Phenolic Boards Market Outlook:

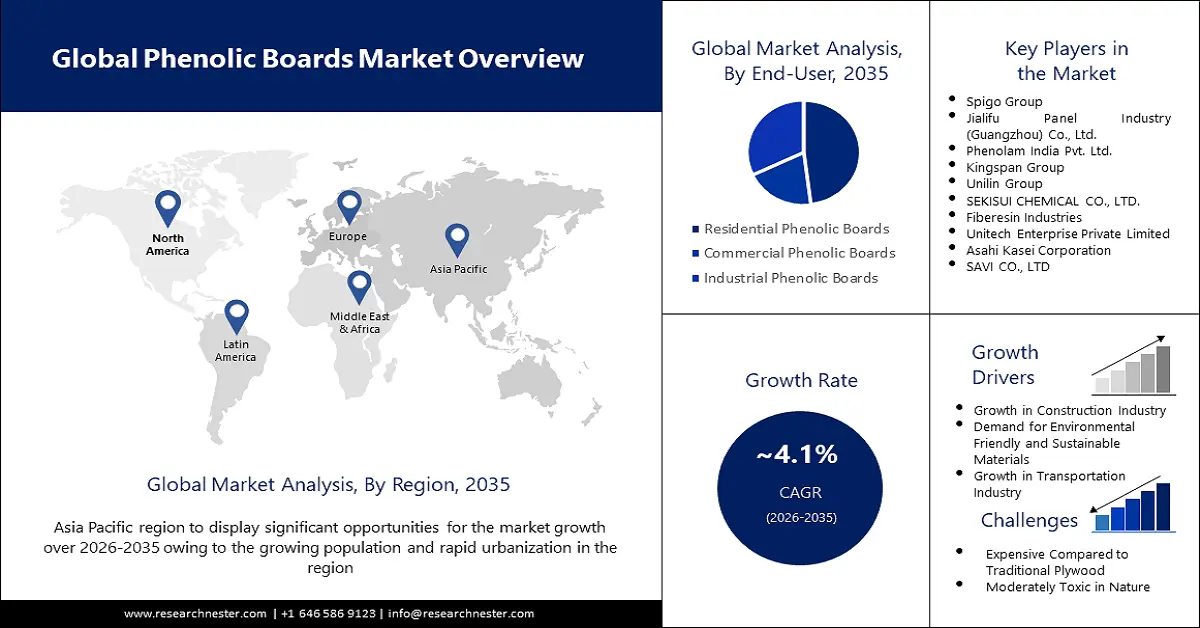

Phenolic Boards Market size was over USD 3.92 billion in 2025 and is projected to reach USD 5.86 billion by 2035, witnessing around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of phenolic boards is evaluated at USD 4.06 billion.

The growth of the market can be attributed to its usage in the construction industry for both interiors as well as external applications. It is estimated that around 14 million homes in the United States are at risk of flooding. Phenolic boards are infused with a special coating that enables them to withstand moisture, heat, and chemical attack, which is predicted to create a greater demand for them in the construction industry. The increasing spending capacity of people with rising disposable income is estimated to drive the construction sector. The construction sector uses huge amounts of phenolic boars for floors, tables, cupboards, and furniture.

Phenolic boards are made by splicing wooden sheets together using Phenol-Formaldehyde. They are also called phenolic panels. These boards are used in the manufacture of furniture, countertops, and cabinetry as they are available in different sizes, colors, and dimensional stability. The booming furniture industry is expected to widen the global phenolic boards market size. For instance, the global export of furniture amounted to USD 190 billion, while the import of furniture was valued at USD 175 billion in 2021. The furniture industry is growing widely with the rising economic standards of people. Also, the increasing number of cafes, restaurants, motels, hotels and educational institutions increases the applications of phenolic boards. The phenolic boards are water-resistant, and heat-resistant which increases their use in the furniture sector. People prefer products that are durable and long-lasting over temporary and cheap ones.

Key Phenolic Boards Market Insights Summary:

Regional Highlights:

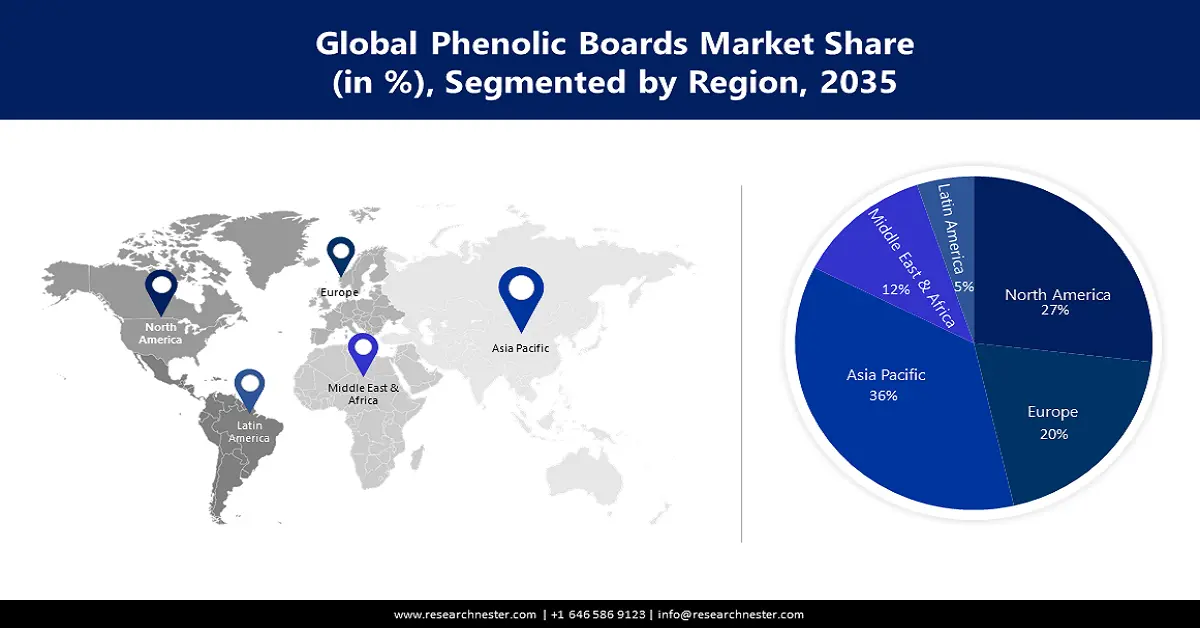

- Asia Pacific phenolic boards market will secure around 36% share by 2035, driven by population explosion and increased infrastructure investment.

Segment Insights:

- The residential segment in the phenolic boards market is expected to achieve a 48% share by 2035, attributed to the steady increase in residential construction to accommodate a growing population.

- The insulation panels segment in the phenolic boards market is projected to capture a 35% share by 2035, driven by the rising use of phenolic boards for thermal and acoustic insulation in construction.

Key Growth Trends:

- Growth in the Construction Industry with Rising Disposable Income of People

- Demand for Environment-friendly and Sustainable Materials with Rising Concern of People

Major Challenges:

- Growth in the Construction Industry with Rising Disposable Income of People

- Demand for Environment-friendly and Sustainable Materials with Rising Concern of People

Key Players: Spigo Group, Jialifu Panel Industry (Guangzhou) Co., Ltd., Phenolam India Pvt. Ltd., Kingspan Group, Unilin Group, SEKISUI CHEMICAL CO., LTD., Fiberesin Industries, Unitech Enterprise Private Limited, Asahi Kasei Corporation, SAVI CO., LTD.

Global Phenolic Boards Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.92 billion

- 2026 Market Size: USD 4.06 billion

- Projected Market Size: USD 5.86 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 9 September, 2025

Phenolic Boards Market Growth Drivers and Challenges:

Growth Drivers

- Growth in the Construction Industry with Rising Disposable Income of People - The ever-evolving construction industry is exploring novel ways of utilizing phenolic boards in various functions as well as aesthetic applications such as partition walls, false ceilings, cladding, and insulated units. It was estimated that the market size of the U.S. construction sector valued at around USD 1.6 trillion in 2021.

- Demand for Environment-friendly and Sustainable Materials with Rising Concern of People - There has been a gradual awakening of environmental consciousness among the elite and the educated population which is looking for eco-friendly materials that can be recycled or repurposed to reduce the global impact on the environment. Various surveys conducted across the globe in 2021 collectively revealed that 40 to 55% of adults are more mindful of their impact on the environment. Moreover, over 80% of people believe that major companies should integrate environmental concerns into their products.

- Growing Scientific Research and Development Activities Increasing the Need for Buildings - As per the data from the World Bank, in 2020, 2.63% of the global GDP was spent on research activities.

- Growth in Transportation Industry Across the World – Phenolic boards are used for flooring in trucks and buses. In 2021, more than 11 million light trucks, and some 0.45 million heavy-duty trucks were sold in the United States.

Challenges

-

Moderately Toxic in Nature - The use of petroleum and natural gas during the production process of phenolic boards. During this time the phenolic boards produce chlorofluorocarbons that are released into the atmosphere. Additionally, the increasing use of phenolic boards rises the use of natural gas and petroleum reserves making them less available. All these factors are considered to be the reason for the limitation of market growth.

- Need for Skilled Labor in Handling

- Expensive When Compared to Traditional Plywood

Phenolic Boards Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 3.92 billion |

|

Forecast Year Market Size (2035) |

USD 5.86 billion |

|

Regional Scope |

|

Phenolic Boards Market Segmentation:

Application Segment Analysis

The global phenolic boards market is segmented and analyzed for demand and supply by application into building & construction, interior applications, insulation panels, furniture, and others. Out of these, the insulation panels segment is estimated to gain the largest market share of 35% over the projected time frame. The rising use of insulation panels and industrial insulation around the world is estimated to rise the growth of the market. The phenolic boards are used for insulation material to reduce the loss of heat. As per the estimations, the uninsulated house loses about 30% from ceilings, over 20% from walls, and over 18% via floor and windows of the house. The insulation property of phenolic boards helps to prevent the loss of energy and regulate the internal temperature. A lot of energy is saved by using phenolic boards for insulation. These are also used as sound insulators as they are made of high-density fiber with phenolic resin. All these together give the characteristics of thermal, mechanical, and acoustic strength to the phenolic boards. The insulation phenolic boards are used in the construction of floors, the building of walls, ceilings, and small chambers.

End-user Segment Analysis

The global phenolic boards market is also segmented and analyzed for demand and supply by end-use into residential phenolic boards, commercial phenolic boards, and industrial phenolic boards. Of these sub-segments, the residential phenolic boards are projected to acquire a larger market share of 48% during the forecast period owing to the steady increase in the construction of buildings to house a growing population. In the United States, the construction industry contributed to around 4% of the national GDP in 2021. The construction of commercial, residential, and entertainment buildings is rising across the world. The increasing disposable income of people makes them affordable for everyone. The increase in the number of hospitals, educational institutions, and daycare centers for the well-being of people is also estimated to rise the market growth. The increasing number of government projects to provide permanent houses for poor and lower middle-class people is increasing the construction sector. The furniture, tables, floor, doors, and windows are made of phenolic boards to prevent damage from corrosion in the future. The phenolic boards are lightweight, easy to handle, and free from termite damage. Termites are insects that live on eating wood and plant materials.

Our in-depth analysis of the global market includes the following segments:

|

By Thickness |

|

|

By Application |

|

|

By End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phenolic Boards Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to account for largest revenue share of 36% by 2035. The growth of the market can be attributed majorly to the population explosion as well as rapid urbanization. According to the World Bank data, 35% of the population of South Asia, and 61% of the total population of east Asia and the Pacific lived in urban settlements. There has been an exponential rise in government spending on infrastructure in some developing countries which is also predicted to drive the growth of the phenolic boards market in the region. The increase in the cases of COVID-19 during the pandemic has increased the growth of hospital construction. The phenolic boards are also used in the construction of many laboratories such as chemical, physical, and biochemical laboratories across the region. The increasing need for clinical trials and new drug discoveries led to a growing number of institutions and research centers. Also, the need for quarantine hubs and health education programs to raise awareness regarding the spread and prevention of the disease is estimated to hike the growth of the market as per the market analysis.

North American Market Insights

Moreover, the North American region is anticipated to share a significant market value in the coming years. The increasing research and development activities across the region are estimated to rise the need for infrastructure facilities. According to the estimations, about 1800 new infrastructure development projects are estimated to rise in the great U.S. as of 2022 reports. The increase in the infrastructure needs thereby increasing the use of phenolic boards. The presence of prominent key players also drives the market growth during the forecast period.

Phenolic Boards Market Players:

- Spigo Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jialifu Panel Industry (Guangzhou) Co., Ltd.

- Phenolam India Pvt. Ltd.

- Kingspan Group

- Unilin Group

- SEKISUI CHEMICAL CO., LTD.

- Fiberesin Industries

- Unitech Enterprise Private Limited

- Asahi Kasei Corporation

- SAVI CO., LTD

Recent Developments

-

Kingspan Group announced a collaboration with AquaTrace to provide clients with efficient and smart-roofing technology that is resistant to heat and moisture and continually monitors leaks

-

Unilin Group along with Pelican Creations Home have initiated a new patent called the Comfort Core Technology which incorporates soft comfort cushioning between robust layers to enhance its user-friendliness

- Report ID: 4221

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phenolic Boards Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.