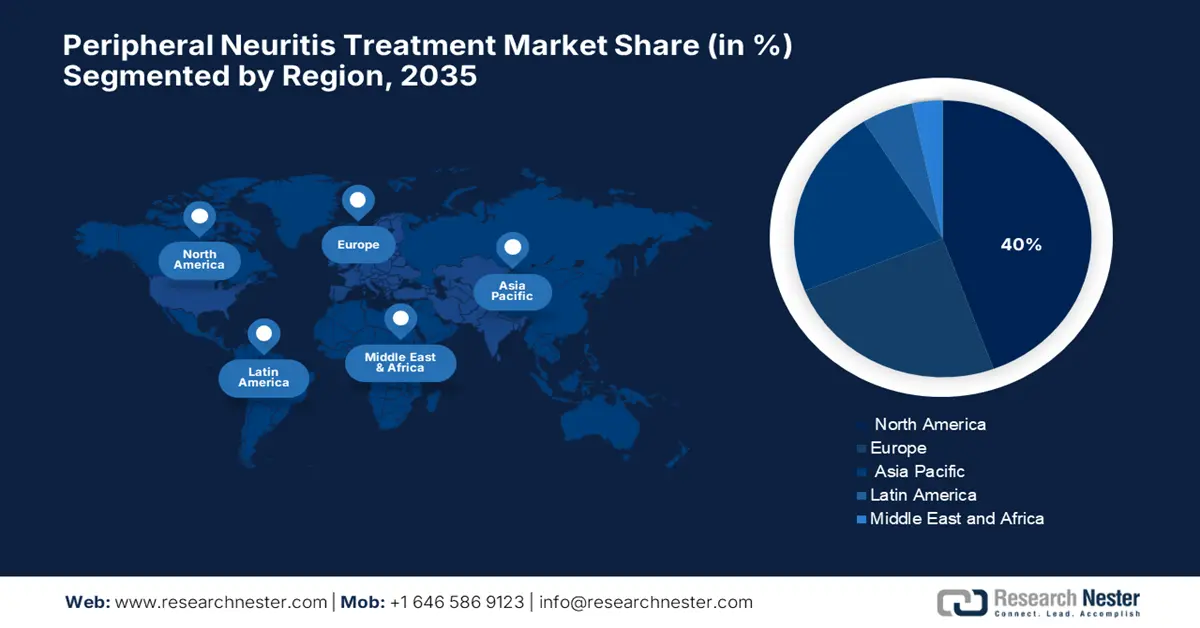

Peripheral Neuritis Treatment Market - Regional Analysis

North America Market Insight

North America region is poised to dominate around 42.6% market share by 2035. Burgeoning incidences of peripheral neuropathy, most notably in elderly adults, are generating a significant market for diagnostic and therapeutic tools. Higher rates in U.S. cohorts (NHANES, ARIC) possibly entail a greater demand for early screening tools such as monofilament testing. Governmental interest is increasing, with specific potential for policy changes leading toward a broader scope of PN screening beyond diabetes populations. More changes in funding and R&D are going into idiopathic PN causes and non-diabetic interventions, while peer pricing remains competitive with rises in public health awareness and clinical demand.

U.S. market is growing steadily. There is an alarmingly high and rising prevalence of peripheral neuropathies, especially among adults aged ≥70, including those without diabetes. With an enlarging disease burden, market considerations for PN diagnostics and interventions also grow. As per a study by Foundations for Peripheral Neuropathy, January 2023, NIH spends 210 million USD on peripheral neuropathy each year. Federal health agencies could fund expanded screening, whereas academic centers focus research and development on idiopathic PN. This strong association with age, race, and duration of diabetes should be considered in targeted programs and cost-effective clinical strategies on a nationwide scale.

The market for peripheral neuritis treatment in Canada is increasing, due to growing neuropathies and awareness about new therapies. High treatment costs and scarce specialized care remain deterrents to treatment access. Diagnostic advancements and early treatment plans will further drive growth for this market. The public health system aids better management of the patient course, while clinical investigations are on their way to promising therapeutic discoveries. However, according to the NLM October 2022 report, the pain reduction in patients varies from a 30 to 50% reduction, and the remaining are roughly 50%, refractory to treatment. This signifies an urgent need for further effective and accessible treatment options within the landscape of Canada's evolving neuropathic care.

Asia Pacific Market Insight

Asia Pacific is expected to be the fastest-growing market during the forecast period. Asian regions for peripheral neuritis treatment, particularly in the treatment of diabetic peripheral neuropathic pain (DPNP), have seen considerable development with the introduction of mirogabalin, a new gabapentinoid. To increase this growth further, it may besupported by increasing trends in clinical trial activities, coupled with growing populations of diabetic patients and rising expenditure on health care. Diagnosis and early intervention are further accelerated by government-sponsored awareness campaigns and infrastructure development.

The market for peripheral neuritis treatment in China is growing. According to a study by NIH June 2025, owing to the DPNP being prevalent among 57.2% of the type 2 diabetic population. The analgesics, with the highest prescription rate of 48.44%, are followed by anti-inflammatory drugs at 47.16% and acupuncture at 16.02%. The health-care costs for patients increased tremendously from 4,112.94 CNY to 7,489.36 CNY per year postdiagnosis. Government insurance accounts for 60.25% coverage of patients, thereby inculcating affordability and access. Treatment is concentrated in Tier 2 and Tier 3 hospitals and is based on their advanced care. Somewhat limited but growing R&D attempts aim at combining these physical therapies to give the best treatment results.

The peripheral neuropathy market in India is growing owing to increased incidents of diabetes and its associated complications, such as diabetic peripheral neuropathy. The increase in awareness and government programs supporting the early screening and treatment has created demand for the various neuropathic therapeutics, which include analgesics, antioxidants, and neuroprotective agents. Certain new agents designed to have positive effects on nerve regeneration and pain relief are subject to clinical trials. In Indian markets, pricing is competitive as the generics hold the majority of the share, as they are looked upon as the cheapest.

Europe Market Insight

The peripheral neuritis treatment market in Europe is expected to grow considerably during the forecast period. According to Eurostat November 2024, among the EU countries, Germany (12.6%), France (11.9%), and Austria (11.2%) had the highest healthcare expenditure in present as per the GDP in 2022. This highlights the importance of using standardized scoring tools for accurately assessing neurological disability, which can guide appropriate treatment decisions and help evaluate the impact on patients. Incorporating these supports the need for advanced diagnostics and targeted therapies in the market by early intervention and improved patient outcomes.

UK market experiences an inflow of funds from international research collaborations, especially among leading countries such as Germany and the Netherlands. The market experiences an inflow of funds from international research collaborations. Its huge collaborations with the US team, Canadian territories, and Qatar drive innovation and clinical trial activity in the field. Growth in the UK market is driven by widening awareness and demand for treatment, with ongoing trials for the various forms of peripheral neuritis. Pricing is somewhere between the treatment armory and what the healthcare system might be able to reimburse.

The peripheral neuritis treatment market in Germany is increasing based on clinical research, collaborative networks, and a well-established health-care system. The country emphasizes neurology and endocrinology, ensuring that it nurtures the development of diagnostic tools and treatments relating to the management of diabetic-related neuropathies. According to Eurostat November 2024, Germany had the highest healthcare expenditure valued at 489 billion euros in 2022 among the EU countries. Other growth-promoting factors include increased awareness, early diagnosis programs, and investment in personalized medicine. The regulatory framework and health insurance coverage promote greater patient access to these new therapies. Besides, when it comes to participation in multinational clinical trials, Germany is a key player, further strengthening its position in orchestrating treatment standards and influencing regional market trends.

Historical Healthcare Expenditure for Countries in Europe

|

Year |

Germany (€ million) |

France (€ million) |

Italy (€ million) |

Spain (€ million) |

Netherlands (€ million) |

Sweden (€ million) |

|

2014 |

322,775 |

247,767 |

144,317 |

93,831 |

70,964 |

48,043 |

|

2015 |

338,638 |

251,497 |

146,613 |

98,363 |

72,956 |

49,212 |

|

2016 |

352,397 |

256,712 |

147,963 |

99,729 |

74,352 |

50,601 |

|

2017 |

370,023 |

264,935 |

150,697 |

104,103 |

75,884 |

51,774 |

|

2018 |

386,123 |

270,562 |

153,790 |

106,321 |

77,552 |

54,021 |

|

2019 |

407,025 |

276,520 |

155,524 |

120,093 |

80,542 |

56,421 |

|

2020 |

431,941 |

279,815 |

159,892 |

123,690 |

86,952 |

60,421 |

|

2021 |

466,713 |

307,568 |

170,278 |

130,661 |

96,862 |

59,160 |

|

2022 |

488,677 |

313,574 |

175,719 |

131,114 |

98,367 |

59,110 |

Source: Eurostat, November 2024