Polycarbonate Diols Market Outlook:

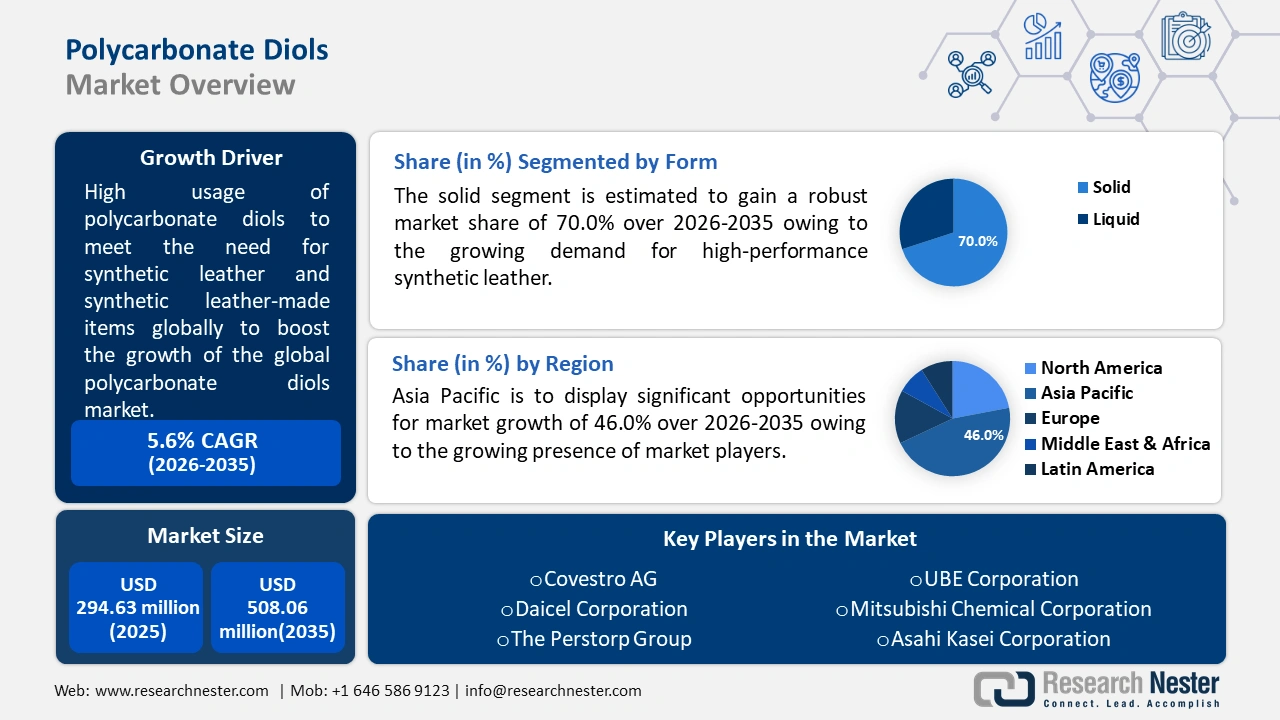

Polycarbonate Diols Market size was valued at USD 294.63 million in 2025 and is set to exceed USD 508.06 million by 2035, expanding at over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polycarbonate diols is evaluated at USD 309.48 million.

The market growth is driven by increasing utilization of polycarbonate diols to fulfill the massively surging demand and production of synthetic leather and synthetic leather products across the world. For instance, Taiwan's polyurethane synthetic leather (PU leather) production output has surpassed roughly 17 million meters in 2020. Moreover, the rising shifts towards water-borne paints and coatings will spike the market size.

In addition, the market revenue is propelled by excellent hydrolytic stability of polycarbonate diols which makes them an excellent product to be used in wide applications. For instance, owing to low moisture absorption and the ability to hydrolyze without creating an acidic molecule, polycarbonate diols have the highest hydrolytic stability among polyester polyols. Acid molecules autocatalyze additional hydrolysis in the soft block of the polyurethane. Additionally, radical expansion in environmental consciousness among people, along with the surge in the strict regulatory policies to conserve the environment is estimated to spur the market growth.

Key Polycarbonate Diols Market Insights Summary:

Regional Highlights:

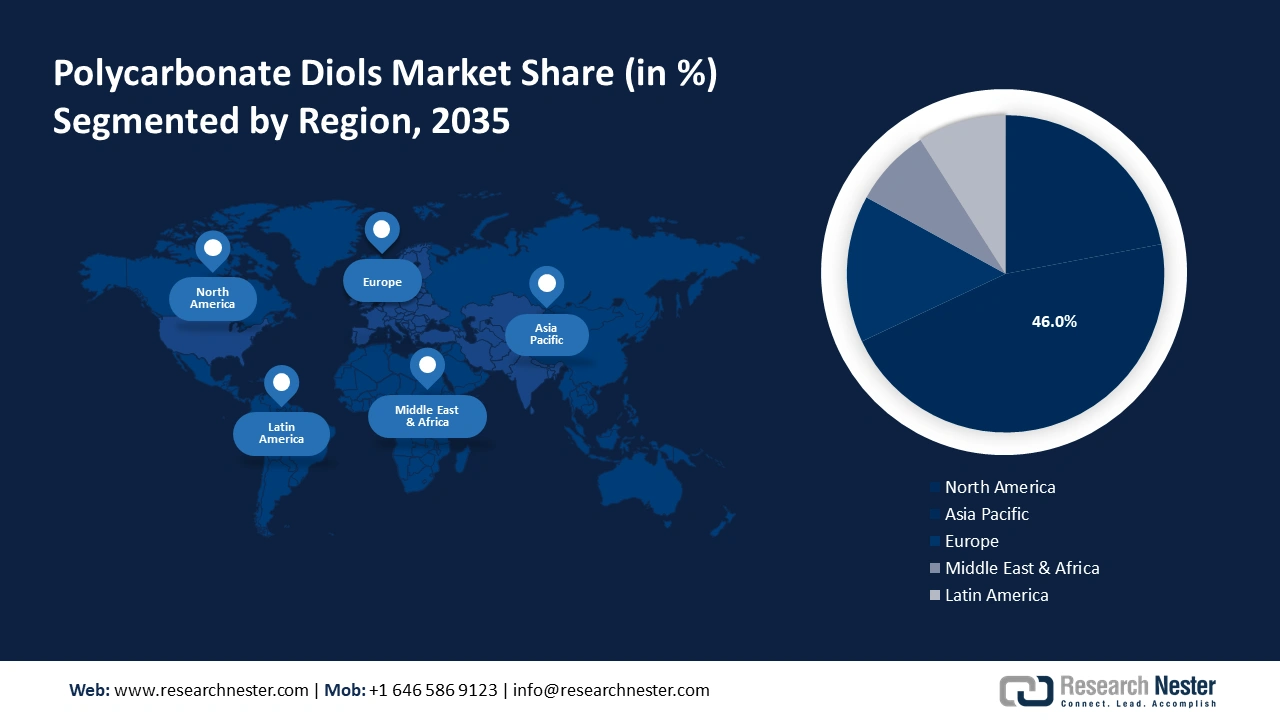

- Asia Pacific polycarbonate diols market will dominate over 47% share by 2035, driven by large end-user presence and regional consumption.

- North America market will capture a 22% share by 2035, driven by adoption of technologies and presence of major players.

Segment Insights:

- The solid form segment in the polycarbonate diols market is forecasted to secure a 70% share by 2035, driven by rising demand for high-performance synthetic leathers and coatings.

- The synthetic leathers segment in the polycarbonate diols market is projected to hold a 39% share by 2035, fueled by rising environmental concerns and animal protection.

Key Growth Trends:

- Expanding Demand and Production of Sealants and Adhesives

- Rising Production of Automotive

Major Challenges:

- Presence of Bisphenol (BPA) in Polycarbonate Diols

- Expensive Than Conventional Polyols

Key Players: Mitsubishi Chemical Corporation, Chemwill Asia co., Ltd., UBE Corporation, Asahi Kasei Corporation, Covestro AG, Daicel Corporation, DuPont de Nemours, Inc., Sumitomo Bakelite Co., Ltd., Saudi Arabian Oil Company, The Perstorp Group.

Global Polycarbonate Diols Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 294.63 million

- 2026 Market Size: USD 309.48 million

- Projected Market Size: USD 508.06 million by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Polycarbonate Diols Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding Demand and Production of Sealants and Adhesives – Polycarbonate diols are being used in the production of high-performance sealants and adhesives. It provides higher durability and extreme performance to sealants and coatings. These sealants and adhesives are being used in various sectors, hence, such increased use of these sealants is expanding the demand for these sealants. As a result, this factor is anticipated to fuel market growth in the coming years. For instance, in 2022, worldwide demand for adhesives and sealants was expected to reach approximately 375 thousand tonnes.

-

Rising Production of Automotive – As of the rising urbanization and surge in worldwide population the demand for vehicles has increased to a significant extent. Surging demand for vehicles is liable for the growing production of various kinds of automobiles comprising, including commercial vehicles, passenger cars, and so on. There is a wider use of synthetic leather in the production of car interiors including car seats, headliners, and so on. Therefore, the rising production of automobiles is projected to accelerate the growth of the market in the coming years. For instance, in 2021, approximately 80 million automotive vehicles were manufactured worldwide, that denotes around a 1.6% increase over 2020.

-

An Upsurge in the Demand for Elastomers - Elastomers are any rubbery material made of long chainlike molecules or polymers that can restore their original shape after being stretched to enormous lengths. Elastomer’s great durability allows a wide range of uses in the automotive industry, including wire and cable fabrication, puncture-resistant seals, and durability in vehicle interiors. Consequently, the unique features of elastomers are increasing their demand in a wide range of industries, which is estimated to proliferate the market growth. For instance, India's elastomer total production was expanded to roughly 370 thousand metric tons in the financial year 2021.

-

Rise in Government’s Stringent VOC Regulations - VOCs are used in the manufacturing of countless goods, including dry cleaning fluids, petroleum-based fuels, paints, adhesives, sealants, and so on. These VOCs pose a wide range of environmental issues. Several authorities have put these substances under rigorous regulations as a result of their hazardous impact on the ecosystem. Low water solubility and high vapor pressure of volatile organic compounds enable their emission as gases into the atmosphere. Hence, the government’s stringent rules for VOC regulation are estimated to drive market growth in the coming years. For instance, in the United States, the EPA's emphasis on VOC regulation arises from its capability to generate photochemical smog when reacting with nitrogen oxides and sunlight. The National Volatile Organic Compound Emission Standards for Consumer and Commercial Goods, 40 CFR 59, outlines the standards for VOC levels and control. This rule segregates the standards for consumer items, architectural coatings, car refinish coatings, aerosol coatings, and fuel containers into different sections. Within each category, legal standards detail how manufacturers must maintain records, labeling, and reports on the VOCs in their products.

-

Significant Expansion in Chemical Industry – For instance, the worldwide revenue of the chemical industry spiked to its highest level in 15 years in 2021, making the total roughly USD 5.10 trillion.

Challenges

-

Presence of Bisphenol (BPA) in Polycarbonate Diols – Polycarbonate diols have a presence of bisphenol (BPA), which is an ecologically harmful compound that causes health effects on the brain and prostate gland of infants, fetuses, and children. Moreover, BPA is known to disrupt normal hormone levels in human beings and is also known to cause cancer. Such factors are therefore anticipated to hamper the market growth during the forecast period.

-

Expensive Than Conventional Polyols

-

Lack of Unified Ordinances Regarding the Applications of Polycarbonate Diols

Polycarbonate Diols Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 294.63 million |

|

Forecast Year Market Size (2035) |

USD 508.06 million |

|

Regional Scope |

|

Polycarbonate Diols Market Segmentation:

Application (Adhesives & Sealants, Synthetic Leathers, Elastomers, Paints & Coatings)

The synthetic leathers segment is poised to dominate about 39% market share by 2035. The segment growth can be attributed to increasing environmental concern, and rise in animal protection. Therefore, a major shift of consumers from conventional leather to synthetic leather has been growing, which is driving more demand for synthetic leather based-products including bags, wallets, footwear, synthetic leather apparel, and so on is significantly expanding, which is projected to fuel the segment growth. For instance, in Poland, the revenue from synthetic leather jackets was expected to reach around USD 8.79 million in 2020.

Form (Solid, Liquid)

The solid form segment is projected to grab a significant share of around 70% by 2035, propelled by rising demand for high-performance synthetic leathers, along with growing demand for waterborne coatings and paints for use in furniture, automotive, and textile industries among others. Solid polycarbonate diols possess high resistance to stain, oxidation, hydrolysis, and wear in polyurethane products. Moreover, solid polycarbonate diols offer optimum strength, performance, excellent mechanical properties, and high thermal stability at low temperatures.

Our in-depth analysis of the global market includes the following segments:

|

By Form |

|

|

By Molecular Weight |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polycarbonate Diols Market Regional Analysis:

APAC Market Statistics

The Asia Pacific polycarbonate diols market is set to dominate 47% share by the end of 2035. The market growth is impelled by prominent presence of several end-users who use polycarbonate diols for the manufacturing of different end-use products. Moreover, the presence of nations, such as China and India, who are also the largest consumers of polycarbonate diols in the region, is anticipated to drive the market growth.

Korea, on the other hand, accounted for the largest exporter of polycarbonates globally. According to the trade statistics of the International Trade Centre, China accounted for the largest share of 34.42% globally for the imports of polycarbonates in the year 2019, whereas the Republic of Korea recorded a share of 14.15% globally for the exports of polycarbonates the same year.

North American Market Forecast

The North American polycarbonate diols market is predicted to hold over 22% share during the forecast period. The market growth is led by rise in the high adoption of sophisticated technologies, as well as the existence of significant players, which are projected to provide ample prospects for market growth in the region. In addition, the surge in construction activities where the utilization of waterborne coatings has been increasing is estimated to push the market revenue.

Europe Market Forecast

The market in the Europe region is poised to grow at moderate CAGR till 2035. The market growth can be credited to significant expanding investment in the chemical industry, along with the remarkably growing demand for vehicle interiors as of the surge in automobile production in the region. Moreover, the rising production of automotive elastomers is projected to further drive the market growth of polycarbonate diols as these elastomers are highly utilized in the manufacturing of tires, automotive seals, and gaskets.

Polycarbonate Diols Market Players:

- Mitsubishi Chemical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Chemwill Asia co., Ltd.

- UBE Corporation

- Asahi Kasei Corporation

- Covestro AG

- Daicel Corporation

- DuPont de Nemours, Inc.

- Sumitomo Bakelite Co., Ltd.

- Saudi Arabian Oil Company

- The Perstorp Group

Recent Developments

-

Mitsubishi Chemical Corporation's biomass-based polycarbonate diol (PCD) BENEBiOL has been certified as a bio-based product under the BioPreferred Program of the United States Department of Agriculture (USDA). This program is aimed to magnify the market horizon for bio-based products.

-

UBE Corporation has begun the third expansion of its polycarbonate diol (PCD) production facilities at one of its Thailand-located subsidiaries. The facility is estimated to commence operations in August 2023, and it is intended to increase the manufacturing capacity from 8,000 tons to 12,000 tons annually.

- Report ID: 2857

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polycarbonate Diols Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.