Polaroid Market Outlook:

Polaroid Market size was valued at USD 1.6 billion in 2025 and is projected to reach USD 2.5 billion by the end of 2035, rising at a CAGR of 4.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of polaroid is evaluated at USD 1.7 billion.

The global polaroid market is witnessing rapid growth during the forecast period, and the market is driven by the trends in photography and fashion. The demand of the market aligns with the broader consumer spending patterns on photographic equipment, as detailed by the national expenditure tracking. According to the U.S. Bureau of Labor Statistics data in April 2025, the producer price index for photographic equipment and supplies reported a 1.7% rise over the 12 months, reflecting a variability in producer prices within this retail sector. Further, the data reflects a modern YoY stability that supports a continued activity in the instant photo segment used by the brands, including Polaroid. These government-validated indicators show that instant photography products benefit from stable discretionary spending despite inflationary pressures, while compliance standards remain central to market access.

Industry-level data from non-profit cultural and photography organizations provides additional insights into demand behavior for instant imaging. The George Eastman Museum, a leading photography preservation institution, notes continued public engagement with analog and instant photography, reporting over 400,000 annual visitors to film and camera-related exhibitions, which correlates with stable interest in legacy photographic formats. Similarly, research published by the Association for Psychological Science highlights that increasing consumer participation in physical media creation, with survey-based findings, depicts that most people prefer the tangible photographic outputs over the digital-only formats, reinforcing the ongoing relevance of instant photo printing. These non-profit sources align with federal spending and import data to offer a consistent view of instant photography, including polaroid-branded products maintain a stable consumer audience with the sustained cultural engagement.

Key Polaroid Market Insights Summary:

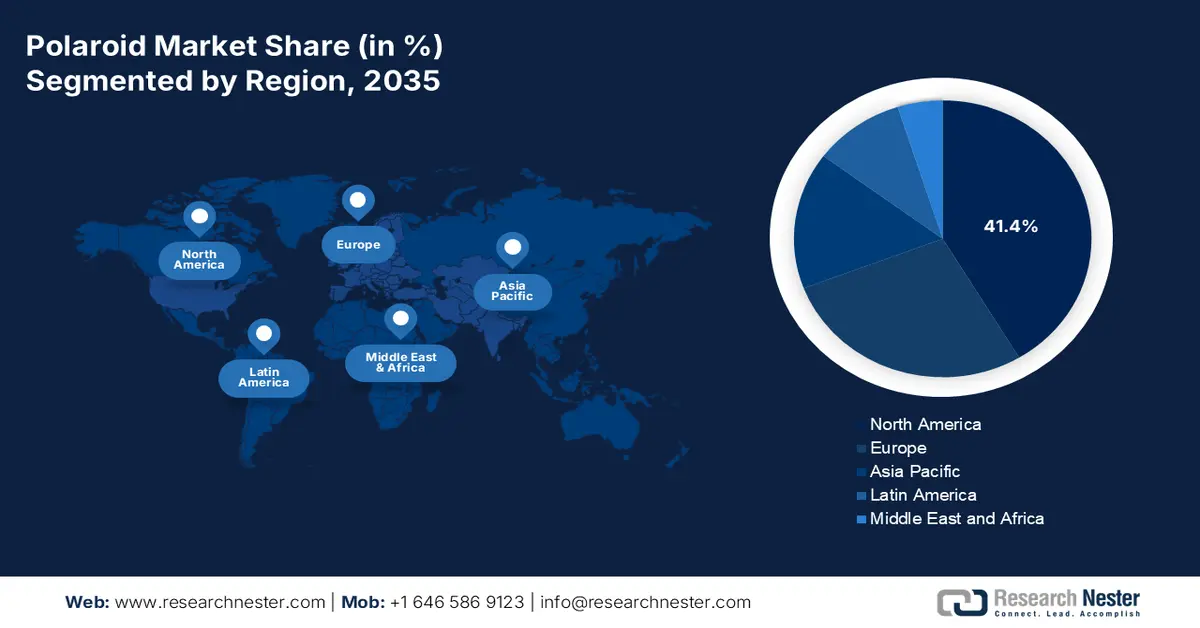

Regional Insights:

- North America is projected to secure a 41.4% share in the polaroid market by 2035, sustained via high discretionary spending and a strong experiential consumption culture.

- Asia Pacific is anticipated to expand at a 9.2% CAGR during 2026–2035, propelled by rapid urbanization, rising disposable incomes, and youth-driven social-media-influenced purchasing behavior.

Segment Insights:

- By 2035, the personal or consumer use segment in the polaroid market is expected to command a 90.4% share, underpinned by a cultural pivot toward experiential consumption and tangible nostalgia among younger demographics.

- The instant film and consumables sub-segment is forecast to lead the product type category by 2035, reinforced by a razor-and-blades revenue model and rising demand for innovative film formats.

Key Growth Trends:

- Tourism and cultural or event-driven demand

- Growth in youth creative activity participation

Major Challenges:

- High R&D and manufacturing entry costs

- Market dominance of the giant players

Key Players: Polaroid (U.S.), Eastman Kodak Company (U.S.), Canon Inc. (Japan), Sony Corporation (Japan), Leica Camera AG (Germany), Lomographische AG (Austria), HP Inc. (U.S.), Nikon Corporation (Japan), MiNT Camera (Hong Kong), Ricoh Company Ltd. (Pentax) (Japan), Olympus Corporation (Japan), Cherish (China), Samsung Electronics (South Korea), LG Electronics (South Korea), Impossible Project (Germany) - now merged into Polaroid, Kogan.com (Australia), JKCamera (India), Pribumi (Malaysia), PoGo (China).

Global Polaroid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Indonesia, Vietnam, Brazil

Last updated on : 8 December, 2025

Polaroid Market - Growth Drivers and Challenges

Growth Drivers

- Tourism and cultural or event-driven demand: The government tourism statistics serve as a critical proxy for event-driven demand within the polaroid market. For example, the World Economic Forum report in May 2025 has stated that Japan reported nearly 36.87 million international visitors, which is a rise of 47.1% compared to the previous year. High tourism volumes create direct opportunities for souvenir-oriented products such as instant cameras and destination photo booths, linking market growth to the global experience economy’s resurgence. This data point highlights the established connection between leisure travel, cultural event attendance, and the purchase of tangible physical mementos. The overall growth of the tourism sector, as measured by the government statistics, is a key indicator for forecasting the demand in the instant photography market segment focused on the personal and event-based memorabilia creation.

- Growth in youth creative activity participation: The UNESCO reports that expanding participation in the youth creative programs worldwide integrates visual arts curricula into the national education frameworks. The photography remains a common module in secondary and vocational systems, creating a steady demand for simple physical output devices such as instant cameras for hands-on learning. Polaroid benefits from increasing institutional procurement and student-led creative activities. This trend is mainly strong in Europe and the Asia Pacific, where governments are expanding arts education funding. Polaroid suppliers can target education ministries and NGOs for the curriculum-based deployments, ensuring repeat purchases of film and supporting accessories.

- Import demand for cameras and photo supplies: The international trade data provides a clear quantitative measure of the underlying demand for the Polaroid market consumables. The OEC 2024 report shows that the global export value of photographic plates in the U.S. reached USD 360 million. This data highlights that the major consumer market, such as the U.S., signifies robust and ongoing demand for photographic film. These strong trade figures serve as a direct economic indicator of healthy market consumption, validating the core razor and blades business model. Further, the report indicates a deeply globalized nature of the film supply chain, where manufacturing, raw materials, and the end user consumption are interconnected across international borders.

Challenges

- High R&D and manufacturing entry costs: Establishing production for the instant film is exceptionally capital-intensive. It requires clean room facilities, precision coating machinery for multi-layered chemical pods, and complex assembly lines. The initial investment can run into tens of millions of dollars before a single pack is sold. The Polaroid's relaunch under the Impossible Projects highlights this; the group spent years and millions in resurrecting a single discontinued film line in a former Polaroid factory, facing immense technical and financial hurdles before achieving marketable quality, demonstrating the steep upfront cost of entry.

- Market dominance of the giant players: The market is a duopoly, with Fujifilm holding the largest global share by volume. This dominance creates immense pressure on shelf space, retailers' relationships, and consumer mindshare. A new brand must convince retailers to stock its product over a guaranteed seller, such as Instax film, and must sway the consumers away from the trusted, widely available standard. Kodak’s struggle to gain a significant share with its Kodak Mini Shot system, despite brand recognition, illustrates the difficulty of challenging the entrenched Instax ecosystem and brand loyalty.

Polaroid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

Polaroid Market Segmentation:

Application Segment Analysis

Under the application segment, the personal or consumer use sub-segment is dominating and is expected to hold the share value of 90.4% in the polaroid market by 2035. The segment is driven by the cultural shift towards experiential consumption and tangible nostalgia, mainly among the younger demographics who utilize instant prints for social sharing, memory keeping, and creative expression. The Instagram generation values the physical artifact as a tool for digital engagement, creating a self-perpetuating cycle of demand. Commercial uses, such as event photo booths, contribute but are a niche by comparison. A key statistical indicator of this broad consumer goods activity is found in the U.S. Bureau of Economic Analysis data, in September 2025 on the personal consumption expenditure for goods and services increased to USD 132.9 billion in August 2025. This data illustrates sustained consumer spending in the recreational product category that encompasses instant photography. Further, this macroeconomic trend supports the sustained investment in personal-use instant camera products and consumables.

Product Type Segment Analysis

By 2035, the instant film and consumables sub-segment is expected to lead the product type segment in the Polaroid market. This follows a classic razor and blades model where the continuous high-margin sale of film drives the profitability far beyond the one-time camera purchase. Innovation in film formats, limited edition collaborations, and specialty films are critical strategies to maintain this lucrative recurring revenue stream. The vitality of this segment is indicated by the international trade data. According to the OEC data in 2023, the import value of photographic plates, films, and instant print film in the U.S. in 2023 reached USD 365 million, demonstrating a clear and rising import demand for the photographic film that directly feeds the instant consumables market. The import data highlights a sustained and long-term demand that strengthens the segment position as the primary revenue engine for the entire industry via 2035 and beyond.

Demographic Segment Analysis

In the demographic segment, the 15 to 30-year demographic is the undisputed core consumer driving the segment in the polaroid market. This group’s purchasing behavior highlights the market trends with drivers indicating the desire for analog authenticity, the use of physical prints as social currency, both online and offline, and high engagement with brand collaborations. Their preference for direct-to-consumer and social commerce channels further solidifies the online distribution segment’s growth. The government labor and spending statistics reflect this cohort’s economic influence. Further, the demographic financial empowerment and digital fluency position the specific aged people as the primary target for major brands, shaping everything from product design to marketing campaigns. Their propensity to spend on experiences over possessions ensures the instant film category booms as a key component of social expression and personal storytelling.

Our in-depth analysis of the polaroid market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Distribution Channel |

|

|

Application |

|

|

Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polaroid Market - Regional Analysis

North America Market Insights

The polaroid market in North America is dominating and is expected to hold the market share of 41.4% by 2035. The market is driven by high discretionary spending and a strong culture of experiential consumption. The key trends include the dominance of the e-commerce channels with the sustained demand for film consumables. On the other hand, the core demographic of young adults treats instant prints as a form of personal expression and social currency, seamlessly blending analog creativity with their online personas. The growth is sustained via a consistent product innovation, such as the new film formats and strategic brand collaborations, and a dominant shift to online retail channels that cater directly to this audience. While the U.S. leads the market with its vast consumer base, Canada contributes to the rise in tourism and outdoor lifestyle usage.

The U.S. Polaroid market is a global leader and is defined by the robust demand for instant film as a tactile leisure product. The primary trend is the full integration of instant photography into the digital lifestyle, where physical prints are used as a social currency. This is driven by the dominant e-commerce distribution, with the U.S. Census Bureau data in August 2025 indicating the retail e-commerce sales for Q2 of 2025 were USD 304.2 billion, which is an increase of 1.4% from Q1 of 2025. Government data from the Bureau of Economic Analysis shows a consistent growth in the recreational goods spending, reflecting the broader category’s strength. The sustainability regulations and the corporate arts funding, such as the grants from the National Endowment for the Arts, also subtly influence institutional and environmentally conscious consumer demand.

The Canada’s polaroid market is driven by the urban millennial and Gen Z consumers. The key trends are the focus on experiential retail and tourism-driven demand, with destinations utilizing instant photography for souvenirs. Government cultural funding via institutions such as the Canada Council for the Arts is funded, USD 28. 3 million total grants to arts organizations for the year 2022 to 2023. This data supports the arts engagement and can indirectly accelerate the demand for creative tools such as instant cameras in community and educational settings. The import reliance defines the market as domestic manufacturing is absent, making it sensitive to global supply chain dynamics and trade policies. Consumer behavior aligns with the broader shift towards tangible goods, but with a notable emphasis on outdoor and travel-related usage, aligning with Parks Canada’s reported increases in national park visitation.

APAC Market Insights

Asia Pacific is the global growth engine for the polaroid market and is projected to grow at a CAGR of 9.2% during the forecast period 2026 to 2035. The market is driven by a massive youth population, rapid urbanization, and rising disposable incomes. The primary demand drivers include the strong cultural emphasis on gift-giving and commemorating social occasions, the influence of social media and K-pop culture on consumer trends, and the rapid expansion of e-commerce and omnichannel retail. China and Japan are the established volume leaders, with Japan’s mature market driven by the high tourism rate and China’s vast domestic manufacturing and consumer base. The emerging markets, such as India and Southeast Asia, present high growth opportunities fueled by the growing middle class.

China’s polaroid market is the leader in the APAC region and is driven by a vast domestic manufacturing ecosystem, immense e-commerce platforms, and a young urban consumer base that views instant photography as a trendy lifestyle accessory. The key drivers include advanced social commerce integration, where platforms such as Xiaohongshu heavily influence purchase decisions, and a strong demand for the limited-edition collaborations with domestic celebrities and IP. The government data highlights the robust digital consumption environment. The People’s Republic of China reported that online retail sales of physical goods increased by 8.4% YoY to 13.02 trillion yuan, accounting for total retail sales of 27.6% of consumer goods. This data demonstrates the powerful channel via which these products reach consumers. The market is defined by fierce local competition and rapid product iteration to match the fast-changing trends.

India represents the highest growth in the APAC polaroid market and is fueled by the rapid digital adoption and profoundly young demographics. The primary driver is the aspirational consumption, where the instant cameras are seen as novel, fashionable gadgets for social occasions and travel. The growth is heavily tied to the expansion of the e-commerce and digital payment infrastructure. The Ministry of Electronics and Information Technology’s India Stack reported that a massive increase in digital transactions, which boosts the online purchases of lifestyle electronics. While the per capita consumption is low, the sheer volume of the new entrants to the consumer economy creates a significant scalable demand, making India a critical long-term strategic market for major brands.

Europe Market Insights

The polaroid market in Europe is defined by a steady demand, high environmental consciousness, and a strong influence of art and design culture on consumer preferences. The growth is driven by discretionary spending in Northern and Western Europe, the sustained popularity of instant photography as a creative hobby, and tourism demand in the Mediterranean countries. A primary regional trend is the heightened focus on sustainability, with consumers and regulators pushing to reduce chemical and plastic waste, aligning with the European Green Deal. This is shaping the product development, as seen with the regulations governing substances in consumer goods. The affordable, digitally connected instant printers are gaining traction in the price-sensitive garments e-commerce penetration remains a key sales channel across the region.

Germany is projected to hold the highest revenue share by 2035 and is driven by its strong economic base, high consumer purchasing power, and deep-rooted appreciation for high-quality technical and design-centric products. The growth is fueled by the popularity of instant photography within the urban creative scenes and as a family leisure activity. A key supportive trend is the country’s advanced e-commerce infrastructure and the high internet penetration, enabling direct consumer sales. Government data from the Destatis report in 2025 indicates that the total online sales of audio and video equipment were 2.8 million euros. This report highlights the robust digital retail channel vital for market growth. Further, Germany's strict adherence to EU environmental regulations drives the demand for brands with strong sustainability credentials.

The UK will remain the top polaroid market in the region due to its influential youth culture and early adoption of trends, and strong retail landscape blending major chains with boutique specialty stores. The demand is heavily driven by the social media trends, event-based usage, and the constant launch of limited edition collaborations customized to the UK market. The supportive data from the UK’s Office for National Statistics indicates a sustained consumer expenditure in the recreational goods categories. For example, the OEC reported that the import of photographic equipment in 2023 reached USD 103 million. This demonstrates the discretionary spending priority given to such hobbyist and leisure products, underpinning the Polaroid market's stability.

Key Polaroid Market Players:

- Fujifilm (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Polaroid (U.S.)

- Eastman Kodak Company (U.S.)

- Canon Inc. (Japan)

- Sony Corporation (Japan)

- Leica Camera AG (Germany)

- Lomographische AG (Austria)

- HP Inc. (U.S.)

- Nikon Corporation (Japan)

- MiNT Camera (Hong Kong)

- Ricoh Company Ltd. (Pentax) (Japan)

- Olympus Corporation (Japan)

- Cherish (China)

- Samsung Electronics (South Korea)

- LG Electronics (South Korea)

- Impossible Project (Germany) - now merged into Polaroid

- Kogan.com (Australia)

- JKCamera (India)

- Pribumi (Malaysia)

- PoGo (China)

- Fujifilm is the dominating player in the polaroid market, and its Instax brand is the undisputed volume leader in the market. The company focuses on a competitive strategy focused on creating a comprehensive ecosystem, driving growth via constant format innovation, stylish and accessible hardware, and a high-margin film consumable. The company’s revenue increased by 7.9% year on year to a record ¥3,195.8 billion in 2024.

- The Polaroid brand leverages its iconic heritage as a key competitive differentiator in the modern Polaroid market. Its landscape is based on competing with the competitors by highlighting analog authenticity, original square format film, and cultural cachet. The strategic initiatives are bifurcated, such as the Polaroid Lab and Polaroid Labs app bridge the analog and the digital worlds.

- Eastman Kodak Company is a key challenger in the polaroid market, and the competitive position relies on brand recognition and value pricing. It differentiates itself by offering affordable, user-friendly instant cameras and film mainly under the Kodak Mii Shot hybrid series that prints from digital devices. In 2024, the total revenue the company has earned in all the segments is USD 882 million.

- Canon participates in the broader polaroid market via its hybrid Zoemini and IVY photo lines. Its competitive advantage stems from its massive reputation in digital imaging, allowing for seamless integration with its cameras and smartphones. The canon’s strategic initiative avoids direct format competition with Fujifilm and polaroid and aims at portable connected printers offering editing flexibility.

- Sony Corporation’s role in the polaroid market is niche and innovation-focused, exemplified by its Xperia Touch projector and portable printers. Sony competes by using its advanced electronics sensor technology to create unique, non-traditional instant sharing experiences. Its strategic initiatives involve exploring the convergence of imaging display and connectivity, moving beyond static prints to interactive projections.

Here is a list of key players operating in the global market:

The polaroid market is very competitive and fragmented. The market is defined by the key players' innovation, such as Fujifilm’s dominance with its Instax ecosystem, competing fiercely with the revitalized Polaroid brand. The competitive landscape sees Fujifilm utilizing a vast format variety and partnerships, while Polaroid focuses on nostalgia and analog authenticity. The key strategic initiatives include extensive brand collaborations with fashion and entertainment, continuous hardware innovation for hybrid digital-analog experiences, and aggressive marketing toward Gen Z and Millennials. Niche players such as Leica and Lomography target high-end and artistic segments, while others compete on affordability and private-label models in emerging markets, sustaining a dynamic, multi-tiered industry. Companies are expanding their footprint via mergers and acquisitions. For example, in June 2024, Polaroid partnered with renowned community photographers to capture the culture of skateboarding in major cities.

Corporate Landscape of the Polaroid Market:

Recent Developments

- In September 2025, Polaroid partnered with Thrasher and launched a limited-edition Polaroid Now camera and film to celebrate skateboarding’s grit, creativity, and community. This collaboration honors a shared belief that human connection defines culture, and moments matter when they are remembered together.

- In March 2025, Polaroid introduced Polaroid Now & Now+ Generation 3 provides sharper shots and better in bright light. The camera is a classic analog instant camera, optimized for sharper pictures in more lighting conditions.

- Report ID: 8284

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polaroid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.