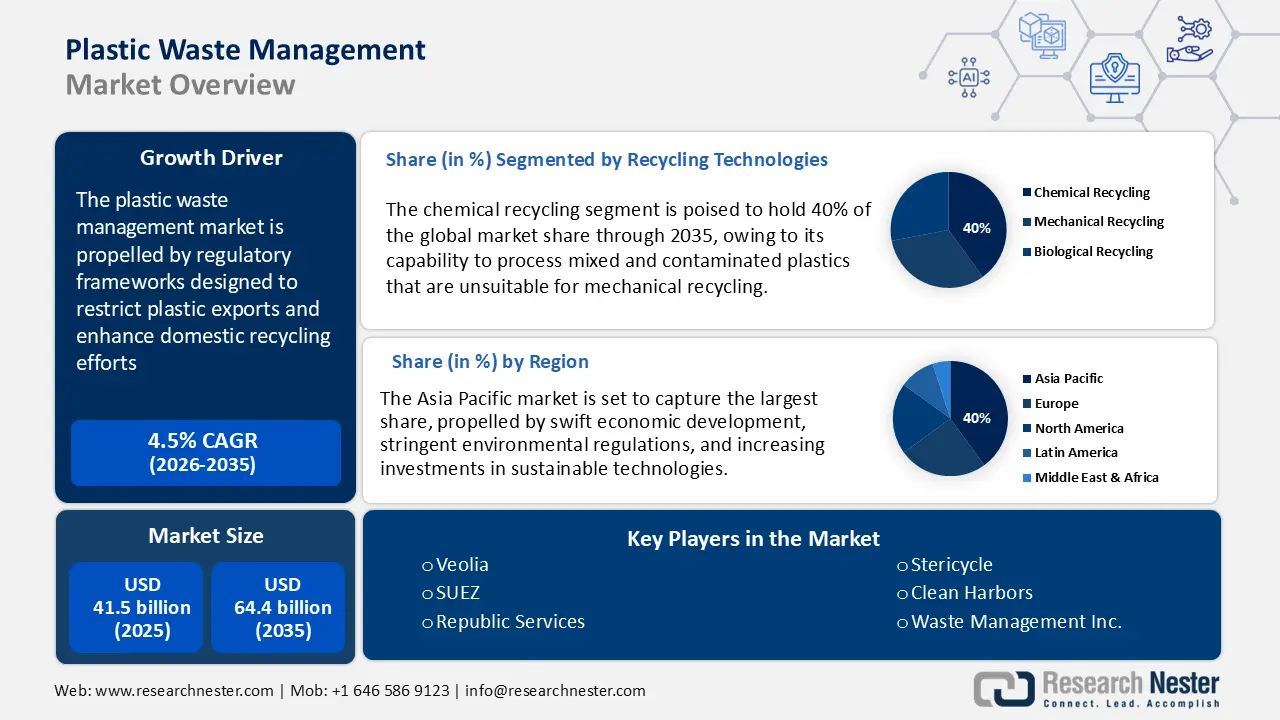

Plastic Waste Management Market Outlook:

Plastic Waste Management Market size was valued at USD 41.5 billion in 2025 and is projected to reach USD 64.4 billion by the end of 2035, rising at a CAGR of 4.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of plastic waste management is anticipated at USD 43.3 billion.

The growth of the market is mainly propelled by regulatory frameworks designed to restrict plastic exports and enhance domestic recycling efforts. The amendment to the Basel Convention 2019 mandates prior informed consent for the export of contaminated plastic waste among 189 countries, thereby limiting the transfer of waste from developed to developing nations. Concurrently, China’s initiative known as Operation National Sword has drastically decreased global imports of plastic waste since 2018. These rules promote investing more in local sorting and recycling plants.

Supply chains for raw materials are increasingly focusing on sourcing recycled feedstock domestically. According to the UN Trade and Development (UNCTAD), in 2023, the global trade in plastics crossed USD 1.1 trillion, totaling 323 million metric tons. The same source also states that more than 78% of all plastic manufactured is commercialized internationally. Also, 75% of all plastics ever produced end up as waste. Furthermore, the European Commission reveals that in 2024, the EU exported 35.7 million tonnes of recyclable raw materials while importing 46.7 million tonnes, which reflects a growing capacity for internal recycling. Research and development investments are supported by government grants and industry levies associated with Extended Producer Responsibility (EPR) schemes under the oversight of Basel. Although consumer-level Consumer Price Index (CPI) data is scarce, service costs continue to be pressured by inflation in upstream feedstock and energy.