Pharyngitis Treatment Market Outlook:

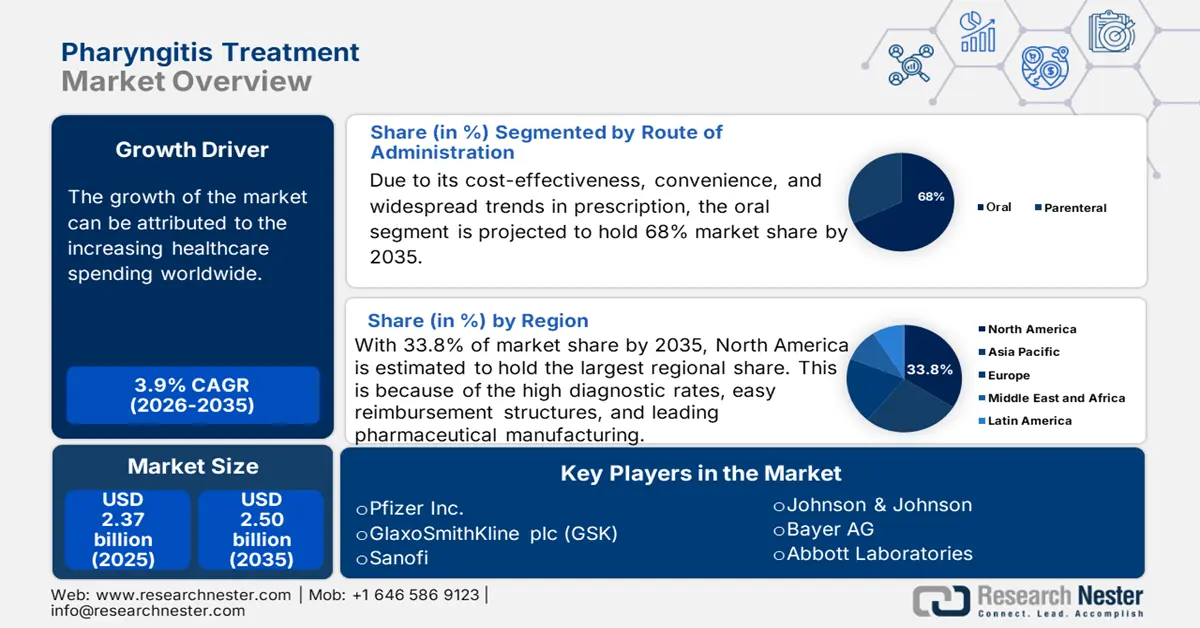

Pharyngitis Treatment Market size was valued at approximately USD 2.37 billion in 2025 and is projected to reach around USD 2.50 billion by the end of 2035, rising at a CAGR of 3.9% during the forecast period 2026-2035. In 2026, the industry size of the pharyngitis treatment is estimated USD 2.46 billion.

The research and development in the pharyngitis treatment market are undergoing rapid changes and surpassing regular antibiotic-based therapies. There is a need for precise diagnostics with the burgeoning burden of the Group A Streptococcus (GAS) infections. Various innovative strategies are gaining traction that aim to prevent the colonization of the GAS. The molecular PCR tests are being upgraded for better results, and the AI-enabled tools are reshaping the management of patients. These types of research and development activities highlight the transition toward preventive strategies.

Additionally, the supply chain of the market is formed around a multi-tiered network and ensures the development of the various novel therapies. The suppliers of the raw materials render active APIs, such as derivatives of penicillin. Contract Research Organizations also play a crucial role in clinical development and implementing various regulatory compliance. Upstream supply chain delays, especially from China following recent regulatory audits, have affected downstream production cycles, driving producer prices higher. The supply chain for the pharyngitis treatment is also evolving from the conventional antibiotic-centric flow to a digitally integrated patient-centric delivery model.

Key Pharyngitis Treatment Market Insights Summary:

Regional Highlights:

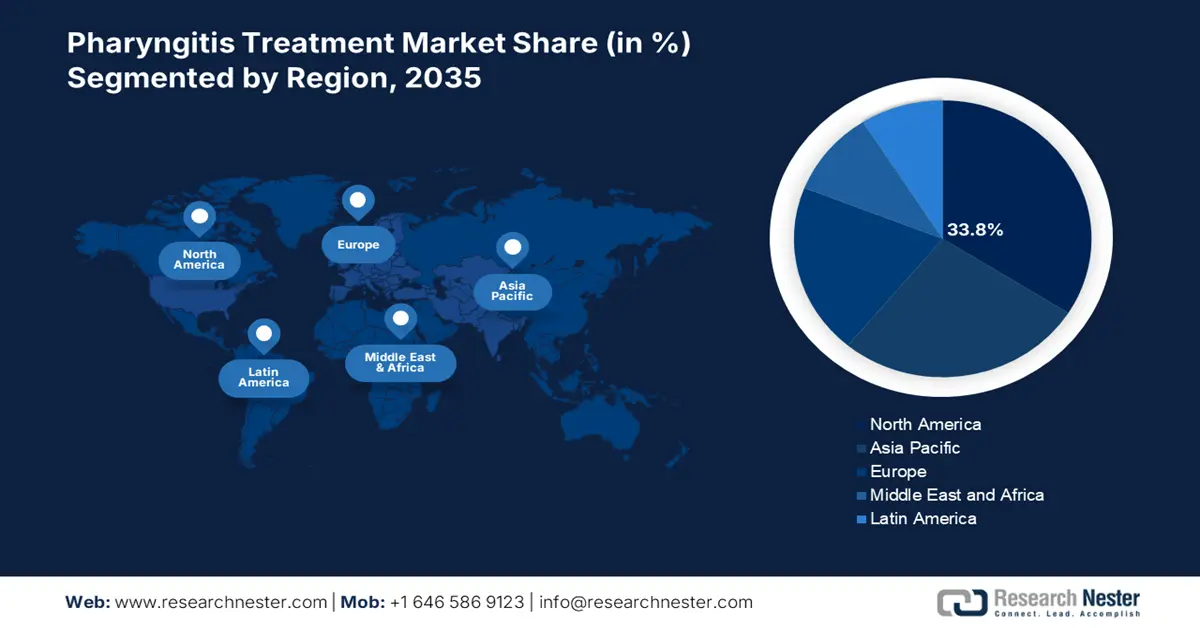

- North America is projected to secure a 33.8% share of the pharyngitis treatment market by 2035, underpinned by expanding reimbursement frameworks and strengthened antimicrobial resistance initiatives.

- Asia Pacific is forecast to reach a 24.7% share by 2035, bolstered by rising infection incidence and wider access to healthcare infrastructure.

Segment Insights:

- The oral segment is projected to capture a 68% share by 2035 in the pharyngitis treatment market, supported by rising telemedicine-driven prescription volumes.

- Bacterial pharyngitis is anticipated to account for a 60% share by 2035, fueled by high treatment demand for Group A Streptococcus infection requiring antibiotics.

Key Growth Trends:

- Rising healthcare spending

- Rising cases of pharyngitis and associated infections

Major Challenges:

- Pediatric formulations reimbursement gaps

Key Players: Pfizer Inc., GlaxoSmithKline plc (GSK), Sanofi, Johnson & Johnson, Bayer AG, Abbott Laboratories, Novartis AG, Takeda Pharmaceutical Co. Ltd., Reckitt Benckiser Group plc, Cipla Ltd., Sun Pharmaceutical Industries, Daewoong Pharmaceutical Co., Biocon Ltd., Dr. Reddy’s Laboratories, Astellas Pharma Inc., CSL Limited, Hovid Berhad, Lupin Limited, Mylan (now Viatris Inc.), Glenmark Pharmaceuticals.

Global Pharyngitis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.37 billion

- 2026 Market Size: USD 2.46 billion

- Projected Market Size: USD 2.50 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Indonesia, South Korea, Mexico, Turkey

Last updated on : 9 September, 2025

Pharyngitis Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising healthcare spending: The rising healthcare spending is a prominent driver fueling the growth of the market. The rising spending is enhancing access to modern therapies while also propelling clinical research. The surge in allocation of resources for primary care is also confirming the broader reach. According to data published by the World Economic Forum in 2021, the global spending on health amounted to USD 9.8 trillion, accounting for more than 10.2% of the worldwide GDP. Additionally, budget realignments under CMS's Outpatient Prospective Payment System (OPPS) and Medicaid's extended formulary support have increased prescription volume and enhanced market penetration, particularly in public health institutions.

- Rising cases of pharyngitis and associated infections: The cases of the Group A Streptococcus are increasing as a global burden with rising pollution and allergen exposure. According to data published by the National Institutes of Health in 2022, almost 288.5 million cases of Strep A sore throat occur among children aged 5-14 years. The rising number of patients with infections is ensuring that there will be a consistent necessity for antibiotics and various other supportive drug therapies. These factors are augmenting the market growth during the forecast period.

- Advancements in diagnostic technologies: There has been an increased shift towards the precise and rapid treatments that amalgamate technologies. Researchers and medical practitioners are emphasizing explicitly distinguishing between bacterial and viral types of pharyngitis, which is imperative to eradicate the misuse of antibiotics. According to the American Medical Association in February 2025, nearly 2/3rd of medical practitioners are using AI in healthcare services. The surge in utilization of state-of-the-art diagnostic solutions is advancing the diagnostic processes and further acting as a catalyst for the targeted treatments. The application of AI is speeding up the adoption of precision medicine and opening a plenty of opportunities for the market players.

Challenges

- Pediatric formulations reimbursement gaps: The pharyngitis treatment’s pediatric version often seems to be lagging in full reimbursement in several countries. Further, manufacturers are not interested in investing in customized pediatric drug development without any assurance of reimbursement support, slowing down the innovation process and limiting pediatric access to essential care.

Pharyngitis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 2.37 billion |

|

Forecast Year Market Size (2035) |

USD 2.50 billion |

|

Regional Scope |

|

Pharyngitis Treatment Market Segmentation:

Route of Administration Segment Analysis

The oral segment is projected to lead the market, registering 68% of the revenue share by 2035. This rise in growth is mainly attributed to its cost-effectiveness, convenience, and widespread trends in prescription. Oral antibiotics for bacterial pharyngitis, such as amoxicillin and azithromycin, are in the first-line treatments, while NSAIDs like ibuprofen are preferred for viral cases. The parenteral segment is limited in hospital settings to severe infections. Further, the growth in telemedicine is boosting demand for oral drugs, with plenty of prescriptions issued digitally.

Disease Type Segment Analysis

Bacterial pharyngitis drives the pharyngitis treatment market and is expected to have a share of 60% by 2035. This rise is mainly due to the treatment demand, primarily due to Group A Streptococcus infection requiring antibiotics. the rapid diagnostic tests are minimizing the use of antibiotics. By increasing treatment precision and stewardship initiatives, emerging point-of-care diagnostics may help further segment the market. These factors are augmenting the market growth exponentially during the assessed time period and offer lucrative opportunities for the market players.

Drug Class Segment Analysis

The antibiotics segment is set to garner 37% of the share by 2035, owing to the high prevalence of bacterial pharyngitis. Also, beta-lactams are manufactured on a wide level, mainly in the fast-growing markets such as China and India. Also, the rising adoption of rapid antigen tests aids in more precise segregation between viral and bacterial cases of pharyngitis. In the advanced countries with state-of-the-art healthcare infrastructure, antibiotics benefit from the robust coverage of the insurance and favorable reimbursement policies. These factors are further strengthening the position of the segment as a pioneering treatment modality.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Route of Administration |

|

|

Drug Class |

|

|

Disease Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pharyngitis Treatment Market - Regional Analysis

North America Market Insights

North America dominates the pharyngitis treatment market and is expected to hold a market share of 33.8% by 2035. The market growth in this region is especially driven by high diagnostic rates, easy reimbursement structures, and leading pharmaceutical manufacturing. The key drivers are expanded Medicaid/Medicare reimbursements, government-led antimicrobial resistance (AMR) initiatives, and rising investments in pediatric care. In the U.S., NIH and CDC both emphasize early treatment adoption and preventive awareness. The region shows a rising trend in e-prescriptions, telehealth integration, and pharmacy automation, further strengthening treatment access.

The pharyngitis treatment market in the U.S. is experiencing consistent growth, mainly supported by the insurance coverage expansions and government-backed public health programs. According to data published by the Centers for Disease Control and Prevention in August 2025, group A strep pharyngitis is considered to be the most common in children between the ages of 5 and 15 years. Also, in recent years, the spending from Medicare and Medicaid has increased significantly and further fueling the market growth during the coming period.

Asia Pacific Market Insights

The APAC market is expected to grow significantly by 2035, and is anticipated to capture a 24.7% share of the global market revenue. The growth in the region is fueled by increasing rates of infection, increased access to healthcare, and robust government interference in major economies. Increased pediatric and elderly populations in India and China continue to raise demand. Also, the national health reforms and public insurance schemes facilitate broader access to treatment. The region is becoming a hub for pharmaceutical manufacturing and research, and development.

China is leading the pharyngitis treatment market and is poised to have a significant share. Recent reforms by NMPA have expedited the approval of domestically manufactured antibiotics and diagnostic reagents, which aligns with the 14th Five-Year Plan's focus on controlling infectious diseases and API self-sufficiency in supply chains (NMPA). The growth of the market can also be attributed to the support from the wide-scale manufacturing and availability of various types of treatments. Healthcare reforms in the country have increased coverage and enhanced access to diagnostic tools.

Europe Market Insights

Europe is set to register significant growth owing to the high occurrence of pharyngitis, mainly during the winter season. The consistent pool of patients sustains robust demand for the antibiotics. The region has well-established healthcare systems and ensures swift patient access. Organizations such as the European Centre for Disease Prevention and Control are implementing stringent guidelines for the prescription. The region has a robust focus on research and development in infectious diseases and is witnessing huge investment.

In Germany, the pharyngitis treatment market is augmented by the presence of strict and evidence-based standards. The advanced healthcare infrastructure in the country and extensive coverage for insurance are also acting as catalysts for the market growth. Additionally, the growth in the market is also increasing due to a high level of healthcare expenditure among the EU countries, valuing USD 542.9 billion in 2022. The country is considered to be a key nation in the world where regulations as well as innovation are converging to foster the growth of the pharyngitis treatment market. Public hospitals have, to a greater extent, embraced rapid diagnostic kits, improving early intervention and secondary complications.

Key Pharyngitis Treatment Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc (GSK)

- Sanofi

- Johnson & Johnson

- Bayer AG

- Abbott Laboratories

- Novartis AG

- Takeda Pharmaceutical Co. Ltd.

- Reckitt Benckiser Group plc

- Cipla Ltd.

- Sun Pharmaceutical Industries

- Daewoong Pharmaceutical Co.

- Biocon Ltd.

- Dr. Reddy’s Laboratories

- Astellas Pharma Inc.

- CSL Limited

- Hovid Berhad

- Lupin Limited

- Mylan (now Viatris Inc.)

- Glenmark Pharmaceuticals

The pharyngitis treatment market is highly competitive and consolidating with major pharmaceutical players. Pfizer, GSK, and Sanofi lead with large portfolios of antibiotics and entrenched global distribution. Manufacturers in India, such as Cipla, Sun Pharma, and Dr. Reddy's, are increasing their share through affordable generics and good API manufacturing. Strategic efforts involve growing in new markets, patent diversification, and joint R&D spending on antimicrobial resistance to provide product differentiation and long-term competitive advantage. Local production and price controls also determine pharyngitis treatment market dynamics.

Here is a list of key players operating in the pharyngitis treatment market:

Recent Developments

- In March 2024, Pfizer introduced its extended-release azithromycin formulation, Zithromax XR+, targeting patients with bacterial pharyngitis and related upper respiratory tract infections. This innovation was strategically designed to address one of the persistent challenges in pharyngitis management.

- In August 2024, GlaxoSmithKline (GSK) expanded its well-established Strepsils Advance portfolio with the introduction of a dual-action throat lozenge combining anti-inflammatory and antiseptic properties. This formulation was strategically developed to address both the symptomatic pain and swelling associated with pharyngitis, as well as the bacterial load that often contributes to infection persistence.

- Report ID: 3124

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pharyngitis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.