Polymer Chameleons Market Outlook:

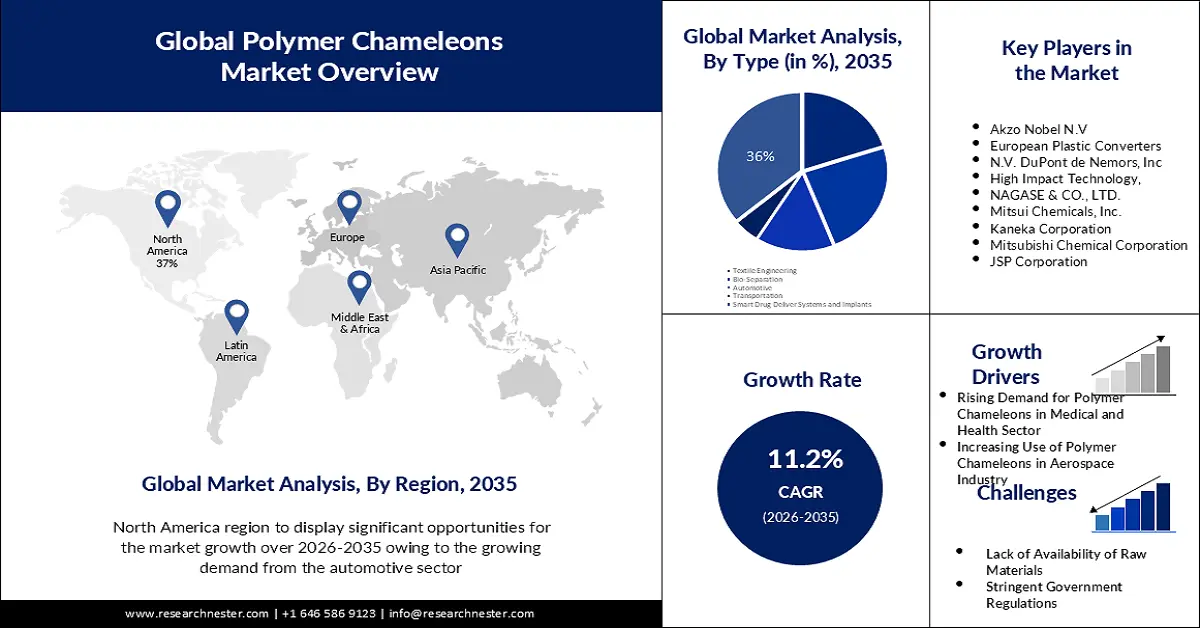

Polymer Chameleons Market size was valued at USD 1.31 billion in 2025 and is likely to cross USD 3.79 billion by 2035, registering more than 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polymer chameleons is estimated at USD 1.44 billion.

The use of polymer chameleons in automobile interiors, undercarriages, and even the engine is anticipated to increase demand for these materials in this industry. As per an estimation, the automotive interiors sector is expected to garner a revenue of USD 385 billion by the end of 2030. Thus, the expansion of automobile industry is likely to drive the market growth rapidly.

Further, other factors that may fuel the polymer chameleons market growth of polymer chameleons include the rise in technological advancements in polymer chemistry. Also, new and inventive polymer chameleons with distinct characteristics and functions are being developed as a result of developments in polymer chemistry.

Key Polymer Chameleons Market Insights Summary:

Regional Highlights:

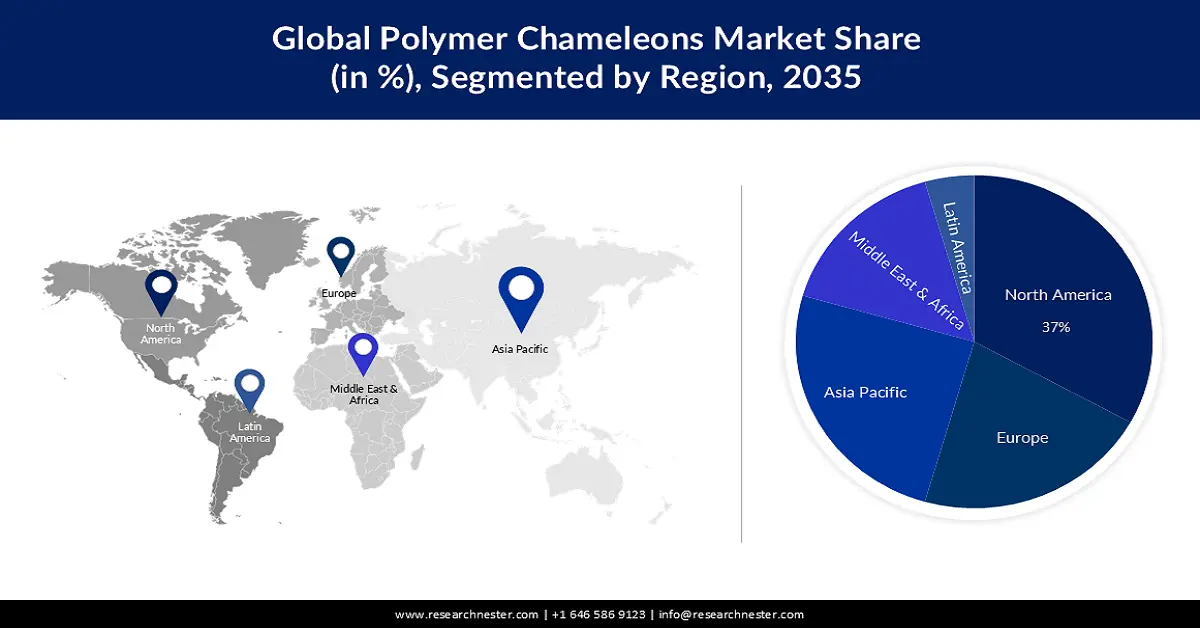

- North America holds a 37% share in the polymer chameleons market by 2035, driven by growing demand from automotive sector and need for better vehicle performance, comfort, and aesthetics.

- Asia Pacific market will command a 28% share by 2035, driven by increasing textile sector demand and expansion in manufacturing with advanced technology.

Segment Insights:

- The smart drug delivery systems and implants segment in the polymer chameleons market is projected to achieve a 36% share by 2035, driven by rising demand from the growing pharmaceutical sector and innovative drug delivery methods.

- The shape memory segment in the polymer chameleons market is expected to achieve a 30% share by 2035, driven by its applications in medical devices and response to environmental stimuli.

Key Growth Trends:

- Rising Demand for Polymer Chameleons in Medical and Health Sector

- Increasing Use of Polymer Chameleons in Aerospace Industry

Major Challenges:

- Rising Demand for Polymer Chameleons in Medical and Health Sector

- Increasing Use of Polymer Chameleons in Aerospace Industry

Key Players: lyondellBasell Industries NV, Akzo Nobel N.V, European Plastic Converters, N.V. DuPont de Nemors, Inc, High Impact Technology, NAGASE & CO., LTD.

Global Polymer Chameleons Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.31 billion

- 2026 Market Size: USD 1.44 billion

- Projected Market Size: USD 3.79 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 8 September, 2025

Polymer Chameleons Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Demand for Polymer Chameleons in Medical and Health Sector- Polymer chameleons are those stimuli-responsive polymers that quickly alter their microstructure in response to atmospheric changes. Polymer chameleons can be used to replace intraocular inserts, intervertebral plates, and vascular inserts in customized prosthetics. Also, an increasing demand for polymer chameleons in drug delivery systems for specific applications. Increasing demand for polymer chameleon Polymer chameleons are increasingly being used in the healthcare and medical sectors owing to an increased focus on smart materials and extended shelf lives which is boosting the polymer chameleons market.

- Increasing Use of Polymer Chameleons in Aerospace Industry- Particularly for deployable structures and components, the aircraft industry uses polymer chameleons. Optical reflectors, morphing skins, trusses, hinges, booms, and antennas are some of the main applications. In addition, various patents for applications involving shape memory polymers (SMPs), such as tuneable automotive brackets, intravascular delivery systems, grippers, and hood/seat assembly vehicles, have been filed by top polymer chameleon manufacturers. Therefore, it is projected that the increasing use of polymer chameleons in the aircraft sector will propel the market's growth rate.

- Growing Environmental Awareness- The demand for polymer chameleons is anticipated to increase as environmental issues and sustainability are given more global attention. More than 55% of people, according to a recent survey performed in 24 countries, are more aware of their environmental effects.

Challenges

-

Exorbitant Cost of Raw Materials- The high cost of raw materials is one of the major factors predicted to slow down the polymer chameleons market growth. For instance, the cost of raw materials needed for producing polymer chameleons keeps fluctuating, which in turn increases the cost of raw materials for manufacturers.

- Lack of Availability of Raw Materials

- Stringent Government Regulations

Polymer Chameleons Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 1.31 billion |

|

Forecast Year Market Size (2035) |

USD 3.79 billion |

|

Regional Scope |

|

Polymer Chameleons Market Segmentation:

Application Segment Analysis

Polymer chameleons market from the smart drug delivery systems and implants segment is expected to hold 36% of the revenue share during the forecast period. The growth of the segment can be attributed to the increasing pharmaceutical sector. As the pharmaceutical industries are growing across the globe, there is a surge in demand for polymer chameleons. Pfizer, a U.S. company, has long been one of the top pharmaceutical firms in the world. The business, which has its main office in New York City, brought in more than USD 100 billion in total sales in 2022. Further, a polymer chameleon that responds to a slightly acidic pH could be used to deliver drugs to cancer cells. According to recent data, the Indian pharmaceutical industry saw a yearly growth of over 17% in 2021.

Type Segment Analysis

The shape memory segment in the polymer chameleons market is expected to garner a significant share of 30% by the end of 2035. Shape memory polymer chameleons have a wide range of potential applications in engineering, materials science, and biology. Besides this, shape memory polymers are often used in medical devices such as stents and catheters as they may be created to expand or contract in response to changes in temperature or other environmental factors. For instance, approximately 2 million different types of medical devices, divided into more than 7000 generic device groupings, are available on the global market. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global polymer chameleons market includes the following segments:

|

Type

|

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Chameleons Market Regional Analysis:

North American Market Insights

North America industry is estimated to account for largest revenue share of 37% by 2035. The growth of the market can be attributed majorly to the growing demand from the automotive sector. Also, the need for better vehicle performance, comfort, and aesthetics is fuelling the demand for polymer chameleons in the region. Therefore, because of the region's developing healthcare sector and expanding medical industry, North America is experiencing considerable expansion in the market.

Asia Pacific Market Insights

Asia Pacific polymer chameleons market is projected to hold a share of 28% by the end of 2035. The growth of the market can be attributed majorly to the increasing textile sector in countries such as India, Japan and China. Several materials, including polymers, which are utilized in the creation of textiles, are in higher demand as a result of the industry's expansion in the region. Companies in the Asia Pacific region are engaged in the creation of a new product portfolio, particularly those with R&D centres in the therapeutic and medical fields. Over the next seven years, it is anticipated that an increase in manufacturing facilities in the area, along with the use of cutting-edge technology and experience, will raise the sales of polymer chameleon smart products.

Polymer Chameleons Market Players:

- lyondellBasell Industries NV

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akzo Nobel N.V

- European Plastic Converters

- N.V. DuPont de Nemors, Inc

- High Impact Technology,

- NAGASE & CO., LTD.

Recent Developments

- LyondellBasell Industries Holdings B.V. produced virgin quality polymers from raw materials derived from plastic waste. Moreover, by using recycled materials, the business increased the range of ecologically acceptable options available to customers and gave them access to recycled polymers for a variety of applications.

- Akzo Nobel N.V. acquired a Colombian paints and coatings firm Grupo Orbis, to improve its position in Latin America for the long run.

- Report ID: 3385

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Chameleons Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.