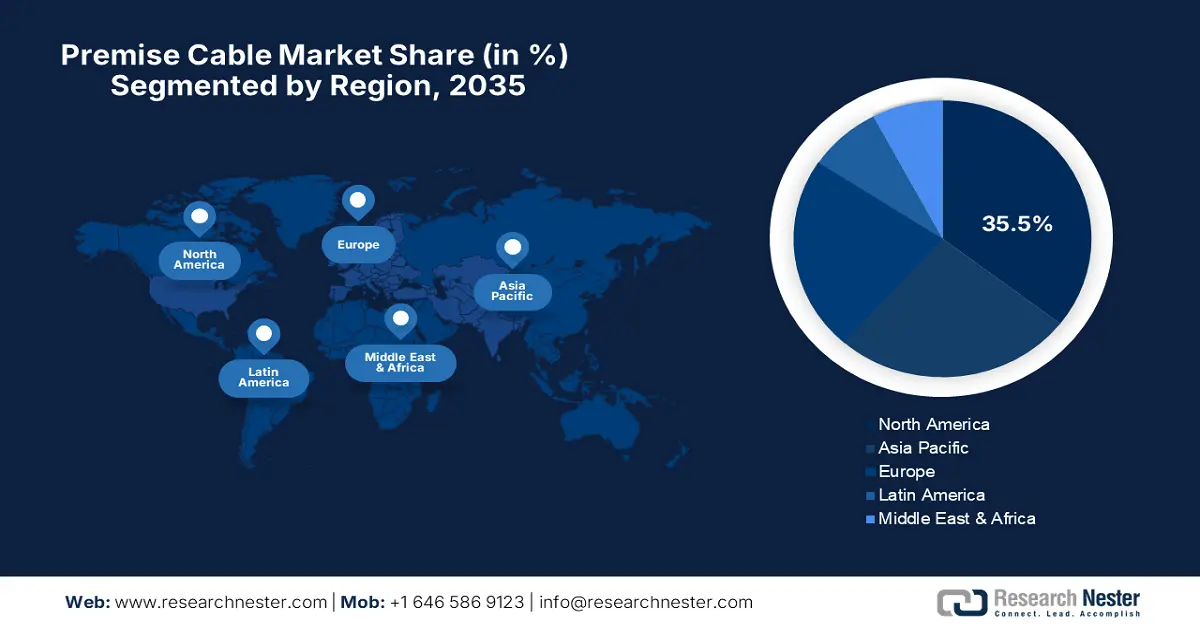

The North America premise cable market is anticipated to hold 35.5% of the global revenue share through 2035. The evolving federal broadband programs are likely to boost the sales of premise cables in the years ahead. The shift in enterprise digitalization and data center expansion is expected to double the revenues of premise cable manufacturers in the coming years. The commercial real estate retrofitting under ESG mandates is further elevating copper/fiber hybrid deployments.

In the U.S., the premise cable sales are expected to increase at a high pace owing to a rise in infrastructure investments. The digital equity and industry-led network modernization programs are pushing the demand for premise cables. The federal programs enabled structured cabling adoption in 15,000+ public libraries, schools, and healthcare facilities between 2021 and 2024. Also, the Federal Communications Commission’s (FCC) E-rate Program expanded its eligibility in 2023, propelling premise cable demand in K-12 public schools.

The rural digital access goals and public infrastructure upgrades are estimated to fuel the sales of premise cables in Canada. The private sector investments in 5G and smart buildings are also increasing the adoption of premise cables. Moreover, the public funding initiatives are likely to promote the sales of premise cables in the years ahead. The growth of the energy sector has contributed to the demand for power cables and related transmission infrastructure. The rollout of high-speed internet networks, expansion of broadband services, and the emergence of 5G technology are also driving demands for fiber optics cables and telecommunication infrastructure.

Europe Market Insights

The Europe premise cable market is poised to account for 22.8% of the global revenue share throughout the study period. The smart city expansion and energy grid modernization programs are accelerating the deployment of premise cable solutions. The EU-funded connectivity projects are expected to double the revenue of premise cable manufacturers in the years ahead. The government funding programs are set to propel the sales of premise cables in the years ahead.

The sales of premise cables market in Germany are expected to increase at a high pace, owing to the expansive industrial digitization projects. The government-supported campus cabling programs and edge computing applications in the automotive and manufacturing sectors are also increasing the demand for premise cables. This investment supports Industry 4.0 automation, campus factory upgrades, and 5G-ready production environments. Thus, the High-Tech Strategy 2025 of the country is poised to push the trade of premise cables in the years ahead.

The nationwide fiber expansion activities are fueling the demand for premise cables in the U.K. The IT modernization in the public sector is set to augment the deployment of premise cables. The expanding digital healthcare infrastructure is poised to fuel the sales of premise cable systems in the coming years. Furthermore, the defense modernization programs are projected to propel the demand for high-performance premise cables.

APAC Market Insights

The Asia Pacific premise cable market is foreseen to expand at a CAGR of 7.7% from 2026 to 2035, owing to the national broadband programs and hyperscale data center expansion. The digital and ICT infrastructure modernization programs are also promoting the demand for advanced premise cables. Countries including Japan, China, India, South Korea, and Malaysia are investing heavily in premise cabling across education, healthcare, smart manufacturing, and e-governance. Overall, Asia Pacific is likely to offer higher gains for premise cable manufacturers.

The new infrastructure initiatives that mandate upgrades in 5G base stations are set to fuel the sales of premise cables in China. The expansion of AI data centers and industrial IoT networks is pushing the demand for premise cables. The favorable public spending initiatives are likely to push the demand for premise cables.

The India premise cable market is forecast to register a CAGR of 9.4% between 2026 and 2035. The massive digital transformation under MeitY’s Digital India, Smart Cities, and BharatNet initiatives is propelling the sales of premise cables. The shift toward high-speed fiber-optic systems in BFSI, manufacturing, and healthcare is also pushing the demand for high-performance premise cables. Overall, investing in India is estimated to offer long-term returns.

Key Premise Cable Market Players:

- CommScope Holding Company, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nexans S.A.

- Belden Inc.

- Prysmian Group

- Corning Incorporated

- LS Cable & System Ltd.

- Leviton Manufacturing Company, Inc.

- Finolex Cables Ltd.

- Rosenberger Group

- Datwyler Cabling Solutions AG

- Hengtong Optic-Electric Co., Ltd.

- Superior Essex Inc.

- NKT A/S

- MM Kembla

- Tenaga Cable Industries Sdn Bhd

The global premise cable market is characterized by the presence of key players and the increasing emergence of start-ups. The leading companies are investing in R&D to enhance the transmission capabilities of the cables. They are entering into strategic partnerships with other players to enhance their product offerings and market reach. Some companies are collaborating with raw material suppliers or end users to maintain stability in sales. Industry giants are also targeting emerging markets to earn fruitful gains from untapped markets.

Recent Developments

- In April 2025, Lightera, announced the expansion of its Rollable Ribbon portfolio by introducing a full line of 16-fiber ribbon products, including both Single and Multimode. These new compact ribbon options are well-suited to support the new adapted 800G and 1.6Tb interconnects for Cloud and AI data centers. Using rollable ribbon technology, the premises cable family RR Cables are able to take advantage of the benefits of both individual fibers and the traditional ribbon application.

- In August 2025, Paramount Global disclosed plans to preserve and develop its long-standing entertainment brands Nickelodeon, MTV, and BET, and to significantly expand its feature film production pipeline. Paramount's plans for growing its legacy cable networks come at a time when other media companies are divesting of fading cable networks.

- Report ID: 7839

- Published Date: Aug 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Premise Cable Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert