Power-to-Gas Market Outlook:

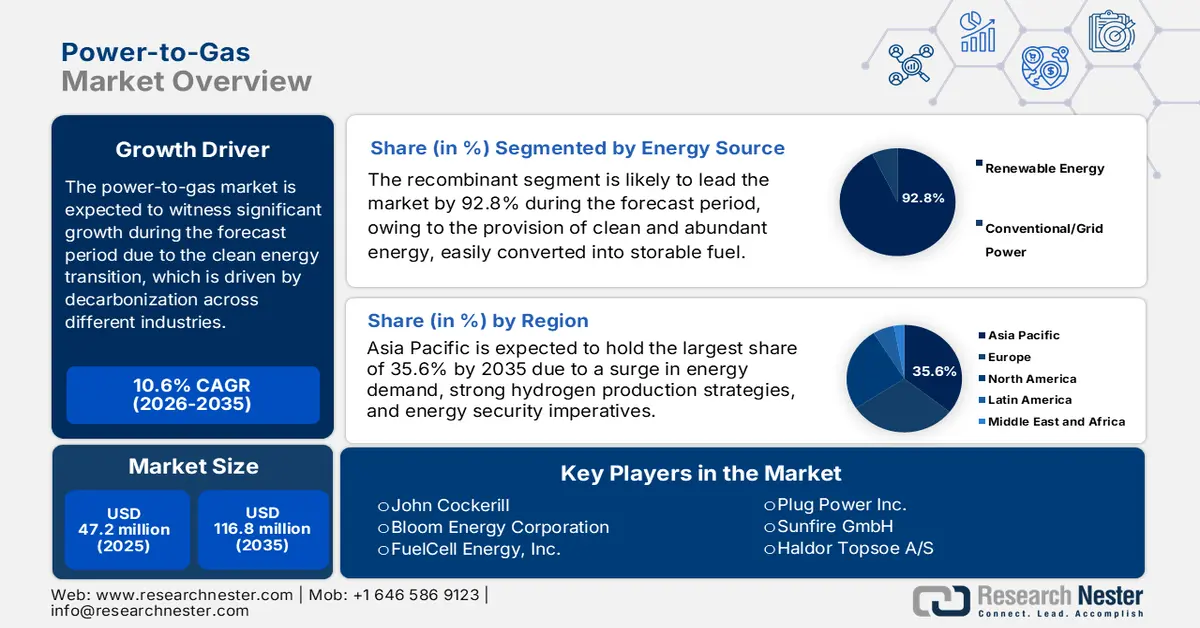

Power-to-Gas Market size was over USD 47.2 million in 2025 and is estimated to reach USD 116.8 million by the end of 2035, expanding at a CAGR of 10.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of power-to-gas is estimated at USD 52.2 million.

The international power-to-gas market is gradually transitioning from a niche technology to a centralized pillar of the clean energy transition, which is fueled by the imperative to decarbonize hard-to-abate economic industries. This particular evolution is readily characterized by a tactical shift from pilot-based demonstration to commercial and integrated projects. According to a data report published by the IEA Organization in 2024, there has been a surge in gas demand by 2.7%, further catering to 115 billion cubic meters as of 2024. This denotes an increase by 2% between 2010 to 2019, as well as by 1% from 2019 to 2023. In addition, developing markets and emerging economies, particularly in Asia, account for almost 40% of additional gas in the same year. Therefore, with an increase in the natural gas demand, there is a huge growth opportunity for the overall market globally.

Yearly Modifications in Natural Gas Demand Regionally (2000 to 2024)

|

Regions |

2000-2010 (EJ) |

2010-2019 (EJ) |

2019-2023 (EJ) |

2024 (EJ) |

|

Europe Union |

0.23 |

-0.13 |

-0.65 |

0.02 |

|

U.S. |

0.03 |

0.87 |

0.38 |

0.62 |

|

Russia |

0.28 |

- |

0.51 |

0.80 |

|

Middle East |

0.67 |

0.60 |

0.47 |

0.45 |

|

China |

0.29 |

0.74 |

0.78 |

0.99 |

|

Other Developing Asia |

0.46 |

0.18 |

0.06 |

0.50 |

|

Rest of the World |

0.84 |

0.44 |

0.03 |

0.50 |

Source: IEA Organization

Furthermore, the gigascale project development, technology optimization and diversification, value chain vertical integration, along with modularization and standardization, are also driving the market’s growth across different nations globally. Regarding technological diversification, as per the October 2025 Energy Conversion and Management: X article, the Solid Oxide Electrolyzer Cell (SOEC) technology has gained densities that exceed 2.87 A/cm2, along with power outputs of 1.68 W/cm2 at 650 degrees Celsius, and ensures stabilized electrolysis operation at 1.42V, while maintaining almost 1005 efficacy. In addition, high currency density (HCD)-based SOECs have significantly displayed hydrogen production rates, accounting for 0.076 g/s with efficient energy for almost 78.2% and 77.6% of exergy efficiencies, thereby boosting the market’s expansion internationally.

Key Power-to-Gas Market Insights Summary:

Regional Insights:

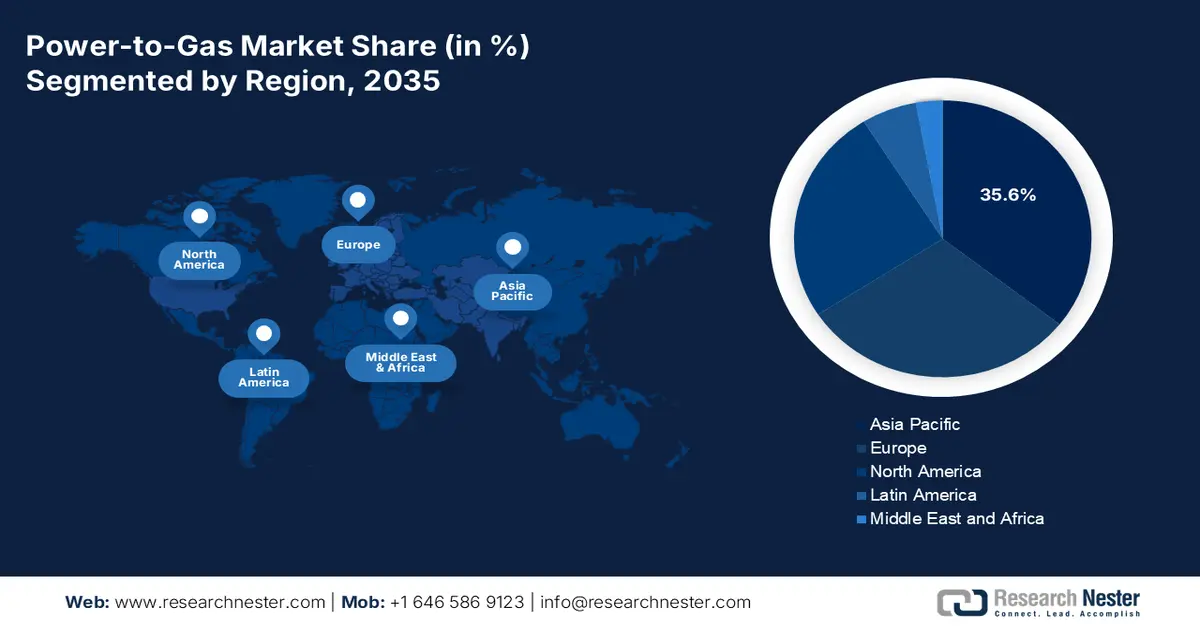

- By 2035, the Asia Pacific market in the power-to-gas market is anticipated to secure a 35.6% share, supported by rising energy demand, robust hydrogen strategies, and expanding renewable-integrated PtG initiatives.

- By 2035, North America is expected to be the fastest-growing region, accelerated by a swift transition from pilot-scale to commercial PtG deployments and heightened emphasis on green hydrogen for industrial decarbonization.

Segment Insights:

- By 2035, the renewable energy (solar/wind) segment in the power-to-gas market is projected to command a 92.8% share, propelled by its ability to offer abundant and clean energy that can be easily converted into a transportable and storable fuel, which is suitable for solving the intermittent issue of renewables.

- By 2035, the electrolysis sub-segment is expected to secure the second-highest share, supported by its usability of renewable electricity to split water into oxygen and hydrogen and readily produce energy storage and clean fuel solutions.

Key Growth Trends:

- Strong national hydrogen approaches

- Industrial decarbonization pressure

Major Challenges:

- Underdeveloped downstream and midstream infrastructure

- Permitting complexity and regulatory uncertainty

Key Players: Siemens Energy AG (Germany), ITM Power PLC (United Kingdom), Nel ASA (Norway), McPhy Energy S.A. (France), ThyssenKrupp AG (Germany), Linde PLC (United Kingdom), Air Liquide S.A. (France), Mitsubishi Power, Ltd. (Japan), Toshiba Energy Systems & Solutions Corporation (Japan), John Cockerill (Belgium), Bloom Energy Corporation (U.S.), FuelCell Energy, Inc. (U.S.), Plug Power Inc. (U.S.), Sunfire GmbH (Germany), Haldor Topsoe A/S (Denmark), Hitachi Zosen Corporation (Japan), ENGIE SA (France), Hydrogenics Corporation (Canada), MAN Energy Solutions SE (Germany), Green Hydrogen Systems A/S (Denmark)

Global Power-to-Gas Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 47.2 million

- 2026 Market Size: USD 52.2 million

- Projected Market Size: USD 116.8 million by 2035

- Growth Forecasts: 10.6 % CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.6% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: Germany, United States, China, Japan, South Korea

- Emerging Countries: India, Australia, United Kingdom, Netherlands, Canada

Last updated on : 3 December, 2025

Power-to-Gas Market - Growth Drivers and Challenges

Growth Drivers

- Strong national hydrogen approaches: The existence of policies, such as Europe’s REPowerEU plan, Japan’s Green Growth Strategy, and the U.S.’s Inflation Reduction Act (IRA), has created an unprecedented demand for the power-to-gas market globally. This demand takes into consideration mandated consumption targets, direct subsidies, and tax credits for clean hydrogen production. According to an article published by the Congress Government in August 2022, the IRA in the U.S. has imposed a minimum tax of 15% of the average yearly adjusted financial statement, which has readily exceeded USD 1 billion within 3 years. Additionally, the act has also imposed a non-deductible 1% excise tax on the overall market value of stock repurchased, which is positively driving the market’s growth.

- Industrial decarbonization pressure: The purpose of significantly decarbonizing industries, such as refining, steelmaking, and ammonia production, is the primary source of bankable offtake and firm demand, which is creating an optimistic outlook for the power-to-gas market. This also provides the revenue certainty, which is essential for undertaking investment-based decisions on large-scale PtG plants. As per an article published by the Department of Energy in 2025, industry accounts for an estimated 30% of U.S. primary energy-related carbon dioxide (CO2) emissions, initially through manufacturing. Besides, the international market for decarbonization and clean energy technologies is predicted to be nearly USD 23 trillion by the end of 2030, which is rapidly uplifting the market’s development.

- Energy security imperatives: The energy supply and geopolitical instability have readily accelerated the focus on clean energy and domestic sources. This positioned PtG as a tactical technology for diminishing reliance on imported natural gas. As stated in an article published by the IRENA Organization in 2025, there is a huge need for the overall international renewable power generation capacity to triple by the end of 2030, and successfully reach 11,000 GW under IRENA’s 1.5 degree Celsius. Based on this, wind power and solar photovoltaic (PV) significantly account for almost 90% of renewable energy capacity additions. Moreover, the yearly investment in renewable power generation needs to reach USD 1,300 billion within the same year in comparison to USD 486 billion as of 2022, thus creating a positive impact on the market.

Challenges

- Underdeveloped downstream and midstream infrastructure: This is a severe roadblock for the power-to-gas market, which remains in the absence of standard infrastructure for hydrogen storage and transport. While natural gas pipelines can efficiently be repurposed, this requires a suitable investment for addressing issues and material upgradation, such as hydrogen embrittlement. New dedicated hydrogen pipeline networks, including the Europe-based Hydrogen Backbone vision, are decades from complete realization. Therefore, with the lack of this midstream infrastructure, PtG projects are frequently restricted to a point-to-point model, wherein production needs to be collocated with offtake. This has critically limited the market scalability and flexibility, thereby creating a gap in the growth and expansion.

- Permitting complexity and regulatory uncertainty: The market significantly operates in a fragmented and often immature regulatory landscape, leading to uncertainty that tends to delay Final Investment Decisions (FIDs). In addition, challenges, such as the lack of a notable accepted as well as legally binding definition for renewable or green hydrogen, especially concerning the temporal correlation. Besides, permitting for pipeline infrastructure, associated renewable generation, and large-scale electrolysis facilities is considered a multi-jurisdictional and lengthy process that can be time-consuming and involves project risk and significant soft expenses. Furthermore, the present energy market design in different regions does not adequately value the long-duration and grid-balancing storage services, thus causing a hindrance in the market’s growth.

Power-to-Gas Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.6% |

|

Base Year Market Size (2025) |

USD 47.2 million |

|

Forecast Year Market Size (2035) |

USD 116.8 million |

|

Regional Scope |

|

Power-to-Gas Market Segmentation:

Energy Source Segment Analysis

The renewable energy (solar/wind) segment, which is part of the energy source, is anticipated to account for the largest share of 92.8% by the end of 2035. The segment’s exposure is highly propelled by its ability to offer abundant and clean energy that can be easily converted into a transportable and storable fuel, which is suitable for solving the intermittent issue of renewables. According to a report published by the PIB Government in August 2025, India has successfully made 1,08,494 GWh of solar power, which is over Japan’s 96,459 GWh, and has emerged as the world’s third-largest solar energy producer. In addition, the country’s solar module manufacturing capacity has also upsurged from 38 GW to 74 GW during 2024 and 2025, thereby denoting an optimistic outlook for the overall segment.

Technology Segment Analysis

The electrolysis sub-segment, part of the technology, is expected to hold the second-highest share in the power-to-gas market during the stipulated period. The sub-segment’s growth is highly driven by its usability of renewable electricity to split water into oxygen and hydrogen and readily produce energy storage and clean fuel solutions. This particular process has developed green hydrogen, which is an essential component for decarbonizing industries that are challenging to electrify. Based on this, the April 2024 International Journal of Hydrogen Energy stated that the yearly hydrogen production has reached 94 million metric tons internationally, along with 10 million metric tons. Moreover, the overwhelming 99% of international hydrogen production derives from fossil fuels through processes, including naphtha reforming, coal gasification, and steam methane reforming. Out of these processes, the steam methane reforming is considered a carbon dioxide-based process and is expected to emit almost 14 kg CO2e/kg hydrogen, thereby suitable for the segment’s development.

Output Gas Segment Analysis

The green hydrogen segment is predicted to cater to the third-highest share in the power-to-gas market by the end of the forecast duration. The segment’s development is highly fueled by the aspect of the only pathway that tends to deliver carbon-free hydrogen and readily aligns with global net-zero mandates. Additionally, this segment is currently guided by strict policies, with regulatory embedded strategies, such as Europe’s Renewable Energy Directive (RED III), as well as the U.S.’s IRA 45V tax credit. This has created a legally binding need by mandating that hydrogen needs to meet stringent emission-based thresholds, which are classified as clean, which is a standard that only green hydrogen can meet reliably. Moreover, this particular policy-based demand is highly concentrated in industries, such as green steel production and green ammonia for fertilizers.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Energy Source |

|

|

Technology |

|

|

Output Gas |

|

|

Capacity |

|

|

Process |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power-to-Gas Market - Regional Analysis

APAC Market Insights

Asia Pacific market is anticipated to garner the largest share of 35.6% by the end of 2035. The market’s upliftment is highly attributed to an increase in the energy demand, robust national hydrogen strategies, and energy security imperatives. The overall region comprises mature economies, such as South Korea and Japan, both of which have focused on hydrogen imports and exports, with the intention of effectively decarbonizing. Likewise, resource-based nations, including Australia, have aimed to emerge as the green hydrogen export superpower. In addition, the PtG integration with massive renewable energy projects, especially wind in Australia and solar in India, is also a regional trend for the market’s growth. According to an article published by ARENA in October 2023, the government in Australia invested USD 2.0 billion in the latest Hydrogen Headstart Program to successfully fund large-scale hydrogen projects.

2023 Hydrogen Export and Import in Asia

|

Countries |

Export (USD) |

Import (USD) |

|

China |

1.9 billion |

2.1 billion |

|

Malaysia |

748 million |

394 million |

|

Japan |

443 million |

1.4 billion |

|

Singapore |

93.9 million |

261 million |

|

South Korea |

92.8 million |

605 million |

|

Thailand |

20.7 million |

139 million |

|

India |

16 million |

486 million |

|

Vietnam |

277 million |

1.1 billion |

Source: OEC

China in the power-to-gas market is growing significantly, owing to the top-down national strategy, which is executed with effective state-based investment, huge domestic need for hydrogen in its chemical and refining sectors, and unparalleled scale of manufacturing. Besides, the Ministry of Industry and Information Technology (MIIT) and the National Development and Reform Commission (NDRC) have readily prioritized green hydrogen, which has resulted in the rapid deployment of gigawatt-scale electrolyzer projects. As per an article published by the CSIS Organization in February 2022, the country is considered the highest producer of hydrogen, with 25 million tons. The majority of the volume is produced from fossil fuels, denoting 60% from coal, and 25% from natural gas, which is positively impacting the overall market.

India market is also growing due to the urgent demand for energy import substitution, a highly proactive government strategy, and abundant low-cost renewable energy potential. As per a data report published by the PIB Government in July 2024, the Union Cabinet accepted the National Green Hydrogen Mission in January 2023, amounting to ₹19,744 crore. In addition, the objective of the Mission is to make the country an international center for production, export, and usage of Green Hydrogen, along with its derivatives, by effectively targeting the 5 MMT production per annum by the end of 2030. Besides, the Mission has an outlay, amounting to ₹600 crore as of 2024, and meanwhile, the Green Hydrogen production capacity has been significantly envisaged and is projected to leverage more than ₹8 lakh crore, which readily contributes to the market’s upliftment.

North America Market Insights

North America market is expected to emerge as the fastest-growing region during the predicted period. The market’s development in the region is highly fueled by a rapid transition from pilot-scale projects to commercial-scale and integrated deployments, especially with a focus on renewable energy storage and green hydrogen production for industrial decarbonization. As per an article published by the Green House Innovation Center in 2023, the U.S. is considered the second-biggest consumer and producer of hydrogen after China, catering to 13% of the international demand. In addition, the country is focused on initiating carbon reduction targets, denoting a 50% reduction of greenhouse gas pollution by 2030, followed by ensuring 1 100% carbon pollution-free electricity industry by 2035, which is positively impacting the overall market in the region.

The U.S. in the power-to-gas market is gaining increased traction, owing to the existence of the Inflation Reduction Act (IRA) as the primary funding mechanism, the presence of funding programs, along with the Environmental Protection Agency (EPA), and chemical safety. For instance, as stated in the October 2023 Biden White House Government article, 7 domestic clean hydrogen centers have been selected to receive USD 7.0 billion in Bipartisan Infrastructure Law funding for escalating the demand for clean and low-cost hydrogen. Additionally, these projects catalyzed over USD 40 billion in private investment and developed standard employment opportunities. This brought the overall private and public investment in hydrogen centers to almost USD 50 billion, thereby denoting an optimistic outlook for rapid expansion of the market in the country.

Canada in the power-to-gas market is also developing due to international partnerships, strategic export ambition, federal fiscal incentives mirroring the U.S. policy, low-cost and abundant renewable feedstock, and decarbonization of domestic heavy industry. According to an article published by PBO Canada in February 2024, the Clean Hydrogen Investment Tax Credit (ITC) has been declared in the 2022 Fall Economic Statement, wherein it provided 15% to 40% refundable tax credit for investments in clean hydrogen projects. The tax credit is 40% for carbon intensity (CI), which is less than 0.7 kg, 25% for CI more than 0.7 kg and less than 2 kg, and 15% for over 2 kg and less than 4 kg. Additionally, the tax credit was also expanded by 15% with the intention of converting hydrogen into ammonia for transportation purposes, which is creating an optimistic outlook for the overall market.

Europe Market Insights

Europe market is projected to grow steadily by the end of the forecast period. The market’s exposure in the region is highly fueled by the REPowerEU Plan, along with the Green Deal approach, which collectively aim to gain climate neutrality by the end of 2050 and diminish reliance on fossil fuels. According to the 2025 Europe Commission article, hydrogen accounted for less than 2% of the region’s energy consumption, and it has been primarily utilized to produce chemical products, including fertilizers and plastics. Moreover, 96% of this hydrogen has been produced with natural gas, leading to significant carbon dioxide emissions. Besides, the 2022 REPowerEU Strategy has set out the objective to produce 10 million tons as well as import 10 million tons by the end of 2030. Furthermore, renewable hydrogen is projected to cover nearly 10% of regional energy demands for decarbonizing the energy-intensive transport sector and industrial processes.

The power-to-gas market in Germany is gaining increased exposure, owing to the huge industrial base, unparalleled government financial commitment, and a tactical focus on supplying and producing green hydrogen to provide energy transition success. Besides, as mentioned in an article published by the World Nuclear Association Organization in May 2024, the country’s national hydrogen approach has approved almost €7 billion to ensure electrolyzer capacity of 5 GW by the end of 2030 for 14 TWh of green hydrogen, demanding 20 TWh of renewable electricity. Additionally, the approach has also offered €2 billion for projects internationally since there is a huge demand for hydrogen imports. Besides, the German Chemical Industry Association has readily recognized that cost-effective hydrogen is crucial for the market’s competitiveness and survival in a decarbonized world.

The power-to-gas market in the UK is also growing due to the existence of its advanced business model, which is significantly focused on a flexible regulatory framework and industrial clusters. In addition, the Department for Energy Security & Net Zero's (DESNZ) cluster-based sequencing process is also another driver, which successfully de-risks investment by co-locating offtake, storage, and production. According to an article published by the UK Government in April 2025, the government declared that it has provided £21.7 billion as a generous fund to carbon capture, usage, and storage (CCUS)-based projects in the country. Moreover, the government also initiated a commitment of £21.7 billion for more than 25 years to support CCUS clusters in the North East and North West of England. Meanwhile, the nation’s Low Carbon Hydrogen Agreement policy, along with the upcoming Hydrogen Production Business Model, are also ensuring long-lasting revenue support for the market’s growth.

Companies Dominating the Power-to-Gas Landscape

- Siemens Energy AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ITM Power PLC (United Kingdom)

- Nel ASA (Norway)

- McPhy Energy S.A. (France)

- ThyssenKrupp AG (Germany)

- Linde PLC (United Kingdom)

- Air Liquide S.A. (France)

- Mitsubishi Power, Ltd. (Japan)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- John Cockerill (Belgium)

- Bloom Energy Corporation (U.S.)

- FuelCell Energy, Inc. (U.S.)

- Plug Power Inc. (U.S.)

- Sunfire GmbH (Germany)

- Haldor Topsoe A/S (Denmark)

- Hitachi Zosen Corporation (Japan)

- ENGIE SA (France)

- Hydrogenics Corporation (Canada)

- MAN Energy Solutions SE (Germany)

- Green Hydrogen Systems A/S (Denmark)

- Siemens Energy AG is considered an international leader in large-scale power-to-gas solutions, significantly through its efficient Silyzer series of PEM electrolyzers. The organization has leveraged its in-depth expertise in energy systems to offer integrated solutions for industrial grid-balancing and decarbonization applications. Besides, as per its 2025 annual report, the organization’s orders amounted to €14.2 billion, along with a revenue generation of €10.4 billion, denoting a surge by 9.7%.

- ITM Power PLC has specialized in Proton Exchange Membrane (PEM) electrolysis technology and has established one of the world’s largest automated manufacturing infrastructures for electrolyzers. The firm is renowned for its tactical partnerships to deploy large-scale industrial energy and refueling stations and storage projects.

- Nel ASA is regarded as the pioneering and pure-play hydrogen organization with a wide-ranging product portfolio that covers both PEM and alkaline electrolyzer technologies. The company has readily focused on lowering the expense of renewable hydrogen through global expansion and high-volume production. Based on this, as stated in the 2024 annual report, the company generated NOK 1,390 million in revenue, along with NOK 1,876 million in cash balance.

- McPhy Energy S.A. offers integrated solutions across the hydrogen value chain, with a focus on hydrogen refueling stations and high-pressure alkaline electrolyzers. The organization’s technology is readily geared towards large-scale industrial facilities and zero-emission mobility infrastructure.

- ThyssenKrupp AG’s Uhde Chlorine Engineers business unit is regarded as the world leader in large-scale alkaline water electrolysis, providing plants with facilities of megawatts. Its technology is crucial for gigawatt-scale green hydrogen projects, which are aimed at decarbonizing the industrial and chemical sectors.

Here is a list of key players operating in the global market:

The international power-to-gas market is highly fragmented and significantly competitive, as well as characterized by tactical alliances and vertical integration. In this regard, established industrial gas firms, such as Linde and Air Liquide, have leveraged their respective worldwide offtake and distribution networks, while specialized tech-based companies, including Nel ASA and ITM Power, have focused on progressing electrolyzer efficacy and upscaling manufacturing capacity. In addition, the formation of consortiums tends to develop integrated Hydrogen Valleys and gain project financing, which is also driving the market’s growth. Besides, in June 2025, Eaton has readily empowered consumers to put digitalization and electrification to operate in the latest ways with its Factories as a Grid strategy. This has enhanced the functionality of present energy systems along with renewable energy resources to gain huge energy level resilience, which caters to the power-to-gas market’s upliftment globally.

Corporate Landscape of the Power-to-Gas Market:

Recent Developments

- In November 2025, GE Vernova Inc. declared its first-ever onshore wind repower upgrade deal outside the U.S., which has signed with Taiwan Power Company to supply 25 repower upgraded kits in Taiwan. This deal has been built on the company’s repowering of more than 6,000 wind turbines in the U.S.

- In November 2025, Venture Global, Inc., along with Tokyo Gas Co., Ltd notified the successful execution of the newest and long-lasting liquefied natural gas sales and purchase agreement for producing 1 million tons per annum of LNG by the end of 2030.

- In January 2025, Enfinity Global has significantly achieved connectivity for 2 GW of utility-scale wind and solar PV projects in Karnataka, Maharashtra, Uttar Pradesh, and Rajasthan, demonstrating a notable progression in the organization’s efforts to extend its renewable energy portfolio.

- Report ID: 3689

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power-to-Gas Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.