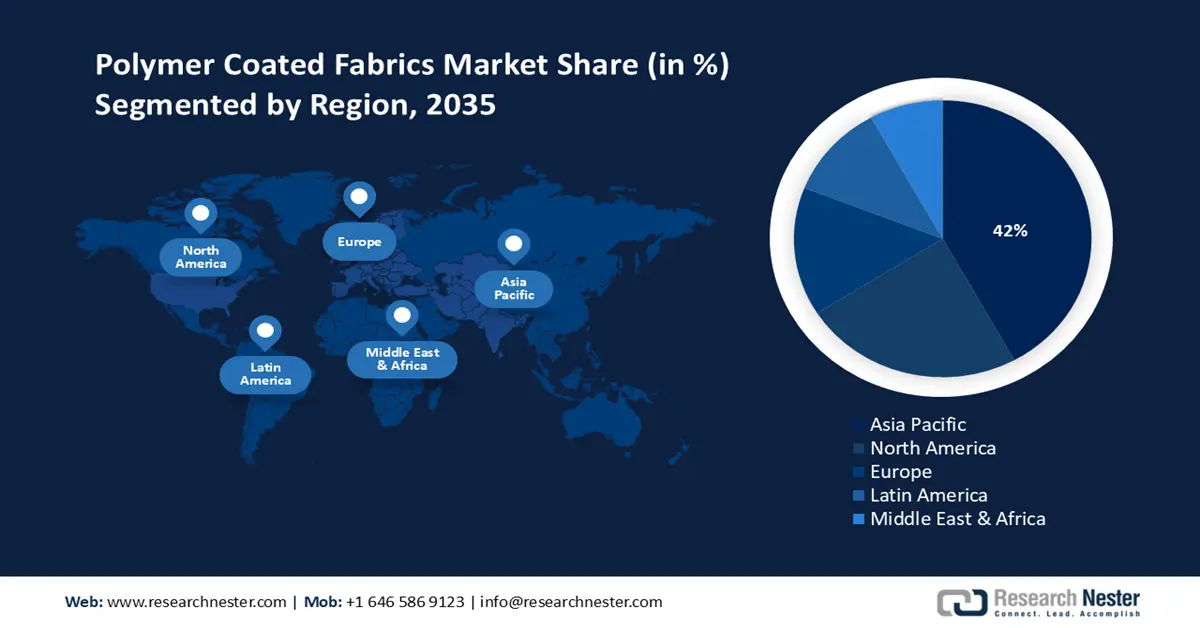

Polymer Coated Fabrics Market - Regional Analysis

Asia Pacific Market Insights

The APAC market for polymer-coated fabrics is expected to capture a 42% share of revenue by 2035. This growth is fueled by swift industrialization, government funding in green chemical technologies, and the rise of manufacturing hubs in China, India, etc. The increasing need for lightweight and durable materials in sectors like electronics, automotive, and construction is propelling market growth. Additionally, environmental regulations and sustainability efforts from regional governments are speeding up the adoption of polymer-coated fabrics. It shows budget distributions, policy initiatives, and investment trends that are fostering growth in the polymer-coated fabrics chemical industry.

By 2037, China is expected to capture the largest revenue share in the APAC region, due to its extensive industrial base, strong government support for sustainable chemical production, and a swiftly expanding manufacturing sector. As part of the nation's efforts to shift to a greener economy, China's main economic regulator, the National Development and Reform Commission, recently announced a 2.4-billion-yuan ($355 million) investment to save energy and lower carbon emissions.

India’s expanding polyurethanes trade is significantly boosting the polymer-coated fabric market, supplying key raw materials needed for producing high-performance, durable coatings. Growing domestic manufacturing of coated textiles for applications in automotive, footwear, and technical textiles is fueled by both local demand and export opportunities. This synergy supports innovation in flexible, water-resistant, and abrasion-resistant fabric technologies. As India strengthens its role in global polyurethane supply chains, it further accelerates the growth and diversification of the polymer-coated fabric sector domestically and internationally.

India’s Polyurethanes Trade Data (2023)

|

Export Destinations |

Value (USD Million) |

Import Sources |

Value (USD Million) |

|

Indonesia |

13.2 |

China |

119 |

|

Bangladesh |

10.3 |

Singapore |

55.6 |

|

United Arab Emirates |

7.35 |

South Korea |

34.2 |

|

Nigeria |

5.18 |

Netherlands |

32.8 |

|

Italy |

4.61 |

Germany |

24.7 |

Source: OEC

North America Market Insights

The polymer-coated fabrics market in North America is expected to capture a 24% share of revenue by 2035, mainly fueled by strong industrial demand and significant government backing for sustainable chemical production. Notable trends involve heightened federal investment in green chemical projects and cutting-edge manufacturing technologies, which promote innovation and adherence to regulations. The emphasis on environmental safety and energy-efficient production techniques in the U.S. and Canada also boosts market expansion, with support from EPA and DOE initiatives.

In 2022, the U.S. Department of Energy announced plans to invest $78 million to advance cross-sector industrial technologies and decarbonize the manufacturing of chemicals. This investment has helped boost polymer-coated fabrics through initiatives from the DOE and EPA. OSHA regulations have also played a role in making manufacturing safer, which in turn has built more trust in the polymer coated fabrics market. Federal grants are backing advanced technologies like Gallium Arsenide Wafer production, which is all about promoting sustainability and efficiency. The EPA’s Green Chemistry program, over 60 sustainable processes were established by 2023, leading to a reduction in hazardous waste, lowering compliance costs, and giving the polymer-coated fabrics industry a stronger competitive edge.

Europe Market Insights

The polymer-coated fabrics market in Europe is expected to capture a 15% share of revenue by 2035, mainly fueled by automotive, construction, and protective clothing end-use industries. Environmental regulatory issues, along with the European Green Deal, push fabricators and manufacturers to reduce the environmental impact of their coatings. Innovation in lightweight, durable, and weather-resistant fabrics supports uptake. There are plenty of R&D activities, several circular economy initiatives, and a very well-established industrial base in a variety of end-use industries that will contribute to the development of polymer coated fabrics.

With $960M in plastic coated textile fabric exports in 2023, Germany was the 2nd largest of the 166 plastic-coated textile Fabric exporters, and this ranked it as the 279th most exported product overall. Its imports were $327M making it the world's 8th largest importer of 219 importers, which ranked it 496th in terms of imports. The broader "polymer coated fabrics" category includes polymer coated textile fabrics because both processes coat materials with a polymer to provide durability, weather resistance, and specific functional performance.

Germany’s Plastic Coated Textile Fabric Trade (2023)

|

Exporting Country |

Value (USD Million) |

Importing Country |

Value (USD Million) |

|

Italy |

72.3 |

Italy |

74.9 |

|

Poland |

71.1 |

China |

60.7 |

|

Romania |

55.8 |

Austria |

23.2 |

|

Austria |

48.1 |

Netherlands |

22.2 |

|

United States |

46.9 |

Switzerland |

17.2 |

Source: OEC