Introduction to Pharmaceutical Excipients

Pharmaceutical excipients are referred to all those substances which are formulated alongside the active ingredient of a medication. These substances are included for the purpose of long-term stabilization, bulking up solid formulations that contain potent active ingredients in small amounts or to confer a therapeutic enhancement on the active ingredient in the final dosage form. Pharmaceutical excipients are also used to facilitate drug absorption, reduce viscosity or enhance solubility of drugs.

Global utilization of pharmaceutical excipients and excipient delivery systems are governed by the Federation of International Pharmaceutical Excipients Council (IPEC), which also develops, implements and promotes global use of appropriate quality, safety, and functionality standards for the pharmaceutical excipients.

Market Size and Forecast

The pharmaceutical excipient market is observing vibrant growth on account of growing pharmaceutical industry and the rising adoption of orphan drugs. Furthermore, advancements in functional excipients, increasing uptake of biopharmaceuticals, emergence of multifunctional excipients, shifting focus of pharmaceutical manufacturing to emerging markets, and the growing biosimilars industry are some of the notable factors that are expected to boost the growth of the pharmaceutical excipients market. According to the statistics by Organisation for Economic Co-operation and Development (OECD), export market share of the pharmaceutical industry in Switzerland grew from 9.80% in 2006 to 13.43% in 2017.

The market is anticipated to record a CAGR of around 5.01% throughout the forecast period, i.e. 2019-2027. The pharmaceutical excipients market is segmented by segmented by formulation into oral, topical, parenteral and others, out of which, oral formulation segment is anticipated to hold largest market share. Oral solid drug formulations are easily consumable by the patient classes, such as children. During the drug manufacturing process, oral dosage forms require more amount of excipients than other forms. Patients find it difficult to swallow conventional hard solid tablets, which has prompted drug manufacturers to devise more innovative solid oral product forms, for instance, oral disintegrating granules (ODGs), effervescent tablets, lozenges and others, which is anticipated to fuel the growth of the segment.

The market is anticipated to record a CAGR of around 5.01% throughout the forecast period, i.e. 2019-2027. The pharmaceutical excipients market is segmented by segmented by formulation into oral, topical, parenteral and others, out of which, oral formulation segment is anticipated to hold largest market share. Oral solid drug formulations are easily consumable by the patient classes, such as children. During the drug manufacturing process, oral dosage forms require more amount of excipients than other forms. Patients find it difficult to swallow conventional hard solid tablets, which has prompted drug manufacturers to devise more innovative solid oral product forms, for instance, oral disintegrating granules (ODGs), effervescent tablets, lozenges and others, which is anticipated to fuel the growth of the segment.

Growth Drivers

Growing Demand for Medicines Globally

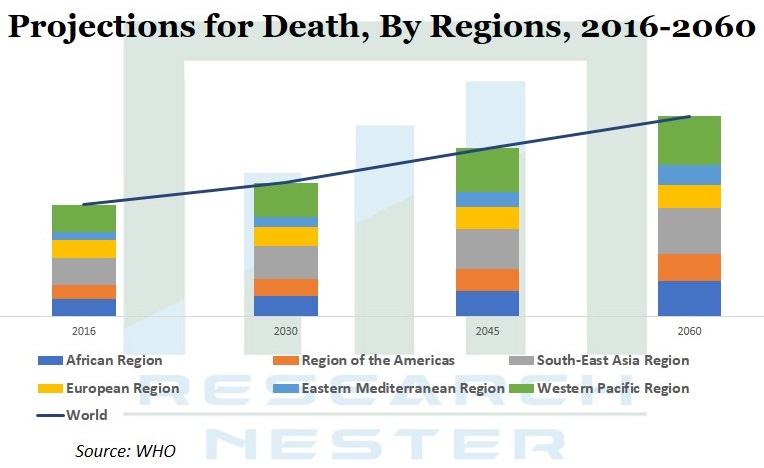

According to the World Health Organization (WHO), projections for deaths caused by communicable, maternal, perinatal, nutritional, noncommunicable and injuries will grow from 56,873 thousands in 2016 to 101,831 thousands in 2060. CLICK TO DOWNLOAD SAMPLE REPORT

Demand for pharmaceutical drugs and consumption of medicines globally have grown manifold owing to rise in the number of diseases, growing geriatric population and the increasing mortality rates. With increased consumption of drugs, pharmaceutical drug manufacturers are also raising their production levels to meet the demand supply gap. The increasing demand for drugs and the rising consumption levels of such drugs are anticipated to raise the demand for pharmaceutical excipients amongst drug manufacturers during the forecast period.

Rising R&D Spends In Pharmaceutical Industry

According to OECD, R&D spends in the pharmaceutical industry in the United States grew from 983.99 USD/capita in 2010 to 1220.40 USD/capita in 2017.

With increasing R&D spends in the pharmaceutical industry, there is a growing demand for continuous up gradation in drug manufacturing processes, and the substances used to manufacture the drugs. It is anticipated that increased patient complaince, and the demand for different form of drugs from doctors for easy consumption by patients will support the growth of the pharmaceuticals excipients market throughout the forecast period.

Restraints

Higher Production Cost and Stringent Government Regulations

Manufacturing costs associated with the production of pharmaceutical excipients is anticipated to hamper the growth of the market. Additionally, stringent norms by governmental organizations, such as IPEC Federation is anticipated to act as a barrier to the growth of the pharmaceutical excipient market during the forecast period.

Market Segmentation

Our in-depth analysis of the pharmaceuticals excipients market includes the following segments:

By Product

- Organic Chemicals

- Carbohydrates

- Petrochemicals

- Inorganic Chemicals

- Calcium Phosphates

- Calcium Carbonate

- Calcium Sulfate

- Halites

- Metallic Oxides

- Others

By Functionality

- Fillers & Diluents

- Binders

- Coating Agents

- Disintegrants

- Suspending & Viscocity Agents

- Flavoring Agents & Sweeteners

- Lubricants & Glidants

- Preservatices

-

Emulsifying Agents

- Others

By Formulation

- Oral

- Topical

- Parenteral

- Others

By Region

On the basis of regional analysis, the pharmaceutical excipients market is into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region.

Europe is expected to have largest market share on the back of presence of a number of pharmaceutical giants with large production capacities. It is anticipated that these leading giants will have high consumption of excipients. Additionally, growing emphasis on superior pharmaceutical products, generics, and biosimilars is raising the demand for novel excipients, which is expected to support the growth of the market in the region.

The pharmaceutical excipients market is further classified on the basis of region as follows:

- North America (U.S. & Canada) Market size, Y-O-Y growth & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market size, Y-O-Y growth & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC, Poland, Turkey, Russia, Rest of Europe) Market size, Y-O-Y growth & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market size, Y-O-Y growth & Opportunity Analysis.

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market size, Y-O-Y growth & Opportunity Analysis.

Top Featured Companies Dominating the Market

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roquette Frères

- Ashland

- BASF SE

- Evonik Nutrition & Care GmbH

- SPI Pharma

- Archer Daniels Midland Company

- The Lubrizol Corporation

- Croda International Plc

- Innophos

Recent Developments

-

September 2019: CVC Capital Partners’ Strategic Opportunities platform have agreed on a transaction for Fonterra’s 50% share in DFE Pharma, a supplier of pharmaceutical excipients.

-

July 2019: China has amended the drug master file (DMF) system for drug packaging. The announcement clarifies and simplifies the procedure and requirements for the registration of drug packaging, APIs, and drug excipients in China.

- Report ID: 2016

- Published Date: Feb 14, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Pharmaceutical Excipients Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert