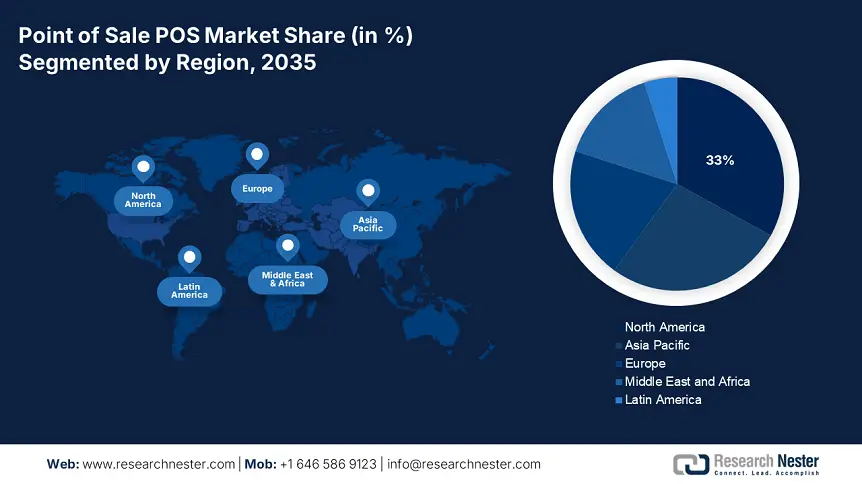

Point of Sale (POS) Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 33% in the global point of sale (POS) market by the end of 2035. The growth is driven by the advanced state of its technological infrastructure, widespread adoption of digital payments, and developed retail ecosystem. According to a 2023 report by the Government of Canada, overall, 7 in 10 businesses in Canada accept cheques as a way to pay, and 6 in 10 businesses accept electronic funds transfer (EFT). Importantly, the Government has supported the growth of broadband connectivity through several initiatives, which are vital to cloud-based POS systems. The federal government also invests considerable amounts of money to support ICT development (Information and Communication Technology). This fosters innovation in payment security and digital transaction technologies.

The U.S. is at the forefront of the POS markets, owing to the presence of advanced technology infrastructure and the adoption of digital payments. The uptake of contactless payment and growth in e-commerce systems are driving the need for advanced POS systems. Initiatives to widen broadband access and expand network reliability have improved the execution of cloud-based POS systems. The U.S. is home to many of the major POS and fintech companies, which continuously develop emerging technologies to meet the changing needs of the payments industry.

The growth of Canada’s POS sector is driven by digital economy programming by the federal government and strong investments in ICT infrastructure. As per a 2023 report by the International Trade Administration, the technology sector in Canada is homegrown and very vibrant. There are over 43,200 firms in the Canadian ICT sector. Most of these firms are from the software and computer services industries. Also, the federal government supports small and medium-sized enterprises (SMEs) in the adoption of modern point-of-sale technology everywhere. The Canadian retail sector is a growing market for the adoption of cloud-based and mobile POS solutions as they streamline the business of service. These measures, amongst many others, are establishing Canada as a strong, growing player in the global POS marketplace.

APAC Market Insights

Asia Pacific is poised to exhibit a notable CAGR in the global point of sale (POS) market throughout the discussed period. The region leads global growth due to the rapid digital transformation of retail, along with expanding retail sectors. For instance, according to Invest India, India has experienced retail growth of 60% in the retail market, and the luxury retail market is valued at USD 30 billion. The region has one of the largest and expanding middle classes who increasingly disposable incomes. This is generating a strong demand for convenient payment solutions from merchants and consumers. Key APAC countries have governments focused on financial inclusion and the development of ICT infrastructure. Furthermore, countries like China and India have systematized large-scale financial inclusion programs, and the increase in digital wallets.

The POS market in India is growing rapidly, fueled by government initiatives as well as initiatives to promote cashless payments. In its 2024 report, the Federal Reserve Bank of Kansas City states that as of right now, Unified Payments Interface (UPI), a mobile-based instant payment system in India, boasts 340 million QR codes at merchant locations and 350 million active users. The Reserve Bank of India (RBI) and the Ministry of Electronics & IT have even further supported digital payment infrastructure with regulation and policy. Local fintech startups have also developed low-cost devices that meet local businesses' needs. The growth of e-commerce and organized retail has also accelerated the demand for complex (advanced POS) systems with omnichannel capabilities.

China is the leader in the POS market in the Asia Pacific due to rapid digital payment uptake from initiatives such as Alipay and WeChat Pay. While rapid urbanization, population increase, and a growing middle class, a variety of sectors such as retail and hospitality are clamouring for payment technologies that are easy to use and accept. The innovation from local device manufacturers and new fintech firms to create POS devices that are accessible, mobile, and cloud-enabled has answered the demand. Regulation in the country has contributed to more merchant trust in each transaction.

Europe Market Insights

The Europe point of sale (POS) market is at the forefront of the global economy, backed by improvements in technology, consumer demand for secure and reliable payment. The retail and hospitality industries, which have made significant investments in next-generation POS solutions, are well-developed in most economies of Europe. As per the De Nederlandsche Bank, in 2024, cash remained the most popular payment method at POS, despite the advent of digital payments in the euro region. In 2024, cash was used for more than half of all POS transactions. This percentage is much lower in the Netherlands, at about one in five. Furthermore, governments across major economies directly advocate for and invest in digital transformation as a strategy for enhancing ICT infrastructure.

France’s POS market is driven by demand from consumers for secure payment systems. Government initiatives support the increased use of digital payments on the grounds of both efficiency and financial inclusion. This has created new opportunities in the retail and hospitality sector in France to invest in next-generation POS solutions. Local and regional trends in France also show that consumers increasingly prefer transactions that are fast and contactless.

Germany's market enjoys the benefits of a tech-savvy retail landscape and a culture around secure data practices. Local manufacturers are most prevalent in the innovation of the hardware and software POS solutions to meet their strict adherence to regulations. The retail and hospitality sectors have also focused on upgrades to install new POS to enhance their customer experience and improve their operations. Innovative industry stakeholders and regulators continue to collaborate to promote best practices related to cybersecurity and build trust in the ecosystem. This engaging ecosystem affords Germany a critical role in Europe's burgeoning POS market.