Pharmacovigilance Outsourcing Market Outlook:

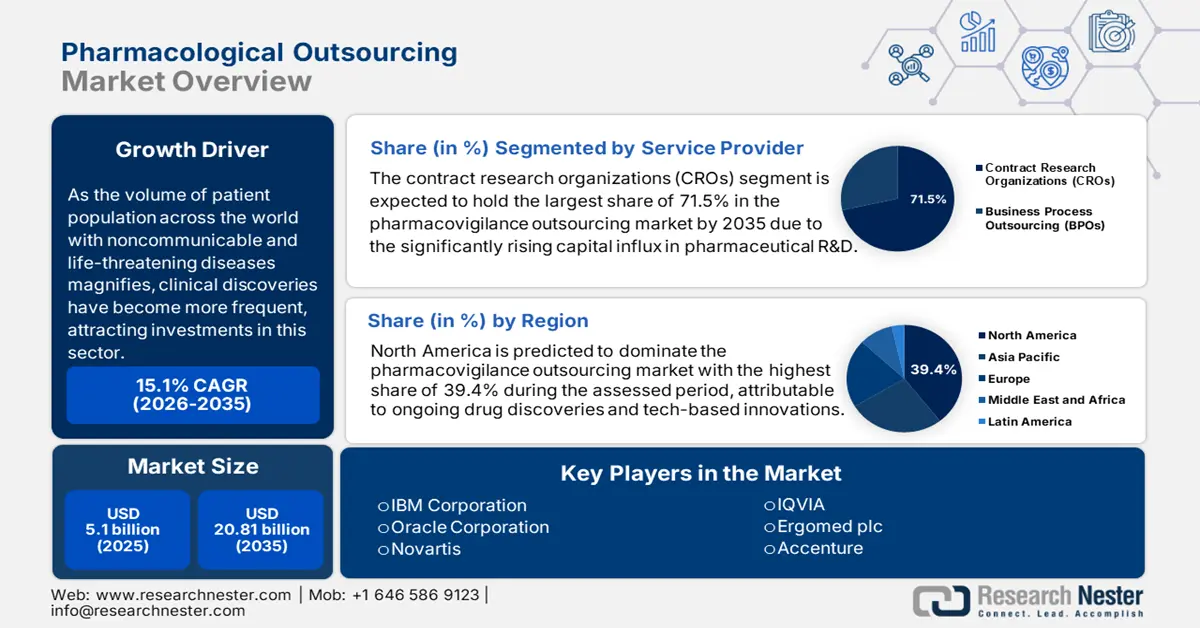

Pharmacovigilance Outsourcing Market size was over USD 5.1 billion in 2025 and is anticipated to cross USD 20.81 billion by 2035, witnessing more than 15.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pharmacovigilance outsourcing is assessed at USD 5.79 billion.

As the volume of patient population across the world with noncommunicable and life-threatening diseases magnifies, clinical discoveries have become more frequent. Thus, pharma companies are increasingly investing in the pharmacovigilance outsourcing market to maintain their competency. According to a 2022 report from the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), only 1 among 5,000–10,000 screened compounds is identified to be effective. The crafted therapeutics further require 10-15 years to pass through plenty of rigorous safety tests. This signifies a long-term and significant investment, where the contractual evaluation services can optimize the process with less spending and time, referring to the rising demand in this sector.

Count of Specified Under-development Drugs around the Globe (2021)

|

Health Condition |

Count of Drugs |

|

Cancer |

3,148 |

|

Immunology |

1,677 |

|

Neurology |

1,688 |

|

Infectious Disease |

1,488 |

Source: IFPMA 2022

The current scenario of the pharmacovigilance outsourcing market focuses on strategic commercial partnerships and cost-reduction efforts. As the tendency to establish a unified standard for clinical trials gains traction, more companies, seeking globalization, prefer external assistance with streamlined services for efficient and on-time marketing. As per NLM, the cost of pioneering a new drug ranged between USD 314.0 million and USD 4.4 billion, concluded from the study in June 2024. However, this pricing highly depends on therapeutic area, data, and modeling assumptions. In order to reduce the economic burden of heightened drug payers’ pricing, the third-party option becomes a priority for a company to balance their total spending on a single medicine development.

Classified Presentation of Pharmacovigilance (PV) Pricing (2022)

|

Type of Procedure or Service |

Standardized Price per Procedure (in USD) |

|

Single Assessments of Periodic Safety Update Report (PSUR) |

26,447.9 |

|

Assessment of imposed Post Authorization Safety Studies (PASS) (in case of over one member state) |

58,312.2 |

|

Assessment of Pharmacovigilance Referrals |

2,42,858.3 |

|

Annual Service (Pharmacovigilance Information Technology and Monitoring of Selected Medical Literature) |

90.6 |

Source: European Medicine Agency

Key Pharmacovigilance Outsourcing Market Insights Summary:

Regional Highlights:

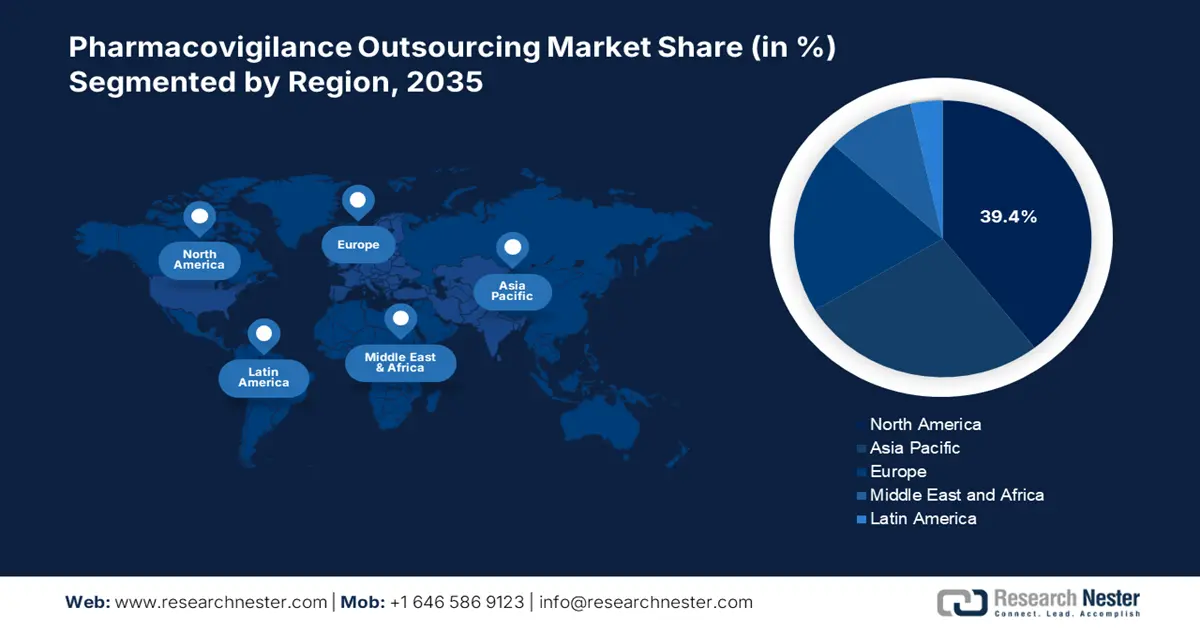

- North America holds a 39.4% share in the Pharmacovigilance Outsourcing Market, driven by ongoing drug discoveries and strong pharmaceutical R&D investments, reinforcing its leadership through innovation by 2035.

Segment Insights:

- The Pharmaceutical Industry segment is projected to achieve the highest revenue CAGR from 2026 to 2035, driven by a well-established worldwide trading environment for pharmaceutical products.

- The CROs segment is projected to hold a 71.5% share by 2035, driven by significant capital influx in pharmaceutical R&D boosting outsourcing demand.

Key Growth Trends:

- Stringent regulatory criteria for commercialization

- Efficiency in marketing time and compliance

Major Challenges:

- Concerns about data privacy and breach threat

- Variability in compliance and consistency

- Key Players: IBM Corporation, Oracle Corporation, Novartis, Accenture, IQVIA, Ergomed.

Global Pharmacovigilance Outsourcing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.79 billion

- Projected Market Size: USD 20.81 billion by 2035

- Growth Forecasts: 15.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Pharmacovigilance Outsourcing Market Growth Drivers and Challenges:

Growth Drivers

- Stringent regulatory criteria for commercialization: With the rising concern on patient safety, regulatory frameworks from across the world, such as PDMA, FDA, MHLW, and European Union, are pushing companies to undergo various clinical studies to attain complete assurance before approval. The pharmacovigilance outsourcing market has evolved with the current dynamics and criteria of these authorization bodies, offering a hassle-free marketing experience. This attracts more pharma pioneers to invest in this field. For instance, in September 2022, AmerisourceBergen engaged USD 1.3 billion in acquiring a global PV service provider, PharmaLex Holding, to captivate the wide network of biopharmaceutical manufacturers in this field.

- Efficiency in marketing time and compliance: The rapid penetration of AI and laboratory automation has leveraged productivity in the pharmacovigilance outsourcing market. On this note, in July 2024, OMNY Health introduced a Data Platform to escalate the capabilities of its AI-driven partners such as ArisGlobal. This tool is designed to upscale the safety signal validation ability of these PV service providers in identifying drug efficacy and patient response with real-world evidence. As the utilization of such advanced technologies grows, the efficiency in timely delivery and budget optimization is enhancing, increasing the popularity of this sector among pharmacology leaders and widening the consumer base.

Challenges

- Concerns about data privacy and breach threat: Hiring professionals from the pharmacovigilance outsourcing market involves sharing a large amount of sensitive data, which raises the risk of leak and misuse. Utilizing confidential information, particularly about patients, often results in hurdles in assuring complete privacy and security. In addition, globally recognized data protection agencies, such as GDPR and HIPPA, may limit and complicate the operations of this field. This may further discourage the participants from investing and engaging their valuable resources.

- Variability in compliance and consistency: The criteria for compliance are different in individual regions, which may create uncertainty in navigating through various regulatory landscapes. Thus, attaining alignment across multiple scenarios becomes challenging for the pharmacovigilance outsourcing market. This may also result in unwanted delays, errors, and expenses, diluting the interest in globalization and limiting the sector’s exposure. Furthermore, the difficulty in maintaining a consistent quality profile for such changing dynamics may hinder progress in this sector.

Pharmacovigilance Outsourcing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.1% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 20.81 billion |

|

Regional Scope |

|

Pharmacovigilance Outsourcing Market Segmentation:

Service Provider (Contract research organizations (CROs), Business process outsourcing (BPOs))

Based on service providers, the contract research organizations (CROs) segment is estimated to dominate around 71.5% pharmacovigilance outsourcing market share by the end of 2035. The significantly rising capital influx in pharmaceutical R&D is fueling this segment. The global expansion of biopharma companies is also contributing to this progress. In this regard, the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) reported that research-based entities from around the globe accumulatively invested USD 198.0 billion in R&D till 2020. It also highlighted its USD 1838.0 billion contribution to the global economy by 2022. These figures indicate the rising demand for assistance from contract research organizations (CROs).

End users (Pharmaceutical Industry, Research Organization, Others)

In terms of end users, the pharmaceutical industry segment is poised to generate the highest revenue from the pharmacovigilance outsourcing market throughout the forecast timeline. The well-established worldwide trading environment for associated products is remarkably propelling growth in this segment. As per OEC, the global business of pharmaceutical commodities, including chemicals, medicaments, vaccines, and special products, accounted for USD 854.0 billion by 2023. This signifies the growing requirement for regional compliance and marketing solutions, securing a stable profit margin in this category. Moreover, the popularity of contractual services is already gaining traction in this industry, which presents a pre-embellished trading atmosphere for leaders.

Our in-depth analysis of the global pharmacovigilance outsourcing market includes the following segments:

|

Service Provider |

|

|

End users |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pharmacovigilance Outsourcing Market Regional Analysis:

North America Market Analysis

North America in pharmacovigilance outsourcing market is likely to dominate over 39.4% revenue share by 2035. Ongoing drug discoveries are one of the major drivers in this field. On this note, a 2022 report from the SiRM, identified North America to be the largest investor in pharmaceutical R&D. It further stated that 68.0%, 46.0%, 67.0%, and 45.0% of venture capital, biopharma, public sector, and non-profit organizations spending were acquired by this region. This signifies the region’s leadership in pioneering novel therapeutics, which require strong safety management solutions to retain sufficient supply and accessibility.

The U.S. is witnessing a massive increment in severe medicine side-effect cases, which is pushing the national health authorities to prioritize and promote the importance of the pharmacovigilance outsourcing market. In a May 2021 article, NLM recognized adverse drug reactions (ADRs) to be the 4th major cause of mortality in the country. In addition, the country’s open business policies in accepting foreign products also indicate the urgent need for post-marketing surveillance. In this regard, OEC stated that the U.S. ranked 1st in importing pharmaceutical products and goods with USD 170.0 billion and USD 47.3 billion in 2023.

Canada is augmenting the pharmacovigilance outsourcing market with well-established governance over regulating safety standards. Governing bodies of this nation are highly active in ensuring patient well-being in every measure, including drug efficacy evaluations. For instance, in May 2020, the Drug Safety and Effectiveness Network (DSEN) in Canada allocated an annual spending of USD 10.o million to finding post-market evidence for drug efficacy and security. This funding was dedicated to supporting Health Canada with targeted oversight and decision-making for human drug products, creating new opportunities for market leaders.

APAC Market Statistics

The Asia Pacific pharmacovigilance outsourcing market is pledged with extended production and is expected to witness the fastest growth during the assessed timeframe. This region is home to many internationally recognized medicine producers and developers, which is drafting a broad consumer base for this sector. This emerging landscape of clinical discoveries is inspiring service providers to upscale the quality and efficacy of offerings, bringing diversity to this field. Besides, developing countries within this territory are highly focused on reducing the prevalence of adverse events. Furthermore, the complexities in regulatory frameworks and the continuation of clinical trials are pushing companies to invest in this field.

India has developed one of the most stringent spectra of safety regulations, which feeds growth in the pharmacovigilance outsourcing market. Both public and private authorities are proactively setting preventive measures and promotional assets across the nation to combat widespread drug adverse cases. For instance, in September 2023, Bharat Serums and Vaccines Limited (BSV) launched a mobile application, BSV AER, for reporting adverse events. This tool is backed by the company’s solely developed pharmacovigilance system, enabling a quick response solution for healthcare professionals, patients, and pharmacology companies.

China is presenting greater scopes of investment for the pharmacovigilance outsourcing market through its frequent participation in clinical trials. The country has shown remarkable progress in cultivating local drug-related R&D and production networks over the past decade, which implies a large consumer base for PV service providers. According to NLM, the share of clinical studies with no action indicated (NAI) for FDA approvals in China was uplifted by 37.0% from 2016 to 2023, showcasing a massive increment in the country’s inspection quality. Another WHO report stated that China registered for the highest number of clinical trials in the world, accounting for 41,834 (22.5%), during the period between 2022 and 2024.

Key Pharmacovigilance Outsourcing Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Clintec

- Covance

- Oracle Corporation

- Novartis

- iGATE Corporation

- Accenture

- iMED Global Corporation

- Bioclinica

- MarksMan Healthcare

- Symogen

- Ergomed

- IQVIA

- Parexel

- Medpace Holdings

- SIRO Clinpharm

- EVERSANA

Key players in the pharmacovigilance outsourcing market are now aiming at globalization. For instance, in December 2022, Alphanumeric Systems a multi-tiered PV service offering for life science pioneers. The new portfolio encompassed case management, strategy deployment services, medical info/case management, regulatory intelligence, quality monitoring, and audits. They are continuously investing in new technologies to increase productivity in their service lines, improving availability in this field. On this note, in December 2023, Thermo Fisher Scientific commercialized its cloud-based data lake platform, CorEvidence, as a pivotal part of its PPD clinical research business. The tool is engineered to escalate the quality of PV case processing and safety data management. Such key players are:

Recent Developments

- In October 2024, EVERSANA opted for Oracle Argus Cloud Service to empower its pharmacovigilance services platform. The company aimed to enhance customer experience through streamlined safety management, regulatory compliance, and operational efficiency.

- In September 2024, Oracle launched a new cloud-based research service, CancerMPact Treatment Architecture Trends, for pharmaceutical and biotech companies. The tool is designed to assist customers with the development and commercialization strategies for new drug approvals, targeting malignancies.

- Report ID: 7363

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.