Phosphodiesterase (PDE) Inhibitors Market Outlook:

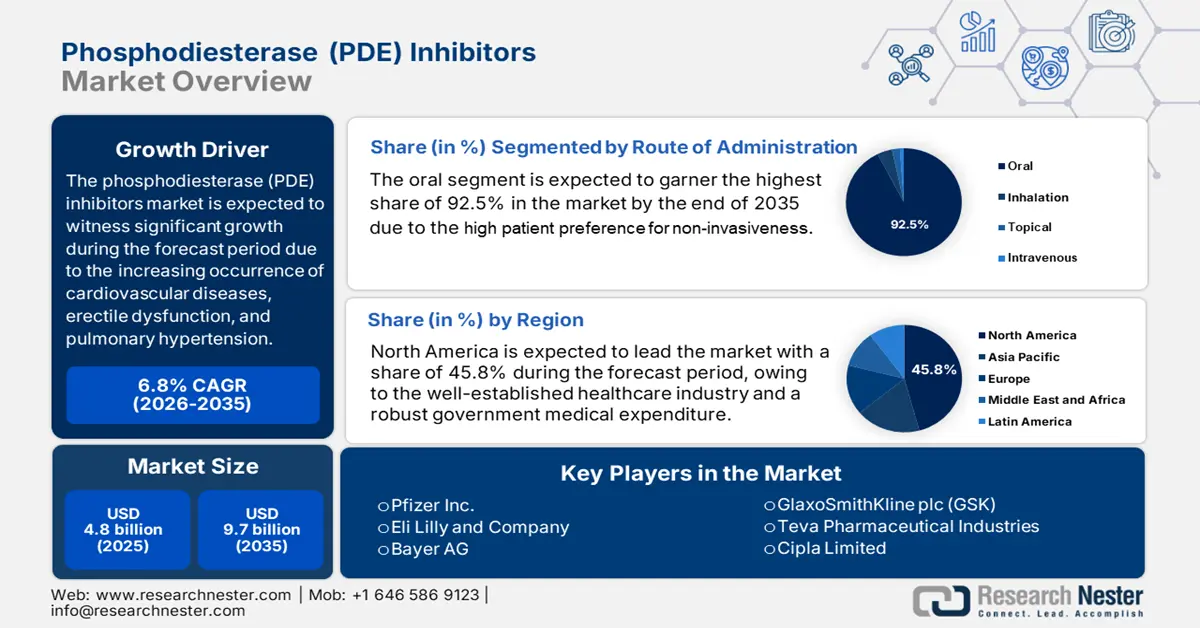

Phosphodiesterase (PDE) Inhibitors Market size was valued at USD 4.8 billion in 2025 and is projected to reach USD 9.7 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of phosphodiesterase (PDE) inhibitors is estimated at USD 5.1 billion.

The global phosphodiesterase (PDE) inhibitors market is gaining immense exposure, fueled by its expanded consumer base. The increasing occurrence of cardiovascular diseases, erectile dysfunction, and pulmonary hypertension is driving business in this sector. In this regard WHO in July 2023 reported that cardiovascular diseases led to nearly 19.8 million deaths in a year, which is approximately 32% of all the deaths in the world. This rising disease incidence necessitates the requirement for PDE-5 inhibitors like sildenafil and tadalafil, appreciably accelerating market expansion.

Furthermore, the business in the sector is significantly influenced by the ongoing trade activities across all nations and firms that are enhancing their research efforts to bring innovations in this field. In this regard, it is reported that the U.S. and Europe are dominating the imports segment of finished products; similarly, China and India are leading with the API exports. Besides, CEIC data in 2021 states that the imports of medicines reached a substantial value of USD 92,622,441.159, reflecting the expanded necessity. Public-private collaborations under EMA are further accelerating clinical trials for novel PDE-4 inhibitors for COPD and psoriasis, thus denoting a positive market outlook.

Key Phosphodiesterase (PDE) Inhibitors Market Insights Summary:

Regional Insights:

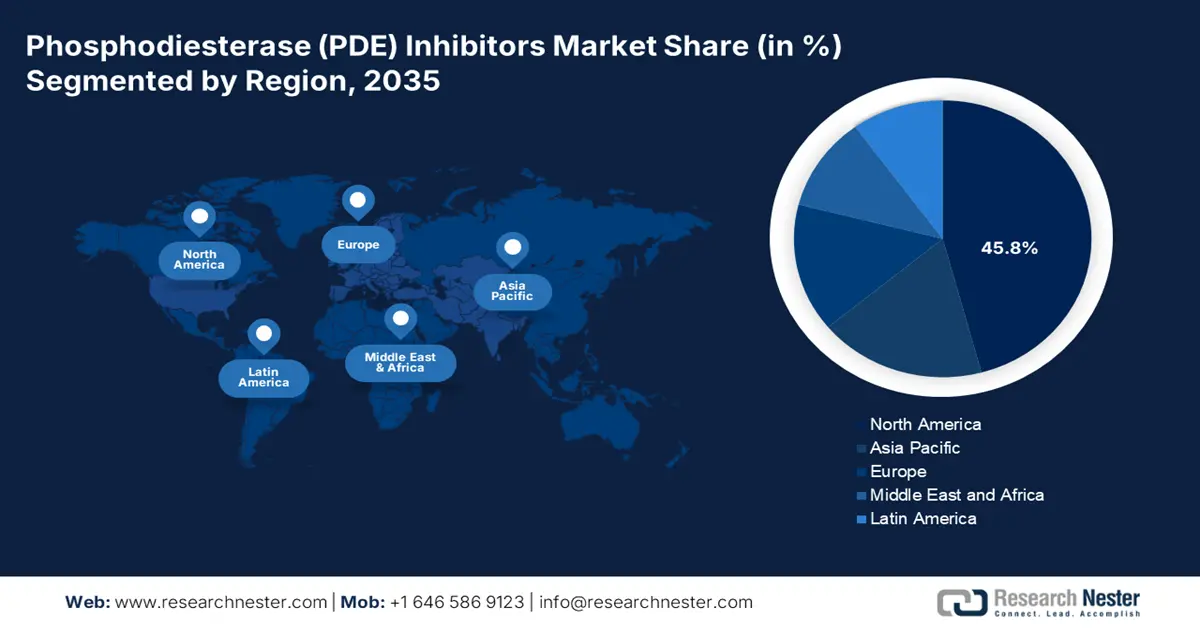

- North America phosphodiesterase (PDE) inhibitors market is expected to hold a 45.8% share by 2035, owing to a well-established healthcare industry and robust government medical expenditure.

- Asia Pacific is projected to capture a 20.2% share by 2035, impelled by advancements in healthcare infrastructure and expanding access to therapeutic measures.

Segment Insights:

- The oral sub-segment under the route of administration is projected to account for 92.5% share by 2035, owing to high patient preference for non-invasiveness, convenience, and self-administration.

- The PDE1 Inhibitors segment is expected to maintain a leading share by 2035, propelled by the widespread clinical use of PDE5 inhibitors for erectile dysfunction.

Key Growth Trends:

- Government and personal expenditure

- Rising patient pool and disease prevalence

Major Challenges:

- Stringent regulatory requirements

Key Players: Novartis AG,F. Hoffmann-La Roche Ltd.,Bristol Myers Squibb (BMS),Pfizer Inc.,Johnson & Johnson (Janssen),AbbVie Inc.,Gilead Sciences (Kite Pharma),Amgen Inc.,Merck & Co. (MSD),Sanofi,GlaxoSmithKline (GSK),Bayer AG,AstraZeneca,Eli Lilly and Company,Takeda Pharmaceutical (ex-Japan ops),Takeda Pharmaceutical,Astellas Pharma,Daiichi Sankyo,Eisai Co., Ltd.,Otsuka Holdings

Global Phosphodiesterase (PDE) Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.8 billion

- 2026 Market Size: USD 5.1 billion

- Projected Market Size: USD 9.7 billion by 2035

- Growth Forecasts: 6.8% % CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Brazil, Malaysia

Last updated on : 10 September, 2025

Phosphodiesterase (PDE) Inhibitors Market - Growth Drivers and Challenges

Growth Drivers

- Government and personal expenditure: Medicare Part D data highlights the spending on PDE inhibitors such as sildenafil and tadalafil. In 2022 alone, Medicare expended more than USD 2 billion on sildenafil (Revatio and generics), and tadalafil also features in the top expenditures for PAH treatment, stated by the NLM article in October 2024. Out-of-pocket expenses are variable, with Medicare beneficiaries spending hundreds of dollars a year on PDE therapy. Increased government sponsorship emphasizes proactive use in therapy, but potently high aggregate expenditure also generates pressure for cost-effectiveness, stimulating demand for generics and biosimilars. This recognizes how federal reimbursement strategies and patient co-payments influence phosphodiesterase (PDE) inhibitors market dynamics.

- Rising patient pool and disease prevalence: The incidence of diseases treated with PDE inhibitors erectile dysfunction (ED), benign prostatic hyperplasia (BPH), and pulmonary hypertension, is gradually increasing. In January 2021, the Rare Disease Advisor report indicated that the cases of PAH in the U.S are 15 to 50 per million, whereas the incidence of erectile dysfunction is higher than that. With an ever-growing pool of patients, PDE inhibitors have a stable demand across various therapeutic categories. Rising lifestyle-based risk factors and aging populations further increase the market opportunity.

- Manufacturer’s innovations and strategies: Key players such as Pfizer, Eli Lilly, and Bayer continue to expand PDE inhibitors via lifecycle management, patient support programs, and geographic expansion. Pfizer expanded sildenafil's reach via collaborations with generics partners, making it more affordable. Many firms are also investing in digital solutions, ensuring consistent dosing and improved results. In 2025, alliances between international healthcare providers and pharmaceutical companies have driven market share growth in emerging markets, highlighting the value that strategic partnerships bring to this sector.

Challenges

- Stringent regulatory requirements: One of the primary bottlenecks for the phosphodiesterase (PDE) inhibitors market is the strict regulations imposed by the governing bodies. This results in delayed market penetration of the product, putting an additional burden on the manufacturer. In this regard, in Japan, Eli Lilly’s PDE5 inhibitor witnessed a delayed approval due to strict clinical trial requirements. NIH states that developing firms find it challenging with extensive documentation, resulting in higher compliance costs, thereby hindering manufacturers’ enthusiasm for product innovation.

Phosphodiesterase (PDE) Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 4.8 billion |

|

Forecast Year Market Size (2035) |

USD 9.7 billion |

|

Regional Scope |

|

Phosphodiesterase (PDE) Inhibitors Market Segmentation:

Route of Administration Segment Analysis

The route of administration is dominated by the oral sub-segment. The segment is expected to hold a share value of 92.5% by the end of 2035. The segment is driven by high patient preference for non-invasiveness, convenience, and the self-administering attribute. Oral PDE5 inhibitors, including sildenafil and tadalafil, are given orally between 25 mg to 100 mg and 5 mg to 20 mg, as per the frontiers article of April 2023. The U.S. FDA and other regulatory agencies have widely approved oral forms, highlighting their safety and efficacy profiles.

Drug Type Segment Analysis

Under the type segment, PDE1 Inhibitors are leading the segment and are expected to maintain a high share value by 2035. PDE5 inhibitors, including sildenafil and tadalafil, are still the first-line medication for erectile dysfunction. The drugs induce vasodilation by inhibiting the PDE5 enzyme and extending the activity of nitric oxide in penile tissue. According to the NLM report for April 2025, UK educational courses led to 86% of patients being advised about appropriate sildenafil use and 70% receiving advice on lifestyle changes regarding ED risk. This demonstrates continued healthcare emphasis on maximizing PDE5 inhibitor use and mitigating associated health risks.

Distribution Channel Segment Analysis

Retail pharmacies dominate the distribution channel segment as they represent the most accessible point of treatment for patients in need of chronic or as-needed drugs such as PDE5 inhibitors. The movement towards outpatient care and convenience in acquiring prescriptions, including through online telehealth services that collaborate with pharmacy networks, drives this segment. Government health expenditure reports often highlight the leading position of retail pharmacies in prescribing outpatient prescription medication.

Our in-depth analysis of the phosphodiesterase (PDE) inhibitors market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Distribution Channel |

|

|

Route of Administration |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phosphodiesterase (PDE) Inhibitors Market - Regional Analysis

North America Market Insights

The North America phosphodiesterase (PDE) inhibitors market is projected to register the highest share of 45.8% during the forecast period. The region benefits from a well-established healthcare industry and a robust government medical expenditure. The U.S. dominates the North America market owing to the high prevalence of cardiovascular diseases. According to the NLM report published in November 2022, 35 PDE inhibitors approved and authorized for marketing by the FDA or other regulatory authorities. These drugs mainly target cardiovascular diseases, respiratory diseases like COPD, inflammatory conditions, and erectile dysfunction.

The phosphodiesterase (PDE) inhibitors market in Canada is backed by strong government health care funding and increasing demand among the aging male population. As per the Canadian Urological Association, erectile dysfunction (ED) rises significantly. Increasing prevalence is fueling demand for PDE-5 inhibitors throughout the country. On the other hand, the CMA report in 2025 states that the total healthcare expenditure reached CAD 344 billion in 2023 and 12.1% of GDP is reflecting sustained federal and provincial investment in healthcare services, which, indirectly, facilitates access to ED treatments.

Asia Pacific Market Insights

Asia Pacific phosphodiesterase (PDE) inhibitors market is experiencing the fastest growth with a share of 20.2%, fueled by the advancements in the healthcare sector. Countries such as India, China, Japan, South Korea, and Malaysia are at the forefront of this growth, with rising healthcare investments and expanding access to therapeutic measures. Besides the ongoing developments in PDE inhibitors with enhanced efficacy, reduced side effects are remarkably contributing to market progression. Furthermore, the widespread availability of OTC solutions is improving patient access.

China is a key leader in the phosphodiesterase (PDE) inhibitors market with tremendous government support and an increased patient population. It is reported that the prevalence of erectile dysfunction (ED) among men aged 40 to 70 is estimated to be around 26%, based on the Frontiers article in January 2025. Numerous factors, such as urbanization, dietary changes, and increased stress levels, contribute to the disease development, further fostering a positive business environment.

Europe Market Insights

Europe is the second-largest phosphodiesterase (PDE) inhibitors market and will share a significant proportion by 2035. In 2023, the FDA, EMA, or MHRA approved 70 new medicines, including PDE Inhibitors, according to the British Journal of Pharmacology in January 2024. Most were first approved by the FDA, creating gaps between approvals because of the different regulatory processes and company strategies. One of the major trends is the adoption of generic drugs, which increases access and puts pressure on price, with innovation concentrated on next-generation, subtype-specific inhibitors.

Germany is the largest phosphodiesterase (PDE) inhibitors market in Europe. The Federal Joint Committee (G-BA) is responsible for reimbursement, and expenditure is high because of early market access to innovation. Although a dedicated budget for a PDE inhibitor is not segregated, the total market for these products is forecast to be in the hundreds of millions of euros, buoyed by Germany's robust statutory health insurance system that universally covers approved therapy, with high patient availability and stimulating phosphodiesterase (PDE) inhibitors market growth.

Key Phosphodiesterase (PDE) Inhibitors Market Players:

- Pfizer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly

- Novartis

- Bayer

- AstraZeneca

- Merck (MSD)

- Sanofi

- Roche / Genentech

- Teva Pharmaceutical

- Sun Pharmaceutical

- Cipla

- Dr. Reddy’s

- Lupin

- Hanmi Pharmaceutical

- CSL Limited

- Takeda

- Daiichi Sankyo

- Astellas Pharma

- Mitsubishi Tanabe Pharma

- Ono Pharmaceutical

Companies involved in the phosphodiesterase (PDE) inhibitors market have established themselves as key leaders in the industry, with an intensifying competition between existing and emerging firms. Companies such as Pfizer, Eli Lilly, and Bayer are leading the market, utilizing exclusive drugs such as Viagra, Cialis, and Levitra. Moreover, these firms focus on expanded drug usage, improving their formulations, and enhancing patient outcomes with strategic collaborations. Besides, firms in developing nations focus on affordable solutions by investing in research and development to bring innovations in this sector, and by maintaining a competitive edge in the market.

Below is the list of some prominent players operating in the global phosphodiesterase (PDE) inhibitors market:

Recent Developments

- In May 2025, Verona Pharma launched a new phosphodiesterase inhibitor called Ohtuvayre, which is a first-in-class selective dual inhibitor of PDE3 and PDE4. Ohtuvayre is mainly used to treat chronic obstructive pulmonary disease in patients.

- In February 2025, Arcutis Biotherapeutics has announced the FDA approval of supplemental New Drug Application (sNDA) for ZORYVE (roflumilast) cream 0.05%, which is a next gen phosphodiesterase-4 (PDE4) inhibitor to treat children from age 2 to 5.

- Report ID: 2634

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phosphodiesterase (PDE) Inhibitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.