Plumbing Fixtures Market size was valued at USD 98.8 billion in 2025 and is projected to reach USD 149.3 billion by the end of 2035, rising at a CAGR of 4.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of plumbing fixtures is evaluated at USD 103.4 billion.

The international plumbing fixtures market is poised for steady expansion in the upcoming years since there has been consistent progress in urbanization, growth in residential and commercial constructions. In this context, the U.S. Census Bureau in September 2025 disclosed that in August 2025, privately-owned housing units authorized by building permits in the U.S. were at an annual rate of 1,312,000, which is seasonally adjusted, wherein the single-family authorizations were at 856,000, and units in buildings with five or more units were at 403,000. It also underscored that privately-owned housing starts surpassed 1,307,000 in August, which also includes 890,000 single-family starts and 403,000 multi-unit starts, and housing completions were reported at 1,608,000. Hence, these figures reflect continued robust construction activity across both single-family and multi-unit housing segments, supporting ongoing demand for residential infrastructure services such as plumbing fixtures.

Furthermore, the adoption of water-efficient and eco-friendly plumbing products is yet another trend that is rearranging the growth dynamics of the market. Governments, manufacturers, and consumers are progressively aligning with sustainability practices, thereby boosting the penetration of low-flow faucets, efficient toilets, and fixtures. As of June 2025, data from the U.S. Environmental Protection Agency, WaterSense is a voluntary label for water-efficient products, homes, and programs that use at least 20% less water while maintaining performance. It also partners with manufacturers, retailers, homebuilders, and utilities to promote water conservation and encourage innovation in manufacturing. In addition, the adoption of WaterSense-labeled fixtures and irrigation systems, both consumers and communities can reduce infrastructure strain and improve resilience against water shortages.

Key Plumbing Fixtures Market Insights Summary:

Regional Highlights:

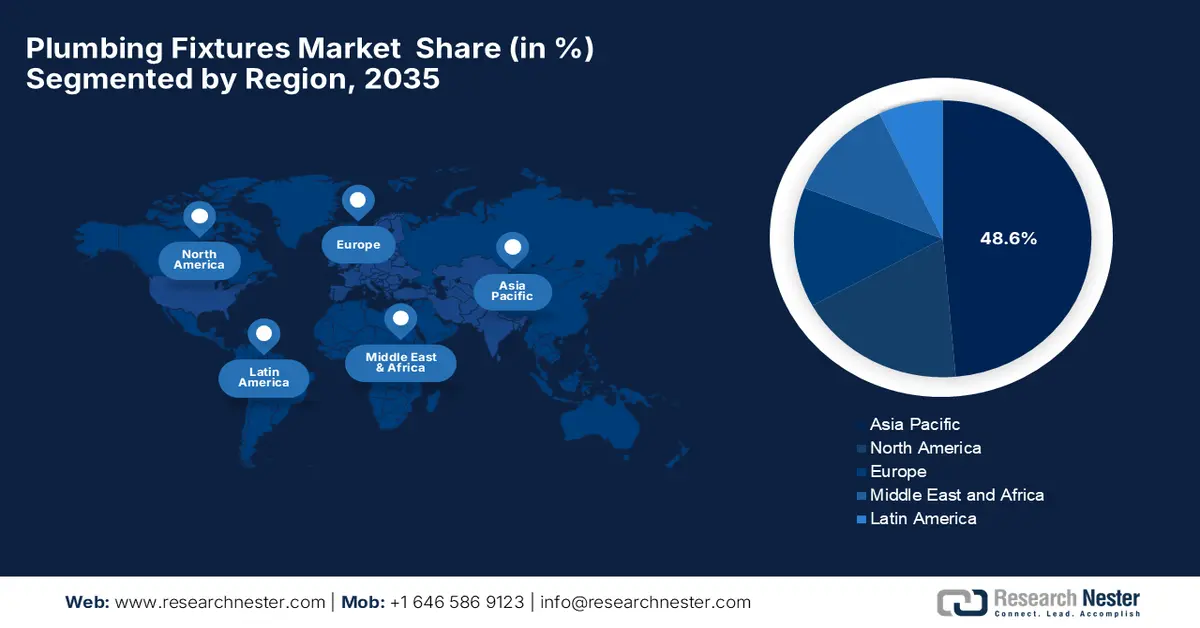

- By 2035, Asia Pacific is anticipated to secure a 48.6% share in the plumbing fixtures market, propelled by accelerating urbanization, infrastructure expansion, and rising disposable incomes.

- North America is expected to witness substantial advancement by 2035, supported by modernization of infrastructure and the rising integration of smart, water-efficient plumbing solutions.

Segment Insights:

- By 2035, the toilets category is projected to capture a 35.5% share in the plumbing fixtures market, bolstered by heightened consumption levels and expanding regulatory incentives.

- The residential segment is expected to grow considerably by 2035, fueled by rapid urbanization, housing expansion, and rising renovation and remodeling activities.

Key Growth Trends:

- Infrastructure upgrades & renovations

- Continuous technological innovation

Major Challenges:

- Fluctuations in raw material costs

- Regulatory compliance

Key Players: Kohler Co. (U.S.), TOTO Ltd. (Japan), LIXIL Corporation (Japan), GROHE AG (Germany), Hansgrohe SE (Germany), Roca Sanitario S.A. (Spain), Geberit AG (Switzerland), Villeroy & Boch AG (Germany), Duravit AG (Germany), Jaquar & Company Pvt. Ltd. (India), American Standard Brands (U.S.), Moen Incorporated (U.S.), Delta Faucet Company (U.S.), RAK Ceramics P.J.S.C. (UAE), Ideal Standard International S.A. (Belgium)

Global Plumbing Fixtures Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size:USD 98.8 billion

- 2026 Market Size: USD 103.4 billion

- Projected Market Size: USD 149.3 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: Vietnam, Indonesia, Mexico, Brazil, United Arab Emirates

Last updated on : 5 December, 2025

Plumbing Fixtures Market - Growth Drivers and Challenges

Growth Drivers

- Infrastructure upgrades & renovations: This is an important growth driver for the plumbing fixtures market. In this regard, the article published by the Ministry of Jal Shakti in December 2022 revealed that the Government of India, through the Jal Jeevan Mission, is aiming to provide tap water to rural households in the country, which has an estimated expenditure of ₹3.60 lakh crore (USD 4 billion), and gained 55.5% coverage as of the published date. Besides, the Swachh Bharat Mission (Gramin) has also successfully delivered 100% rural household toilet access, wherein the SBM 2.0 is focusing on waste management. Furthermore, technological improvements in terms of solar-based water systems, IoT-enabled smart metering, and portable water quality testing devices are being implemented, thus providing an optimistic market opportunity for pioneers across the globe.

- Continuous technological innovation: This is one of the most important growth drivers for the market since the smarter solutions, such as sensor-based faucets and automated water systems, enhance convenience, attracting both commercial and residential buyers. In August 2024, CONTI+ announced that it has launched its new salina series of hybrid kitchen faucets, which features fully electronically programmable functions with a 300° sensor activation range adjustable through a touch control panel. Besides, the faucets operate touch-free or manually, include a soft jet aerator for splash-free flow, and offer easy installation on which are upto worktops up to 55 mm thick. Furthermore, it is integrated with the CONTI+ CNX water management system and Service APP, and these faucets allow real-time monitoring of settings such as sensor sensitivity, run-on time, and sanitary rinses.

- Rising disposable income and premiumization: The plumbing fixtures market is extremely benefiting from developed markets, wherein growing income levels and changing consumer preferences for luxury and designer fixtures support the adoption of high-value products. In March 2025, the article published by India Brand Equity Foundation (IBEF) revealed that India’s rising middle class and growing disposable incomes are extensively driving the adoption of affordable luxury products across different sectors. It also underscored that consumer spending is projected to reach USD 6 trillion by the end of 2030, wherein the aspirational buyers are increasingly seeking premium-quality, aspirational goods at accessible prices. In addition, this trend is reflected in Tier II and III cities, where demand for high-end products, flexible payment options, and tiered luxury offerings is readily expanding, highlighting the influence of income growth and consumer preferences on market premiumization.

Challenges

- Fluctuations in raw material costs: The plumbing fixtures market relies on metals such as brass, copper, stainless steel, and other alloys, as well as plastics and ceramics, for various products. Therefore, the existence of volatility in these raw materials, impacted by various factors such as supply-demand dynamics, tariffs as well and geopolitical tensions, increases the production costs in this field. For example, fluctuations in copper prices directly affect faucets, pipes, and fittings. In addition, manufacturers face challenges in maintaining margins along with competitive pricing, wherein the delays can lead to longer lead times for clients such as contractors, developers, and distributors.

- Regulatory compliance: This, coupled with sustainability requirements, is yet another challenge for the market. Governments and regulatory bodies across all nations are imposing strict regulations on these products regarding water efficiency. Besides compliance with initiatives such as the U.S. EPA WaterSense program or the European Union’s Eco-Design Directive requires manufacturers to redesign products, test performance, and obtain certifications. These standards promote sustainability, whereas they also increase operational costs, which extend the product’s development cycles. Therefore, small and medium-sized enterprises may struggle to meet these regulations due to limited resources, negatively impacting long-term market growth.

Plumbing Fixtures Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 98.8 billion |

|

Forecast Year Market Size (2035) |

USD 149.3 billion |

|

Regional Scope |

|

Plumbing Fixtures Market Segmentation:

Product Segment Analysis

The toilets category is anticipated to lead the entire market, capturing 35.5% of the total share during the forecast duration. The dominance of the subtype is highly subject to their higher consumption and regulatory incentives. Simultaneously, the state-level efficiency mandates coupled with utility rebate programs further support adoption in this field. In May 2025, A Star All Solutions Ltd announced that it had acquired Algeco’s portable toilet business, adding 400 site toilets, which also include disabled access units and urinals, along with a fleet of five service vehicles. Hence, this move enhances the company’s ability to provide reliable sanitation solutions across industries such as construction and event management throughout the UK’s vast geography. Furthermore, the company aims to offer a much faster delivery, a wider range of portable toilets, marking a significant step in its growth.

End use Segment Analysis

Based on end use, the residential segment is expected to grow at a considerable rate in the plumbing fixtures market by the end of 2035. The growth in this segment is highly attributable to the rapid urbanization and housing growth. Similarly, the renovation and remodeling activities are also driving the purchase of fixtures such as faucets, sinks, and showers, which are supported by federal programs promoting water and energy efficiency. In February 2024, TOTO announced that it showcased its latest innovations, which include the NEOREST WX wall-hung smart bidet toilets, Soirée WASHLET+ S7A, and matte black faucets. It also mentioned that these products are leveraging technologies such as ACTILIGHT, CEFIONTECT, EWATER+, and ECOPOWER systems, which offer personalized comfort along with modern designs. Additionally, the firm also introduced IoT-enabled long-range connectivity for smart restroom management, thereby strengthening its leadership in creating eco-friendly bathroom solutions.

Distribution Channel Segment Analysis

By the end of the analyzed timeframe, the online segment is projected to grab a significant portion of the plumbing fixtures market, owing to the presence of B2B buyers, contractors, and small developers who are sourcing plumbing fixtures digitally. Simultaneously, the government guidance on energy-efficient procurement through various energy management programs also encourages purchases of certified products, most of which are available online. The emergence of e-commerce platforms enables manufacturers to reach a broader audience group, thereby tracking compliance with efficiency standards, boosting revenue growth. Moreover, personalized recommendations along with online reviews enhance buyer confidence, further accelerating digital sales. Furthermore, with the integration of smart technologies, manufacturers are also offering connected plumbing solutions that attract the tech-savvy customers.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

End use |

|

|

Distribution Channel |

|

|

Location |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plumbing Fixtures Market - Regional Analysis

APAC Market Insights

Asia Pacific market is expected to lead, capturing the largest revenue share of 48.6% by the end of 2035. The key factors propelling the region’s progress in this field include rapid urbanization, infrastructure expansion, and rising disposable incomes. The presence of key market players and their strategic activities is also prompting a favorable business environment for the plumbing fixtures sector. In December 2024, Prince Pipes and Fittings announced that it had been recognized among the top 2 most desired brands in the pipes category by TRA Research’s Most Desired Brand Report 2024. The company is one of the most prominent manufacturers of polymer piping solutions across CPVC, UPVC, HDPE, and PPR, and it has recently expanded into premium bathware with the Aquel brand. Furthermore, the firm leverages a network of over 1,500 distributors across the nation, and it continues to strengthen its market presence and consumer reach.

China is witnessing significant growth and has captured the dominant position in the regional plumbing fixtures market owing to the large-scale construction projects and smart city initiatives. There has been an increasing awareness of hygiene and water conservation, which is prompting the adoption of technologically advanced fixtures, allowing continued progress in the country’s market. In May 2025, Xiamen Jielin Industrial Co., Ltd. announced that it had completed its factory relocation, which marks a major milestone in its industrial upgrade process. The company notes that this new facility readily enhances logistics efficiency, expands production capacity, and elevates the customer experience through improved infrastructure, along with a modern showroom. Hence, with this move, the company is positioned to support future growth, thereby making it suitable for overall market growth.

India has become the target landscape for most investors in the market, wherein the government initiatives and funding grants play a pivotal role in increasing adoption. The country’s market is also seeing innovation in affordable, durable, and stylish solutions, making it suited to consumer preferences. The government of India in November 2025 reported that the country’s sanitation journey under the Swachh Bharat Mission has been transformative, which significantly enhanced access to toilets, strengthened Open Defecation Free (ODF) sustainability, and advanced waste-management systems. The report also underscored that there has been a massive growth in ODF plus villages as well as urban progress, which is allowing it to move from basic access to long-term cleanliness and environmental safety. Furthermore, the country is emerging as the global model of sanitation reform and community-driven cleanliness.

Key Sanitation Achievements Under Swachh Bharat Mission (As of 2025)

|

Indicator |

Value / Growth |

Notes |

|

ODF Plus Villages |

5,67,708 |

467% growth from Dec 2022 (1 lakh) |

|

ODF Plus Model Villages |

4,85,818 |

Highest tier of ODF sustainability |

|

Rural India declared ODF |

2019 |

Achieved under SBM Phase I |

|

Cities with ODF status |

4,692 (Nov 2025) |

Urban sanitation expansion |

|

WHO health impact |

3,00,000 fewer diarrheal deaths (2019 vs 2014) |

Due to improved sanitation |

|

Household savings |

~₹50,000/year |

Reduced health-related expenses in ODF villages |

|

Women feeling safer |

93% |

Due to household toilet access |

Source: PIB

North America Market Insights

North America in the plumbing fixtures market is poised for notable upliftment, efficiently backed by the modernization of infrastructure and increasing adoption of smart and water-efficient solutions. There has been consistent progress in residential renovation programs, coupled with a heightened demand for premium bathroom designs, which is providing encouraging opportunities for both national and foreign manufacturers to introduce more innovative fixtures. The region also benefits from a strong distribution network and the growing presence of online channels, which are allowing suppliers to reach both commercial and residential buyers more efficiently. In addition, the aspects of supportive government standards promoting water conservation are accelerating the utilization of eco-friendly products. Furthermore, the rising investments in commercial construction are boosting demand for advanced plumbing solutions in the region.

The U.S. market is primarily shaped by a strong focus on energy-efficient plumbing products. Builders and contractors in the country are preferring certified fixtures in new constructions and remodeling projects. In addition, the presence of advanced manufacturing technologies and a competitive landscape promotes the development of more durable products, which are suitable for urban lifestyles. In January 2024, California Faucets announced that it had launched its new bathroom faucet creator, which is an online tool that enables designers and homeowners to easily craft fully customized bathroom faucets by mixing spouts, handles, and more than 25 artisan finishes. Besides, the platform offers zoom-in detail views, simple sharing options to support design planning and collaboration. Furthermore, the firm is offering Hand-finished and made-to-order items in Huntington Beach, wherein each creation has unique features.

Canada in the plumbing fixtures market has gained momentum, positively influenced by stringent building codes and environmental regulations, which are encouraging the adoption of low-flow and water-saving solutions. The industry has also witnessed growing interest in smart home integration, particularly in urban areas. In addition, the domestic manufacturers are undertaking partnerships with distributors and online platforms, thereby expanding their reach to both residential and commercial demand. In March 2025, Wolseley Canada announced that it presented USD 10,000 to Water First, with a primary goal of supporting clean water initiatives and technical training in Indigenous communities. It also stated that this contribution will help advance water quality studies, restoration projects, and long-term resource management through collaborative programs. Hence, this initiative underscores the country’s potential for public health, water sustainability across the country.

Europe Market Insights

Europe represents one of the largest and most influential landscapes of the plumbing fixtures market, highly influenced by the sustainability trends and stringent regulatory frameworks, which are promoting energy-efficient solutions. Consumers in this region are preferring high-quality, eco-friendly, and aesthetically appealing fixtures, encouraging more players to establish their footprint in the country. For instance, in March 2025 AXOR introduced its new Wall Outlets Fine, which features a minimalist and flatter design that complements a wide range of shower styles. It is available both in soft square, round, and square forms with all AXOR FinishPlus surfaces; the new outlets align with the updated AXOR ShowerSelect ID aesthetic. The firm is a part of the Hansgrohe Group, and it continues to deliver high-quality products developed in collaboration with the world’s most renowned designers.

Germany is considered to be the key powerhouse for the regional plumbing fixtures market is shaped by a strong focus on smart plumbing solutions, and water-saving fixtures are in high demand. The presence of pioneering companies and their strategic initiatives is enabling the country to gain immense prominence in this field. In September 2025, the Hansgrohe Group announced that it achieved two awards at the 2025 German Sustainability Projects Awards for its sustainable corporate strategy and the innovative recycling of galvanized plastics. The company at its Offenburg site operates a unique recycling plant that reintegrates chrome-plated ABS plastics into new production, thereby creating a closed-loop system that conserves resources. Furthermore, the company’s ECO 2030 initiative aims to equip all water-carrying products with water- and energy-saving technologies by the end of 2030, reflecting the company’s preference for ecological responsibility and high-quality manufacturing.

The emphasis on modern bathroom designs, water-efficient products, and smart home compatibility is allowing the U.K. to gain a strong position in the plumbing fixtures market. In addition, digital channels and e-commerce platforms facilitate greater accessibility and convenience, enabling manufacturers to connect with both commercial and individual buyers effectively. In September 2025, Geberit UK announced that it is relocating its warehousing operations from Alsager to a modern, sustainable facility at Cabot, which supports the company’s focus on operational efficiency and environmental sustainability, offering improvement. The company clearly states that there will be no reduction in staff, and the relocation will ensure continuity in product availability and customer service across the country. Hence, such instances reflect the country’s focus on modernizing infrastructure and strengthening the efficiency and competitiveness of its market.

Key Plumbing Fixtures Market Players:

- Kohler Co. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TOTO Ltd. (Japan)

- LIXIL Corporation (Japan)

- GROHE AG (Germany)

- Hansgrohe SE (Germany)

- Roca Sanitario S.A. (Spain)

- Geberit AG (Switzerland)

- Villeroy & Boch AG (Germany)

- Duravit AG (Germany)

- Jaquar & Company Pvt. Ltd. (India)

- American Standard Brands (U.S.)

- Moen Incorporated (U.S.)

- Delta Faucet Company (U.S.)

- RAK Ceramics P.J.S.C. (UAE)

- Ideal Standard International S.A. (Belgium)

- Kohler Co. is one of the oldest and most diversified manufacturers in the kitchen and bath segment of plumbing fixtures. The company has grown efficiently as the leading provider of plumbing fixtures, bath products, and other building-related goods; it also has more than 50 manufacturing sites across the globe. Kohler makes heavy investments in product innovation by offering premium and design-driven fixtures across the economy to luxury segments, which helps it maintain relevance across both residential as well as commercial projects.

- TOTO Ltd. is recognized as the world leader in sanitaryware and plumbing fixtures. Its product range spans toilets, washlets (i.e., smart bidet-toilets, sanitary ceramics, bathtubs, modular bathrooms, fittings, and more. The company is maintaining a global footprint with many of its manufacturing facilities across multiple countries and a robust R&D infrastructure. Toto is best known for water-efficient, technology-enabled fixtures that conserve water and energy by delivering high performance.

- Grohe AG, a part of LIXIL Group, is a long-established plumbing fixtures manufacturer based in Europe and is known for faucets, showers, bathroom and kitchen fittings, and full‑bathroom systems. It has built an efficient network of sales and production that spans many nations with a philosophy of quality, design, as well as water technology. Furthermore, the company continues to focus on premium fittings and complete bathroom or kitchen solutions by offering a wide portfolio that helps address customer needs from value to luxury segments.

- Hansgrohe SE is considered to be one of the central Europe-based manufacturers of sanitary fittings, taps, shower systems, and bathroom accessories. The company exports to a significant number of countries, with factories located across Germany, the U.S., France, and China, which highlights the extensive global footprint. The company has its strong focus on high-quality fixtures, thereby emphasizing water efficiency, product durability, and premium aesthetics.

- Jaquar & Company Pvt. Ltd. represents a rising force in the plumbing fixtures sector, especially across Asia, the Middle East, and Africa. The company is a leading manufacturer of faucets, showers, sanitaryware, water‑heaters, concealed cisterns, and even lighting. Jaquar is constantly putting efforts into scaling production and global presence by operating in multiple manufacturing plants and producing tens of millions of fittings annually. In addition, the firm’s strategy of vertical integration, wide distribution, and value‑to‑a premium product range enables competitive positioning in emerging economies.

Below is the list of some prominent players operating in the global market:

The international market is intensely competitive, which hosts multinational firms such as Kohler, TOTO, Roca, and Geberit, are together command a significant portion of demand for sanitary fixtures. These pioneers are readily making investments in sensor faucets, dual flush toilets, and expansion of global manufacturing and supply networks. Simultaneously, the competitive structure incentivizes continuous R&D and footprint expansion, enabling these companies to address the changing customer segments. In August 2022, Wavin, which is a part of Orbia, announced that it had acquired Bow Plumbing Group, a prominent manufacturer of plastic pipes and fittings for residential and commercial construction. This acquisition expands the firm’s capacity and enhances its end-to-end water management solutions, which also extends its support for urban resilience and sustainable development, hence denoting a positive market outlook.

Corporate Landscape of the Plumbing Fixtures Market:

Recent Developments

- In October 2025, Zurn Elkay introduced its new line of ligature-resistant floor, which features a patented tapered radial baffle, cut-resistant edges, and vandal-proof screws to enhance safety without compromising durabilityprovide a versatile, easy-to-install solution for safer environments.

- In June 2025, Everflow Supplies, a distributor of plumbing, electrical, fire protection, and industrial products, announced a growth investment from affiliates of Paceline Equity Partners where with the investment aiming to support Everflow’s expansion in the wholesale distribution channel across the U.S., enhancing its product offerings and operational capabilities.

- Report ID: 5202

- Published Date: Dec 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plumbing Fixtures Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.