Power Tools Market Outlook:

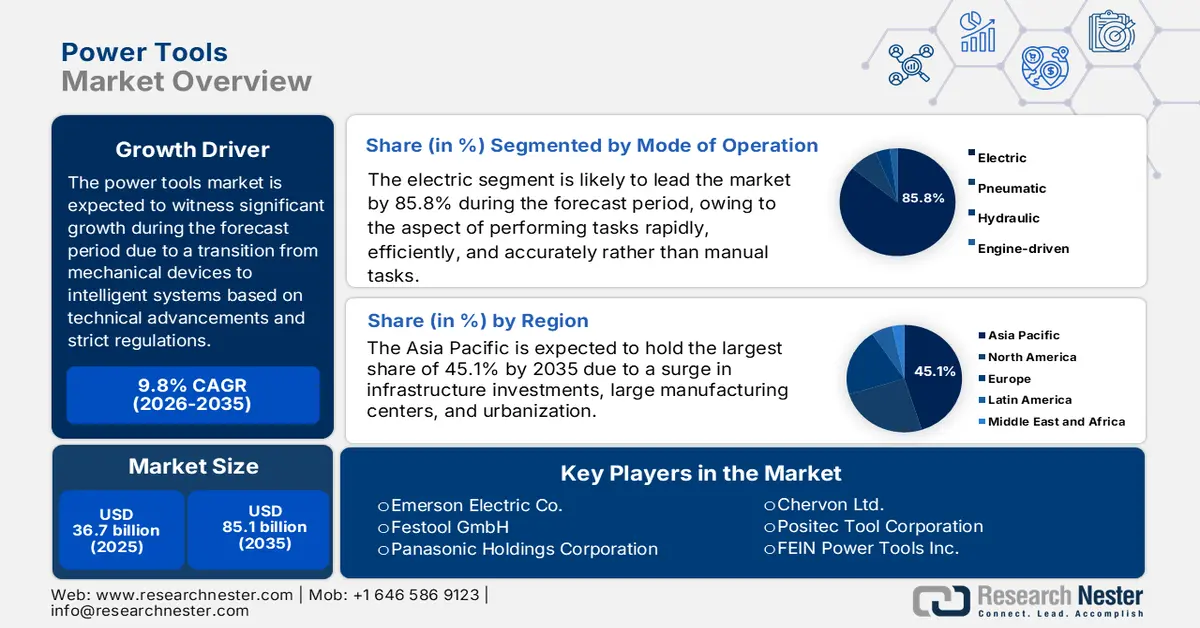

Power Tools Market size was over USD 36.7 billion in 2025 and is estimated to reach USD 85.1 billion by the end of 2035, expanding at a CAGR of 9.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of power tools is assessed at USD 40.3 billion.

The worldwide power tools market is an evolving and dynamic sector, presently characterized by a fundamental shift from simple mechanical devices to connected intelligent systems. This transition is highly fueled by a confluence of technological advancements, strict regulatory shifts towards sustainability, and evolving end user demands for increased safety and productivity. According to an article published by the World Economic Forum in April 2025, 67% of stakeholders ensure familiarity with sustainable construction, based on which the market is continuously growing. In addition, 69% of stakeholders witness sustainable construction as the topmost priority, which is significantly echoed by 60% of the general public. Besides, 67% of professionals have claimed to evaluate carbon footprint projects, and 30% prefer to evaluate systematically.

Furthermore, the aspect of customer lock-in, platform ecosystem, Internet of Things (IoT), and connectivity integration, increased focus on user-centric and ergonomic design, prosumer segment’s growth, and circular economy and sustainability initiatives are also bolstering the market globally. As per an article published by e-Prime - Advances in Electrical Engineering, Electronics and Energy in December 2024, the international electric vehicle industry is projected to quadruple by the end of 2027, with a predicted valuation of USD 1.4 trillion. In addition, this has translated into an outstanding growth rate of over 19.1%. Besides, almost 14% of passenger vehicle sales in 2022 catered to electric vehicles, denoting an increase of almost 5.3% from previous years. Therefore, with continuous growth in this industry, there is a huge growth opportunity for the market across different nations.

Key Power Tools Market Insights Summary:

Regional Highlights:

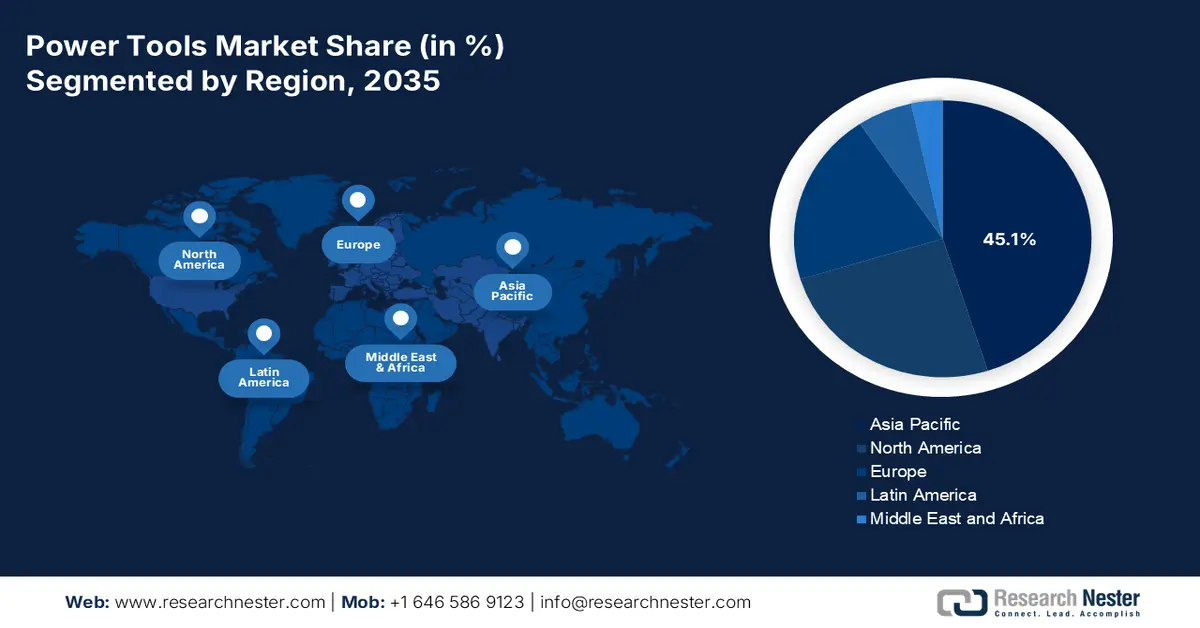

- Asia Pacific in the power tools market is anticipated to command 45.1% share by 2035, supported by its position as a global manufacturing hub and large-scale infrastructure and industrial expansion across China, India, and Southeast Asia.

- Europe is projected to be the fastest-growing region during 2026–2035, strengthened by rapid technological modernization, sustainability initiatives, and the region’s push to double its annual building renovation rate.

Segment Insights:

- The electric sub-segment is anticipated to secure 85.8% share by 2035 in the power tools market, supported by its capacity to deliver precise, rapid, and efficient task execution owing to consistent motor-driven torque and speed.

- The cordless/battery-powered segment is projected to hold the second-largest share during 2026–2035, bolstered by advancements in lithium-ion energy-density cells and innovative battery management systems that enhance power, fast charging, and operational runtimes.

Key Growth Trends:

- Revolution in cordless lithium-ion

- Smart manufacturing and industrial automation

Major Challenges:

- Diverging and strict regulatory compliance

- Cybersecurity risks in connected ecosystems and tools

Key Players: Stanley Black & Decker, Inc. (U.S.), Techtronic Industries (TTI) (Hong Kong), Robert Bosch GmbH (Germany), Makita Corporation (Japan), Hilti Corporation (Liechtenstein), Snap-on Incorporated (U.S.), Apex Tool Group, LLC (U.S.), Koki Holdings Co., Ltd. (Japan), Emerson Electric Co. (U.S.), Festool GmbH (Germany), Panasonic Holdings Corporation (Japan), Chervon Ltd. (China), Positec Tool Corporation (China), FEIN Power Tools Inc. (Germany), Metabo (Germany), Atlas Copco AB (Sweden), Ingersoll Rand Inc. (U.S.), ISCAR Ltd. (Israel), 3M Company (U.S.), AIMCO (U.S.).

Global Power Tools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.7 billion

- 2026 Market Size: USD 35.5 billion

- Projected Market Size: USD 40.3 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Mexico, South Korea, Indonesia

Last updated on : 4 December, 2025

Power Tools Market - Growth Drivers and Challenges

Growth Drivers

- Revolution in cordless lithium-ion: The transition from pneumatic and corded tools to brushless motor cordless tools is readily powered by innovative lithium-ion batteries, which remain the primary driver for the power tools market. These particular platforms provide superior power-to-weight ratios, diminished maintenance, long-lasting runtimes, and ensure true worksite mobility. According to a data report published by NITI Aayog in April 2025, the international trade facilities for tools are valued at USD 100 billion as of 2022, which is projected to reach USD 190 billion by the end of 2035. Besides, the share in India for exports amounts to USD 600 million for hand tools and USD 425 million for power tools. Meanwhile, the continuous motor-working tools supply chain is also boosting the market’s exposure globally.

2023 Motor-Working Tools Export and Import

|

Countries/Components |

Export (USD) |

Import (USD) |

|

China |

3.1 billion |

- |

|

Germany |

1.1 billion |

482 million |

|

U.S. |

712 million |

1.3 billion |

|

Mexico |

- |

458 million |

|

Global Trade Valuation |

9.0 billion |

|

|

Global Trade Share |

0.04% |

|

|

Product Complexity |

1.3 |

|

Source: OEC

- Smart manufacturing and industrial automation: The automation of assembly lines in electronics, aerospace, and automotive manufacturing is significantly fueling the demand for sensor-based and programmable tools, which is uplifting the power tools market internationally. These particular tools offer precise torque control, seamless integration into networked production systems, and data logging for quality assurance. For instance, as per an article published by NLM in May 2025, GE’s Brilliant Factory initiative has integrated IoT sensors, machine learning, and artificial intelligence to monitor the overall manufacturing process and gain 20% optimization in production efficacy. Additionally, the real-time adaptive control in additive manufacturing has revealed low electricity utilization by almost 15% to 20% in comparison to traditional production methods, thus suitable for skyrocketing the market.

- Increased construction spending: The aspect of huge private and public investments in infrastructure, as well as sustained residential construction activity, is creating high-volume and sustained demand for both finishing and heavy-duty demolition tools. As stated in the November 2025 Census Government data report, the international construction expenditure has been estimated to be worth USD 2,169.5 billion, denoting a 0.25 more than the USD 2,165.0 billion in July. Besides, the private construction expenditure is valued at USD 1,652.1 billion, residential construction with a yearly rate of USD 914.8 billion, and non-residential construction catering to USD 737.3 billion. Therefore, with continuous growth in expenditure in construction, there is a huge growth opportunity for the overall market.

Challenges

- Diverging and strict regulatory compliance: Manufacturers need to navigate an increasingly complicated and frequent diversified international regulatory landscape. Based on this aspect, regulations usually span various domains with safety standards, environmental regulations, and wireless communication strategies for connected tools. Besides, compliance is not considered a one-time expense but a continuous burden that demands dedicated legal and engineering resources. Moreover, these regulations can vary between regions, such as Asia, the U.S., and Europe, which necessitate different product versions and increasing complexity. Additionally, the push for sustainability is also catering to potential right-to-repair legislation and stringent carbon footprint, which is causing a hindrance in the market globally.

- Cybersecurity risks in connected ecosystems and tools: As tools become advanced and readily integrated into corporate IT networks through IoT platforms, there is a pathway that leads to significant cybersecurity vulnerabilities in the market. Besides, the utilization of connected tool fleets in severe manufacturing, large construction, and infrastructure projects is regarded as a potential entry point for cybersecurity, resulting in operational sabotage, ransomware, and data theft. Moreover, a breach can lead to theft of sensitive project data, data logging manipulation, and construction timelines disruption. Therefore, manufacturers need to ensure substantial investments to achieve ongoing firmware updates and software development lifecycle practices.

Power Tools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 36.7 billion |

|

Forecast Year Market Size (2035) |

USD 85.1 billion |

|

Regional Scope |

|

Power Tools Market Segmentation:

Mode of Operation Segment Analysis

The electric sub-segment, part of the mode of operation, is anticipated to hold the largest share of 85.8% in the power tools market by the end of 2035. The sub-segment’s upliftment is highly driven by its ability to permit tasks to be performed accurately, efficiently, and rapidly than manual tools. This is readily achieved by the utilization of motors that offer consistent torque and speed, which diminishes physical strain on the consumer and increases productivity. In this regard, according to an article published by the PIB Government in April 2025, NITI Aayog, along with the Foundation for Economic Development, jointly unveiled the more than USD 25 billion exports for India’s power and hand tools sector. This has successfully laid out a wide-ranging roadmap to upscale the country’s international exports from the present USD 1 billion to more than USD 25 billion by the end of 2035.

Technology Segment Analysis

The cordless/battery-powered segment, which is part of the technology, is projected to account for the second-largest share in the market during the predicted period. The segment’s growth is highly attributed to the technological vanguard and undisputed growth engine. In addition, an increase in the evolution of lithium-ion battery technology, particularly the shift towards energy density cells and innovative battery management systems that deliver power, rapid charging, and long-term runtimes, are also responsible for the segment’s growth. Besides, the core factor is the aspect of overcoming the performance barrier with corded tools, thereby liberating professionals from power outlets and generators to enhance flexibility and productivity in job locations. This particular segment is also defined by intensified competition, which centers on proprietary battery ecosystems to develop recurring revenue and high-margin streams and foster profound brand loyalty.

Application Segment Analysis

Based on the application, the industrial/professional segment in the market is projected to account for the third-largest share by the end of the forecast timeline. The segment’s development is highly fueled by the aspect of displaying the overall market’s high-performance core and high valuation, which is readily characterized by an increase in the demand for usage cycles, precision, low price sensitivity, and strict requirements in comparison to the customer DIY industry. The segment’s growth is also associated with macroeconomic indicators, such as capital spending, manufacturing output, and construction expenditure for industries, such as energy, aerospace, and automotive. Furthermore, the industrial shift towards automation and Industry 4.0 has integrated connected and sensor-equipped tools into assembly lines for data-logged and precise fastening to ensure traceability and quality control.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Mode of Operation |

|

|

Technology |

|

|

Application |

|

|

Source |

|

|

Sales Channel |

|

|

Tool Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Tools Market - Regional Analysis

APAC Market Insights

Asia Pacific in the power tools market is anticipated to garner the highest share of 45.1% by the end of 2035. The market’s upliftment in the region is highly fueled by the region’s position as the largest manufacturing center, huge government-based infrastructure investments, and unprecedented urbanization. Besides, India’s Make in India and China’s Belt and Road Strategy, along with Southeast Asia’s industrial expansion, are also responsible for boosting the market in the region. Furthermore, the market is successfully shifting from conventional to advanced lithium-ion models, owing to a surge in labor expenses and manufacturing sophistication. According to the 2023 IEA Organization article, there has been a growing demand for vehicles in China by more than 70%, while electric car sales increased by 80% as of 2022. Therefore, there is a huge demand for batteries in the region, particularly in China, which denotes a huge growth opportunity for the market in the region.

Battery Demand in China by Mode (2016-2022)

|

Years |

LDVs (GWh/year) |

Bus (GWh/year) |

Others (GWh/year) |

|

2016 |

22.3 |

11.5 |

10.0 |

|

2017 |

36.7 |

12.8 |

31.2 |

|

2018 |

75.3 |

16.2 |

27.9 |

|

2019 |

96.5 |

15.5 |

22.7 |

|

2020 |

129.7 |

14.1 |

23.9 |

|

2021 |

292.5 |

11.2 |

30.3 |

|

2022 |

501.9 |

13.0 |

35.6 |

Source: IEA Organization

China in the power tools market is growing significantly, owing to its status as the world’s factory, along with the strategic government push for industrial upgradation and colossal domestic infrastructure development. Besides, the National Development and Reform Commission (NDRC) is continuing to accept huge infrastructure projects from urban clusters to high-speed rail, which consume massive quantities of professional-grade power tools. According to an article published by the International Review of Economics & Finance in November 2024, the country’s digital economy has witnessed increased growth, amounting from 27.2 trillion yuan in 2017 to 50.2 trillion yuan in 2022. In addition, there has been a rise in the country’s contribution to the gross domestic product (GDP) from 32.9% to 41.5%, which is also proliferating the market’s growth.

India in the power tools market is also growing due to the government-based spending, an upsurge in the manufacturing industry based on production-linked incentive (PLI) schemes, and increased urbanization. According to a report published by the Invest Budget Government data report in December 2024, the capital spending by the country’s union government for major infrastructure industries has been growing at a 38.8% between 2020 and 2024. Moreover, the National Infrastructure Pipeline (NIP) has been unveiled, which has readily targeted a projected infrastructure investment of approximately ₹111 lakh crore by the end of 2025. This particular strategy has encompassed more than 9,766 projects as well as schemes across 37 sub-sectors, thus suitable for driving the market’s exposure in the country.

Europe Market Insights

Europe in the power tools market is projected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is extremely uplifted by increased focus on technological advancements, sustainability, and quality. In addition, the growth is further driven by the region’s ambitious shift to double the yearly energy renovation rate of buildings. As stated in an article published by the Europe Commission in July 2024, there has been an increase in advanced manufacturing centers from 1,900 to 4,500 between 2009 and 2023. This has further demonstrated over 10% of the industrial applications for progressive technologies in manufacturing processes. Besides, 3D printing is considered the highest manufacturing technological area, with the ADMAN sector readily accounting for 39% of activities by utilizing this technology in the region.

Germany in the market is gaining increased traction, owing to the massive private and public investment in energy transition and industrial modernization, along with a leading manufacturing hub. In addition, the country’s Industrial Strategy 2030, as well as its commitment to climate neutrality, has also catalyzed unprecedented capital spending. In this regard, the 2025 State Government data report indicated that the U.S.-based foreign direct investment (FDI) in the country amounted to USD 193 billion. Besides, the €1 trillion package comprises generous investments in infrastructure and defense, along with €500 billion effectively allocated to a specialized fund for infrastructure development, and €100 billion for climate-based investments. Furthermore, notable U.S.-specific FDI industries in the country are also driving the market’s growth in the country.

U.S. FDI Investments in Germany (2025)

|

Industry Type |

Investment Amount (USD) |

|

Manufacturing |

37 billion |

|

Chemicals |

3.7 billion |

|

Information Technology |

12 billion |

|

Machinery |

9.4 billion |

|

Finance |

13.8 billion |

|

Professional, Technical, and Scientific Services |

15 billion |

Source: State Government

Poland in the market is also developing due to its pivotal role as the nearshoring center for regional manufacturing, the booming residential construction industry, and the increased absorption of regional recovery funds. As per a report published by the Europe Commission in 2025, the provision of €59.8 billion as plan valuation, €25.3 billion as RRF grants, and €34.5 billion as RRF loans caters to the country’s plan to become resilient, sustainable, and prepared for opportunities, particularly in digital transition and green transition. Moreover, based on this objective, the country comprises 56 investment streams, along with 55 reforms. Additionally, 46.6% of the plan is poised to support the green transition, and 21.3% of the plan caters to the digital transition, thereby denoting an optimistic outlook for the market’s development in the country.

North America Market Insights

North America in the power tools market is predicted to witness steady growth by the end of the stipulated duration. The market’s growth in the region is highly propelled by the sustained residential and industrial demand. This is followed by the increased adoption of battery-powered and cordless tools, which is driven by innovations in lithium-ion battery ecosystems for notable players. As stated in a data report published by the Congress Government in November 2025, lithium-ion batteries in the U.S. represent 17% of the overall energy storage battery imports, which increased to 84% by the end of 2024. Likewise, in the case of exports, non-lead-acid battery parts are exported to Mexico, which increased from USD 43 million in 2023 to USD 1.9 billion as of 2024. Therefore, this effectively catered to 96% of all non-lead-acid battery part exports from the U.S. in 2024, thereby making it suitable to boost the market growth in the region.

The power tools market in the U.S. is gaining increased exposure due to federal budget allocation, along with advanced manufacturing, safety programs, and environmental sustainability approaches. For instance, according to an article published by the Department of Energy in May 2023, the U.S. Department of Energy's (DOE) Hydrogen and Fuel Cell Technologies Office announced an estimated USD 42 million in grants to support 22 new projects. The purpose was to make advancements in critical technologies for deploying, storing, and producing hydrogen. These projects, in turn, progressed DOE’s Hydrogen Shot objective of reducing the hydrogen cost to USD 1 per kilogram in a decade. Besides, as per the February 2023 ASC Organization article, the U.S. chemical producers increased by 3.9% as of 2022, and the chemical sector employment continued to grow, with a surge in payrolls by over 15,000 in the same year, thus creating an optimistic outlook for the overall market.

The power tools market in Canada is also growing, owing to the existence of housing plans, federal infrastructure, industrial investment, critical minerals strategy, energy retrofits, green building codes, digitalization, and skilled trades migration. According to the April 2024 Government of Canada article, the Budget 2024 outlined a bold approach to unveil 3.8 million new homes by the end of 2031. This comprised a minimum of 2 million net new homes, and 1.8 million homes are projected to be developed by 2031. Moreover, federal actions supported 1.2 million homes and have instructed to build more than 800,000 housing properties by the end of 2031. As per the March 2025 HJS Organization report, the country implemented the Canada Critical Minerals Strategy in 2022, which has stipulated CAD 3.8 billion for research and development, which positively impacts the market’s growth.

Key Power Tools Market Players:

- Stanley Black & Decker, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Techtronic Industries (TTI) (Hong Kong)

- Robert Bosch GmbH (Germany)

- Makita Corporation (Japan)

- Hilti Corporation (Liechtenstein)

- Snap-on Incorporated (U.S.)

- Apex Tool Group, LLC (U.S.)

- Koki Holdings Co., Ltd. (Japan)

- Emerson Electric Co. (U.S.)

- Festool GmbH (Germany)

- Panasonic Holdings Corporation (Japan)

- Chervon Ltd. (China)

- Positec Tool Corporation (China)

- FEIN Power Tools Inc. (Germany)

- Metabo (Germany)

- Atlas Copco AB (Sweden)

- Ingersoll Rand Inc. (U.S.)

- ISCAR Ltd. (Israel)

- 3M Company (U.S.)

- AIMCO (U.S.)

- Stanley Black & Decker, Inc. is considered one of the world’s largest manufacturers, and it readily dominates the market through its robust portfolio of outstanding brands, such as DEWALT, particularly for professionals and BLACK+DECKER for customers. The organization has positioned itself as a pioneer in cordless technology with its innovative POWERSTACK battery platform. Based on these developments, and as stated in its 2024 annual report, the organization has generated USD 15.4 billion in overall revenues, USD 1.1 billion from operational activities, and 29.4% as a gross margin rate.

- Techtronic Industries (TTI) is regarded as the most formidable growth disruptor in the sector, well-known for its data-based and agile approach to make advancements and commercialize, which has readily propelled its MILWAUKEE brand to a leadership position. The company’s approach to developing an expanded and brand-loyal M12 and M18 cordless ecosystem has readily redefined market demand.

- Robert Bosch GmbH is considered a global technology and engineering leader that represents German-based engineering in power tools, recognized for its increased focus on innovation, safety, and quality, especially in precise measurement tools and cordless technology. The organization has continuously invested in sustainable product creation and comprises a robust dual-brand strategy that serves professionals with its blue Bosch Professional line. Besides, as stated in its 2024 annual report, the organization generated €152,269,378 income from participating interests, €3,617,178 in other interest and similar income, and €455,616 from similar spending.

- Makita Corporation is regarded as a true industry pioneer and is credited with introducing the world’s first-ever cordless power tool, and it remains an international leader through its in-depth vertical integration. The firm’s strength originates from its massive 18V LXT cordless platform, which is one of the widest-ranging tools in the overall industry, and is increasingly accepted by traders for its extensive tool lineup and durability.

- Hilti Corporation has occupied a premium and unique niche as a direct-sales leader, exclusively targeting professional construction, along with maintenance, repair, and operations customers with its integrated system of high-performance services, software, and tools. Additionally, the organization’s contribution is a consumer-centric model, centered on tool leasing, on-site services, and fleet management, which implements unparalleled consumer loyalty and offers a predictable revenue stream insulated from conventional retail cycles.

Here is a list of key players operating in the global market:

The international power tools market is an oligopoly, which is readily dominated by notable players controlling a significant majority of the market share. The market’s landscape is effectively defined by intensified competition, with primary focus on technological advancements in battery technology and cordless platforms. Meanwhile, key players, such as TTI and Stanley Black & Decker significantly compete strongly on brand strength and portfolio breadth. Strategically, these companies are also experiencing growth through ongoing product development, developing expanded ecosystems, and mergers and acquisitions to fill portfolio barriers. Besides, in June 2024, Toshiba Corporation, along with Japan’s Sojitz Corporation of Japan and Brazil’s CBMM, completed the development of a cutting-edge e-bus-based lithium-ion battery that utilizes niobium titanium oxide (NTO) in the anode. Additionally, these organizations also introduced a prototype e-bus powered with the latest battery to ensure ultra-fast charging time of almost 10 minutes and significantly deliver energy density, thus suitable for uplifting the market.

Corporate Landscape of the Power Tools Market:

Recent Developments

- In March 2025, Bosch Limited declared the launch of its newest hand tools for professionals and artisans, as well as innovative industrial tools, which are significantly designed to simplify assembly line operations.

- In September 2024, Accenture made expansion in its tactical partnership with Unilever to simplify its digitalized core and apply generative AI to boost efficiencies and optimize business agility.

- Report ID: 4906

- Published Date: Dec 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Tools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.