Postmenopausal Osteoporosis Market Outlook:

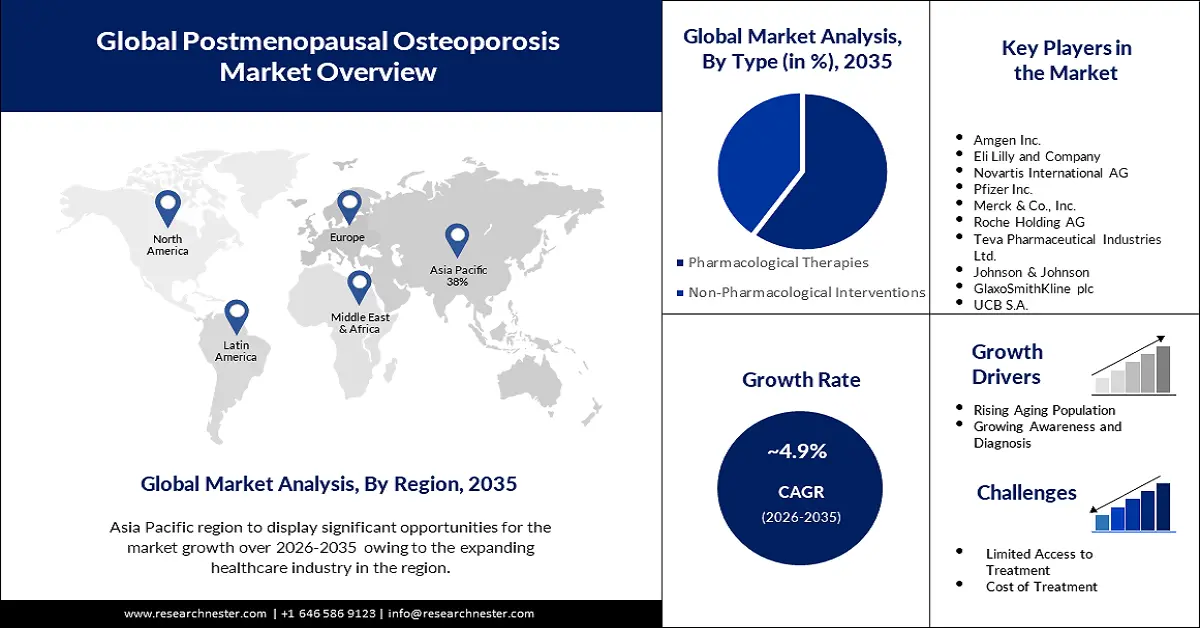

Postmenopausal Osteoporosis Market size was valued at USD 7.9 billion in 2025 and is likely to cross USD 12.75 billion by 2035, expanding at more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of postmenopausal osteoporosis is assessed at USD 8.25 billion.

In recent years, the remarkable progress in monoclonal antibody therapy has emerged as a pivotal growth driver in the postmenopausal osteoporosis treatment market. A study, involving over 7,800 women, revealed a significant 68% reduction in the relative risk of vertebral fractures compared to a placebo group.

In addition, as denosumab and other monoclonal antibodies continue to shape the landscape of postmenopausal osteoporosis treatment, the postmenopausal osteoporosis market is poised for substantial growth, driven by the increasing acceptance of these innovative therapies among healthcare professionals and patients alike. The emphasis on targeted, biologically-driven interventions underscores a paradigm shift in the approach to managing postmenopausal osteoporosis, fostering optimism for improved patient outcomes and a burgeoning market.

Key Postmenopausal Osteoporosis Market Insights Summary:

Regional Highlights:

- Asia Pacific postmenopausal osteoporosis market will dominate more than 38% share, driven by the region’s aging population, dietary changes, and increasing incidence of osteoporosis, forecast period 2026–2035.

- North America market will hold the second largest share, fueled by lifestyle and dietary habits impacting bone health and calcium intake, forecast period 2026–2035.

Segment Insights:

- The pharmacological therapies segment in the postmenopausal osteoporosis market is projected to capture a 60% share by 2035, driven by evolving treatment paradigms and improved safety profiles of SERMs and monoclonal antibodies.

- The hospitals segment in the postmenopausal osteoporosis market is projected to capture a 45% share by 2035, driven by rising fractures requiring hospital care and increasing surgical interventions.

Key Growth Trends:

- Rising aging population

- Increasing awareness and diagnosis

Major Challenges:

- Rising aging population

- Increasing awareness and diagnosis

Key Players: Amgen Inc., Eli Lilly and Company, Novartis AG, Pfizer Inc., Merck & Co., Inc., Cipla Inc., Innovent Biologics, Inc., F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Johnson & Johnson Private Limited.

Global Postmenopausal Osteoporosis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.9 billion

- 2026 Market Size: USD 8.25 billion

- Projected Market Size: USD 12.75 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Postmenopausal Osteoporosis Market Growth Drivers and Challenges:

Growth Drivers

- Rising aging population - The demographic shift towards an aging population remains a robust growth driver for the postmenopausal osteoporosis market. As individuals age, the risk of osteoporosis increases, particularly in postmenopausal women owing to hormonal changes. The World Health Organization (WHO) estimates that by 2050, the global population aged 60 years and older will reach 2 billion, doubling from 2015 figures. This demographic trend amplifies the prevalence of postmenopausal osteoporosis, propelling the demand for innovative treatments and preventive measures.

- Increasing awareness and diagnosis - Rising awareness about postmenopausal osteoporosis and advancements in diagnostic technologies contribute substantially to postmenopausal osteoporosis market growth. Increased efforts in educating healthcare professionals and the general population about the importance of bone health have led to earlier and more accurate diagnoses. Technological advancements in imaging, such as dual-energy X-ray absorptiometry (DEXA) scans, have significantly improved the diagnosis and monitoring of osteoporosis. These innovations allow for precise assessment of bone mineral density, aiding in early detection and personalized treatment strategies.

- Lifestyle changes and nutrition - Shifts in lifestyle and dietary habits impact bone health and contribute to the demand for osteoporosis treatments. Sedentary lifestyles and inadequate nutritional intake, especially of calcium and vitamin D, are tremendous risk factors. The growing adoption of anabolic therapies, such as teriparatide and abaloparatide, contributes to the diversification of treatment options. Anabolic agents stimulate bone formation, offering an alternative approach to traditional anti-resorptive medications.

Challenges

- Adherence to medication - Adherence to long-term medication regimens poses a lucrative challenge in managing postmenopausal osteoporosis. Patients may encounter difficulties in consistently following prescribed treatments impelled by factors such as forgetfulness, medication side effects, or the absence of noticeable symptoms. Poor adherence can compromise the effectiveness of therapies and contribute to increased fracture risks.

- The selection of appropriate medications involves a delicate balance between the benefits of increased bone density and fracture prevention and the potential risks associated with certain therapies. For instance, long-term use of bisphosphonates has been linked to rare but severe side effects like atypical femoral fractures and osteonecrosis of the jaw.

- Limited Access to Treatment

- High Cost of Treatment

Postmenopausal Osteoporosis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 7.9 billion |

|

Forecast Year Market Size (2035) |

USD 12.75 billion |

|

Regional Scope |

|

Postmenopausal Osteoporosis Market Segmentation:

Type Segment Analysis

The pharmacological therapies segment in the postmenopausal osteoporosis market is estimated to gain the largest revenue share of about 60% in the year 2035. The segment growth can be set to the evolving treatment paradigms and improved safety profiles. A landmark clinical trial demonstrated that raloxifene, a widely used SERM, significantly reduced the risk of vertebral fractures by 30-50% in postmenopausal women. The study also highlighted the positive impact of SERMs on bone mineral density.

As treatment paradigms evolve towards personalized medicine, the safety profiles of SERMs make them a favorable choice for women with specific health considerations, such as a history of breast cancer. The balance of efficacy and safety positions SERMs as a key growth driver in the pharmacological armamentarium against postmenopausal osteoporosis. Monoclonal antibodies, particularly denosumab, have gained momentum in the postmenopausal osteoporosis market propelled by their enhanced efficacy and targeted action mechanisms.

End User Segment Analysis

Based on end user, hospitals segment is expected to hold largest revenue share of about 45% by 2035. For the hospital segment, the rising number of fractures linked to osteoporosis is a major growth driver for postmenopausal osteoporosis market in this segment. A large proportion of fractures, especially hip fractures in the senior population, are caused by osteoporosis, according to a study published in the Journal of the American Geriatrics Society. The study reported that over 300,000 hip fractures occur annually in the United States, leading to hospitalizations.

As fractures often necessitate immediate medical attention and specialized care, hospitals experience a surge in demand for their services. The rising number of osteoporosis-related fractures reinforces the importance of hospitals as key providers of comprehensive care, driving growth in this segment. The growth of hospitals in the market expansion is influenced by the increasing number of surgical interventions for osteoporotic fractures.

Our in-depth analysis of the global postmenopausal osteoporosis market includes the following segments:

|

Type |

|

|

End User |

|

|

Risk Factors |

|

|

Comorbid Conditions |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Postmenopausal Osteoporosis Market Regional Analysis:

APAC Market Insights

Postmenopausal osteoporosis market in the Asia Pacific region, amongst the market in all the other regions, is slated to hold the largest with a share of about 38% by the end of 2035. The region's growing aging population and accompanying demographic shift are likely to drive market demand. The World Health Organization (WHO) projects that by 2050, the share of older adults in Asia will rise to 28.3%.

Postmenopausal osteoporosis is more common than ever before because of the sharp rise in osteoporosis risk that comes with aging. This demographic trend emphasizes the growing incidence of osteoporosis in the senior population, underscoring the need for targeted healthcare measures.

Osteoporosis is becoming more common in the Asia Pacific region as a result of significant dietary and lifestyle changes. Rising urbanization and changing dietary preferences have resulted in a noticeable decline in traditional diets rich in calcium and other minerals that support bone health. Simultaneously, sedentary lifestyles have grown in favor of postmenopausal osteoporosis market.

North America Market Insights

The postmenopausal osteoporosis market in North America is expected to develop significantly in the upcoming years and is expected to keep the second position. This is due to the region's population's food and lifestyle choices, which have a significant impact on bone health. Adults in North America are showing a worrying trend of insufficient calcium intake, according to a study published in Osteoporosis International.

Unhealthy food choices, such as consuming less dairy and foods high in calcium, can lead to less than ideal bone health. In order to improve bone density and avoid postmenopausal osteoporosis in the North American population, it is imperative that certain lifestyle variables be addressed.

Postmenopausal Osteoporosis Market Players:

- Amgen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly and Company

- Novartis AG

- Pfizer Inc.

- Merck & Co., Inc.

- Cipla Inc.

- Innovent Biologics, Inc.

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Johnson & Johnson Private Limited

Recent Developments

- Innovent Biologics, Inc. and Indonesian biotechnology company PT Etana Biotechnologies Indonesia jointly announced that Bevagen (bevacizumab biosimilar), a recombinant humanized anti-vascular endothelial growth factor (anti-VEGF) monoclonal antibody drug, was approved for five indications: metastatic colorectal cancer (mCRC), locally recurrent or metastatic triple-negative breast cancer (mTNBC), advanced, metastatic, or recurrent non-small cell lung cancer (NSCLC), primary peritoneal cancer (OC), and cervical cancer (CC).

- Pfizer Inc. returned, in improved packaging, the menopause hormone therapy DUAVEE to the U.S. market. This return follows a voluntary recall due to a packaging problem that had nothing to do with worries about the product's efficacy or safety. It is anticipated that this relaunch plan will fix the packaging problems and increase sales revenue.

- Report ID: 5653

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Postmenopausal Osteoporosis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.