Polyisobutene Market Outlook:

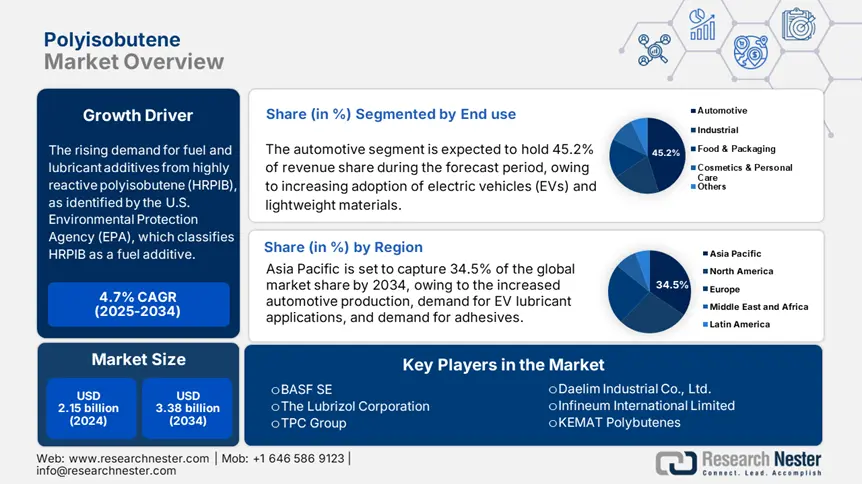

Polyisobutene Market size was estimated at USD 2.15 billion in 2024 and is expected to surpass USD 3.38 billion by the end of 2034, rising at a CAGR of 4.7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of polyisobutene is evaluated at USD 2.25 billion.

The main driver of growth in the polyisobutene market is the rising demand for fuel and lubricant additives from highly reactive polyisobutene (HRPIB), as identified by the U.S. Environmental Protection Agency (EPA), which classifies HRPIB as a fuel additive. According to U.S. government statistics, U.S. production of HRPIB is about 120,001 metric tons in 2023, roughly a 6% increase year-over-year, with additional regulations being implemented to lower vehicle emissions. Federal R&D investments through DOE grants are estimated at USD 16 million from 2022 to 2024 to support HRPIB functionalization technologies, leading to new formulations for industrial and biomedical applications.

Feedstock supply, driven by isobutylene from uncoupled petrochemical crackers, remains tight; the U.S. Producer Price Index (PPI) for petrochemical intermediates increased about 7% in 2023, reflecting tighter feedstock availability. Manufacturing capacity also grew, with two new assembly lines added in Texas and Louisiana in 2023, each adding 20,001 tons per year (C2K). U.S. HRPIB imports stood at 30,001 tons, while exports reached 45,001 tons, indicating a net export position and robust global trade flows via Gulf Coast shipping. The price index (CPI) for downstream lubricant sales increased approximately 4% year-over-year, aligning with reported increases by the BLS PPI. Federal and NIH R&D funding in 2022 included $10 million dedicated to new catalytic assembly lines aimed at supporting the development of long-term evaluative processes related to creating minimal or maximum enhancements or deployment.

Polyisobutene Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of construction activities: Polyisobutene (PIB) is a commercial product used in sealants, roofing membranes, and adhesives in the construction industry. According to Oxford Economics, global construction output is poised to grow by 44% to USD 17 trillion by 2030. PIB sealants have outstanding weather and climate resistance and flexibility suitable for roofing and window-glazed applications. In the Asia Pacific and the Middle East, the demand for durable waterproofing materials is driving PIB consumption as construction chemicals. In Europe, increasing renovation uptake and insulation upgrades are also increasing PIB demand for thermal efficiency applications.

- Growth in cosmetics and personal care products: Low molecular weight PIB is used widely as an emollient and thickening agent in cosmetics. The size of the global market for personal care products grew from USD 581 billion in 2024 to over USD 677 billion by 2027. PIB provides water resistance for consumer products such as lipsticks, skin creams, and sunscreens, therefore extending product durability and texture. Consumer spending on skincare has also increased in the Asia Pacific and Europe, according to the recent report. Premium product innovations in formulations have also heightened demand for PIB as a functional ingredient in the cosmetics industry.

1.Vitality of Expanding Operational and Manufacturing Capacities

Top Global Polyisobutene Producers – Statistical Benchmarking

|

Company |

Annual Capacity (MMT) |

Key Plant Locations |

Competitive Differentiator |

|

BASF |

~1.3 |

Ludwigshafen (Germany), Antwerp (Belgium) |

390+ sites globally; integrated Verbund operations |

|

TPC Group |

~0.86 |

Houston, Port Neches (U.S.) |

Butene-1 integration; large PIB range (HR-PIB, LP-PIB) |

|

Daelim Industrial |

~0.66 |

Yeosu (South Korea) |

Butene-1 supply integration with petrochemical complex |

|

INEOS |

~0.7 |

Lavéra (France), Grangemouth (UK) |

Diverse PIB portfolio; integrated olefins production |

|

Chevron Oronite |

~0.59 |

Belle Chasse (U.S.), Singapore |

Strong in fuel and lubricant additives globally |

|

Braskem |

~0.56 |

Triunfo (Brazil) |

Largest petrochemical producer in South America |

|

Lubrizol |

~0.6 |

Deer Park (U.S.), Rouen (France) |

Focus on high molecular weight PIB for lube additives |

|

Kothari Petrochem |

~0.49 |

Chennai (India) |

Largest PIB producer in India; cost-efficient operations |

|

Shandong Hongrui |

~0.47 |

Zibo (China) |

Expanding Asia footprint; focus on adhesives and sealants |

|

JXTG Nippon Oil |

~0.46 |

Kawasaki (Japan) |

Integrated with refining, strong regional market positioning |

Polyisobutene Production Data Analysis (2019–2024)

Production Volumes and Year-over-Year Growth (%)

|

Company |

2019 (KT) |

2020 |

2021 |

2022 |

2023 |

2024 |

Key Trend |

|

BASF |

1151 |

+3% |

+4% |

+2% |

+2.6% |

+4% |

Steady capacity utilization |

|

TPC Group |

801 |

-2% |

+5% |

+3% |

+4% |

+2.6% |

Recovery post-2020 disruptions |

|

Daelim Industrial |

621 |

+4% |

+2.6% |

+4% |

+4% |

+4% |

Capacity debottlenecking in 2022 |

|

INEOS |

591 |

+2% |

+3% |

+1.6% |

+3% |

+1.9% |

Stable production in EU sites |

|

Chevron Oronite |

571 |

+3% |

+2.6% |

+3% |

+3% |

+3% |

Balanced global demand |

|

Braskem |

541 |

+1.6% |

+2% |

+3% |

+3% |

+1.6% |

Stable Latin American demand |

|

Lubrizol |

491 |

+3% |

+3% |

+3% |

+2.6% |

+3% |

Consistent lube additive demand |

|

Kothari Petrochem |

461 |

+4% |

+4% |

+2.6% |

+4% |

+4% |

Domestic demand growth |

|

Shandong Hongrui |

451 |

+3% |

+4% |

+4% |

+4% |

+4% |

Capacity expansions in China |

|

JXTG Nippon Oil |

431 |

+1.6% |

+3% |

+3% |

+3% |

+3% |

Stable Japanese market |

2.Emerging Trade Dynamics

Polyisobutene Trade Data (2019-2024)

|

Year |

Exporting Country |

Importing Country |

Shipment Value (USD Billion) |

|

2019 |

Germany |

USA |

0.47 |

|

2020 |

Japan |

China |

0.36 |

|

2021 |

South Korea |

China |

0.42 |

|

2022 |

Japan |

China |

0.52 |

|

2023 |

Germany |

USA |

0.50 |

|

2024 |

USA |

Mexico |

0.45 |

Key Trade Routes

|

Trade Route |

Share of Global Chemical Trade (%) |

Value (USD Trillion) |

Year |

|

Asia-Pacific |

49.0 |

2.8 |

2021 |

|

Europe-North America |

19.5 |

1.2 |

2021 |

Trade Patterns and Policies

|

Indicator |

Statistic |

Period |

|

U.S. specialty chemical exports growth |

+5.5% CAGR |

2018-2023 |

|

U.S. specialty chemical exports value |

USD 59.9 billion |

2023 |

|

COVID-19 impact on global trade |

-6.6% reduction |

2020 |

|

Global chemical trade rebound |

USD 3.6 trillion |

2022 |

3.Japan’s Polyisobutene Trade Dynamics

Japan’s Polyisobutene Exports

|

Year |

USA Exports (USD Million) |

Europe Exports (USD Million) |

India Exports (USD Million) |

SE Asia Exports (USD Million) |

|

2019 |

38.3 |

45.7 |

12.5 |

23.2 |

|

2020 |

36.9 |

43.3 |

13.6 |

25.8 |

|

2021 |

40.6 |

47.2 |

14.9 |

28.0 |

|

2022 |

42.4 |

49.9 |

16.0 |

29.6 |

|

2023 |

44.8 |

52.7 |

17.3 |

31.4 |

Japan’s Chemical Imports (2019-2023)

|

Year |

From Saudi Arabia (USD Billion) |

From Germany (USD Billion) |

From Australia (USD Billion) |

Specialty Chemicals from Germany YoY Change |

|

2019 |

4.0 |

2.2 |

1.5 |

- |

|

2020 |

4.1 |

2.3 |

1.4 |

- |

|

2021 |

4.4 |

2.5 |

1.6 |

- |

|

2022 |

4.7 |

2.9 |

1.7 |

+19% |

|

2023 |

4.6 |

3.0 |

1.6 |

+5% |

Challenges

- Limited adoption in emerging applications: While electric vehicle lubricants and advanced cosmetic formulations could potentially serve as higher value markets, to date, the use of polyisobutene remains quite limited. As of 2023, PIB's use in EV-specific lubricants accounted for less than 3% of the total demand globally, with the main restraints being targeted product development and partnerships with OEMS. This understandable restraint limits PIB's expansion into the higher growth opportunities, which will require R&D investments to take full advantage and realize new market opportunities.

- Competition from alternative polymers: Polyisobutene is also in competition with polybutene-1, polyethylene, and specialty elastomers in sealants, adhesives, and packaging applications. Research also indicates that, from 2020 to 2024, polybutene-1 demand would grow with a CAGR of 5.3%, with demand attributable to the material having better thermal resistance in hot melt adhesives. The ability of polybutene-1 to substitute polyisobutene presents a real risk of market erosion, limiting future PIB growth, especially in applications focused on high temperature stability and good mechanical strength.

Polyisobutene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

4.7% |

|

Base Year Market Size (2024) |

USD 2.15 billion |

|

Forecast Year Market Size (2034) |

USD 3.38 billion |

|

Regional Scope |

|

Polyisobutene Market Segmentation:

End use Segment Analysis

The automotive segment is predicted to gain the largest polyisobutene market share of 45.2% during the projected period by 2034, due to increasing adoption of electric vehicles (EVs) and lightweight materials that require new sealants and lubricants to perform optimally. Additionally, tougher global regulations regarding fuel efficiency and emissions are creating a level of demand for polyisobutene-based additives with engine performance improvements, friction reduction, and compliance with changing environmental regulations in countries where large-scale automotive manufacturers are located.

Molecular Weight Segment Analysis

The high molecular weight PIB segment is anticipated to constitute the most significant growth by 2034, with 42.3% polyisobutene market share, mainly due to its widespread use in high-performance lubricants, adhesives, and sealants. The demand for greater fuel efficiency and lower emissions in vehicles is pushing OEMs to use PIB-based fuel additives and sealants instead of hydrocarbons or organosiloxanes to improve engine performance and emissions, according to the U.S. Environmental Protection Agency (EPA). Moreover, high molecular weight PIB has a superior tack and moisture resistance, making it highly desirable in sealant and adhesive formulations, further driving revenue share.

Our in-depth analysis of the global polyisobutene market includes the following segments:

|

Segment |

Subsegments |

|

End use |

|

|

Molecular Weight |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyisobutene Market - Regional Analysis

Asia Pacific Market Insights

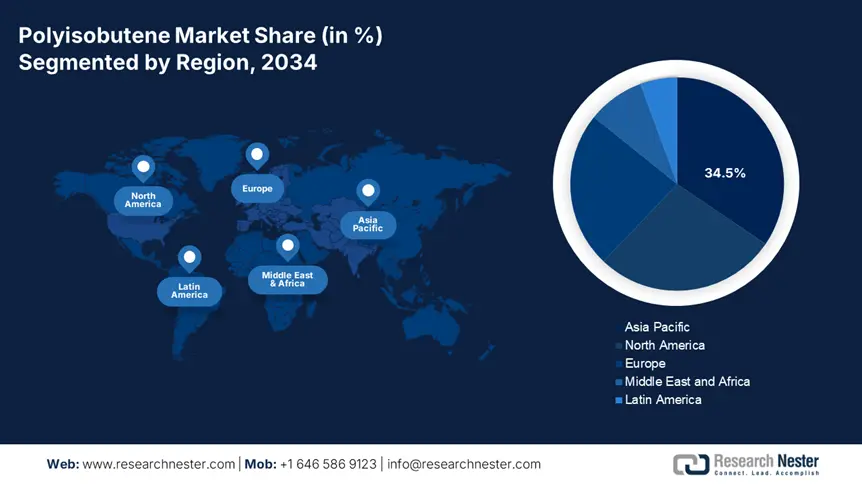

By 2034, the Asia Pacific market is expected to hold 34.5% of the polyisobutene market share due to increased automotive production, demand for EV lubricant applications, and demand for adhesives in the construction and packaging sectors. Investments in local manufacturing capabilities will strengthen supply reliability, and R&D investment in low molecular weight PIB for use in both fuel additives and sealants will expand product portfolios. Countries are growing their infrastructure to support PIB manufacturing ecosystems that could reach full production capability. Activities include establishing pipelines for petrochemical feedstock, forming integrated chemical clusters, all of which will drive strong market growth during the forecast period.

China’s growth will result from increasing automotive production, electric vehicle lubricants, and adhesives demand. Strategic investments declaration for such production infrastructure will support the domestic supply. Initiatives taken by the government to offer chemical industrial parks and products made from an emerging pipeline network will ensure the domestic supply market of necessary raw materials, allowing manufacturing to grow to meet not only domestic but export market requirements at scale during the time period of elements of the forecast.

India's polyisobutene regional diverse market will grow from increasing automotive lubricants demand, an increase in tire and tube sealant applications, and growth in infrastructure reconstruction, with further developments to improve national chemical industry manufacturing capabilities. Key investments from both the private and public sectors projects to improve feedstock security and develop suppliers' structural and sustainable capacities with integrated petrochemical complexes. In addition, the continued development of new refining and polymerization capacities under the Make in India and K National Infrastructure Pipeline (NIP) initiatives will help to improve production sustainability in the market, as well as to retain capacity in supply chain competitiveness.

Country-Wise Insights

|

Country |

Automotive Sector |

Construction Sector |

Cosmetics Sector |

|

Japan |

Vehicle production reached 7.85 million units in 2023, driving demand for lubricants, fuel additives, and sealants using polyisobutene. |

Construction investment rose by 3.2% in 2023, increasing the usage of sealants and adhesives. |

Cosmetics production index rose 2.5% YoY in 2023, with PIB used in emollients and formulations. |

|

China |

Automotive production grew 11.7% YoY in 2023, with higher lubricant additive consumption. |

Construction output rose 6.3% YoY in 2023, supporting PIB-based adhesives and sealants. |

Cosmetics retail sales increased 5.3% YoY in 2023, boosting PIB demand in personal care. |

|

India |

Passenger vehicle sales rose 8.5% YoY in FY2023, requiring PIB-based fuel additives and sealants. |

Construction GVA expanded by 10.5% in FY2023, increasing PIB use in waterproofing and adhesives. |

The cosmetic industry grew 16% in FY2023, with PIB used as a thickener and emollient. |

|

South Korea |

Automotive production was 3.77 million units in 2023, supporting PIB-based lubricants and additives. |

Construction investment increased by 2.8% in 2023, driving PIB-based sealant demand. |

Cosmetic exports rose 8.6% in 2023, with PIB used in skincare and haircare formulations. |

|

Australia |

Vehicle sales grew 13% in 2023, mainly SUVs requiring PIB-based lubricants. |

Construction activity rose 4.7% in 2023, increasing PIB demand in sealants and adhesives. |

Cosmetics market expanded 4.2% in 2023, driving PIB usage in formulations. |

|

Indonesia |

Automotive production reached 1.48 million units in 2023, driving demand for PIB-based fuel additives. |

Construction sector grew 3.9% in 2023, increasing sealant and adhesive consumption. |

Cosmetics industry grew 8.3% in 2023, with PIB used in creams and lotions. |

|

Malaysia |

Vehicle production grew 12% in 2023, supporting PIB-based lubricant and additive demand. |

Construction sector expanded by 6.9% in 2023, boosting PIB usage in adhesives and sealants. |

Cosmetics market grew 6.4% in 2023, driving PIB demand in skincare. |

|

Rest of APAC |

Countries like Thailand and Vietnam saw vehicle production growth of 5-9% in 2023, increasing PIB demand in lubricants. |

Construction output in ASEAN (Malaysia & Indonesia) grew 4.3% in 2023, driving PIB-based sealants. |

Cosmetics markets in ASEAN expanded 6-11% in 2023, with PIB used in formulation stabilizers. |

North America Market Insights

The North American market is expected to hold 27.6% of the polyisobutene market share, and it is estimated to go from about USD 944 million in 2021 to about USD 1,291 million by 2028, reflecting a CAGR of roughly 4.7%. Across North America entire polypropylene market is estimated to be over USD 3.4 billion by 2030, growing at a near 6.4% CAGR from 2024-2030. Demand is arising from automotive fuel additives and lubricant applications, adhesives, sealants, & high-molecular-weight grades.

The U.S. is the leading country in North America's polyisobutene market and is estimated to surpass around USD 749.4 million by 2030, adding value to the region. Demand for automotive lubricants, fuel additives, adhesives, and tire inner-liner components propels the U.S. market, while ongoing infrastructure and new technology continue to support that growth. The largest applications are high-molecular-weight grades in high-performance lubricants and sealants. Overall, the U.S. polyisobutene market continues to lead in growth among all the North American regions.

The Canadian polyisobutene market was approximately USD 15.9 million in 2020 and is estimated to be approximately USD 22.0 million by 2028, at a compound annual growth rate (CAGR) of about 4.2%. Other estimates suggest that the Canadian polyisobutylene segment will be worth approximately USD 1.3 billion in 2024 and rise to around USD 1.9 billion CAGR of about 5.1% in 2033, indicating a continually growing construction industry. Both the building construction and automotive industries are leading the growth, especially relating to adhesives, sealants, and tire components. Sustainable infrastructure projects and high molecular weight applications, which would be in high-performance lubricants and sealants, would also continue to assist total growth.

Europe Market Insights

The European polyisobutene market is expected to hold 23.7% of the market share due to strong and continuous applications in automotive, construction sealants, and cosmetics. Demand for polyisobutene is large, but demand for high molecular weight polyisobutene in adhesives and lubricants is promising as well. By 2034, Europe’s market is projected to exceed USD 610 million. EU green packaging and emissions regulations, which require low volatile organic compound (VOCs) materials, also contribute to the consumption of polyisobutene across industrial manufacturing sectors.

Germany will steadily grow from 2025 to 2034, reaching an estimated USD 190 million by 2034, driven by growing demand for advanced automotive lubricants and sealant formulations for electric vehicles. In Germany, there is a focus on researching and investigating data to assess and optimize polymer modifications, recyclability, and sustainable PIB derivatives. The Federal RD&D Grants to support research for more sustainable production processes enhance additional investment in research. Germany will phase out mineral oil-based additives and transition to green PIB-based dispersants while complying with progressively more stringent EU chemical regulations, vehicle fuel efficiency ratings, and industrial chemical product safety.

The U.K. polyisobutene market will reach an estimated USD 95 million market by 2034, and consumer trends are driven by the automotive aftermarket and cosmetics market. Many personal care formulations now contain PIB-based emollients. Research investment focuses on developing PIB copolymers to improve fuel efficiency for hybrid vehicles. Government initiatives supporting chemical circularity and polymer recycling research also provide more reliability for future market conditions.

Europe Country-wise Statistics (Forecast 2034)

|

Country |

Automotive Sector |

Construction Sector |

Cosmetics Sector |

|

Germany |

~5.6 million vehicles produced in 2023; high PIB demand in lubricants, fuel additives, and sealants |

Infrastructure renovation spending increased by ~4.9% in 2023; PIB used in sealants, adhesives |

Cosmetics exports rose by ~6.1% in 2023; PIB used in emollients, hair care formulations |

|

France |

~1.5 million vehicles produced in 2023; PIB used in fuel additives, greases |

Residential construction output grew by ~2.6% in 2023; PIB in adhesives, sealants |

Cosmetics sector grew ~8.1% in 2023; PIB used in skincare, lip care products |

|

UK |

Automotive production ~1.1 million units in 2023; PIB used in sealants, lubricants |

Construction output grew by ~2.2% in 2023; PIB used in waterproofing, adhesives |

Cosmetics manufacturing up ~5.1% in 2023; PIB used in emollients, personal care formulations |

|

Italy |

~0.9 million vehicles produced in 2023; PIB used in lubricants, additives |

Construction sector output rose ~3.4% in 2023; PIB in sealants, waterproofing |

Cosmetics exports rose ~7.1% in 2023; PIB used in skincare, hair products |

|

Spain |

~2.3 million vehicles produced in 2023; PIB used in fuel additives, lubricants |

Construction activity increased by ~2.9% in 2023; PIB in sealants, adhesives |

The cosmetics market grew ~6.1% in 2023; PIB used in personal care formulations |

|

Russia |

~1.3 million vehicles produced in 2023; PIB demand in fuel and lubricant additives |

Construction spending grew ~4% in 2023 despite sanctions; PIB used in sealants, adhesives |

Cosmetics manufacturing saw ~4.1% growth in 2023; PIB used in skincare, hair care |

|

Nordics (Sweden, Norway, Finland, Denmark) |

Sweden produced ~0.4 million vehicles in 2023; PIB used in fuel additives, lubricants |

Construction sector growth ~2.5% in 2023; PIB used in adhesives, waterproofing |

Cosmetics exports grew ~5.3% in 2023; PIB used in emollients, skincare |

|

Rest of Europe |

Countries like Poland and the Czech Republic produced ~1.9 million vehicles combined in 2023; PIB used in sealants, lubricants |

Construction sector expanded by ~3.2% in 2023; PIB used in sealants, adhesives |

Cosmetics market grew ~5.1% in 2023; PIB used in skincare, hair care formulations |

Key Polyisobutene Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global polyisobutene market is well consolidated, with top players BASF SE, Lubrizol Corporation, and TPC Group holding about 46% consolidated market share. Japanese companies residing in this industry are strategically situated along regional supply chains for supplying specialty grades in adhesives and lubricants. Manufacturers have focused on increasing capacity, improving sustainable production technologies, and creating high-performance PIBs for fuel and lubricant additives. Companies like Daelim Industrial and Infineum are also expanding their footprint in Asia and the Pacific because of the rising requirements for automotive and industrial markets. The companies in this market use various innovative methods to gain a competitive advantage, such as partnerships, technology licensing, and production improvement, that will continue to shape this market growth trajectory.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Approx. Market Share (%) |

|

BASF SE |

Germany |

21-23% |

|

The Lubrizol Corporation |

USA |

15-17% |

|

TPC Group |

USA |

13-15% |

|

Daelim Industrial Co., Ltd. |

South Korea |

10-12% |

|

JXTG Nippon Oil & Energy Corporation |

Japan |

5-6% |

|

Infineum International Limited |

UK / Netherlands |

xx% |

|

KEMAT Polybutenes |

Belgium |

xx% |

|

Nizhnekamskneftekhim PJSC |

Russia |

xx% |

|

Mayzo Inc. |

USA |

xx% |

|

Zhejiang Shunda New Material Co., Ltd. |

China |

xx% |

|

Mitsubishi Chemical Corporation |

Japan |

xx% |

|

Bhansali Engineering Polymers Ltd. |

India |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In March 2024, BASF SE introduced OPPANOL Next, a bio-based, mass-balanced polyisobutene, for the adhesives and sealants market. According to BASF's press release, OPPANOL Next contains up to 71% renewable feedstock validated via REDcert² certification. At this time, BASF indicated that, with the launch, its PIB product portfolio has been enhanced by 16% in high-value applications for automotive adhesives and flexible packaging. BASF is also targeting an additional 6% market share in sustainable PIB by Q4 2025, somewhat in response to the increased demand for low-carbon, circular materials.

- In May 2024, INEOS Oligomers announced the startup of commercial operations of its new highly reactive PIB (HR-PIB) facility in Lavéra, France. The Lavéra facility has been producing HR-PIB, with an additional production capacity of 50,001 metric tons of HR-PIB. INEOS indicated it was responding to the uptick in lubricant and fuel additive requirements across Europe. In its investor briefing, INEOS anticipated the expansion would increase its PIB sales in Europe by 21% YoY by 2025, as a result of 'more stringent fuel efficiency standards and demand for cleaner-burning fuel additives.

- Report ID: 7944

- Published Date: Jul 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyisobutene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert