PCB Connector Market Outlook:

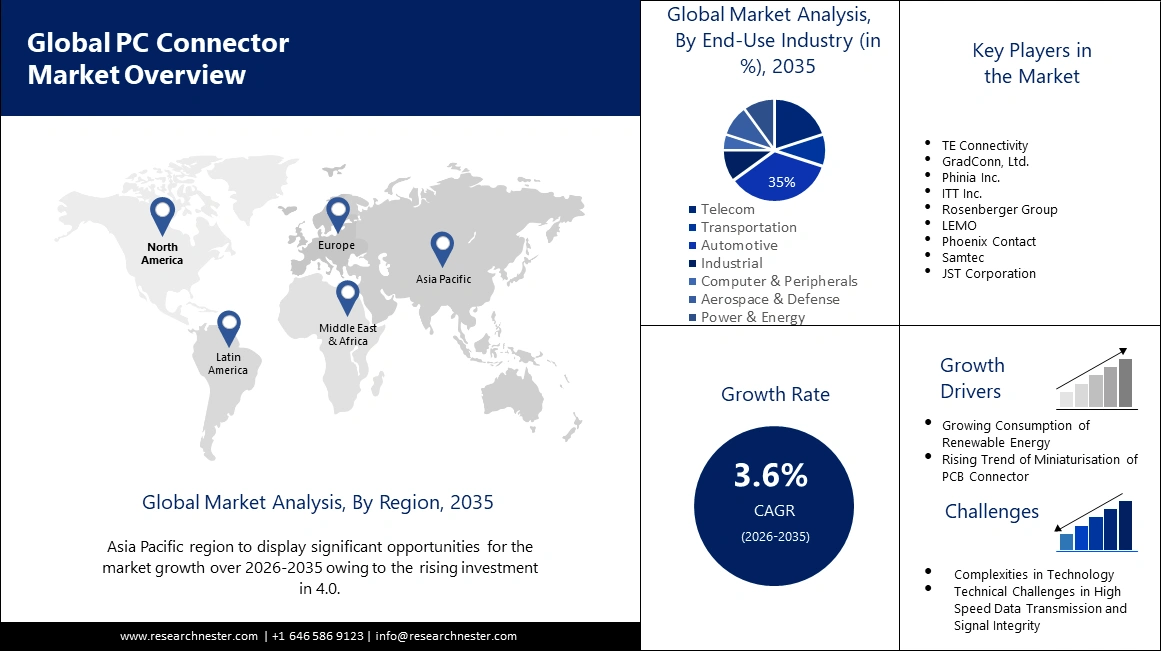

PCB Connector Market size was over USD 10.29 billion in 2025 and is anticipated to cross USD 14.66 billion by 2035, growing at more than 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of PCB connector is assessed at USD 10.62 billion.

The major factor that dominates the market revenue is the growing demand for electric vehicles. Global sales of electric vehicles exceeded over 9 million in 2022, and this year's sales are predicted to increase by another about 34% to close to 13 million. Hence, the demand for PCB connectors is also growing. PCBs are a crucial component of electric vehicles, providing connections between the vehicle's many electrical components. They work great in electric cars as they are more compact, dependable, and lighter than conventional wire.

Furthermore, in various nations, governments are working towards encouraging the adoption of electric vehicles through several schemes and offers. Also, there is great investment in the development of EV charging stations which is further expected to boost the market expansion for PCB connectors.

Key PCB Connector Market Insights Summary:

Regional Highlights:

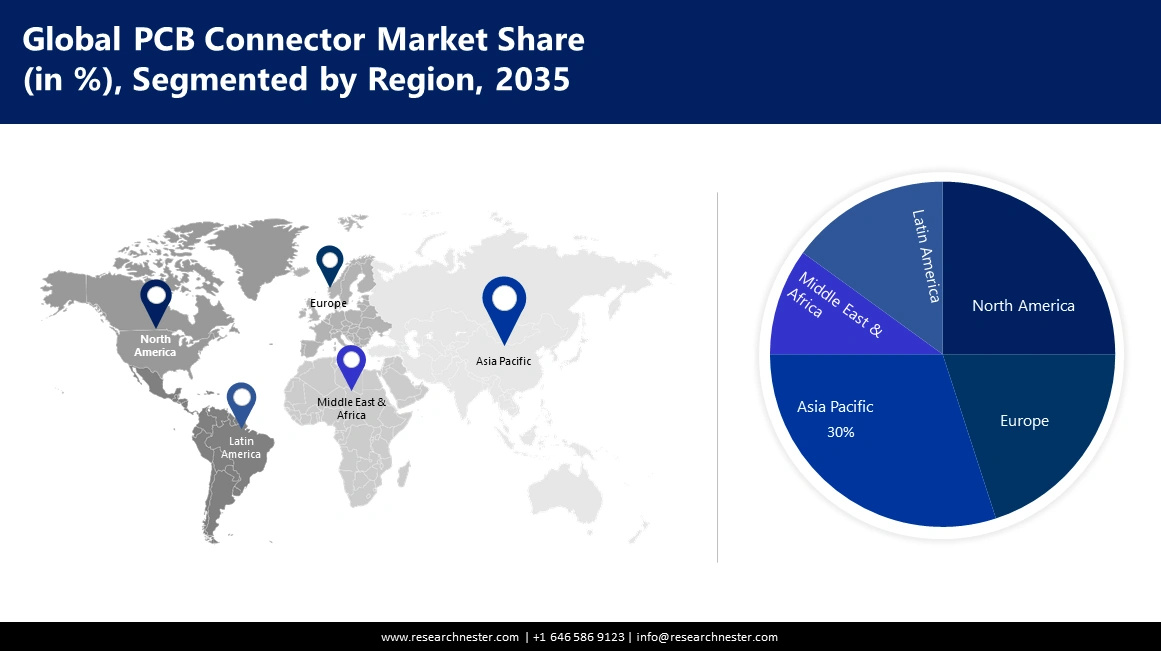

- Asia Pacific pcb connector market is expected to capture 30% share, driven by rising investment in Industry 4.0 and electric vehicles, forecast period 2026–2035.

Segment Insights:

- The automotive segment in the pcb connector market is projected to hold a 35% share by 2035, driven by the increasing need for PCB connectors in advanced automotive electronics and autonomous systems.

- The board-to-board connectors segment in the pcb connector market is projected to hold a 30% share by 2035, influenced by increasing data centers and demand for high-speed, reliable connectivity.

Key Growth Trends:

- Growing Consumption of Renewable Energy

- Rising Trend of Miniaturisation of PCB Connector

Major Challenges:

- Growing Consumption of Renewable Energy

- Rising Trend of Miniaturisation of PCB Connector

Key Players: TE Connectivity Ltd., Molex, LLC (Koch Industries), Amphenol Corporation, Hirose Electric Co., Ltd., JAE Electronics, Inc., Samtec, Inc., Phoenix Contact GmbH & Co. KG, Wurth Elektronik GmbH & Co. KG, HARTING Technology Group, Kyocera Corporation.

Global PCB Connector Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.29 billion

- 2026 Market Size: USD 10.62 billion

- Projected Market Size: USD 14.66 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

PCB Connector Market Growth Drivers and Challenges:

Growth Drivers

- Growing Consumption of Renewable Energy -PV panels, wind turbines, and other renewable energy installations need PCB connections to connect different systems and parts. The power and energy sector is expanding as a result of the increasing shift to renewable energy sources and supportive government initiatives to address environmental issues. It is estimated that between 2022 and 2027, the world's renewable capacity will increase by almost over 2 399 GW, or nearly about 74%. PCBs for the renewable energy industry connect electrical components so that signals and power may travel to different devices, just as PCBs for other purposes. The renewable energy sector depends on power-producing devices with intricate electronics. These machines operate more efficiently due to PCBs, which control loads and processes and distribute electricity to numerous devices in an efficient manner. Hence, with the growing demand for renewable energy, the PCB connector market is growing.

- Rising Trend of Miniaturisation of PCB Connector -Smaller connections with more pins and high-density layouts are being designed as a result of the PCB connector trend toward miniaturization. The demand for more compact and smaller electronic gadgets, such as wearables is the driving force behind this. Miniaturized connectors improve the overall appearance and mobility of the gadget in addition to saving space. To accomplish this, manufacturers are employing sophisticated materials and manufacturing processes, which enable them to connect several components in constrained places while guaranteeing dependable electrical connections. Custom connectors or connectors with intricate geometries are being produced by experimenting with innovations in manufacturing processes, such as 3D printing.

- Surge in Automation & Robotics -PCB connectors facilitate the simple transfer of power and signals between different parts, modules, and subsystems, which guarantees efficient coordination and communication in automation and robotics. Robotics installations are being driven by the growing requirement for increased productivity, increased precision, lower labor costs, and the capacity to handle complicated jobs with efficiency. This is driving up the need for PCB connectors proportionately.

Challenges

- Complexities in Technology - Board-to-board connectors must meet specific requirements for each application, including those related to power transfer, signal integrity, size restrictions, environmental factors, and mechanical considerations. Connector design and development that satisfies these particular specifications may be difficult and time-consuming. The constraints are further compounded by the quick speed at which technology is developing and the requirement for customization for various applications and sectors.

- Technical Challenges in High-Speed Data Transmission and Signal Integrity - Ensuring dependable signal transmission with low loss, distortion, and interference becomes essential as data transfer rates rise. These difficulties are caused by several variables, including material selection, connection crosstalk, insertion loss, reflection, crosstalk, impedance management, noise, EMI, skew, and timing problems. To meet these obstacles, manufacturers need to use sophisticated design approaches, exacting testing procedures, and premium materials. Delivering board-to-board connectors that satisfy the exacting standards of high-speed data transmission systems requires close customer collaboration and careful consideration of particular application requirements. To reduce the effects of noise, interference, and transmission mistakes, optimize signal routes, and enhance connector performance, ongoing research, and development are required.

- High Cost of PCB Connector

PCB Connector Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 10.29 billion |

|

Forecast Year Market Size (2035) |

USD 14.66 billion |

|

Regional Scope |

|

PCB Connector Market Segmentation:

Type Segment Analysis

The board-to-board connectors segment in the PCB connector market is projected to gather the highest revenue share of 30% during the forecast period. The growth of the segment is set to be influenced by the rise in several data centers. As of December 2023, there were roughly 10,976 data center installations worldwide. Hence, board-to-board connectors, with their polarized, flame-retardant housings that safeguard connections in challenging situations, offer dependable, high-speed data transfer with improved clarity to data centers. Further, there has been a surge in the integration of IoT and edge computing in board-to-board connectors. The demand for board-to-board connectors for enabling connectivity between devices, sensors, and edge computing modules is driven by the growing adoption of loT devices and edge computing solutions. This allows for connectors with specific properties such as low power consumption, secure connections, and strong designs for loT and edge computing applications. In the industrial sector, for instance, "edge computing" is used to monitor and manage manufacturing processes in real-time. At the network's edge, board-to-board connectors facilitate the efficient conveyance of data and decision-making by connecting sensors, actuators, and processing units.

End-Use Industry Segment Analysis

The automotive segment in the PCB connector market is projected to gather the highest revenue share of close to 35% in the coming years. Automotive electronics, including GPS, anti-lock brake systems, engine controls, rearview cameras, and front lights, employ PCB connectors. Additionally, with the growing demand for autonomous vehicles, the market is expected to grow more further. However, safety is one of the crucial factors in autonomous vehicles. Lane departure systems, sleepy driver alert systems, blind spot recognition, and other features are instances of safety features. Hence, PCB connectors are needed for these systems. PCBs inside the cabin regulate the interior climate, entertainment systems, and navigation.

Our in-depth analysis of the global PCB connector market includes the following segments:

|

Type |

|

|

Material |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

PCB Connector Market Regional Analysis:

APAC Market Insights

The Asia Pacific PCB connector market is projected to gather the highest revenue share of 30% in the coming years. The major factor to influences the market growth in this region is rising investment in 4.0. Spending on Industry 4.0 increased to about USD 5–7 billion in the Indian manufacturing industry in FY21. Moreover, the market is also projected to grow on account of rising investment in electric vehicles by countries including China, Japan, and India. Additionally, the demand for consumer electronics is also flourishing in this region which includes smartphones and more. Connectors in smartphones provide electricity from the battery to the processor, display, and other parts of the device. The modularity of electrical equipment is further enhanced by PCB connectors.

North American Market Insights

The PCB connector market in North America is also estimated to have notable growth during the forecast period. This growth could be owing to the growth in several key players indulged in manufacturing more advanced PCB connectors. Also, the demand for various gadgets including digital cameras, printers, and gaming consoles is high in this region owing to the growing disposable income of people. As a result, this factor is also projected to dominate the market expansion in this region.

PCB Connector Market Players:

- TE Connectivity

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GradConn, Ltd.

- Phinia Inc.

- ITT Inc.

- Rosenberger Group

- LEMO

- Phoenix Contact

- Samtec

- JST

Recent Developments

- A time-saving solution, the D-2970 Dynamic Series tiny wire-to-board PCB connector from TE Connectivity (TE), a leader in connectivity and sensors globally, features a field-installable push-in clamp termination mechanism. This unique connector offers versatility and simplicity for a range of applications by enabling dependable and efficient wire-to-board connections. The D-2970 Dynamic Series connector improves productivity and streamlines the PCB assembly process thanks to its small size and easy installation.

- I-PEX and GradConn are pleased to establish a global partnership for GradConn bulkhead connection cable assemblies and I-PEX MHF series micro connectors.

- In collaboration with TraceParts, one of the top CAD-content platforms for engineering worldwide, and HIROSE Electric Co., Ltd., a connector producer, over 10,000 ready-to-use 3D models for various Hirose PCB mountable connections have been made available.

- Report ID: 5669

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

PCB Connector Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.