Perforating Gun Market Outlook:

Perforating Gun Market size was over USD 1.9 billion in 2025 and is estimated to reach USD 3.5 billion by the end of 2035, expanding at a CAGR of 7.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of perforating gun is evaluated at USD 2 billion.

The international perforating gun market is a severe segment within the well completion ecosystem, positively influencing hydrocarbon ultimate recovery and flow initiation. The market’s growth is further characterized by a consolidated competitive landscape and increased technological intensity. In addition, the upliftment is associated with industrial shifting priorities, reservoir complexity, and upstream capital spending. For instance, according to an article published by the ITA in January 2024, Aramco generated a net income of SAR 604.0 billion (USD 161.1 billion) as of 2022, permitting the organization to expand its balance sheet and focus on an ambitious capital spending program. Moreover, the organization sold a 49% stake in its very own gas pipeline network for USD 15.5 billion in February 2022, and later in March 2023, settled a capital expenditure objective of USD 45 billion to USD 55 billion. Besides, the profit generation by other companies also makes it suitable for bolstering the market’s growth and expansion.

Profit Earning Oil and Gas Organizations (2024)

|

Company Name |

Profit Per Minute |

Latest Quarter |

Previous Year |

5 Years Profit |

10 Years Profit |

|

ExxonMobil |

USD 55,812 |

USD 7,394,000,000 |

USD 33,464,000,000 |

USD 152,738,000,000 |

USD 224,886,000,000 |

|

Total Energies |

USD 33,258 |

USD 4,406,000,000 |

USD 18,264,000,000 |

USD 99,756,000,000 |

USD 154,526,000,000 |

|

Shell |

USD 27,634 |

USD 3,661,000,000 |

USD 23,716,000,000 |

USD 115,971,000,000 |

USD 188,232,000,000 |

|

Chevron |

USD 27,415 |

USD 3,632,000,000 |

USD 18,256,000,000 |

USD 95,271,000,000 |

USD 132,450,000,000 |

|

bp |

USD 8,824 |

USD 1,169,000,000 |

USD 8,915,000,000 |

USD 57,529,000,000 |

USD 94,898,000,000 |

Source: Energy Profits Organization

Furthermore, the digitalized integration, engineered completions, innovation in Green perforating technology, transition toward operational safety and efficiency, technological sovereignty, and supply chain localization are other drivers that are bolstering the perforating gun market. As per a report published by the UNCTAD Organization in 2025, based on digitalization, frontier technologies are rapidly making advancements, with an industrial size projected to be worth USD 16.4 trillion by the end of 2033. In addition, 100 organizations are significantly responsible for more than 40% of global business investment in research and development. Besides, these technologies demonstrate USD 2.5 trillion as of 2023, which is further expected to witness a 20% compounded yearly growth rate. Therefore, with continuous growth in such technologies, there is a huge growth opportunity for the overall market globally.

Key Perforating Gun Market Insights Summary:

Regional Highlights:

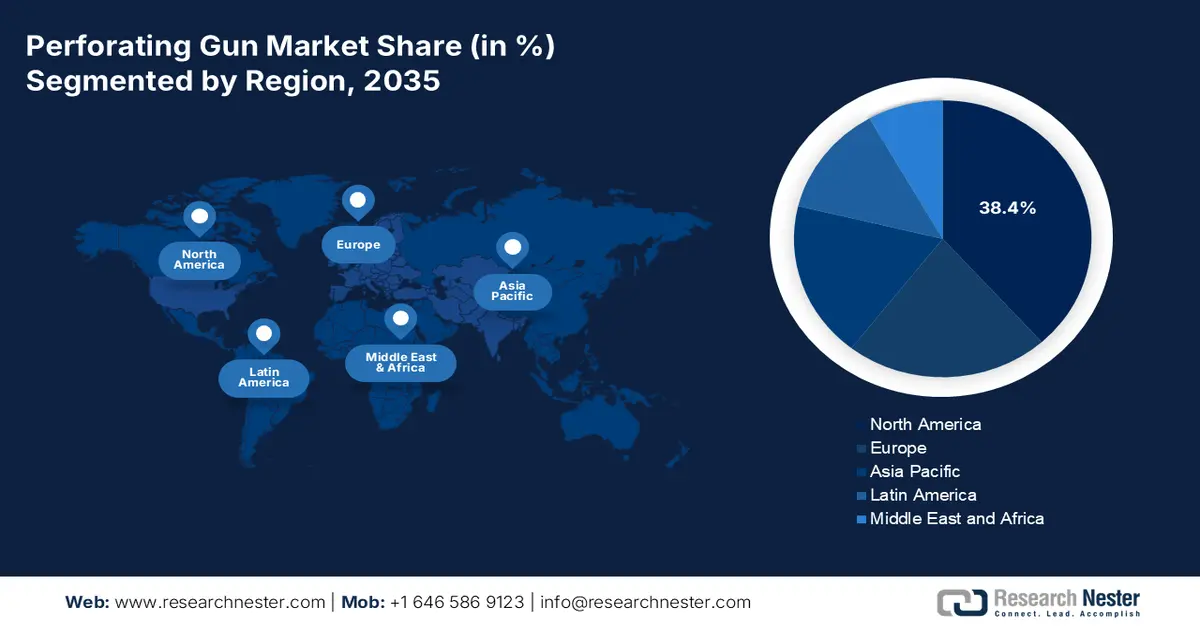

- North America is anticipated to command a 38.4% share in the perforating gun market by 2035, uplifted by intensified focus on completion efficiency and investments aimed at maximizing estimated ultimate recovery per well.

- By 2035, Asia Pacific is set to emerge as the fastest-growing region, supported by expanding shale gas development, rising offshore activities, and escalating domestic production targets across key countries.

Segment Insights:

- The horizontal wells segment is projected to account for a 62.8% share by 2035 in the perforating gun market, propelled by its ability to enhance reservoir contact and recovery across tight formations.

- The wireline conveyed sub-segment is expected to secure the second-largest share by 2035, bolstered by its precision, operational flexibility, and reduced rig-related costs.

Key Growth Trends:

- Increased demand for enhanced recovery in mature fields

- Exploration in deepwater and ultra-deepwater

Major Challenges:

- Technological commoditization and intensified competitive pressure

- Environmental and regulatory compliance burden

Key Players: Halliburton (U.S.), Schlumberger Limited (SLB) (U.S.), NOV Inc. (U.S.), DynaEnergetics (A subsidiary of Enpro Industries) (U.S.), Hunting PLC (U.K.), Baker Hughes (U.S.), Core Laboratories (U.S.), SAZ Oilfield Services (Saudi Arabia), Shaanxi FYPE Rigid Machinery Co., Ltd. (China), Oil States International, Inc. (U.S.), Sinopec Oilfield Service Corporation (China), CNPC Bohai Drilling Engineering Company Limited (China), Promperforator (Russia), G&H Diversified Manufacturing, L.P. (U.S.), GULF ENERGY SAOC (Oman), Groupe OFFP (France), GIV Energy Solutions (UAE), GWR Global Well Rehabilitation (Canada), Tassaroli S.A. (Argentina), Hexagon Energy Technologies Limited (Australia).

Global Perforating Gun Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 3.5 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Saudi Arabia, Canada, Russia

- Emerging Countries: India, Brazil, United Arab Emirates, Indonesia, Australia

Last updated on : 9 December, 2025

Perforating Gun Market - Growth Drivers and Challenges

Growth Drivers:

- Increased demand for enhanced recovery in mature fields: The international pivot towards expanding the life of current and frequently declining assets is a primary driver for the perforating gun market internationally. Besides, innovative perforating techniques, such as extreme and oriented overbalanced perforating, are crucial for optimizing recovery factors and readily accessing bypassed reserves in mature basins. According to an article published by Energy in September 2023, at present, enhanced oil recovery methods are crucial for keeping the field output at a level of almost 200 million tons per year in China. Furthermore, heavy oil reserves cater to over 2/3 of the overall volume of reserves, thus denoting an optimistic outlook for proliferating the market across different nations.

- Exploration in deepwater and ultra-deepwater: The presence of high-value offshore projects, especially across regions such as West Africa, the Gulf of Mexico, and Brazil, significantly demands high-performance and highly reliable perforating systems. These are capable of withstanding critical temperatures and pressures, thereby creating a technological and premium-driven segment in the perforating gun market. As per an article published by the U.S. Department of Energy in 2025, the Ultra-Deepwater and Unconventional Natural Gas and Other Petroleum Resources Research Program, which has been unveiled by the Energy Policy Act (EPAct), is regarded as a private and public partnership worth USD 400 million for more than 8 years. This has been designed for customers by creating technologies to enhance domestic gas and oil production in America to diminish reliance on foreign imports.

- Rising focus on CCUS: The emergence of carbon capture, utilization, and storage as a severe decarbonization pathway is creating a non-traditional and new demand stream. Besides, precise perforating is needed for developing suitable carbon dioxide injection walls and for verifying and monitoring activities in storage reservoirs, which is positively impacting the perforating gun market. According to a data report published by the IEA Organization in April 2025, there has been just more than 50 million tons of carbon dioxide storage and capture capacity in operation. However, this capture capacity is expected to reach nearly 430 million tons per year by the end of 2030. Meanwhile, the storage capacity is also projected to reach almost 670 million tons within the same year, denoting a 10% surge, thus driving the market’s demand internationally.

Challenges:

- Technological commoditization and intensified competitive pressure: The perforating gun market is significantly characterized by intense competition that expands beyond the conventional oligopoly of integrated service organizations. While NOV, SLB, and Halliburton readily compete on the technology integration and global scale, they witness pricing pressure from low-cost and agile specialists, such as DynaEnergetics, which tend to disrupt the market with efficient and standardized product platforms. Likewise, national and regional manufacturers in markets such as China, Russia, and the Middle East are increasingly improving their technical capabilities, which is supported by localized content policies that highly favor domestic suppliers, thereby driving a dangerous trend for the perforating gun market.

- Environmental and regulatory compliance burden: The perforating gun market operates under an increasingly strict and complicated web of national, local, and global regulations governing explosives handling, storage, utilization, and transportation. Besides, compliance with regulations from bodies, such as the U.S. Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF), along with the Department of Transportation (DOT), and other equivalent agencies globally, demands suitable administrative overhead, secure logistics, and specialized personnel by adding to generous operational expense. Meanwhile, more impactful is the increasing environmental, social, and governance (ESG) mandate, which has pushed for radical modifications in waste management and product design, thereby negatively impacting the perforating gun market.

Perforating Gun Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3.5 billion |

|

Regional Scope |

|

Perforating Gun Market Segmentation:

Well Type Segment Analysis

The horizontal wells segment, which is part of the well type, is anticipated to account for the largest share of 62.8% in the perforating gun market by the end of 2035. The segment’s upliftment is highly attributed to its ability to enable maximum reservoir contact, permitting guns to access production and long zones in tight formations. In addition, it also maximizes stimulated reservoir volume, intersects natural fractures, and ensures increased recovery and efficient multi-stage fracturing. According to an article published by the Visualizing Energy Organization in September 2023, there has been a surge in horizontal wells from 10% to over 80% of overall drilled wells. Besides, there has been a development of over 4 million wells, all of which are drilled in the U.S., intending to search for and extract oil and natural gas. Therefore, this denotes a huge growth opportunity for horizontal wells within the market globally.

Deployment Segment Analysis

By the end of 2035, the wireline conveyed sub-segment, which is part of the deployment segment, is projected to garner the second-largest share in the perforating gun market. The sub-segment’s growth is highly driven by its fundamental benefits in operational cost-effectiveness, precision, and efficiency for a huge majority of well types. This particular method comprises the electric line or slickline usage to lower the gun assembly into the wellbore, permitting standard depth control through gamma ray correlation or casing collar locators. Additionally, its primary strength remains in flexibility and speed, and it does not demand a workover rig or drilling, which drastically diminishes operational cost time in comparison to tubing-conveyed methods. Therefore, with all these capabilities, there is an increased exposure for the segment across different locations.

Application Segment Analysis

Based on the application, the shale/tight oil and gas segment in the perforating gun market is expected to account for the third-largest share during the forecast duration. The segment’s development is highly fueled by its ability to serve as the volume engine for the international market. The segment’s growth is further directly connected to the completion intensity and factory-mode drilling of multi-well pads, especially in North America-based basins, such as the Permian. Besides, each long lateral well demands huge individual perforating runs as a part of the multi-stage plug-and-perforate fracturing process. This creates repetitive and immense need for high-shot-density and dependable guns. Moreover, the aspect of economic optimization caters to operators seemingly seeking perforating systems that increase cluster efficacy and ensure effective fracture initiation.

Our in-depth analysis of the perforating gun market includes the following segments:

|

Segment |

Subsegments |

|

Well Type |

|

|

Deployment |

|

|

Application |

|

|

Explosive Type |

|

|

Well Depth |

|

|

Gun Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Perforating Gun Market - Regional Analysis

North America Market Insights

North America in the perforating gun market is anticipated to garner the highest share of 38.4% by the end of 2035. The market’s upliftment in the region is highly attributed to the relentless focus on completion efficacy and well productivity. Besides, with premium drilling inventory emerging to be concentrated, operators are generously investing in innovative perforating technologies, with the intention of maximizing estimated ultimate recovery per well. For instance, in September 2024, the U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) collaborated with DOE’s Office of Energy Efficiency and Renewable Energy (EERE) and declared nearly USD 19.5 million in federal funding. The purpose is to initiate advancement in technologies that are suitable for diminishing expenses for recovering critical materials and minerals. Moreover, the organization has proposed additional funds, ranging from USD 500,000 to USD 2.5 million, which is also uplifting the perforating gun market.

DOE Additional Fund Provision for Advanced Technologies (2024)

|

Approximate Federal Fund |

Expected Individual Fund Size |

Maximum DOE Share of Fund |

||

|

DOE Share (USD/%) |

Cost Share (USD/%) |

Overall Amount (USD) |

||

|

USD 5,000,000 |

2,500/80 |

625/20 |

3,125,000 |

USD 2,500,000 |

|

USD 5,000,000 |

2,500/80 |

625/20 |

3,125,000 |

USD 2,500,000 |

|

USD 7,500,000 |

3,750/80 |

937.5/20 |

4,687,500 |

USD 3,750,000 |

|

USD 2,000,000 |

500/80 |

125/20 |

625,000 |

USD 500,000 |

|

Total: USD 19,500,000 |

|

|

24,375,000 |

|

Source: U.S. Department of Energy

The U.S. in the perforating gun market is growing significantly, owing to material security, advanced manufacturing, safety and environmental regulations driving research and development, along with carbon management and clean energy strategies. As per an article published by the Clean Energy Ministerial Organization in January 2025, based on the Bipartisan Infrastructure Law, USD 12 billion has been allocated for carbon management strategies, including USD 8 billion for regional clean hydrogen centers. This is extremely crucial since perforating guns are essential for injecting well and ensuring monitoring in CCUS projects, thus creating a non-conventional and new growth opportunity as well as expansion for the market in the country.

Canada, in the perforating gun market, is also growing due to the unconventional resource development in the Duvernay and Montney formations, the adoption of oil sands in-situ recovery methods, administrative emphasis on well abandonment and integrity, and export-driven LNG projects. As stated in an article published by the Government of Canada in October 2025, the natural gas production in the country has surpassed records, accounting for 18.3 billion cubic feet per day. In addition, the overall domestic production has been strong between January and May, averaging 19.2 billion cubic feet per day. Besides, Alberta has emerged as the top-producing province, constituting for almost 59.7% of the country’s natural gas output as of 2024. British Columbia followed with 38.6%, Saskatchewan catered to 1.6%, and the rest of the nation readily produced 0.1%, thus making it suitable for bolstering the overall perforating gun market.

APAC Market Insights

The Asia Pacific in the perforating gun market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by the sustained shale gas development in China, Indonesia and Australia’s significant offshore conventional and LNG activity, and India’s strong domestic production targets. According to an article published by NLM in April 2025, the shale gas production in China has been growing continuously by 21% with a long-lasting national energy approach, hence driving the market’s expansion. This continued production is highly driven by the demand for more than 6,000 newest wells, which are drilled within the Yangtze River Basin in South China. Besides, this country comprises 134 trillion cubic meters of geological reserves, along with 25 tcm of technologically recoverable reserves, thereby denoting an optimistic outlook for the perforating gun market in the overall region.

China in the perforating gun market is gaining increased traction, owing to the aspect of an unwavering national energy security strategy. Besides, as per an article published by China Government in March 2022, the country has aimed to ensure the yearly domestic energy production capacity of more than 4.6 billion tons of standard coal by the end of 2025. In addition, the yearly crude oil is projected to stabilize and recover at 200 million tons, while the annual natural gas output is poised to reach more than 230 billion cubic meters by the same year. Therefore, based on these objectives, the nation is equally seeking to diminish its carbon dioxide emissions per unit by 18% within 5 years. Moreover, plans have been initiated to enhance the non-fossil energy consumption share to nearly 20% by 2025, thus bolstering the overall market in the country.

India, in the perforating gun market, is also developing due to the urgent production enhancement and the potential mix of policy-based exploration acceleration. Additionally, the government’s Hydrocarbon Exploration and Licensing Policy (HELP), as well as the ongoing pressure on ONGC/OIL to uplift domestic production, are also fueling the market in the country. According to a data report published by the PPAC Government in July 2023, the country has a capacity of 5,045,000 barrels daily as of 2022, denoting a 17.9% change since 2012, along with an addition of 766,000 barrels. Besides, the domestic gross production of natural gas has increased by 0.8% between 2022 and 2023. In addition, this surge has been possible from 10.5% of PSC/JVs fields and 3.9% from nomination fields. Besides, an upsurge in petroleum products is also bolstering the market’s growth in the country.

Yearly Self-Sufficiency in Petroleum Products in India (Million Metric Ton)

|

Components |

2018-2019 |

2019-2020 |

2020-2021 |

2021-2022 |

2022-2023 |

|

Indigenous crude oil processing |

31.7 |

29.3 |

28.0 |

27.0 |

26.5 |

|

Products from indigenous crude |

29.6 |

27.3 |

26.1 |

25.2 |

24.7 |

|

Products from Fractionators |

4.9 |

4.8 |

4.2 |

4.1 |

3.5 |

|

Overall production from indigenous crude and condensate |

34.5 |

32.1 |

30.3 |

29.3 |

28.2 |

|

Total domestic consumption |

213.2 |

214.1 |

194.1 |

201.7 |

223.0 |

|

Self-sufficiency% |

16.2 |

15.0 |

15.6 |

14.5 |

12.6 |

Source: PPAC Government

Europe Market Insights

Europe in the perforating gun market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by the aspect of managed decline and late-life asset optimization, in comparison to expansion in greenfield. In addition, extension in well life programs, especially in the mature North Sea, along with plugging and abandonment activities, which are deliberately mandated across the region. Besides, according to an article published by the IEA Organization in 2025, the regions’ overall oil supply accounts for 24,138,874 TJ, along with constituting to a 13% in the global share as of 2023. Moreover, Germany caters to 3,495,542 TJ capacity and 14.5% in share, which is followed by 2,694,699 TJ and 11.2% in France, and 2,164,221 TJ and 9.0% in the UK, thereby making it suitable for the market’s upliftment and demand.

The perforating gun market in Russia is gaining increased exposure due to the sheer upscale of its traditional onshore, as well as the Arctic resource base, which has necessitated the ongoing workover and drilling operations to effectively maintain production levels. Besides, the Ministry of Energy of the Russia-based Federation has significantly outlined plans to sustain oil production by focusing on brownfield development and boosting oil recovery in West Siberia. This has translated to high-volume and consistent demand for perforating guns for both existing and new wells stimulation. Moreover, the aspect of technological sovereignty and import substitution is considered the dominating trend, along with domestic players, such as Rosneft and Tatneft, strongly localizing the standard supply chain for completion tools, thus proliferating the perforating gun market in the country.

The perforating gun market in Norway is also growing, owing to the escalated P&A of the aging infrastructure and large-scale Carbon Capture and Storage. According to an article published by the Norway Government in June 2025, carbon dioxide in the country is significantly transported by ship and also safely stored 2,600 meters beneath the Øygarden seabed. In addition, based on the Lordship project, 1.5 million tons of carbon dioxide are stored during the Phase 1 every year, which is poised to increase the capacity by more than 5 million tons per year. Besides, the overall region has identified Northern Lights as a Project of Common Interest by generously enabling €131 million in investment from the Connecting Europe Facility (CEF). Therefore, with such progress and funding provision, there is a huge growth opportunity for the market in the overall country.

Key Perforating Gun Market Players:

- Halliburton (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schlumberger Limited (SLB) (U.S.)

- NOV Inc. (U.S.)

- DynaEnergetics (A subsidiary of Enpro Industries) (U.S.)

- Hunting PLC (U.K.)

- Baker Hughes (U.S.)

- Core Laboratories (U.S.)

- SAZ Oilfield Services (Saudi Arabia)

- Shaanxi FYPE Rigid Machinery Co., Ltd. (China)

- Oil States International, Inc. (U.S.)

- Sinopec Oilfield Service Corporation (China)

- CNPC Bohai Drilling Engineering Company Limited (China)

- Promperforator (Russia)

- G&H Diversified Manufacturing, L.P. (U.S.)

- GULF ENERGY SAOC (Oman)

- Groupe OFFP (France)

- GIV Energy Solutions (UAE)

- GWR Global Well Rehabilitation (Canada)

- Tassaroli S.A. (Argentina)

- Hexagon Energy Technologies Limited (Australia)

- Halliburton is considered a market leader, well known for its very brand portfolio, which comprises the H1 Perforating System and in-depth expertise in complicated completions, especially in North America's deepwater and shale markets internationally. The organization readily drives innovation through integrated service provisions and digitalized perforating solutions that tend to improve well performance. Based on this, and as stated in its 2024 annual report, the organization generated USD 22,944 million in revenue, USD 19,122 million in total operating expenses, USD 3,822 million in operating income, and USD 3,234 million in income before taxes.

- Schlumberger Limited (SLB) is regarded as the dominating technology, as well as an integration leader, providing high-performance perforating systems, such as the Spectra and PURE charges, along with excelling in complicated international projects and deepwater through its Well Services segment. The company’s strategy focuses on digitalized integration, associating perforating data with the reservoir as well as fraction models to enhance recovery.

- NOV Inc. is regarded as the technological and premier equipment provider since its completion tools segment readily supplies strong and reliable perforating systems, along with related downhole hardware, to the international client base. The organization has leveraged its huge engineering expertise and manufacturing scale to serve both independent operators and major integrated service companies. Therefore, as stated in its annual report, published in April 2025, the organization’s energy equipment increased revenue by 5% and adjusted EBITDA by 30%, leading to a 250-basis-point optimization in margin.

- DynaEnergetics is regarded as one of the most renowned innovators, especially well-known for pioneering the implementation of its affordable, reliable, and safe dx|Perf integrated single-trip perforating and gun system. The organization has also focused on operator-friendly and modular designs that tend to enhance safety and efficiency in conventional operations and shale development.

- Hunting PLC is a notable international manufacturer of precision-based perforating guns, associated components, and shaped charges, with a robust technological presence in the titanium charge liner market. The organization is well-known for its debris-control and high-quality solutions, and significantly serves as a critical technological partner and supplier to other major service organizations globally.

Here is a list of key players operating in the global perforating gun market:

The worldwide perforating gun market is an oligopoly, which is readily dominated by a few integrated service organizations, such as NOV, SLB, and Halliburton, which are leveraging international scale, in-depth research and development, as well as full-service portfolios. Moreover, tactical strategies are focused on digitalized integration and technological differentiation in high-value segments, which are associating perforating data with fraction designs. Notable trends, including consolidation among small players, supply chain sovereignty, and a push for local manufacturing in certain regions, such as Asia and the Middle East, are also driving the market. Besides, in January 2025, Halliburton declared a contract from Petrobras for successfully integrating drilling services across different offshore fields in Brazil. Based on this contract, the organization provides the iCruise intelligent rotary steerable system (RSS) for diminishing well placement and time appropriately, along with the LOGIX remote and automation operations platform to optimize construction consistency.

Corporate Landscape of the Perforating Gun Market:

Recent Developments

- In October 2025, Baker Hughes notified a deal from Aramco to readily ensure expansion in its integrated and underbalanced coiled tubing drilling operations, especially across Saudi Arabia’s natural gas fields.

- In September 2024, GEODynamics announced the introduction of its EPIC Orbit Perforating System, which has the capability of the EPIC Flex suite of solutions. Additionally, these systems offer completely customizable options to integrate addressable charges, detonating cords effectively, and switches from any OEM.

- Report ID: 8289

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perforating Gun Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.