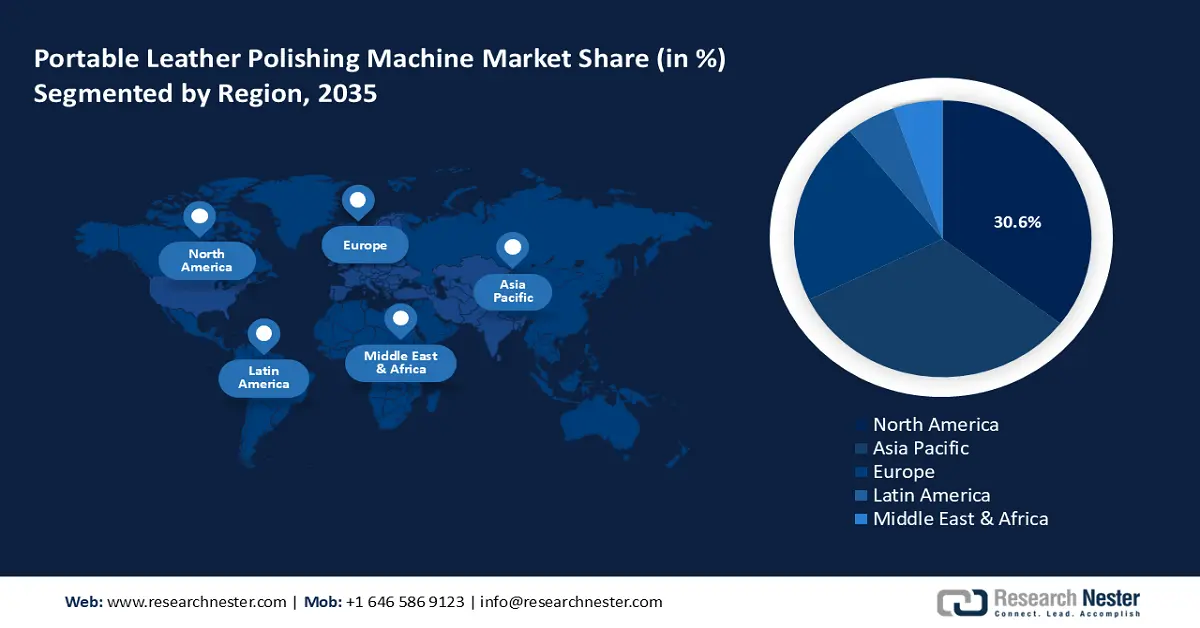

Portable Leather Polishing Machine Market - Regional Analysis

North America Market Insights

The North America portable leather polishing machine sector is predicted to maintain a leading revenue share of 30.6% by the end of 2035. The regional market’s growth is supported by the widespread adoption of portable leather polishing machines across footwear, automotive leather interiors, and luxury accessory manufacturing clusters. Additionally, the nearshoring initiatives in North America are set to benefit OEMs due to stainless steel and chromium supply chains in domestic or trusted allied countries, ensuring lesser risks to the supply chain.

The U.S. portable leather polishing machine market is estimated to account for a leading revenue share by the end of 2035. A key factor driving the U.S. market is an uptick in contract manufacturing facilities. Under the Customs Modernization Act, U.S. importers of polishing equipment are benefiting from the heightened clearance for finished durable capital goods. Additionally, manufacturers of U.S. machinery are capitalizing on this benefit by expanding localized assembly operations in states with existing leather hubs, such as Michigan, Massachusetts, and North Carolina.

Canada's portable leather polisher market is driven by the growing leather goods industry, particularly in footwear, winter wear, apparel, and accessories. Increased consumer interest in artisanal and handmade products is resulting in more adopters of the product form among smaller manufacturers. Strong retail and e-commerce growth within the country provides an international context for brands rooted in Canadian representation and manufacturing. Focusing on the use of eco-friendly materials while supporting craftsmanship through sustainable practices also adds appeal to new polishing machines and strengthens the consistently strong growth within the leather polishing machine market in Canada

Asia Pacific Market Insights

The APAC portable leather polishing machine market is expanding at a 5.3% CAGR during the forecast period, exhibiting the fastest expansion. The APAC market is characterized by the scale of the leather export-industrial ecosystem. Emerging economies in APAC offer lucrative export opportunities. Vietnam, in particular, has escalated the exports of leather and footwear. Complementing this trend, the Technology Upgradation Fund Scheme has accelerated portable machinery adoption by MSMEs. Due to these trends, a dense cluster of production hubs has emerged in Tamil Nadu (India) and Ho Chi Minh (Vietnam), where portable leather polishing machine units have become a vital component of just-in-time export manufacturing systems.

The China portable leather polishing machine market is poised to exhibit robust growth throughout the anticipated timeline. The Chinese market is fueled by the 14th Five-Year Plan’s emphasis on upgrading MSME infrastructure. Due to the emphasis, polishing machine manufacturers in provinces such as Guangdong and Zhejiang have leveraged subsidies for equipment modernization. The Made in China 2025 agenda has supported manufacturing. Additionally, with the surging demand for export-quality leather, manufacturers driving local demand, the opportunities for local manufacturers are set to be ripe by the end of 2035.

India’s leather industry is a global leader, producing 2 billion sq. ft. of tanned leather annually, meeting 10% of world demand and earning the MODEUROPE color recognition. It is the second-largest footwear producer with 2,065 million pairs yearly, 95% sold domestically, and footwear exports comprising 45% of leather exports. The nation also ranks second in leather garments (16 million pieces) and fifth in leather goods, accessories, saddlery, and harness, contributing 25% of total exports.

Europe Market Insights

The European portable leather polishing machine market is projected to register a major revenue share by the end of 2035. The market is anchored by Italy, France, and Germany, and is favorably impacted by the policy-led sustainable modernization. Dual regulatory mechanisms, such as the EU Machinery Regulation 2023/123, have contributed to enforcing harmonized safety and cyber standards set to be in practice from January 2027. The EU imported EUR137 billion worth of apparel and textiles in 2022 and exported EUR67 billion. In 2022, China, Bangladesh, and Turkey were the top exporters of apparel and textiles to the EU.

The German portable leather polishing machine sector is poised to expand during the forecast period. Additionally, Germany has a strong mechanical engineering base and is aligned with the REACH directive, pushing manufacturers to favor automated and centrifugal polishing units. With the drive to reduce emissions intensifying in Germany, the market is expected to remain profitable by the end of 2035. Global leather article trade hit $92.7 billion in 2023, up 1.18% from $91.6 billion in 2022, and has expanded at an annualized 3.36% rate over the past five years, reflecting steady international demand growth.

Trade Data of Leather Articles in 2023

|

Exporting Country |

Value (USD Billion) |

Importing Country |

Value (USD Billion) |

|

China |

32.1 |

United States |

13.9 |

|

Italy |

13.9 |

Japan |

5.86 |

|

France |

13.0 |

France |

5.47 |

Source: OEC