Food Packaging Market Outlook:

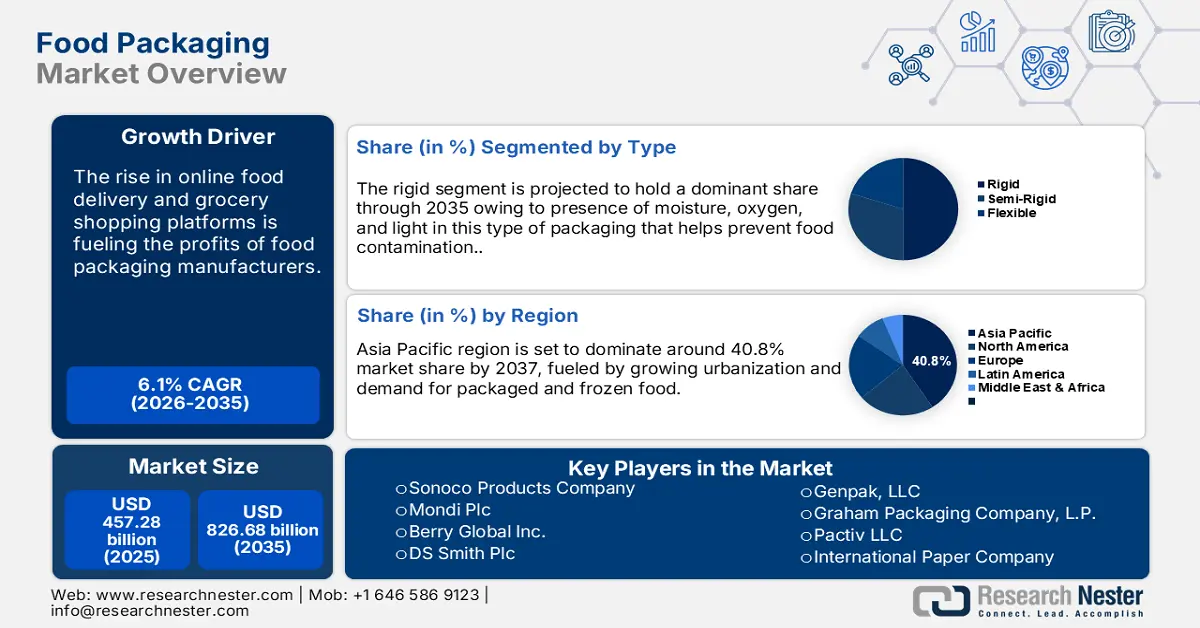

Food Packaging Market size was over USD 457.28 billion in 2025 and is poised to exceed USD 826.68 billion by 2035, witnessing over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of food packaging is estimated at USD 482.38 billion.

The growth of the market can primarily be ascribed to the globally changing lifestyles of people, and their rising preference for packaged and processed foods. Moreover, owing to the hectic lifestyle, people usually don’t have time to prepare their own food before going to office, so they opt for packed food that is easy to access. Therefore, it is anticipated to boost the market’s growth in the upcoming years. For instance, the global consumption of ultra-processed foods has hugely increased. These foods now account for 27-62% of a person's daily energy needs.

Food packaging is significant for keeping food items fresh and ensuring that they reach their destination without losing any of their original flavor or quality. It shields the food from contaminants and moisture, guards against spills and tampering, and aids in maintaining the products' shape and quality. The importance of food packaging as a means of transmitting information, such as the nutritional value, expiration date, cost, and country of origin of the packaged goods, has increased. Additionally, packaging serves as a contemporary marketing tool used by retailers to attract more customers. The rising count of novel and efficient food processing techniques that need a quality packaging of food after processing is fueling up the demand for packaging market over the forecast period. For instance, the concept of nanotechnology for food processing has opened the door for the processing and formulation of colorants, sensors, flavors, additives, preservatives, and food supplements in both animal and plant-based products (nanoencapsulation and nanoemulsion). Nanomaterials have demonstrated a variety of electrochemical and optical properties in various sauces, beverages, oils, and juices. Unique properties have demonstrated excellent qualities in the field of food processing as ingredients and supplements. Oxide chemicals such as magnesium oxide and silicon dioxide are able to flavor, color, and bake foods. Titanium dioxide has also been approved for use as an ingredient in gums, sauces, and cakes.

Key Food Packaging Market Insights Summary:

Regional Highlights:

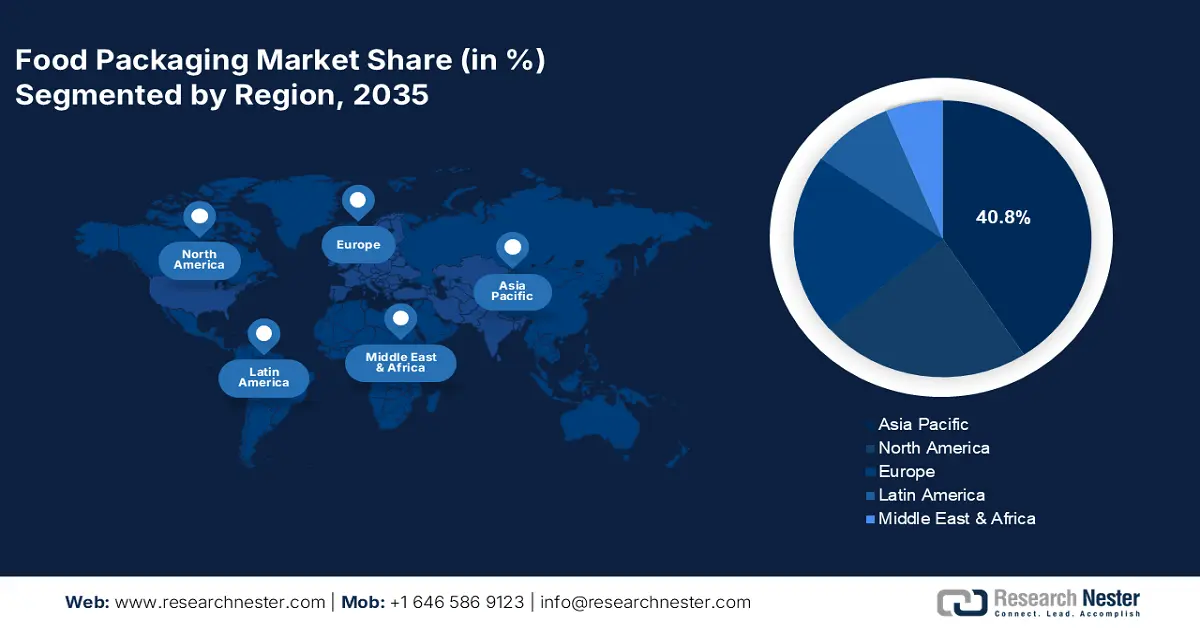

- The Asia Pacific food packaging market will hold around 40.8% share by 2035, fueled by growing urbanization and demand for packaged and frozen food.

Segment Insights:

- The plastic segment in the food packaging market is expected to experience noteworthy growth over 2026-2035, driven by its wide application in containers, wraps, and pouches, coupled with its cost-effectiveness and lightweight properties.

- The rigid segment in the food packaging market will hold the largest share, driven by its protective properties against moisture, oxygen, and light, helping prevent food contamination, forecast year 2035.

Key Growth Trends:

- Skyrocketing Trend of Online Food Delivery

- Upsurge in Dairy Industry

Major Challenges:

- The increasing Cost of Raw Materials

- Rapidly Changing Technology of Food Packaging

Key Players: Sealed Air Corporation, Sonoco Products Company, Mondi plc, Berry Global Inc., DS Smith Plc, Genpak, LLC, Graham Packaging Company, L.P., Pactiv LLC, International Paper Company, Winpak Ltd.

Global Food Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 457.28 billion

- 2026 Market Size: USD 482.38 billion

- Projected Market Size: USD 826.68 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Food Packaging Market - Growth Drivers and Challenges

Growth Drivers

-

Skyrocketing Trend of Online Food Delivery – Since 2020, the food delivery trend has boosted a lot, owing to the social distancing that followed during that time. People are tending to order online food as a result of their busy lifestyle, and for keeping the social distancing. Moreover, the introduction of food delivery apps has accelerated and simplified the process of obtaining favorite foods. Such factors are expected to drive the demand for food packaging market over the forecast period. For instance, in 2022, worldwide revenue of online food delivery segment is expected to reach approximately USD 324 billion.

-

Upsurge in Dairy Industry – Dairy industry is one of the most sector that use packaging for their products such as milk, cheese, and others. Moreover, there has been a growing awareness related to the plant-based products, that is further predicted to increase the growth of the global food market. For instance, the organized dairy industry in India is projected to witness around 11% revenue growth by the end of 2022.

- Worldwide Escalating Trend of Online Grocery Shopping – It was observed in research, around 29% of European preferred to choose online method to purchase grocery items.

- Increase in Working Population – Nowadays, consumers are opting for convenient food options, thereby, good packaging can protect the freshness of the food item, which in turn, is anticipated to rise the market’s growth. For instance, globally, the count of employed people was reached approximately 3 billion in 2019.

- Rise in Urbanization – The purchasing power of the population has improved, followed by the rise in the urban population. Thus, it is expected to increase the growth of the global food packaging market. According to the World Bank, currently, more than 50% of the world's population resides in cities. The number of people living in urban areas is estimated to rise more than double to 6 billion by 2045.

Challenges

-

The increasing Cost of Raw Materials - The raw materials used for the manufacturing of food packaging keep fluctuating, which affects the packaging industry. Moreover, the cost of skilled labor is another factor contributing to the surge in the price of the final products. Therefore, it is expected to hamper the growth of the global food packaging market.

-

Rapidly Changing Technology of Food Packaging

- Environmental Concern Related to the Use of Plastic for Packaging

Food Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 457.28 billion |

|

Forecast Year Market Size (2035) |

USD 826.68 billion |

|

Regional Scope |

|

Food Packaging Market Segmentation:

Material Segment Analysis

The global food packaging market is segmented and analyzed for demand and supply by material into plastic, glass, metal, paper & paperboard, wood, and others. Out of which, the plastic segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the wide use in form of containers, wraps, pouches, tubs, and others. Moreover, features such as, flexibility, spill proof, cost-effectiveness, and lightweight are some plus points that make plastic a most preferred material to be used in food packaging. Moreover, there has been an increase in the production of plastic across the globe, along with the use of plastic for convenient food packaging, that is anticipated to surge the segment’s growth in the market. As per the United States Environmental Protection Agency (EPA), 14.5 million tons of packaging and plastic containers were manufactured in 2018.

Type Segment Analysis

On the other hand, the global food packaging market is segmented by type into semi-rigid, rigid, and flexible. Out of these, the rigid segment is anticipated to hold the largest market size in the upcoming years. This can be attributed to the presence of moisture, oxygen, and light in the rigid packaging that helps prevent food contamination. Moreover, there has been a rising consumption of fresh vegetable, fruit, and dairy product, which is increasing the use of rigid packaging. Hence, it is predicted to increase the growth of the rigid segment in the market.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Packaging Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is set to dominate around 40.8% market share by 2035, fueled by growing urbanization and demand for packaged and frozen food. The growth of market can be ascribed to the increasing urban population, growing demand for packaged food, the rise in online food ordering, and increasing disposable income in the region. Additionally, there has been surging awareness among the businesses, and consumers for sustainable packaging, and it is expected to boost the market’s growth in the region. Furthermore, a rising demand and export for frozen food in the countries such as China, and India, is predicted to add up the global market. According to the World Bank data, in 2021, the ratio of urban populations in East Asia and the Pacific reached 61% of the total population of the region. Moreover, the China exports of agri-food commodities accounted for nearly USD 64 billion in the year 2019.

Food Packaging Market Players:

- Sealed Air Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sonoco Products Company

- Mondi plc

- Berry Global Inc.

- DS Smith Plc

- Genpak, LLC

- Graham Packaging Company, L.P.

- Pactiv LLC

- International Paper Company

- Winpak Ltd.

Recent Developments

-

Mondi plc has partnered with Heiber + Schröder to launch the eComPack automatic packaging machine to automate the packaging of its EnvelopeMailer for eCommerce operations.

-

Berry Global Inc. has started the initiative with Taco Bell to manufacture plastic cup with post-consumer recycled plastic. Taco Bell has scheduled to test the new, clear polypropylene (PP) cup in select U.S. restaurants in the latter part of 2022.

- Report ID: 4448

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.