Parametric Insurance Market Outlook:

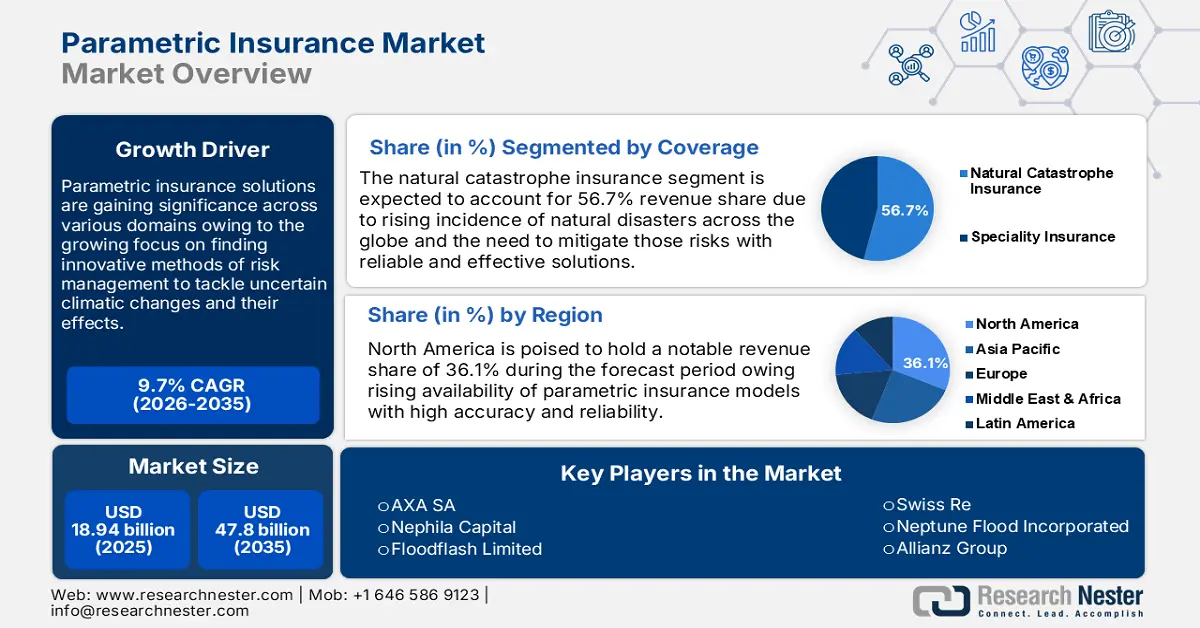

Parametric Insurance Market size was over USD 18.94 billion in 2025 and is anticipated to cross USD 47.8 billion by 2035, growing at more than 9.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of parametric insurance is assessed at USD 20.59 billion.

Parametric insurance is gaining traction in business and industry domains, with firms focusing more on derivation to innovative methods of risk management to tackle unforeseen climate and other related events. Contrasting with traditional method of compensation, parametric insurance offers a predetermined payout on an expected set of triggers, usually extreme weather events, natural disasters, or even other measurable occurrences. This streamlined approach allows for faster processing of claims and high transparency therefore, it holds a crucial place in the risk portfolio of those industries that face high environmental volatility and is driving high demand in the parametric insurance market.

Key drivers for this market are mounting natural disaster frequency and severity due to climate change, and increasing demand for quick financial recovery in agriculture, energy, construction, and tourism. Also, businesses are involving parametric insurance in their diversification strategy to manage rare. For instance, in September 2024, Tower, announced its partnership with CelciusPro to launch a trendsetting IT platform to streamline the parametric insurance distribution.