Paralleling Switchgear Market Outlook:

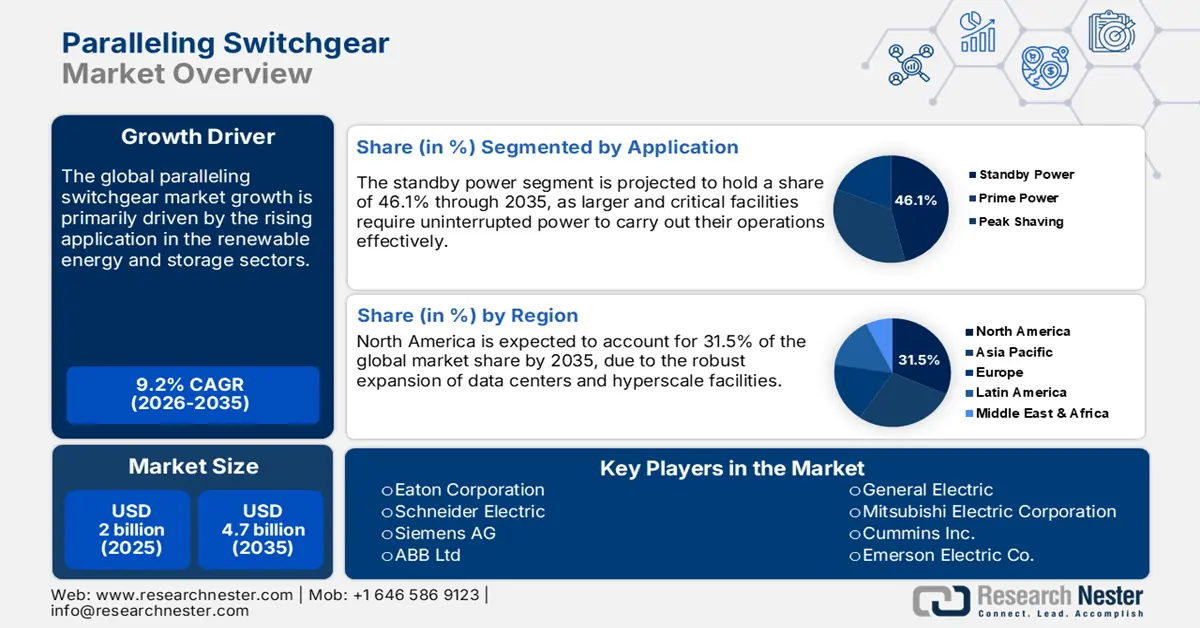

Paralleling Switchgear Market size was USD 2 billion in 2025 and is estimated to reach USD 4.7 billion by the end of 2035, expanding at a CAGR of 9.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of paralleling switchgears is assessed at USD 2.1 billion.

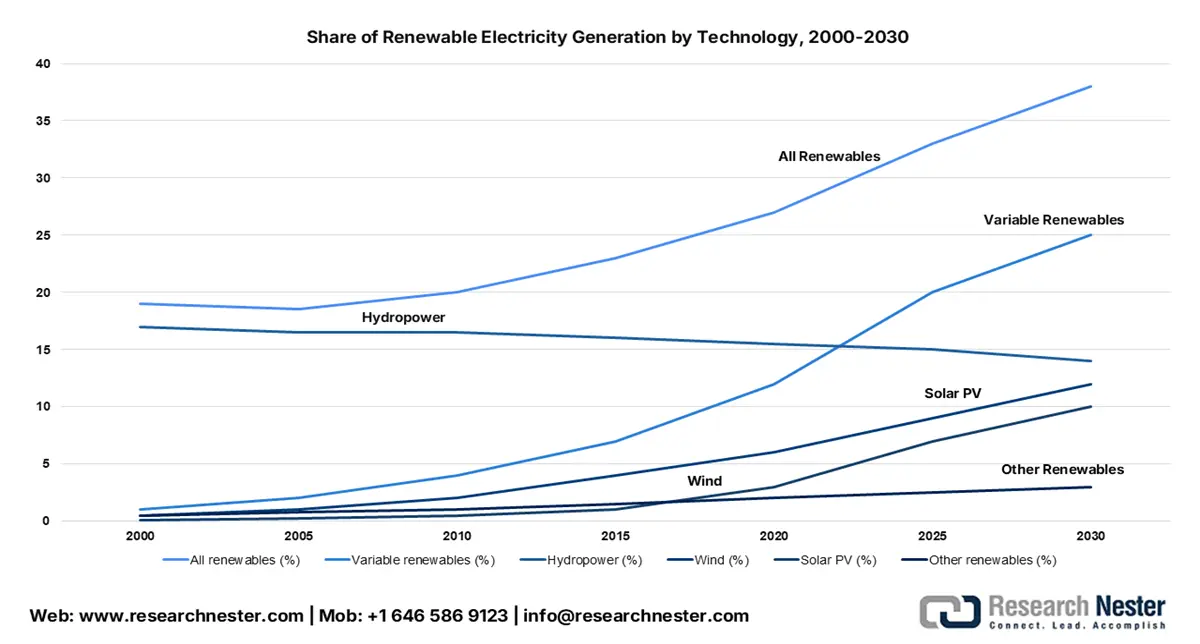

Source: IEA

The renewable energy and storage sector leads the sales of paralleling switchgears, as these facilities need to ensure uninterrupted power flow. The growing investments in the expansion of power grid infrastructure across the world are projected to double the trade of paralleling switchgears. The International Energy Agency (IEA) estimates that global renewable electricity production is projected to reach over 17,000 terawatt-hours (TWh) by 2030, nearly doubling from 2023. This amount is estimated to cover the total electricity needs of both China and the United States in 2030. Further, enterprises and utilities are combining gensets with solar PV, wind, and battery energy storage systems (BESS) to create hybrid power solutions, which is accelerating the demand for advanced paralleling switchgears.

Key Paralleling Switchgear Market Insights Summary:

Regional Highlights:

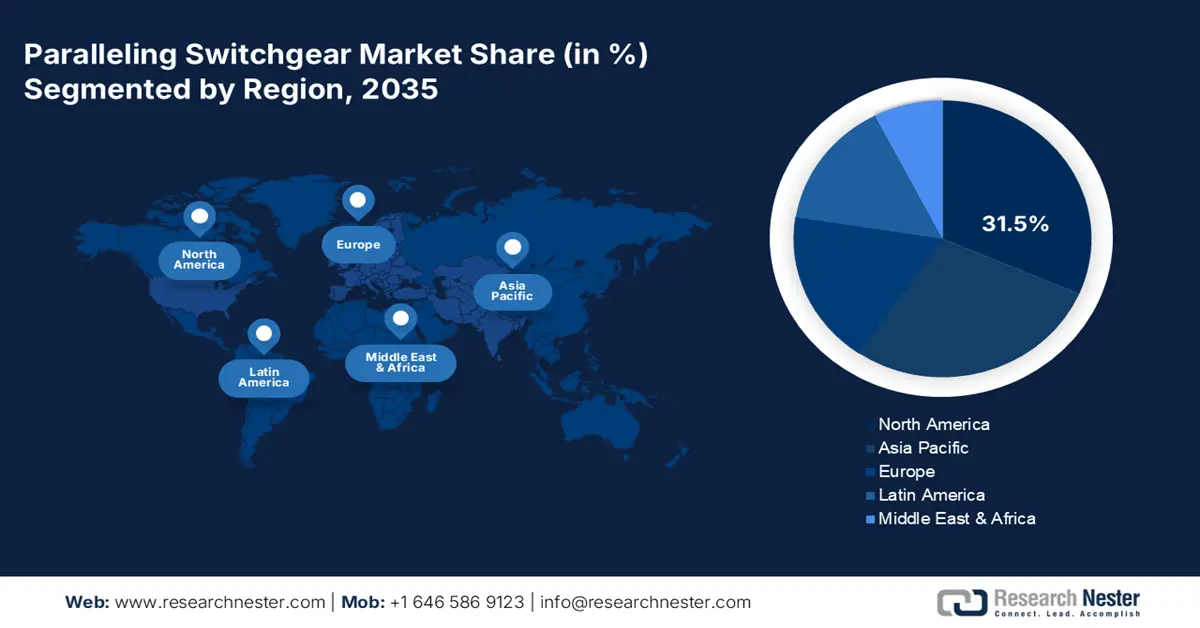

- North America is projected to hold a 31.5% revenue share through 2035 in the paralleling switchgear market, sustained by the rapid expansion of data centers, healthcare, and industrial sectors supported by favorable government initiatives.

- Europe is expected to account for the second-largest market share during 2026–2035, bolstered by advanced healthcare infrastructure, industrial automation, and increased investments in clean energy and digital networks.

Segment Insights:

- The standby power segment is projected to capture a 46.1% share by 2035 in the paralleling switchgear market, driven by the growing need for uninterrupted power in hospitals, data centers, airports, and large manufacturing facilities.

- The open transition systems segment is anticipated to hold the largest market share during 2026–2035, owing to their ease of operation and high reliability in ensuring seamless power transitions across commercial, industrial, and institutional sectors.

Key Growth Trends:

- Industrial electrification

- Remote monitoring & predictive maintenance

Major Challenges:

- High capital investment

- Supply chain volatility

Key Players: Eaton Corporation, Schneider Electric, Siemens AG, ABB Ltd, General Electric, Mitsubishi Electric Corporation, Cummins Inc., Emerson Electric Co., Toshiba Corporation, Fuji Electric Co., Ltd., Socomec, LS Electric, Schneider Electric India Pvt. Ltd., Himoinsa S.L., Delta Electronics, Inc., Hitachi Energy, Rittal GmbH & Co. KG, Meidensha Corporation, Schneider Electric Malaysia, Yaskawa Electric Corporation

Global Paralleling Switchgear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 4.7 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Singapore, Canada

Last updated on : 3 October, 2025

Paralleling Switchgear Market - Growth Drivers and Challenges

Growth Drivers

- Industrial electrification: The industrial electrification trend is poised to fuel the application of paralleling switchgears in the years ahead. Factories using advanced automation, robotics, and digital systems are likely to spend a lot on these switchgears to prevent power outages or fluctuations, as power disruptions stop production and cause big financial losses. The World Economic Forum (WEF) estimates that electricity’s share in total energy use is expected to grow from 20% now to over 50% by 2050 in a net-zero emissions plan. Switching to electricity can greatly reduce pollution and make industrial processes more efficient, especially those needing low to medium heat (up to 500°C), which cause about half of all carbon emissions from factories. Thus, the electrification of industries is set to accelerate the installation of paralleling switchgears in the coming years.

- Remote monitoring & predictive maintenance: The remote monitoring and predictive maintenance needs are expected to increase the importance of advanced paralleling switchgear in critical power systems. IoT-enabled sensors embedded in switchgear continuously track parameters such as temperature, vibration, current, and synchronization accuracy. Technological advancements and the continuous demand for next-gen power control systems are set to double the revenues of paralleling switchgear manufacturers. Many manufacturing organizations are also shifting to IoT-based switchgears for enhanced performance.

- Retrofit & upgrade market: The paralleling switchgears are anticipated to be widely used in the retrofit and upgrade facilities. Some of the healthcare facilities, manufacturing units, utilities, and data centers still operate on legacy systems designed primarily for basic generator synchronization. Thus, to enhance their operational efficiency, they are increasingly investing in paralleling switchgears. Retrofitting helps make expensive electrical systems last longer while ensuring they meet new safety and regulatory standards. Thus, vendors are capitalizing by offering modular retrofit kits and software upgrades.

Challenges

- High capital investment: The production of paralleling switchgears is a capital-intensive process, which creates a challenging environment for small and new companies. The need for a skilled workforce and advanced manufacturing infrastructure adds to the costs, limiting the sales of paralleling switchgears in price-sensitive markets. Many small and medium-sized businesses, particularly in manufacturing or commercial real estate, struggle to afford this spending when cheaper options are available.

- Supply chain volatility: Supply chain issues create big challenges for companies manufacturing paralleling switchgears. These switchgears are heavily dependent on parts such as circuit breakers, relays, and busbars. Further, the changes in the availability or cost of these parts increase production costs and delay delivery times, reducing profits for top companies.

Paralleling Switchgear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 2.0 billion |

|

Forecast Year Market Size (2035) |

USD 4.7 billion |

|

Regional Scope |

|

Paralleling Switchgear Market Segmentation:

Application Segment Analysis

The standby power segment is projected to capture 46.1% of the global paralleling switchgear market share by 2035. The hospitals, data centers, airports, and large manufacturing facilities require uninterrupted power to carry out their operations effectively. These companies invest heavily in multiple standby generators to operate in synchronization, which directly fuels the installation of paralleling switchgears. The rise of hyperscale data centers is also emerging as a critical driver for the sales of standby power paralleling switchgears.

Type Segment Analysis

The open transition systems are estimated to account for the largest market share throughout the study period. The ease of operation and reliability are prime factors boosting the sales of open transition systems. In an open transition setup, there’s a short pause in power when switching from the main utility to a generator or between different power sources, which increases the need for advanced paralleling switchgears. The commercial, industrial, and institutional sectors are key users of open transition systems.

End user Segment Analysis

The commercial and industrial segment is anticipated to hold the leading global market share throughout the forecast period. These users require reliable, cost-efficient backup power, which accelerates the sales of paralleling switchgears. Factories, warehouses, offices, shopping malls, and telecom centers face big operational and financial problems during power outages. To overcome this issue, they invest heavily in paralleling switchgears for smooth operations. The robust industrialization and urbanization across developing economies are poised to double the revenues of parallel switchgear manufacturers.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Voltage |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Paralleling Switchgear Market - Regional Analysis

North America Market Insights

The North America paralleling switchgear market is projected to hold 31.5% of the global revenue share through 2035. The data centers, healthcare, utilities, and industrial sectors are key end users of paralleling switchgears in the region. The robust expansion of data centers and hyperscale facilities across key areas such as Virginia, Texas, and Ontario is creating a lucrative environment for manufacturers of paralleling switchgears. Furthermore, supportive government policies are poised to propel sales of paralleling switchgears in both the U.S. and Canada.

The rapid growth of hyperscale data centers is propelling the sales of paralleling switchgears in the U.S. Hospitals are also emerging as key drivers for the application of paralleling switchgears as they require uninterruptible power in life-critical operations. The industrial automation and robotics trends are further accelerating the demand for paralleling switchgears.

The clean energy trend is expected to propel the market in Canada during the forecast period. The healthcare and mining sectors are leading the application of paralleling switchgears. The mining sector, concentrated in Alberta and Northern Canada, relies heavily on reliable backup power due to remote operations and harsh environmental conditions, creating a profitable environment for key players.

Europe Market Insights

The Europe paralleling switchgear market is estimated to account for the second-largest revenue share throughout the study period. The advanced healthcare sector and critical infrastructure are propelling the sales of paralleling switchgears. The industrial automation trend is also pushing the adoption of advanced paralleling switchgears for smooth electricity flow. The increasing investments in clean energy and growing digital infrastructure are estimated to create a high-earning environment for paralleling switchgear companies.

Germany is projected to lead the sales of paralleling switchgears during the anticipated timeline. The country’s highly industrialized economy and emphasis on energy reliability are accelerating the demand for paralleling switchgears. The public initiatives promoting energy efficiency and decentralized power generation are also driving the adoption of advanced paralleling switchgears.

The healthcare, commercial infrastructure, and digital services are promoting the sales of paralleling switchgears in the U.K. Hospitals and critical care facilities require reliable backup systems to comply with NHS regulations and avoid operational risks, which directly fuels the trade of paralleling switchgears. Rapid growth in cloud services and data centers is further accelerating the demand for scalable and software-enabled parallel systems.

APAC Market Insights

The APAC market is expected to increase at a high pace from 2026 to 2035. The rapid industrialization and urbanization activities are pushing the adoption of paralleling switchgears. The digitalization trend is also supporting the high trade of paralleling switchgears. The highly industrialized countries, including China and Japan, are driving demand for advanced digital-controlled systems. India and South Korea are also high-earning marketplaces for paralleling switchgear companies.

China is estimated to lead the sales of paralleling switchgears, driven by its massive industrial base and urban infrastructure. The expanding digital economy and manufacturing bus are also amplifying the adoption of paralleling switchgears. The hybrid energy integration, including battery storage and solar PV, is a revenue-boosting factor for paralleling switchgear manufacturers.

The India paralleling switchgear market is projected to expand at the fastest pace between 2026 and 2035. The rapid industrial and urban activities are fueling the adoption of paralleling switchgears. Manufacturing hubs, IT parks, hospitals, and commercial complexes are prime end use industries for paralleling switchgears. The government’s push for smart cities and data center growth under the Digital India initiative is set to double the revenues of key players. The Ministry of New and Renewable Energy announced that India’s total renewable energy capacity grew by 24.2 gigawatts (13.5%) in one year, reaching 203.18 gigawatts in October 2024, up from 178.98 gigawatts in October 2023. The expanding renewable energy infrastructure is a key propeller for paralleling switchgear adoption.

Key Paralleling Switchgear Market Players:

- Eaton Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- Siemens AG

- ABB Ltd

- General Electric

- Mitsubishi Electric Corporation

- Cummins Inc.

- Emerson Electric Co.

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Socomec

- LS Electric

- Schneider Electric India Pvt. Ltd.

- Himoinsa S.L.

- Delta Electronics, Inc.

- Hitachi Energy

- Rittal GmbH & Co. KG

- Meidensha Corporation

- Schneider Electric Malaysia

- Yaskawa Electric Corporation

The global market is characterized by the strong presence of industry giants and the increasing emergence of start-ups. The key players are employing both organic and inorganic marketing strategies to boost their revenue shares and reach. They are investing heavily in research and development activities to introduce next-gen paralleling switchgears. Some of the leading companies are also entering into strategic partnerships with other players to increase their product offerings and collaborating with raw material suppliers to avoid price volatility.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2025, Hitachi Energy announced the successful testing of a 765 kilovolt (kV) / 400 kV single-phase, 250 megavolt-ampere (MVA) natural ester-filled oil transformer. This development is accelerating the application of switchgears.

- In September 2023, ABB Ltd showcased a new 500 mm panel version of its UniGear ZS1, a modern air-insulated medium-voltage switchgear, at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2023. The event, organized by the Abu Dhabi National Oil Company (ADNOC), took place in Abu Dhabi, UAE, from October 2 to 5, 2023.

- Report ID: 8166

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Paralleling Switchgear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.