Polyetherimide Market Outlook:

Polyetherimide Market size was valued at USD 737.52 million in 2025 and is likely to cross USD 1.41 billion by 2035, expanding at more than 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyetherimide is assessed at USD 781.99 million.

The growth of the market can be attributed to the escalating demand for polyetherimide in the aerospace industry backed by the higher manufacturing process of aircraft owing to growing air traffic across the globe. As of 2021, the number of passengers boarded by the global airline industry was anticipated to reach around 2 billion. Polyetherimide is used in the manufacturing of aerospace components since it is lightweight and reduces the utilization of metal parts.

In addition to these, global polyetherimide market trends such as rising demand for polyetherimide in the pharmaceutical industry are expected to influence the growth of the market positively over the forecast period. In the pharmaceutical industry, polyetherimide is used highly in making containers, manifolds, and others owing to its excellent properties. For instance, in 2021, the total revenue generated by the global pharmaceutical industry was anticipated to be around USD 1.5 trillion. Furthermore, the spiking utilization of polyetherimide in metal replacement is also estimated to expand the market size across the globe during the forecast period.

Key Polyetherimide Market Insights Summary:

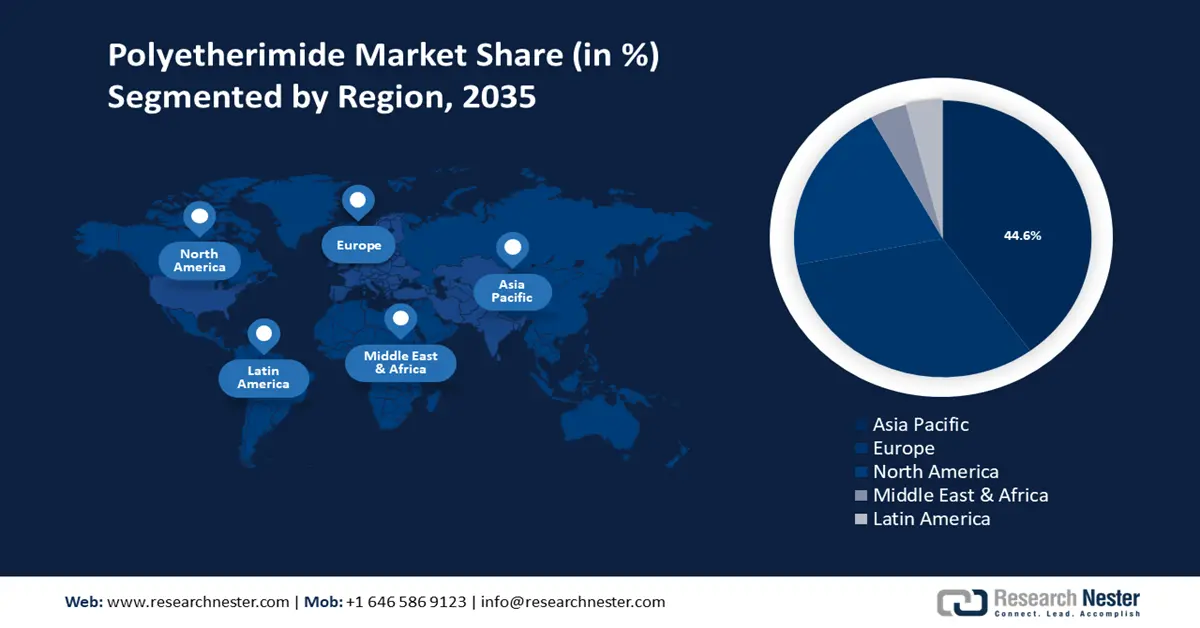

Regional Highlights:

- Asia Pacific polyetherimide market will secure around 44.6% share by 2035, driven by rising urbanization and population growth increasing demand across key sectors.

- Europe market gains a lucrative share by 2035, attributed to increased healthcare applications and awareness of chronic diseases.

Segment Insights:

- The pei sheet segment in the polyetherimide market is anticipated to achieve the largest share by 2035, attributed to the excellent thermal performance and high stiffness of PEI sheets.

- The reinforced segment in the polyetherimide market is expected to hold a substantial share by 2035, fueled by its higher capability to fulfill all sorts of engineering demands.

Key Growth Trends:

- Growing Demand for Polyetherimide in Medical and Health Care

- Rising Requirement for Polyetherimide in the Electric & Electronics Industry

Major Challenges:

- High-Cost Associated with Polyetherimide

- Lack of Colorability

Key Players: Solvay SA, RTP Company, Inc., Kuraray Europe GmbH, Röchling Group, Ensinger Plastics Pvt. Ltd., 3M Company, Mitsubishi Chemical Advanced Materials AG, Toray TCAC Holding B.V, Honeywell International Inc., Saudi Basic Industries Corporation.

Global Polyetherimide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 737.52 million

- 2026 Market Size: USD 781.99 million

- Projected Market Size: USD 1.41 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Polyetherimide Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Polyetherimide in Medical and Health Care – A higher demand for polyetherimide can be observed in medical and health care. PEI is used in the medical sector to fabricate reusable devices such as instrument trays, stopcocks, pipettes, and dental devices. It is anticipated to perform various sterilization techniques. Hence, the growth in medical expenditure is expected to hike the market growth over the forecast period. For instance, it was estimated that healthcare expenditure in the United States alone grew by approximately 3% in 2021.

-

Rising Requirement for Polyetherimide in the Electric & Electronics Industry – Polyetherimide is known to have excellent electrical properties such as increased rigidity and strength when exposed to significantly escalated temperatures. The most common application of polyetherimide in the electric & electronics industry are reflectors, connectors enclosures, and others. For instance, the total revenue generated by the electric & electronics industry is estimated to be around USD 100 billion in 2023.

-

Increasing Utilization of Polyetherimide in the Automotive Industry – Polyetherimide is a highly required component in the manufacturing of automotive components. These components are bezels, light reflectors, lightbulb sockets, and others. Hence, higher manufacturing of automobiles is expected to hike the market growth over the forecast period. For instance, it was estimated that in 2021, approximately 65 million units of automobiles were sold out across the globe.

-

Growing Aerospace Industry to Hike the Market Growth – The application of polyetherimide in aerospace are air and fuel valves, steering wheels, commercial airline food tray containers, interior cladding components, and others. Polyetherimide is considered to be the most suitable component for this sector since it is highly flame resistant.

-

Rising Utilization of Polyetherimide in Household Commodities to Boost Market Growth – Polyetherimide is highly flexible and which makes it quite convenient to take any sort of shape. It is generally used in the making of food trays, microwavable bowls, cooking utensils, and steam pans. For instance, the household care segment is projected to reach approximately USD 30 billion by the year 2027.

Challenges

- High-Cost Associated with Polyetherimide

- When polyetherimide is compared with other thermoplastics, it is quite expensive. Polyetherimide needs high processing temperatures and high-quality material, hence, the processing cost of polyetherimide is increased rapidly.

- Lack of Colorability

- Attacked by Acetates, Polar Chlorinated Solvents, Aromatic Hydrocarbon

Polyetherimide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 737.52 million |

|

Forecast Year Market Size (2035) |

USD 1.41 billion |

|

Regional Scope |

|

Polyetherimide Market Segmentation:

Form

The PEI sheet segment is estimated to gain the largest market share by 2035, attributed to the excellent thermal performance and high stiffness of PEI sheets making them suitable for multiple applications. It has remarkable dimensional stability in all sorts of environments and has fewer properties for moisture absorption. PEI sheets are lubricated with carbon fiber inside which makes them remarkable friction and wear characteristics. Other properties of PEI sheets are resistance to acids, flame retardant, and indifference to hot and steam water, which comprises excellent dimensional stability. Owing to all these properties, PEI becomes suitable for adhesion for printed items, heated beds, tape and glue removal, and others.

Grade

In polyetherimide market, reinforced segment is poised to account for substantial revenue share by the end of 2035, on the back of its higher capability to fulfill all sorts of engineering demands. This segment can be divided mainly into two types which are glass-reinforced and fiber reinforced. Reinforced PEI is known to have greater dimensional stability and enhanced electrical and mechanical properties that make it suitable for a wide range of properties. The reinforced grade is highly used in corrosion protection. It can carry the load and also offers strength and stiffness.

Our in-depth analysis of the global market includes the following segments:

|

By Form |

|

|

By Grade |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyetherimide Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 44.6% market share by 2035, attributed majorly to the rising urbanization, and rapid population growth in the region boosting the demand for food and beverage, pharmaceutical products, and others. Another report by the World Bank suggests that the population of South Asia has only witnessed a hike since 1960. In 2020, the population of the region was 1.857 billion, up from 1.836 billion in 2019. Apart from these, the surge in the growth of the aircraft parts and assembly manufacturing sector across the globe is also anticipated to drive the market growth.

Europe Market Insights

In polyetherimide market, European region is anticipated to capture lucrative share by the end of 2035, attributed majorly to increasing high usage of the product in the healthcare sector and escalating awareness regarding chronic diseases. Polyetherimide is highly used in pharmaceutical products, drug delivery, sutures, and tissue engineering scaffolds. Polyetherimide has been observed to be used in therapy for removing excess substances from the blood in treatment for chronic kidney disease using a dialyzer. For instance, it was estimated that in 2021, approximately 35% of the population in Europe was suffering from chronic health problems

North American Market Insights

By the end of 2035, North America region in polyetherimide market is estimated to capture significant revenue share. The region has world’s most robust automotive industry driven by countries such as Canada and the United States. Hence, there is a higher demand for polyetherimide for lighting applications such as fog reflectors, light sockets, headlight reflectors, and others. As of 2021, nearly 2.5 million passenger cars were assembled in the North American region.

Polyetherimide Market Players:

- Solvay SA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RTP Company, Inc.

- Kuraray Europe GmbH

- Röchling Group

- Ensinger Plastics Pvt. Ltd.

- 3M Company

- Mitsubishi Chemical Advanced Materials AG

- Toray TCAC Holding B.V

- Honeywell International Inc.

- Saudi Basic Industries Corporation

Recent Developments

-

Solvay SA unveiled its new service, Polycare Heat Therapy which is developed for bio-based thermoprotection in hair care. It comprises active ingredients that are most suitable to provide protection for hair from thermal damage owing to the higher utilization of hair styling appliances at very high temperatures.

-

RTP Company, Inc. made innovative plastic technology, RTP 2000 HC series, that is used to resist chemical attacks from hospital disinfectants. It is an excellent solution for the premature catastrophic failure of plastic devices.

- Report ID: 3527

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyetherimide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.