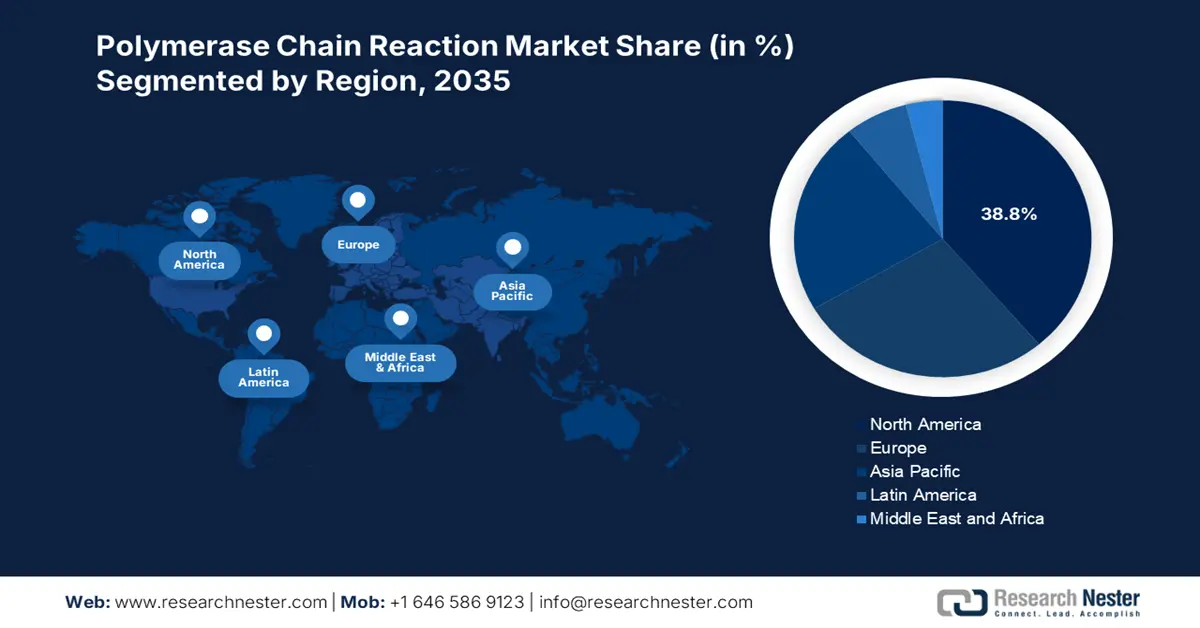

Polymerase Chain Reaction Market - Regional Analysis

North America Market Insights

The North America polymerase chain reaction market is expected to capture the largest share of 38.8% throughout the assessed tenure. The presence of a robust healthcare infrastructure, technological advancements, and provincial Federal investments are accumulatively placing this region at the forefront of the global landscape. For instance, the evidence from Statistics Canada report in September 2022 clearly highlights that 1 in 5 people in Canada are tested with PCR during the COVID-19. Furthermore, the favorable updates in reimbursement policies also fuel this field with a stable cash inflow, attracting more participants.

The U.S. is presenting predominant captivity over the regional polymerase chain reaction market with extensive Medicare & Medicaid services and AI-based healthcare integrations. In addition, the country is pledged to the continuous capital influx from both governing and institutional entities, which fosters a diverse and greater profit margin, besides the enlarging patient pool. As per Our World in Data in June 2022, the total number of COVID-19 PCR tests performed in December 2021 was 724.34 million. The U.S. market is also benefitted from extensive NIH-led R&D, including funding for digital PCR innovations.

Import Data of Medical Test kits/ Instruments, apparatus used in Diagnostic Testing

|

Country |

Year |

Imported to |

Product |

Trade Value 1000USD |

|

U.S. |

2021 |

Sweden |

Medical test kits |

692,977.59 |

|

U.S. |

2021 |

Singapore |

Medical test kits |

629,807.09 |

|

Canada |

2023 |

Germany |

Medical test kits |

79,183.87 |

|

Canada |

2023 |

United Kingdom |

Medical test kits |

78,751.44 |

Source: WITS

APAC Market Insights

Asia Pacific is predicted to attain the fastest pace of growth in the global polymerase chain reaction market during the forecasted timeframe. The recent progress in infrastructural development in emerging economies, such as China and India, is propelling the region's propagation in this sector. Ministry of Chemicals and Fertilizers in 2023 has stated that in India over the past 5–7 years, Serum Institute invested ₹100 crores in MyLab to boost PCR capacity. Moreover, a remarkable localized API production capacity and distribution channel network are cultivating a lucrative business atmosphere for both domestic and foreign pioneers.

China is augmenting the polymerase chain reaction market with immense government support and continuous public funding. As per the NLM article published in May 2023, in 2023, in China, nearly 900 million people were infected by COVID-19, and PCR and RAT tests were performed to analyze the status. Further, the country controls the global supply of associated reagents, making China a pivotal landscape for this sector amid offering various business opportunities. The country's strong research capabilities are setting new standards for innovation in this merchandise.

Europe Market Insights

Europe PCR market continues to be robust to 2035, bolstered by continued public health expenditure, IVDR-fueled quality standards, and EU research initiatives. The EU's EU4Health initiative provides €5.3 billion (2021–2027) for reinforcing health systems, lab capacity, and surveillance domains where PCR platforms are central facilitators. Horizon Europe's Health Cluster also subsidizes molecular diagnostics R&D with multi-billion euro calls. EMA and the IVDR regime bolster the clinical performance, post-market monitoring, and supply-chain resilience, aiding provider confidence and adoption. Countries such as France, Italy, and Spain are actively increasing the oncology pathways to integrate PCR for actionable biomarkers, in line with EU cancer and AMR strategies.

Germany’s dominance is highlighted by high laboratory density, robust oncology and programs for infectious disease, and rapid IVDR alignment. EMA guidance and IVDR conformity increases the performance baselines, favoring established suppliers with validated clinical evidence. The country is driven by the oncology companion testing expansion, persistent respiratory/virology screening, and middleware/LIS connectivity that lifts throughput and utilization. Germany’s reimbursement stability and academic-industry consortia accelerate translation of PCR innovations into routine care, keeping utilization and consumables pull-through high.