Phytogenic Feed Additives Market Outlook:

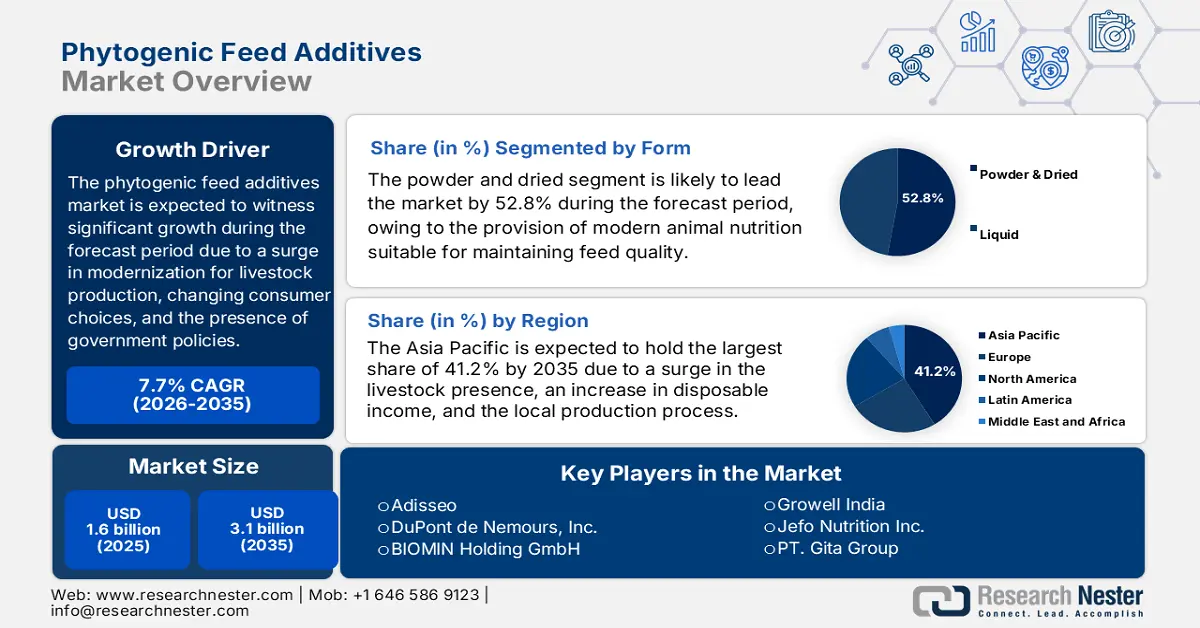

Phytogenic Feed Additives Market size was over USD 1.6 billion in 2025 and is estimated to reach USD 3.1 billion by the end of 2035, expanding at a CAGR of 7.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of phytogenic feed additives is estimated at USD 1.7 billion.

The international phytogenic feed additives market is currently experiencing an effective transformation, which evolves from a niche natural alternative option into a science-backed and mainstream segment, which is further crucial for modernized and sustainable livestock production. This transformation is highly propelled by administrative reforms, modified customer preferences, and the sector’s relentless pursuit of efficacy. According to an article published by the USDA Government in September 2024, the global production of livestock, aquaculture commodities, and crops surged from USD 1.1 trillion gross valuation to USD 4.2 trillion. This particular growth has been readily gained by unveiling the newest resources into the production procedure, which has intensified the input utilization, including labor and fertilizers, thus driving the market’s exposure.

Furthermore, the shift from simplified blends to standardized and scientifically-validated products, innovative delivery technologies, increased focus on synergistic formulations, precision nutrition, and digitalized integration are other factors that are also bolstering the market globally. As per an article published by NLM in April 2022, essential oils from cloves, citronella, celery, parsley, oregano, thyme, and tarragon seeds are successfully able to inhibit 50% of the 2,2-diphenylpicryl-hydrazyl (DPPH) radical elimination activity. In addition, these oils are complex mixtures that comprise more than 300 different compounds, and are characterized by high concentrations, ranging between 20% to 70%, in comparison to other components. Therefore, with the presence of these oils, there is a huge growth opportunity for the overall market across different nations.

Key Phytogenic Feed Additives Market Insights Summary:

Regional Insights:

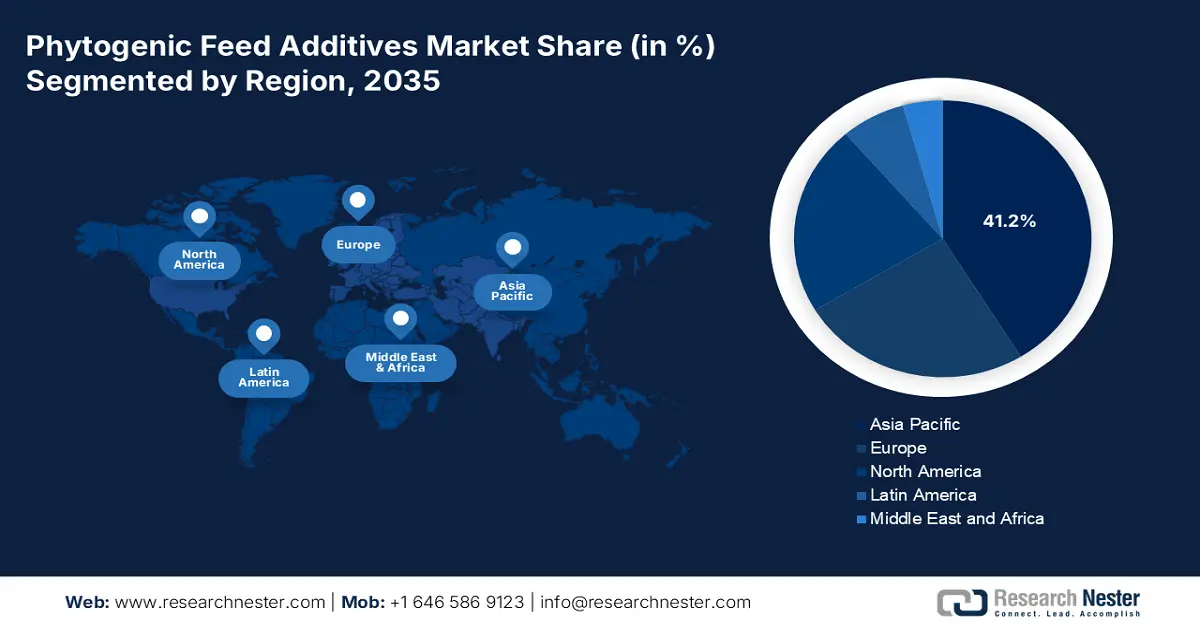

- By 2035, the Asia Pacific region in the phytogenic feed additives market is forecasted to secure a 41.2% share, supported by expanding livestock production, rising disposable incomes, and regulatory bans on antibiotic growth promoters.

- North America is poised to become the fastest-growing region by 2035, propelled by heightened consumer awareness, stringent regulatory norms, and technologically advanced livestock production systems.

Segment Insights:

- By 2035, the powder and dried sub-segment in the phytogenic feed additives market is expected to capture a 52.8% share, reinforced by its capacity to enhance feed stability, boost productivity, and strengthen overall animal health.

- The direct sales segment is projected to hold the second-largest share by 2035, influenced by its specialized consultative model that integrates high-value technical expertise into feed formulation strategies.

Key Growth Trends:

- Rise in customer demand for residue-free and natural products

- Intensification of livestock production

Major Challenges:

- Increased entry barriers and regulatory fragmentation

- Price sensitivity and cost competitiveness

Key Players: Delacon Biotechnik GmbH (Austria), Dostofarm GmbH (Germany), Phytobiotics Futterzusatzstoffe GmbH (Germany), Silvateam S.p.a. (Italy), Igusol S.L. (Spain), Pancosma SA (Switzerland), Nutrex NV (Belgium), Kemin Industries, Inc. (U.S.), Adisseo (France), DuPont de Nemours, Inc. (U.S.), BIOMIN Holding GmbH (Austria), Nor-Feed SAS (France), Natural Remedies Private Limited (India), Ayurvet Limited (India), Growell India (India), Jefo Nutrition Inc. (Canada), PT. Gita Group (Indonesia), Layn Natural Ingredients Corp. (China), Synthite Industries Ltd. (India).

Global Phytogenic Feed Additives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3.1 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, Brazil

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Turkey

Last updated on : 26 November, 2025

Phytogenic Feed Additives Market - Growth Drivers and Challenges

Growth Drivers

- Rise in customer demand for residue-free and natural products: The aspect of intensifying customer awareness regarding food production is increasing the need for dairy, eggs, and meat produced without synthetic chemicals addition. This clean-label strategy has pressured producers to implement natural feed ingredients, which is positively impacting the market globally. According to an article published by NLM in April 2025, the global production of cereal straw accounted for 2,000 million tons, and countries in Southeast Asia produce almost 200 million tons of straw, which is made from rice every year. Besides, more than 90% of the animal production in the region, with populations in China and Mongolia, is frequently fed with 30% to 40% of the rice straw. Meanwhile, this aspect readily uplifts animal feed preparations, which ensures a continuous supply chain across different nations.

2023 Animal Feed Preparations Export and Import

|

Countries/Components |

Export (USD) |

Import (USD) |

|

Netherlands |

2.6 billion |

962 million |

|

U.S. |

1.8 billion |

912 million |

|

Germany |

1.7 billion |

1.0 billion |

|

Global Trade Valuation |

20.5 billion |

|

|

Global Trade Share |

0.09 |

|

|

Product Complexity |

-7.6% |

|

Source:OEC

- Intensification of livestock production: As the phytogenic feed additives market operates and consolidates at a massive scale, the economic impact of sub-optimal performance and health magnifies. The market provides a proven means to optimize feed conversion ratio (FCR), lower mortality, and enhance the total productivity in dense production environments. As per an article published by NLM in May 2023, livestock production is currently witnessing pressure, and farms are needed to reduce greenhouse gas emissions since enteric methane emissions from ruminant livestock account for an estimated 10% to 12%. Besides, the international human population is projected to exceed 9 billion by the end of 2050, based on which meat consumption is poised to increase by over 70%, which is readily driving the market growth.

- Environmental and sustainability benefits: The market contributes to sustainability objectives by optimizing feed efficacy, thus diminishing the holistic environmental footprint of feed production. Moreover, a few additives, such as tannins for ruminants, have readily displayed efficiency in lowering methane emissions and aligning with worldwide climatic targets. As stated in an article published by the Journal of Dairy Science in January 2025, climate action plans constitute the objective to lower greenhouse gas emissions through nationally determined contributions (NDC), which have demonstrated that almost 36% of nations focused on grassland and livestock mitigation, thus readily maintaining sustainability.

Challenges:

- Increased entry barriers and regulatory fragmentation: The international regulatory landscape for the phytogenic feed additives market is a fragmented and complicated patchwork of approval processes with a lack of a universal standard. Besides, a product approved for utilization in Europe under the strict EFSA guidelines might not be automatically accepted in the U.S. by the FDA. Instead, each jurisdiction comprises its very own data requirements, approval timelines, and safety assessment protocols, which can exceed several years. This administrative maze has created huge costs and complexity for manufacturers demanding international market accessibility. Meanwhile, organizations need to invest generously in regulatory affairs and navigate distinct application processes for each country, thus bolstering the market’s development.

- Price sensitivity and cost competitiveness: The market needs to compete on price with a comprehensive range of other feed additives, such as established and frequently cheap synthetic alternatives, such as organic acids. Besides, the production of standardized and high-quality phytogenic feed additives involves a sustainable form of raw materials, quality control, and innovative extraction technologies, which are extremely expensive. These prices, in turn, are readily passed down to farmers operating on thin margins are increasingly price-sensitive. Besides, in different developing regions, the primary purchase driver is usually the lowest upfront expense in comparison to long-lasting valuation and return on investment (ROI). Therefore, convincing a farmer to invest in a premium additive is considered a sales risk, which is causing a market hindrance.

Phytogenic Feed Additives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.1 billion |

|

Regional Scope |

|

Phytogenic Feed Additives Market Segmentation:

Form Segment Analysis

The powder and dried sub-segment, which is part of the form segment, is anticipated to account for the largest share of 52.8% in the market by the end of 2035. The sub-segment’s upliftment is highly attributed to its importance in modernized animal nutrition, suitable for ensuring feed quality and stability, along with improving productivity and growth, and enhancing animal health. According to an article published by NLM in September 2024, the Malva sylvestris leaf powder (MSLP) inclusion in the diet at a 2% level successfully decreased the coliform count in comparison to control-based birds. In addition, the MSLP supplementation, ranging between 1.5% to 2% led to optimized production performance in the case of broiler chicken, thereby readily uplifting the overall segment globally.

Distribution Channel Segment Analysis

The direct sales segment, which is part of the distribution channel, is projected to hold the second-largest share in the phytogenic feed additives market during the predicted period. The segment’s growth is highly driven by the increasingly consultative and highly technical nature of the product. Besides, unlike standard commodities, premium phytogenic feed additives demand in-depth technological expertise for significant integration into feed formulations. Moreover, this segment, which is comprised of specialist nutritionists and technological sales representatives, offers significant value-added services. They operate collaboratively with client research and development departments, with the objective to provide continuous on-farm support to improve dosage and display a clear ROI through metrics, such as improved FCR, along with customizing synergistic blends and conducting trials for health risks and specific species.

Livestock Segment Analysis

Based on the livestock, the poultry segment in the market is expected to cater to the third-largest share by the end of the forecast duration. The segment’s development is highly propelled by its usefulness in boosting productivity and growth, optimizing feed efficiency, and uplifting overall health and immune function. As per an article published by the ICAR in 2024, Vanaraja, which is a dual-purpose chicken variety, comprises 1.5 kg to 1.8 kg body weight within 12 weeks of age. Additionally, the adult body weight is almost between 2.2 kg to 2.5 kg in males, and between 1.8 kg to 2.0 kg in the case of females. Besides, the yearly egg production is nearly 100 to 110 eggs, particularly in free range conditions, and this variety is increasingly accepted in overall agro-climatic zones, especially in India. Therefore, with this increased availability, there is a huge growth opportunity for the segment in the market.

Our in-depth analysis of the phytogenic feed additives market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Distribution Channel |

|

|

Livestock |

|

|

Source |

|

|

Product Type |

|

|

Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phytogenic Feed Additives Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the phytogenic feed additives market is anticipated to garner the highest share of 41.2% by the end of 2035. The market’s upliftment in the region is highly attributed to the intensifying and huge livestock production, a rise in disposable incomes, and governmental bans on antibiotic growth promoters. Moreover, the market’s localized production, with organizations creating blends that are suitable for regional feed ingredients, such as cassava and palm kernel cake. According to an article published by the Global Forest Coalition in 2022, based on the Stop Financing Factory Farm Campaign, the top 5 development banks in the region have generously invested nearly USD 4.5 million into Big Meat organizations across countries, such as Singapore, China, Vietnam, and others, thus creating an optimistic outlook for the overall market’s growth and expansion.

China market is gaining increased traction, owing to the presence of a national policy that has strongly targeted the reduction of antibiotics in animal production. In addition, the government’s National Action Plan for the Reduction of Veterinary Antimicrobial Drugs has developed a strong regulatory push, which has further compelled integrators and feed mills to achieve effective alternatives. As per an article published by NLM in December 2024, the country readily produced 55.4 million tons of poke meat every year as of 2022. Moreover, the pork production further reached 55.5 million tons in 2023, and the consumption in the country surpassed production by 57.5 million tons. This eventually led to an increase in 55.9 million tons of production and 57.7 million tons in consumption in 2024, thereby denoting an optimistic outlook for the market’s growth.

Annual Pork Production Analysis in China (2018-2029)

|

Year |

Production (million tons) |

Consumption (million tons) |

|

2018 |

54.0 |

55.2 |

|

2019 |

42.5 |

44.8 |

|

2020 |

36.3 |

41.5 |

|

2021 |

47.5 |

51.7 |

|

2022 |

55.4 |

57.4 |

|

2023 |

55.5 |

57.5 |

|

2024 |

55.9 |

57.7 |

|

2029 |

59.7 |

60.7 |

Source: NLM

India in the phytogenic feed additives market is also growing significantly due to the transformative modernization of dairy and poultry industries, a rise in domestic meat consumption, and standard governmental policies. Additionally, strategies, such as the Pradhan Mantri Matsya Sampada Yojana (PMMSY) and the National Mission on Sustainable Agriculture for fisheries, have explicitly promoted sustainable productivity and intensification enhancement, which has developed a suitable environment for innovative feed additives. According to the 2024 DAHD Government data report, the livestock industry significantly contributes 30.2% of agricultural GVA, along with 5.5% of the national economy. Besides, the 303.7 million bovines, comprising yak, mithun, buffalo, and cattle, readily signify the dairy production’s backbone, which denotes a huge growth opportunity for the overall market in the country.

North America Market Insights

North America in the phytogenic feed additives market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the region is highly attributed to an increase in consumer awareness, strict regulatory standards, and innovative livestock production systems. In addition, the demand for natural solutions to optimize animal welfare and productivity, along with sustained producer and customer shift from antibiotic growth promoters, are also responsible for boosting the market in the region. According to an article published by NLM in May 2023, meat consumption is predicted to be higher in the region by 9.0%, based on which meat retailers and producers are increasingly implementing sustainability pledges, wherein the market is playing a vital role in diminishing the environmental footprint of livestock operations.

The U.S. in the phytogenic feed additives market is gaining increased traction, owing to the impact of governmental expenditure programs on the chemical sector, sustainability and advanced manufacturing, the aspect of clarification and correction, and industrial partnership. As per a data report published by the Semiconductor Industry Association in October 2024, domestic organizations in the semiconductor ecosystem have declared over 90 newest manufacturing projects since the CHIPS commencement. This resulted in almost USD 450 billion in announced investments across 28 states in the country. In addition, the May 2024 SIA-Boston Consulting Group report forecasted that the country will boost its share in advanced chip manufacturing to 28.0% of international capacity by the end of 2032, and also achieve 28% of overall global capital spending by the same year. Meanwhile, the continuous research and development spending for the chemical sector in the country is also bolstering the market’s growth.

Yearly R&D Expenditure and Sales in the U.S. Chemical Industry (2014-2024)

|

Years |

R&D Expenditure (USD Million) |

Sales % |

|

2014 |

11.8 |

2.0 |

|

2015 |

12.2 |

2.3 |

|

2016 |

10.8 |

2.1 |

|

2017 |

10.9 |

2.1 |

|

2018 |

11.3 |

2.1 |

|

2019 |

10.7 |

2.1 |

|

2020 |

10.2 |

2.2 |

|

2021 |

12.8 |

2.2 |

|

2022 |

14.0 |

2.1 |

|

2023 |

13.3 |

2.0 |

|

2024 |

14.8 |

2.2 |

Source: America Chemistry

Canada in the phytogenic feed additives market is also developing due to the presence of carbon pricing and the federal Green Agriculture policy, export market imperatives for sustainable protein, provincial support for value-addition in agri-innovation, and a sudden shift in consumer and retail preferences domestically. As per an article published by Citizens’ Climate Lobby Canada Organization in August 2024, the federal government in the country is deliberately spending USD 37.1 million on 99 grain drying projects, which is considered a part of its very own USD 496.7 million Agricultural Clean Technology program. Besides, the Minister of Agriculture and Agri-Food declared a generous investment of USD 185 million for the upcoming 10 years for the latest Agricultural Climate Solutions (ACS) program. Therefore, with an increase in governmental investment, there is a huge growth opportunity for the market in the country.

Europe Market Insights

Europe market is projected to grow steadily by the end of the stipulated period. The market’s growth in the region is highly driven by the existence of a strict regulatory framework, an overall ban on antibiotic growth promoters, and strong customer demand for sustainable animal husbandry. The market in the region is also characterized by a robust preference for standardized and scientifically validated products with proven action modes. As per an article published by the Europe Commission in February 2024, the regional Partnership on Animal Health and Welfare and the Partnership on Agroecology launch resulted in the EU budget covering almost 50% of expenses, which is further estimated to reach an overall €600 million. This successfully caters to the region’s concrete solutions for overcoming sustainability challenges in the agricultural industry, which is positively impacting the market.

The phytogenic feed additives market in Germany is gaining increased exposure, owing to the presence of a highly and largely intensive livestock industry, particularly for pork meat production, along with the strictest national legislation on antibiotic reduction. Besides, the government’s German Antimicrobial Resistance Strategy (DART 2030) has readily mandated ongoing reduction targets, especially for veterinary antibiotic utilization, which has created a non-negotiable market pull for effective alternatives. As stated in the October 2024 USDA Government data report, the country is considered a net importer of the majority of food products, with an upsurge in grocery retail sales by approximately USD 318.3 billion as of 2022. Besides, according to the April 2025 AHDB Organization article, the country emerged as the second-largest pig meat exporter, with a surge in export volumes by 2.4%, displaying 45,000 tones upliftment.

Poland is also growing due to the intensification and modernization of its huge poultry and pork industries, which are regarded notable export engines. Besides, the country’s integrators readily compete for a suitable market share within the region, based on which they are significantly compelled to cater to the antibiotic-reduction as well as sustainability standards. As per an article published by Procedia Computer Science in 2025, there has been an increase in the artificial intelligence (AI) adoption by Polish food sector, denoting a 2.1% in 2021, which surged to 3.6% in 2024, further demonstrating a 1.5% change. In addition, the robotic process automation (RPA) is most common AI in the food industry, denoting a 1.9% utilization in the country. Therefore, with the presence of such digital technologies, the market is poised to gain importance in the country.

Key Phytogenic Feed Additives Market Players:

- Cargill, Incorporated (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Delacon Biotechnik GmbH (Austria)

- Dostofarm GmbH (Germany)

- Phytobiotics Futterzusatzstoffe GmbH (Germany)

- Silvateam S.p.a. (Italy)

- Igusol S.L. (Spain)

- Pancosma SA (Switzerland)

- Nutrex NV (Belgium)

- Kemin Industries, Inc. (U.S.)

- Adisseo (France)

- DuPont de Nemours, Inc. (U.S.)

- BIOMIN Holding GmbH (Austria)

- Nor-Feed SAS (France)

- Natural Remedies Private Limited (India)

- Ayurvet Limited (India)

- Growell India (India)

- Jefo Nutrition Inc. (Canada)

- PT. Gita Group (Indonesia)

- Layn Natural Ingredients Corp. (China)

- Synthite Industries Ltd. (India)

- Cargill, Incorporated is regarded as the global agribusiness leader, which has leveraged its extensive supply chain and immense scale to make phytogenic additives accessible to the majority of integrators internationally. The organization’s contribution originates in uplifting the mainstream adoption through effective investment in research and development of standardized and scientifically-backed products for continuous performance. Besides, as stated in its 2024 annual report, the organization generated USD 160 billion in yearly revenue, with its operations across 70 nations and selling products to 125 economies.

- Delacon Biotechnik GmbH is comprehensively identified as one of the science and pioneer leaders in phytogenics, building its reputation for decades in clinical trials and research. The firm’s notable contribution has set the industrial benchmark for scientific validation and efficiency by providing a wide-ranging portfolio of synergistic blends.

- Dostofarm GmbH has successfully established a robust position by specializing in single-herb and high-quality phytogenic mixtures, deriving from controlled cultivation. Its usual contribution is increased focus on product traceability and purity, along with tailored solutions, especially for equine and ruminant industries.

- Phytobiotics Futterzusatzstoffe GmbH is considered a notable innovator, well-known for its innovative product development, including the patented Salkil line for specific phytogenic and acidification solutions. The organization’s contribution centers on developing targeted and effective products that can cater to specific risks, including feed hygiene and gut health.

- Silvateam S.p.a. has readily occupied an outstanding position as a vertically integrated producer, efficiently controlling the overall supply chain system from sustainable quebracho tree forests, chestnut, and finished tannin-based extracts. The company’s major contribution is offering a high-volume and dependable supply of natural tannins, which are essential ingredients for protein metabolism and gut health in animal feed.

Here is a list of key players operating in the global market:

The international market is highly fragmented and features a combination of specialized pioneers as well as diversified agrobusiness giants. Notable players, such as Phytobiotics in Germany and Delacon in Austria, significantly compete with international entities, including Adisseo in France and Cargill in the U.S. This has further leveraged expanded distribution networks, which are suitable for uplifting the market globally. Key approaches, including aggressive extension into high-growth Asia-based markets through localized subsidiaries and strong scientific validation through university partnerships, are also driving the market. Besides, in July 2024, NUQO declared its affiliate in India, with the intention of expanding its services that cater to creating the latest bioprocessing and production technologies, thus making it suitable for boosting the market globally.

Corporate Landscape of the Phytogenic Feed Additives Market:

Recent Developments

- In June 2025, dsm-firmenich notified the significant completion of the sales of its stake in the Feed Enzymes Alliance to Novonesis for €1.5 billion. The company, in return, gained an estimated €1.4 billion in net cash, which is suitable to develop renewable ingredients and ensure sustainability.

- In September 2024, Louis Dreyfus Company launched its newest specialty feed production facility in Tianjin, which is a part of the organization’s tactical plans to readily diversify revenue through value-added products.

- In March 2024, EW Nutrition introduced its latest product, Axxess XY, which is an intrinsically thermostable xylanase that can easily break down both insoluble and soluble fiber fraction from feed ingredients, including grain, wheat, corn, and oilseed cakes.

- Report ID: 973

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phytogenic Feed Additives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.