Pectin Market Outlook:

Pectin Market size was valued at USD 1.47 billion in 2025 and is set to exceed USD 2.79 billion by 2035, expanding at over 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pectin is estimated at USD 1.56 billion.

The pectin market is growing steadily, driven by increasing demand for natural and clean-label ingredients in food and beverage products. Rising health consciousness among consumers is boosting the use of pectin as a natural thickener, stabilizer, and gelling agent, especially in products such as yogurts, jams, confectionery, and beverages. According to the OEC data, 2023, Pectic substances, pectinates, pectates ranked 2157 in global trade value, out of the 4644 products traded in 2023. Additionally, the growing popularity of organic foods is further fueling the demand for pectin derived from citrus fruits and apples.

The OEC 2023 data further states that trade in the pectic substances category expanded at an annualized rate of 1.59% in the last five years. The top exporters of these substances in 2023 were Germany with USD 209 million worth of exports, Denmark with USD 161 million, and Brazil with USD 93.4 million worth of exports. Moreover, companies are investing in sustainable sourcing, innovative product formulations, and regional production facilities to meet regulatory standards and cater to diverse industry needs. These drivers collectively position pectin as a critical ingredient across multiple sectors, including food, pharmaceuticals, and cosmetics.

Key Pectin Market Insights Summary:

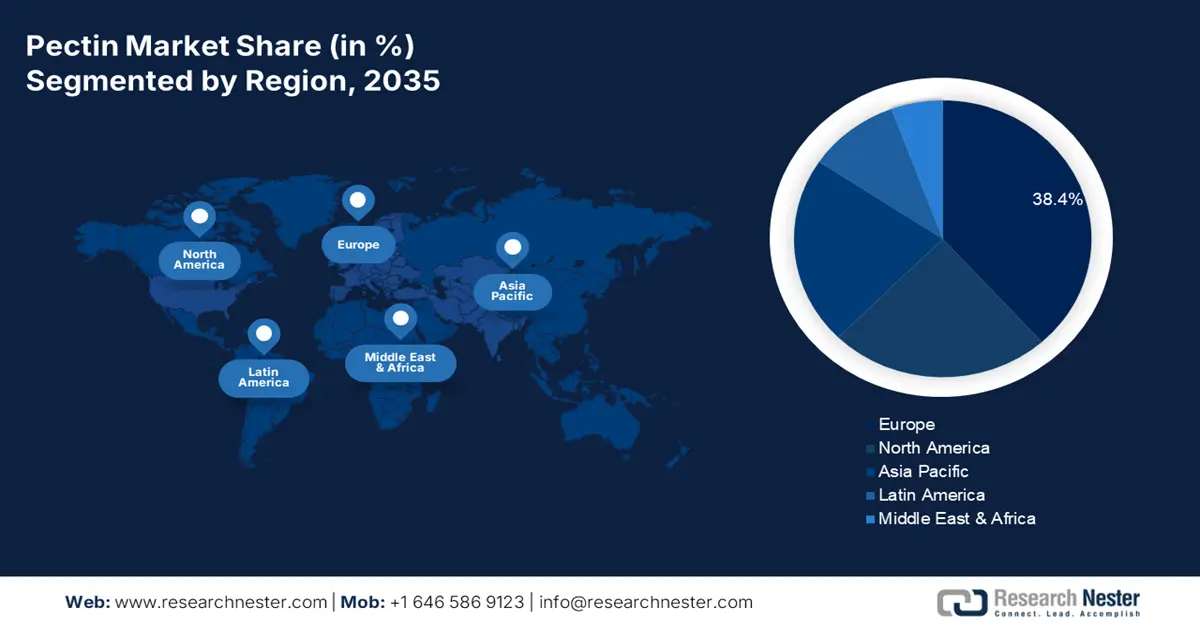

Regional Highlights:

- Europe pectin market is poised to capture 38.4% share by 2035, driven by robust regulatory frameworks demanding high-quality standards for food additives.

Segment Insights:

- The gelling agent function type segment in the pectin market is expected to experience considerable growth during 2026-2035, driven by increasing preference for clean-label and natural ingredients in food products.

- The food & beverage segment in the pectin market is anticipated to hold a significant share from 2026-2035, driven by rising demand for probiotic-rich yogurts and fortified drinks.

Key Growth Trends:

- Increasing global demand for processed foods

- Rising demand for natural thickeners and stabilizers

Major Challenges:

- Regulatory and quality compliance

Key Players: DuPont, B&V srl, Ceamsa, Yantai Andre Pectin Co. Ltd., CP Kelco, Naturex, Silvateam, Tate & Lyle, Herbstreith & Fox.

Global Pectin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.47 billion

- 2026 Market Size: USD 1.56 billion

- Projected Market Size: USD 2.79 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Denmark, France

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 8 September, 2025

Pectin Market Growth Drivers and Challenges:

Growth Drivers

- Increasing global demand for processed foods: The global rise in consumption of processed foods such as jams, jellies, yogurts, bakery products, and ready-to-drink beverages has significantly driven the demand for pectin. To cater to this growing demand, companies are expanding their production facilities, aiming to increase output and reduce lead times. For instance, in September 2021, Cargill announced the expansion of its new, cutting-edge pectin production facility, located in Bebedouro, Brazil, with investments of around USD 150 million, to meet growing global demand for the label-friendly texturizing ingredient.

- Rising demand for natural thickeners and stabilizers: With increasing health awareness and a shift towards clean-label products, consumers are seeking food items that contain natural, recognizable ingredients. For instance, in 2021, The Vegan Society stated that more than 16,439 products were registered with The Vegan Trademark. Pectin, being a plant-based, non-GMO thickener and stabilizer, fits perfectly into this trend.

Challenge

- Regulatory and quality compliance: Companies in the pectin market are expected to meet strict global food safety and quality standards set by bodies including the FDA, EFSA. Maintaining compliance requires heavy investments in testing, documentation, and facility upgrades. Frequent regulatory changes also demand continuous monitoring and adaptation. These challenges increase operational costs, slow product innovation, and create barriers for market expansion.

Pectin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 1.47 billion |

|

Forecast Year Market Size (2035) |

USD 2.79 billion |

|

Regional Scope |

|

Pectin Market Segmentation:

Function Type Segment Analysis

The gelling agent segment in pectin market is anticipated to expand at a considerable rate by 2035 due to its essential role in creating the desired texture and consistency. Pectin’s natural gelling properties make it a preferred choice over synthetic alternatives, aligning with the growing demand for clean-label and natural ingredients. As the popularity of fruit-based spreads and desserts rises, the demand for pectin as a gelling agent continues to drive market growth.

Application Segment Analysis

Food & beverage segment is anticipated to register a significant share during the forecast period in the pectin market. Probiotic-rich yogurts and fortified drinks, where pectin is used as a natural stabilizer and thickener, are driving the segment’s expansion. Prominent players are also engaging in several market strategies in the food and beverage industry for better access to consumers. For instance, in November 2024, Tate & Lyle announced the acquisition of CP Kelco subsidiaries, including U.S., China, and CP Kelco ApS.

Our in-depth analysis of the global pectin market includes the following segments:

|

Function Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pectin Market Regional Analysis:

Europe Market Insights

Europe region is poised to dominate around 38.4% market share by 2035, a robust regulatory framework that demands high-quality standards for food additives. OEC data 2023 shows that Russia was one of the major importers of pectic substances with USD 55 million worth of exports. Moreover, the region’s consumers are highly receptive to innovations in food texture and tastes, leading to increased use of pectin in a variety of applications, including dairy and confectionery.

France market is influenced by the country’s rich culinary heritage, with an emphasis on high-quality fruit preserves and gourmet food products. France’s stringent food safety regulations and a preference for natural ingredients create a favourable environment for pectin usage in artisanal and industrial food production. The strong presence of key food manufacturers, particularly in the jam and confectionery sectors, drives local demand. According to OEC 2023, France witnessed around USD 54.3 million worth of pectin substances imports.

North America Market Insights

North America pectin market is driven by increasing consumer awareness of health and wellness trends. The shift towards low-sugar, gluten-free, and clean-label products has created a surge in demand for pectin as a natural ingredient in a variety of food products. Furthermore, the strong presence of global pectin suppliers and manufacturers in North America facilitates innovation and product diversification.

The U.S. market is boosted by a diverse food industry where pectin is widely used in everything from jams and beverages to confectionery and dairy products. OEC 2023 stated that the U.S. was the largest importer of pectin substances, with a total of USD 137 million worth of imports. The country’s large-scale food processing industry drives the demand for pectin as a cost-effective and versatile ingredient. Additionally, the U.S. has witnessed a growing trend toward plant-based and vegan alternatives, creating new avenues for pectin usage in non-dairy products.

Pectin Market Players:

- DuPont

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B&V srl

- Ceamsa

- Yantai Andre Pectin Co. Ltd.

- CP Kelco

- Naturex

- Silvateam

- Tate & Lyle

- Herbstreith & Fox

Key players in the pectin market adopt strategies such as investing heavily in research and development to create high-quality, customized pectin solutions for various industries, especially food and beverages. Expanding their production capacities, forming strategic partnerships with fruit processors, and acquiring smaller firms to strengthen their supply chains are a few of the focus points of the market players. Some of the key players in the market are:

Recent Developments

- In December 2024, CandyPros launched a plant-based gummy, Naked Gold Pectin Gummy Base, designed to replace traditional gelatin-based options

- In September 2023, Cargill launched a new range of LM conventional (LMC) pectins, developed organically with proprietary technology to deliver novel texture.

- Report ID: 1309

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pectin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.