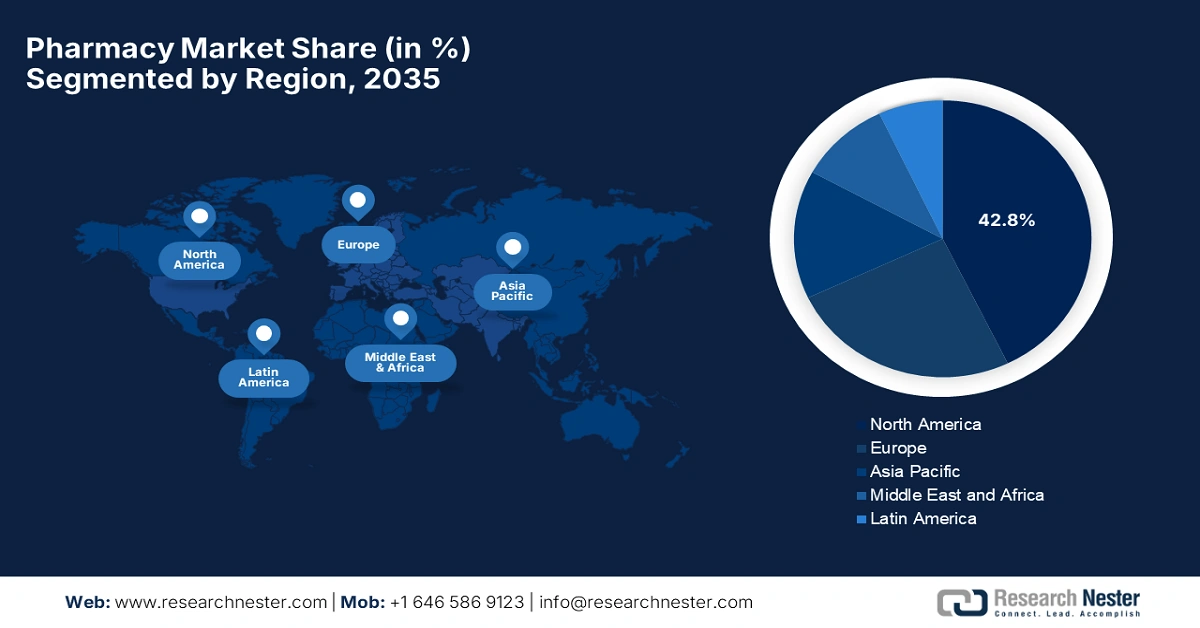

Pharmacy Market - Regional Analysis

North America Market Insights

North America market holds a dominant position with the largest share of 42.8% by the end of 2035. The region’s leadership in this field is attributed to its advanced healthcare infrastructure and consistent demand for pharmacy services. The region is also paving the way towards enhancing pharmacy accessibility, wherein in January 2025, Walmart Inc. notified the launch of Same-Day Pharmacy Delivery service across 49 states in the U.S. in a single online order, which is powered by AI, geospatial tools, and cloud-based platforms. The company received support from over 15,000 pharmacists, thereby creating an optimistic market opportunity.

U.S. is augmenting its leadership in the regional market on account of growing demand for long-term prescriptions and robust research infrastructure. Besides, the country hosts substantial technological advances with the emergence of AI, automation, and home delivery options. Therefore, in June 2025, Walgreens Boots Alliance, Inc. celebrated its major milestone in the U.S. retail pharmacy, productively marking three years of its clinical trials initiative, which is the longest-standing clinical research commitment by any retail pharmacy in the country. Such instances transform pharmacies into community research hubs, thereby enhancing accessibility, supporting innovation in drug development.

There is a huge opportunity for the market in Canada, extensively facilitated by the expansion of retail and clinic-based pharmacy models. The country also benefits from supportive administrative bodies facilitating suitable reimbursements. For instance, in June 2025, Astellas Pharma Canada, Inc. declared that its XTANDI (enzalutamide), an androgen receptor pathway inhibitor, is reimbursed and is currently funded under the Ontario Drug Benefit Program’s Exceptional Access Program. Hence, these enhanced reimbursements and faster patient access to efficacious treatments will foster a favorable business environment in Canada.

Pharmaceutical and Prescription Drug Expenditure Data in 2023

|

Category |

U.S. (2023) |

Canada (2023) |

|

Total Expenditure |

USD 722.5 billion (↑13.6% vs. 2022) |

Prescription drug expenditures ↑12.9% (return to pre-pandemic trend) |

|

Drivers of Growth |

• Utilization ↑6.5% |

• Higher-cost medicines (drug-mix effect) avg. 6.3% (2018–2023), peaked at 9.2% in 2023 |

|

Top Drugs |

1. Semaglutide |

Not specified (but growth driven by high-cost drugs) |

|

Hospital & Clinic Expenditures |

• Nonfederal hospitals: USD 37.1B (↓1.1%) |

Not applicable (focus on private plans only) |

Source: Government of Canada, February 2025, NLM July 2024

APAC Market Insights

Asia Pacific market is likely to exhibit the fastest growth from 2026 to 2035. The region’s progress in this field is highly attributed to the growing aging populations, rising chronic disease prevalence, and improving healthcare infrastructure. Besides the prominent countries, China, India, and Japan each contribute uniquely to this robust expansion. The region also benefits from increasing demand for prescription medications, OTC products, and expanding retail pharmacy networks, thereby positioning Asia Pacific as the critical leader in the pharmacy industry.

China has become the prime focus for investors around the global pharmacy market due to its evolving healthcare ecosystem. Besides, the country hosts ample government healthcare reforms and expanded insurance coverage, thereby benefiting both service providers and consumers. In this regard, Lupin Limited in June 2025 declared that it entered into a strategic alliance with Sino Universal Pharmaceuticals for the commercialization of its benchmark product called Tiotropium Dry Powder Inhaler (DPI) in China, targeting chronic obstructive pulmonary disease (COPD) treatment. Therefore, this collaboration is all set to drive the country’s market with improved access.

India is gaining enhanced traction in the regional market owing to its large population and rising healthcare awareness. The country receives mounting government support for improving medical accessibility across the nation has spurred the pharmaceutical sector. Therefore, the Pharmaceutical Industry report published in February 2025 by the India Brand Equity Foundation states that the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) achieved sales of Rs. 1,000 crore (USD 119 million) in October 2024, which underscores its potential in expanding affordable generic medicines. Hence, such events strengthen the country’s potential in this field, ultimately benefiting the overall market.

Europe Market Insights

Europe is the key player in the global market, readily accountable to its strong healthcare infrastructure and rising burden of chronic diseases. The region also benefits from a well-established regulatory framework and an increased adoption of exclusive pharmaceutical technologies. For instance, in January 2024, Boehringer Ingelheim announced that it is expanding its manufacturing plant in Koropi, Greece, with a total investment of EUR 120 million. The company plans to increase production capacity for both new and existing medications. Hence, such moves will productively boost the domestic economy and employment as well.

Germany stands at the forefront of growth in the regional pharmacy market due to the existence of robust R&D investments and a large export hub. The country’s focus on innovation and digital health integrations also contributes to development in this field. For instance, in February 2025, Isotopia, in partnership with DSD Pharma, notified the launch of Isoprotrace in Germany with a great focus on efficient and reliable delivery of Isoprotrace to hospitals, clinics, and diagnostic centers across the country’s vast geography, hence positively impacting the country’s healthcare sector.

France holds a strong position in Europe market, which is gaining enhanced recognition facilitated by the increasing foreign investments and a focus on sustainability. This heightened demand has encouraged players to undertake strategic initiatives, thereby fostering a profitable business environment. In February 2025, STRATACACHE declared that it acquired SNED, which is a France-based LED solutions specialist focused on pharmacy displays and signage as well. This acquisition will support STRATACACHE’s operations across France and the Benelux region, hence making it suitable for standard market development.