Perovskite Solar Cell Market Outlook:

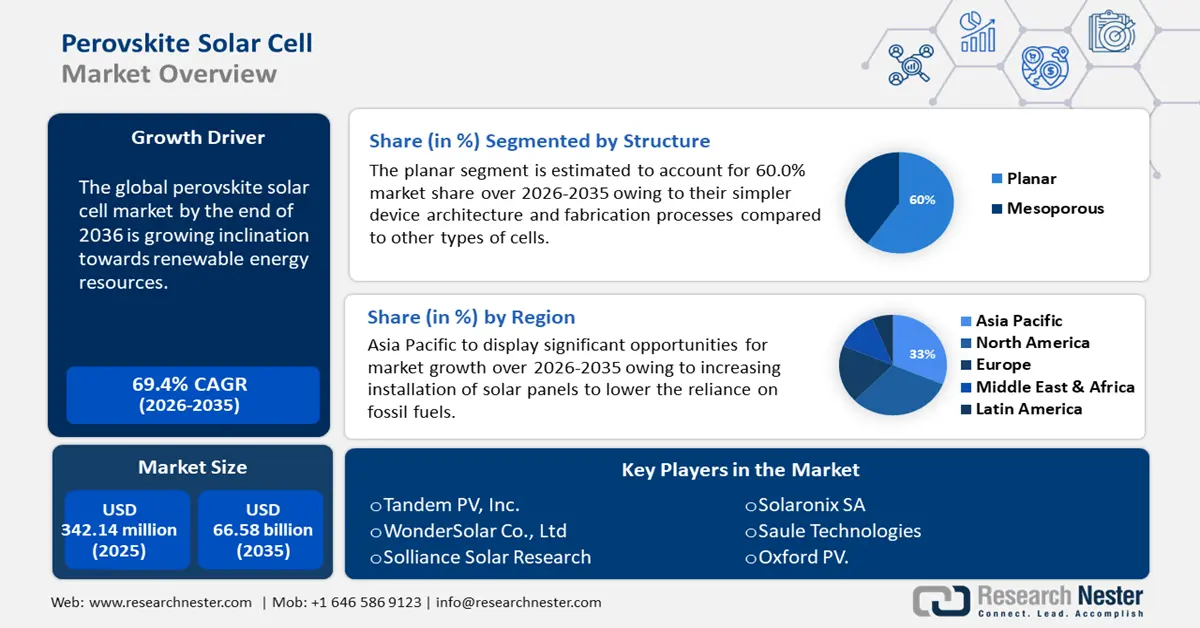

Perovskite Solar Cell Market size was over USD 342.14 million in 2025 and is projected to reach USD 66.58 billion by 2035, witnessing around 69.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of perovskite solar cell is evaluated at USD 555.84 million.

The global perovskite solar cells market is rapidly expanding due to a growing inclination towards renewable energy resources and rising demand for perovskite solar cells (PSCs) in the building and construction industry. Currently, the building and construction sector consumes about 40% of energy globally and this is expected to double by 2050 due to population growth, high usage of consumer electronics, and lifestyle changes. Thus, building energy generation is steadily shifting from fossil fuels to renewable energy sources, resulting in high demand for photovoltaic systems.

Integrating PSCs into buildings helps to reduce the overall carbon footprint and provide clean, renewable energy. PSCs are used in building materials such as windows, facades, and roofs due to their flexibility, thin-film nature, and ability to blend with architectural designs, without compromising the aesthetics. Several companies are investing in developing advanced and durable PSCs for the construction sector. For instance, in April 2022, Saule Technology and its two Polish partners signed a strategic agreement regarding the development of new products based on perovskite cells.

Key Perovskite Solar Cell Market Insights Summary:

Regional Highlights:

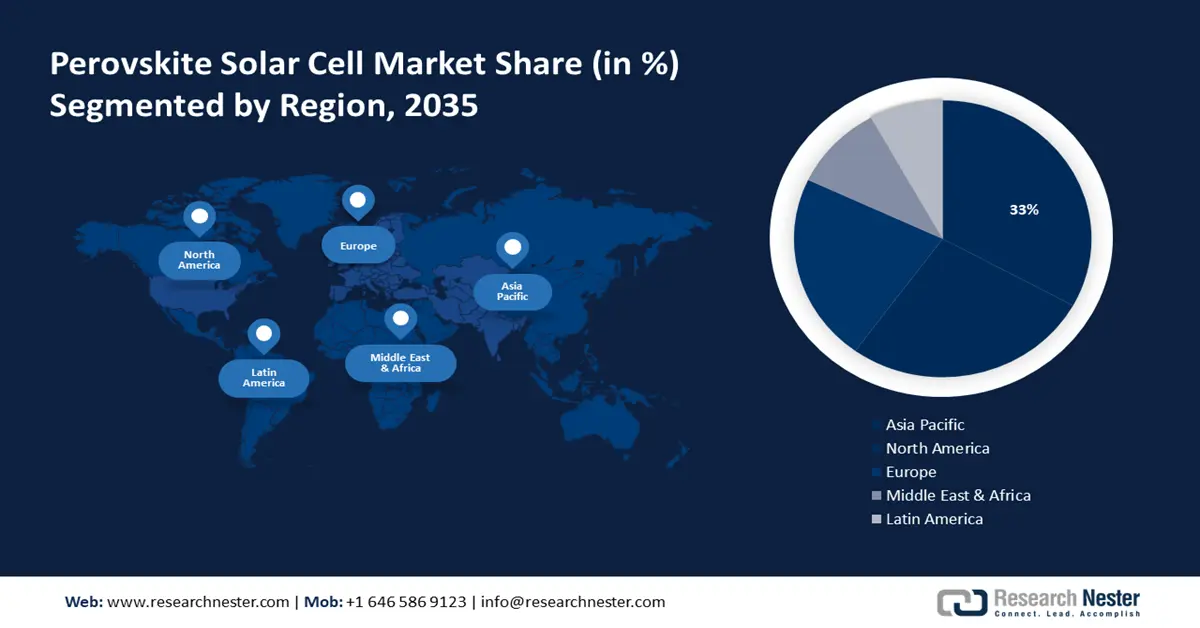

- The Asia Pacific perovskite solar cell market achieves a 33% share by 2035, driven by increasing installation of solar panels to reduce reliance on fossil fuels and supportive government initiatives.

Segment Insights:

- The planar segment segment in the perovskite solar cell market is projected to hold a 60% share by 2035, fueled by simpler device architecture and fabrication process improvements.

- The flexible segment in the perovskite solar cell market is projected to achieve significant growth till 2035, driven by versatility and innovative potential in solar energy applications.

Key Growth Trends:

- Increasing demand for renewable energy

- Supportive government policies and incentives

Major Challenges:

- Side Effects on human health

- Stability and durability issues associated

Key Players: Oxford PV, Saule Technologies, Solaronix SA, Solliance Solar Research, WonderSolar Co., Ltd, Tandem PV, Inc.

Global Perovskite Solar Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 342.14 million

- 2026 Market Size: USD 555.84 million

- Projected Market Size: USD 66.58 billion by 2035

- Growth Forecasts: 69.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Perovskite Solar Cell Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand for renewable energy: The demand for global energy has significantly increased due to rising worldwide population. However, this has also resulted in growing concerns about the depletion of non-renewable resources and climate change. To cater to these issues, many companies and governments worldwide are inclining towards renewable energy. This has resulted in growing demand for highly efficient, versatile, and cost-effective solar technologies including PSCs.

- Supportive government policies and incentives: Many governments across the globe implement policies and schemes such as tax redemption, subsidies, and research grants to promote the adoption of renewable energy, including solar panels and systems. For instance, in July 2023, the Dutch government launched the SolarNL initiative to fund companies and research organizations working on solar cells and solar energy manufacturing to scale the production of circular integrated solar panels and cells in the Netherlands.

Challenges

-

Side Effects on human health: The crystal structure of perovskites resembles that of the perovskite material, comprising titanium oxide (CaTiO3). The breakdown of the perovskite cell leads to the release of toxic substances known as Pbl, which can adversely impact the human respiratory system. This substance also contains lead, posing a threat to the environment through the contamination of air, water, and soil. As a result, the detrimental effects of perovskite solar cells serve as a limiting factor for market expansion.

- Stability and durability issues associated: Issues associated with stability and durability of perovskite solar cells are the major factors hampering the market growth. Although there have been significant improvements in efficiency and the potential for cost-effective production, ensuring the long-term stability of perovskite materials continues to be a significant challenge.

Perovskite Solar Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

69.4% |

|

Base Year Market Size (2025) |

USD 342.14 million |

|

Forecast Year Market Size (2035) |

USD 66.58 billion |

|

Regional Scope |

|

Perovskite Solar Cell Market Segmentation:

Type

In terms of type, the flexible segment in the perovskite solar cell market is expected to account for a significant revenue share of 40% by the end of 2035. The versatility and innovative potential of flexible PSCs make them an ideal choice for solar energy applications and can be integrated into various surfaces and materials such as portable chargers, clothing, and unconventional building structures. Their lightweight and flexibility have paved the way for new opportunities in solar installations, especially in areas where traditional rigid panels are not feasible. One of the leading companies in the market, Sekisui launched a next-generation type of solar cells in May 2024. These perovskite cells are light and flexible making them suitable for building walls, curved surfaces, and loadbearing roofs.

Structure

Based on structure segmentation, the planar segment in the perovskite solar cell market is anticipated to hold a share of 60% during the forecast timeframe. Planar perovskite solar cells are currently the dominant technology in the industry, largely due to their simpler device architecture and fabrication processes compared to other types of cells. Recent improvements in material engineering and device optimization have greatly enhanced their power conversion efficiency. Furthermore, planar perovskite solar cells demonstrate improved stability and durability, effectively addressing worries about the long-term performance of perovskite materials.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Structure |

|

|

Method |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Perovskite Solar Cell Market Regional Analysis:

APAC Market Insights

The perovskite solar cell market in Asia Pacific industry is poised to dominate majority revenue share of 33% by 2035owing to increasing installation of solar panels to lower the reliance on fossil fuels and supportive government initiatives. Companies in the market are heavily investing in R&D activities to develop advanced perovskite solar cells. In June 2023, P3C Technology and Solutions announced fundraising of USD 25 billion for demonstrating flexible perovskite solar cells to various government and private bodies.

In India, the market is expected to account for a significant revenue share during the forecast period owing to rising awareness about solar power and favorable government support to promote perovskite solar cells. Moreover, the public and private sectors are focused on developing advanced technologies and solar cells. For instance, in July 2023, Indian scientists from the Department of Science and Technology developed low cost and highly stable carbon-based perovskite solar cells with better thermal and moisture stability than the conventional ones.

The market in Japan is anticipated to register a staggering CAGR by the end of 2035. This growth can be attributed to the growing demand for renewable energy and rising efforts to achieve carbon neutrality in Japan by 2050.

North America Market Insights

The North America perovskite solar cell market is expected to register a significant revenue share in the global market during the forecast period owing to growing inclination towards renewable energy sources to cater to rising climate changes, rapid advancements in solar cell technology, and presence of leading companies.

The market in the U.S. is predicted to witness robust revenue growth during the forecast period due to rising demand for renewable energy and ongoing research on improving the efficiency, stability, and scalability of perovskite solar cells. In July 2024, A U.S research team developed a 15cm2 perovskite solar module resistant to UV light. This module is expected to improve overall panel stability and efficiency.

The Canada perovskite solar cell market is expected to register rapid CAGR between 2024 and 2035 owing to increasing awareness about the high adoption of advanced technologies, increasing installations of solar panels, and rising investments in R&D activities. In February 2024, researchers at the University of Victoria, Canada developed a fully printable flexible perovskite solar cell based on PET substrate and is expected to achieve 17.6% efficiency.

Perovskite Solar Cell Market Players:

- Greatcell Energy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IDTechEx Ltd

- Microquanta Semiconductor Co. Ltd.

- Oxford PV

- Saule Technologies

- Solaronix SA

- Solliance solar research

- WonderSolar Co., Ltd

- Tandem PV, Inc

The perovskite solar cell market is rapidly changing due to notable technological breakthroughs and an increasing focus on renewable energy sources. A market share study highlights major players, geographical dominance, and new trends that are influencing the direction of the industry, illuminating how various regions and businesses are positioned within this dynamic market. Here is a list of key players operating in the global market.

Recent Developments

- In June 2024, Canon Inc. launched a high-performance material for perovskite solar cells, expected to enhance the durability and mass-product stability of PSCs.

- In November 2023, LONGi Green Energy Technology Co. announced that the company set a world record in the efficiency of crystalline silicon PSCs of 33.9%.

- In April 2023, RenShine Solar announced the launch of a new 150 MW perovskite cell production line to enhance the mass-scale production of perovskite panels.

- Report ID: 6346

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perovskite Solar Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.