Polycide Market Outlook:

Polycide Market size was over USD 3.8 billion in 2025 and is estimated to reach USD 6.2 billion by the end of 2035, expanding at a CAGR of 5.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of the polycide is assessed at USD 4.0 billion.

The international market is continuously witnessing growth, owing to its demand for cleaning applications, food and beverage, and pharmaceuticals. Apart from this, there has been a rise in semiconductors, which is also responsible for the market’s growth. According to an article published by the Semiconductor Industry Association in July 2025, the U.S. semiconductor sector is considered the ultimate global leader, with more than 50% of worldwide chip revenues. In addition, owing to this, more than 100 projects across 38 states in the region have declared half a trillion dollars in private investment, which is projected to lead to over 500,000 job opportunities by the end of 2032, thus denoting a huge growth opportunity for the market.

Research and Development Expenditure Driving the Market Globally (2024)

|

Components |

Percentage of Sales |

|

R&D Spend by Industry |

|

|

Pharmaceuticals & Biotechnology |

21.5 |

|

Semiconductors |

17.7 |

|

Software & Computer Services |

15.6 |

|

Semiconductor Manufacturing Equipment |

11.4 |

|

Mobile Telecom |

10.5 |

|

Consumer Electronics |

5.5 |

|

Semiconductor Industry R&D Spend by Economy |

|

|

U.S. |

17.7 |

|

South Korea |

11.8 |

|

Taiwan |

11.5 |

|

Europe |

10.8 |

|

China |

9.2 |

|

Japan |

5.7 |

Source: Semiconductor Industry Association

Furthermore, the assembly line of polycide production has a complexity, involving raw material acquisition, which goes from production to final product manufacturing. For instance, as per an article published by the OEC in October 2025, China is one of the topmost exporters of organic chemicals, with a valuation of USD 95.6 billion, while the U.S. is the top importer, with USD 61.7 billion. Meanwhile, the market’s trading pattern is highly dependent on strategic research and development, assembly line efficiency, and extrusion. These are extremely essential to combat the vulnerable supply chain aspect, while catering to the highly volatile expense of raw materials from speculators into account, thereby bolstering the market’s exposure.

Organic Chemicals 2023 Export and Import Uplifting the Market

|

Countries/Components |

Export |

Import |

|

China |

USD 95.6 billion |

USD 45.8 billion |

|

U.S. |

USD 49.5 billion |

USD 61.7 billion |

|

Ireland |

USD 40.2 billion |

- |

|

Germany |

- |

USD 42.6 billion |

|

Global Trade |

USD 502 billion |

|

|

Global Trade Share |

2.2% |

|

|

Product Complexity |

0.8 |

|

Source: OEC

Key Polycide Market Insights Summary:

Regional Highlights:

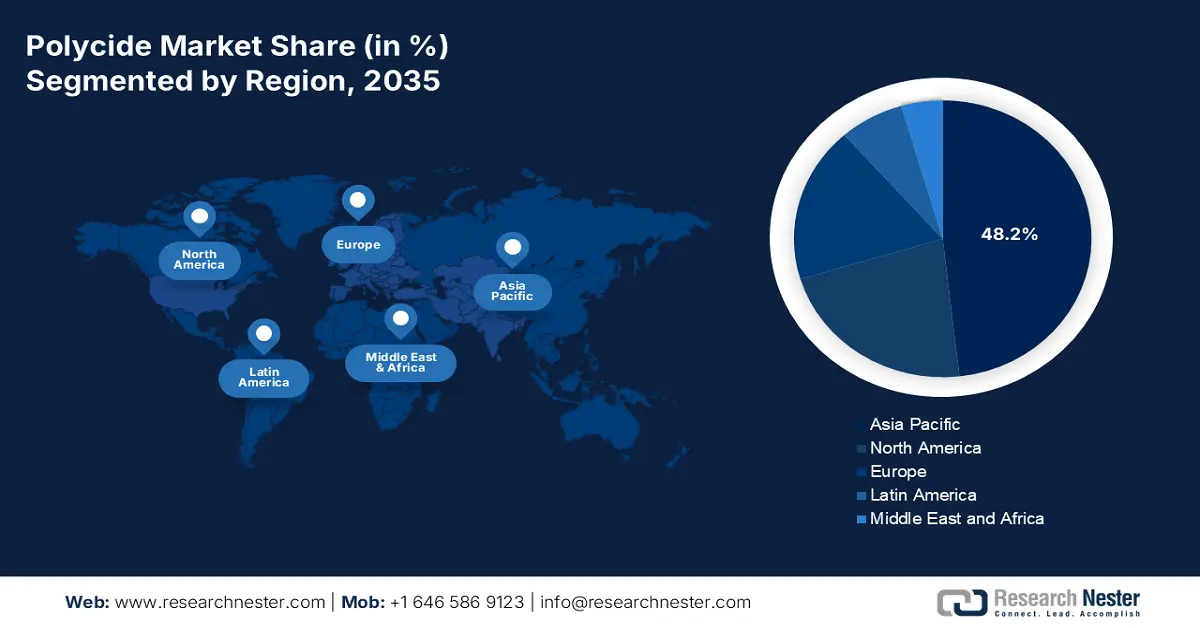

- Asia Pacific is anticipated to hold a 48.2% share by 2035 in the polycide market, owing to increasing demand for high-frequency semiconductors and government-backed initiatives.

- Europe is expected to emerge as the fastest-growing region during the forecast period 2026-2035, impelled by robust industrial and automotive sectors and strategies to reduce semiconductor dependency.

Segment Insights:

- Merchant segment is projected to account for 65.8% share by 2035 in the polycide market, driven by a tactical industrial shift towards specialized outsourcing.

- 300 mm segment is expected to secure the second-highest share during the forecast period 2026-2035, propelled by its role as the standard workhorse for international semiconductor manufacturing.

Key Growth Trends:

- Increasing demand in pharmaceuticals

- Shifting regulatory landscape for antimicrobial products

Major Challenges:

- Price cap regulations and antimicrobial resistance (AMR) issues

- Strict regulatory compliance

Key Players: Entegris, Inc. (U.S.), Versum Materials (Merck KGaA) (Germany), Applied Materials, Inc. (U.S.), Lam Research Corporation (U.S.), Tokyo Electron Limited (TEL) (Japan), Hitachi High-Tech Corporation (Japan), SUMCO Corporation (Japan), GlobalWafers Co., Ltd. (Taiwan), ASM International N.V. (Netherlands), SAMSUNG SDI CO., LTD. (South Korea), SK Materials (South Korea), Air Liquide S.A. (France), Linde plc (UK), Cabot Microelectronics Corporation (U.S.), ULVAC, Inc. (Japan), JSR Corporation (Japan), BASF SE (Germany), Hemlock Semiconductor Operations LLC (U.S.), Siltronic AG (Germany), Shin-Etsu Chemical Co., Ltd. (Japan).

Global Polycide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.8 billion

- 2026 Market Size: USD 4.0 billion

- Projected Market Size: USD 6.2 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Japan, South Korea, Germany, China

- Emerging Countries: India, Malaysia, Taiwan, Vietnam, Thailand

Last updated on : 3 November, 2025

Polycide Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand in pharmaceuticals: One major source of demand for polycide stems from its use as a preservative in pharmaceutical products for topical and liquid oral drops, such as eardrops, nasal drops, and antiseptics. Besides, according to an article published by the NIH in June 2025, there has been an investment of almost USD 48 billion for conducting medical research, particularly among the population in America. Of this, nearly 82% has been allocated for extramural research, and approximately 11% of the budget supports projects that are conducted by 6,000 scientists in laboratories, thus boosting the market’s adoption in the pharmaceutical sector.

- Shifting regulatory landscape for antimicrobial products: The aspect of modification for the newest antimicrobial wound dressings designations denotes a clear indication of the increased scrutiny of regulation around infection-prevention technologies. Therefore, consolidating the established safety and efficiency of products, such as polycide is in a robust position to effectively facilitate this change in administrative requirements. As per an article published by NLM in December 2022, the incidence of chronic skin wounds, mostly catering to venous leg ulcers and diabetic foot ulcers, is estimated to be 2%, thus enhancing the market’s demand.

- Expansion in progressive conformal coatings and electronics manufacturing: An increase in the adoption of electronics industry is one the most primary growth driver for the market, particularly for ensuring advanced packaging and high-performance conformal coatings. Polycide-specific coatings are essential for protecting sensitive components, such as printed circuit boards, sensors, and microprocessors, from electrochemical migration, corrosion, and moisture. This has readily increased the market’s demand, which is further propelled by the proliferation of the Internet of Things (IoT), 5G infrastructure, and electric vehicles, wherein reliability is paramount.

Challenges

- Price cap regulations and antimicrobial resistance (AMR) issues: The price capping aspect in Europe is considered a regular activity, which is readily imposed on antiseptic products through public procurement processes. For instance, the GKV-Spitzenverband, which is Germany’s national drug pricing authority, has instituted a reference pricing strategy as of 2023. This has spanned antiseptics, and has pressured producer to either limit their product price or offer suitable rebates on their expenses to gain a tender. Additionally, these cost restrictions impede the latest entrants, lacking economies of scale and established procurement relationships, thus negatively impacting the market.

- Strict regulatory compliance: The market is experiencing a significant gap in navigating strict international biocidal regulations, including the U.S. EPA guidelines and Europe’s Biocidal Products Regulation (BPR). These regulatory frameworks have mandated expanded and expensive testing to ensure product safety as well as efficiency, a process that is considered to be time-consuming. Besides, this increased compliance burden has disproportionately impacted small-scale manufacturers, thus potentially limiting market competition as well as stifling advancements.

Polycide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 3.8 billion |

|

Forecast Year Market Size (2035) |

USD 6.2 billion |

|

Regional Scope |

|

Polycide Market Segmentation:

Trade Segment Analysis

Based on trade, the merchant segment is anticipated to garner the highest share of 65.8% by the end of 2035. The segment’s growth is highly attributed to a tactical industrial shift towards specialized outsourcing. Few semiconductor manufacturers readily maintain in-house polycide production, owing to immense capital, expertise, and expenditure. In addition, they depend on enthusiastic merchant suppliers, who tend to achieve economies of scale, ensure strict quality control, and drive innovative material progression. This particular model permits chipmakers to effectively focus on core fabrication and design, while significantly leveraging best-in-class materials.

Wafer Size Segment Analysis

Based on the wafer size, the 300 mm segment is expected to account for the second-highest share during the projected period. The segment’s upliftment is fueled by its ultimate status as the fixed workhorse for international semiconductor manufacturing. Additionally, this segment offers more than 2.3 times the silicon area of 200mm wafers, rapidly diminishing cost per chip. The majority of cutting-edge memory, logic, and high-volume mature nodes are successfully produced from this particular platform. Besides, massive existing fabrication capacity as well as continuous improvement of 300mm processes cement its deliberate leading, which is positively impacting the overall segment.

Process Segment Analysis

Based on the process, the chemical vapor deposition segment is predicted to cater to the third-largest share by the end of the forecast duration. The segment’s development is highly driven by its versatile process, suitable for creating high-performance and high-purity coatings and films, utilized in severe industries, such as aerospace, optoelectronics, and semiconductors. According to an article published by NLM in January 2022, hexagonal boron nitride (hBN) is an insulating 2D material, which has identified applications in optoelectronic devices, and researchers have been successful in producing large-scale film domains of 80 μm2 having 95% to 100% coverage ratio, thus suitable for uplifting the overall segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Trade |

|

|

Wafer Size |

|

|

Process |

|

|

Function |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polycide Market - Regional Analysis

APAC Market Insights

Asia Pacific in the polycide market is anticipated to garner the largest share of 48.2% by the end of 2035. The market’s growth in the region is highly attributed to an increase in the demand for high-frequency semiconductors, a rise in the implementation of polycide transistors in medical imaging, and support through government-funded initiatives in Japan, China, India, South Korea, and Malaysia. For instance, according to a data report published by the PIB Government in January 2022, the National Policy on Electronics (NPE) 2019 has successfully set a target of achieving USD 300 billion for electronics production between 2025 and 2026, which denotes a massive growth opportunity for the market in the overall region.

The polycide market in China is significantly growing, owing to the presence of huge electronics manufacturing output, along with the Made in China 2025 industrial policy. Besides, as per an article published by the CSIS Organization in May 2023, the USD 21 billion National Integrated Circuit Industry Fund, commonly known as China’s Big Fund, has been readily renewed since its initiation with an additional USD 35 billion. This plays a pivotal role in successfully implementing the central government's semiconductor policy, along with the localized government establishing 15 semiconductor funds for investments, with a valuation of USD 25 billion, thus making it suitable for uplifting the market in the country.

The polycide market in South Korea is also growing due to the government’s K-Semiconductor Strategy which constitutes the provision of huge tax incentives, as well as infrastructure support, with the intention of facilitating private investment for developing mega clusters to increase polycide consumption. Besides this, domestic companies are also making a relevant contribution to boost the market’s growth in the country. For instance, in October 2025, Samsung Heavy Industries, Samsung C&T, Samsung SDS, Samsung Electronics, and OpenAI has deliberately notified their tactical partnership to escalate innovation in global AI and initiate technological innovations in semiconductors, and other data centers, thus uplifting the market in the country.

Europe Market Insights

Europe in the polycide market is expected to emerge as the fastest-growing region during the projected timeline. The market’s development in the overall region is propelled by its robust industrial and automotive industries, along with tactical approaches to diminish semiconductor dependency. As per an article published by the Europe Commission in February 2022, the EU Chips Act mobilized over €43 billion of public and private investment, and it has successfully set measures to overcome, prepare, anticipate, and rapidly cater to future supply chain disruption. Therefore, this has directly fueled the need for progressive materials, such as polycides utilization in sensors, power electronics, and microcontrollers, thus boosting the market demand.

The polycide market in Germany is gaining increased exposure, owing to the existence of both industrial and automotive manufacturing sectors, direct support, and the country’s Zukunftsfonds (Future Fund), which are aligned with the EU Chips Act. According to the 2025 Federal Ministry for Economic Affairs and Energy article, the Economic Affairs Ministry has operated a funding programme, known as ELECTRIC POWER II: Electric Mobility, by providing almost €29 million to a overall of 13 research and development projects. Besides, the German Federal Ministry for Economic Affairs and Climate Action also initiates active funding to boost technological sovereignty, thus bolstering the market in the country.

The polycide market in France is also developing due to regional strategies to create a resilient semiconductor ecosystem, the France 2030 investment plan, the development of the latest research and production infrastructure, and governmental commitment. For instance, the Important Projects of Common European Interest (IPCEI) on microeconomics readily provides support to the French leadership in FD-SOI technology, which is a process that significantly uses polycide materials. Besides, the French 2030 approach constitutes the objective to double the electronic production components by the end of 2030, thereby creating a sustained and direct need for advanced materials.

North America Market Insights

North America in the polycide market is projected to grow steadily by the end of the forecast duration. The market’s development in the overall region is highly driven by a robust semiconductor facility, a solid digitalization mandate in healthcare, and an integrated advanced ecosystem. Besides, as per an article published by Semiconductors Organization in July 2025, the manufacturing grant incentives, along with the Advanced Manufacturing Investment Credit (Section 48D), have initiated generous investments in the U.S., accounting for more than 130 projects across 28 states, resulting in over USD 600 billion in the form of private investments.

Semiconductor Supply Chain Investments in North America (2025)

|

Company |

Project Type |

Category |

Technology |

Project Size |

Jobs Expected |

|

Absolics |

New facility |

Materials |

Substrates |

USD 343 million |

1,200 |

|

Air Liquide |

New facility |

Materials |

- |

USD 250 million |

- |

|

Akash Systems |

New Facility |

Semiconductors |

Diamond cooling devices, systems, and substrates |

USD 121 million |

400 |

|

AMD |

New facility |

Chip design |

Design and validation of mixed-signal integrated circuits and processors packaging |

USD 3.3 million |

165 |

|

Applied Materials |

New facility |

R&D facility |

- |

USD 4 billion |

2,000 |

|

ASML |

Expansion |

Equipment |

- |

USD 200 billion |

1,000 |

Source: Semiconductors Organization

The U.S. polycide market will be able to grow robustly due to more government funding, sophisticated biomedical research, and a growing need for semiconductor technology to build new diagnostics. According to an article published by NIH in February 2025, the NIH made an investment of over USD 35 billion as of 2023, on nearly 50,000 competitive grants, as well as over 2,500 medical schools, universities, and other research institutes across 50 states. Of this fund, an estimated USD 26 billion catered to direct expenses for research, and USD 9 billion was readily allocated through the organization’s indirect cost rate. Therefore, this appears to be suitable to conduct effective research on polycide in the country.

The polycide market in Canada is also growing, owing to the existence of federal initiatives, which are aimed at achieving a suitable position in the overall region’s semiconductor ecosystem. In addition, a notable trend in the market’s upliftment is the effective focus on specialized fields, such as packaging technologies, photonics, and compound semiconductors. In this regard, the Government of Canada, as of July 2024, readily supported the commercialization and manufacturing of semiconductors by investing USD 120 million in a more than USD 220 million project, which is led by CMC Microsystems. This denotes a huge contribution towards uplifting polycide implementation in the overall country.

Key Polycide Market Players:

- Entegris, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Versum Materials (Merck KGaA) (Germany)

- Applied Materials, Inc. (U.S.)

- Lam Research Corporation (U.S.)

- Tokyo Electron Limited (TEL) (Japan)

- Hitachi High-Tech Corporation (Japan)

- SUMCO Corporation (Japan)

- GlobalWafers Co., Ltd. (Taiwan)

- ASM International N.V. (Netherlands)

- SAMSUNG SDI CO., LTD. (South Korea)

- SK Materials (South Korea)

- Air Liquide S.A. (France)

- Linde plc (UK)

- Cabot Microelectronics Corporation (U.S.)

- ULVAC, Inc. (Japan)

- JSR Corporation (Japan)

- BASF SE (Germany)

- Hemlock Semiconductor Operations LLC (U.S.)

- Siltronic AG (Germany)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Entegris, Inc. is one of the leading suppliers of high-purity materials and innovative materials processing solutions vital for semiconductor manufacturing. The organization provides critical precursor gases as well as specialty chemicals, utilized in polycide films deposition. Based on these activities, the organization has achieved USD 792 million in net sales, along with USD 0.35 of EPS, and USD 0.66 of diluted EPS.

- Versum Materials (Merck KGaA) is considered the top international provider of urbane deposition precursors, which include metal-organic and silane-based sources, crucial for forming polycide layers. In addition, their product portfolio is essential for developing conductive interconnects and gates in innovative semiconductor devices.

- Applied Materials, Inc. is regarded as the dominating provider of semiconductor manufacturing equipment, particularly offering atomic layer deposition systems and advanced chemical vapor deposition, readily utilized to apply uniform polycide films onto wafers. Besides, as per its 2024 annual report, the company readily distributed USD 5 billion to shareholders through increased dividends and share repurchases.

- Lam Research Corporation effectively specializes in deposition and etch technologies that are suitable for defining polycide structures on a chip. Its plasma etch system is essential for accurately and selectively patterning polycide gates, as well as interconnects, without damaging the surrounding silicon substrate.

- Tokyo Electron Limited (TEL) is one of the premier manufacturers of semiconductor production equipment, comprising innovative developer or coater systems, along with thermal processing platforms vital for annealing and patterning polycide films. The firm’s technologies ensure the suitable integration of polycide interconnect and gates, which are crucial for gaining the scalability and performance of logic and modernized memory devices.

Here is a list of key players operating in the global market:

The international market is significantly consolidated, with companies from South Korea, Japan, and the U.S. jointly accounting for the majority of the market share. Few market players, such as Samsung, Tokyo Electron, and Applied Materials, are readily innovating the process, initially through atomic layer deposition methods as well as EUV compatibility. Their tactical initiatives comprise developmental alliances, vertical integration, cross-border research, and government-specific funds for semiconductor initiatives. Besides, in November 2024, Samsung Electronics announced the arrangement of its latest semiconductor research and development complex at the Giheung campus. The purpose of this is to invest almost KRW 20 trillion by the end of 2030 to ensure advanced semiconductor R&D, thereby suitable for the market’s growth.

Corporate Landscape of the Polycide Market:

Recent Developments

- In December 2024, GlobalFoundries (GF) and Rensselaer Polytechnic Institute (RPI) are operating together to further strengthen and grow the semiconductor workforce, based on a partnership program to provide employees with suitable opportunities.

- In October 2024, Raytheon, a business vertical of RTX, has been offered a 3-year and a two-phase contract from DARPA to successfully develop functional and ultra-wide bandgap semiconductors, based on aluminum and diamond nitride technology.

- In July 2024, Merck has joined the Semiconductor-X, which is a research project, with increased focus on supply chain digitalization within the semiconductor sector, comprising Fraunhofer IFF and Intel Germany and 20 other partners from Germany.

- Report ID: 3987

- Published Date: Nov 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polycide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.