Pancrelipase Market Outlook:

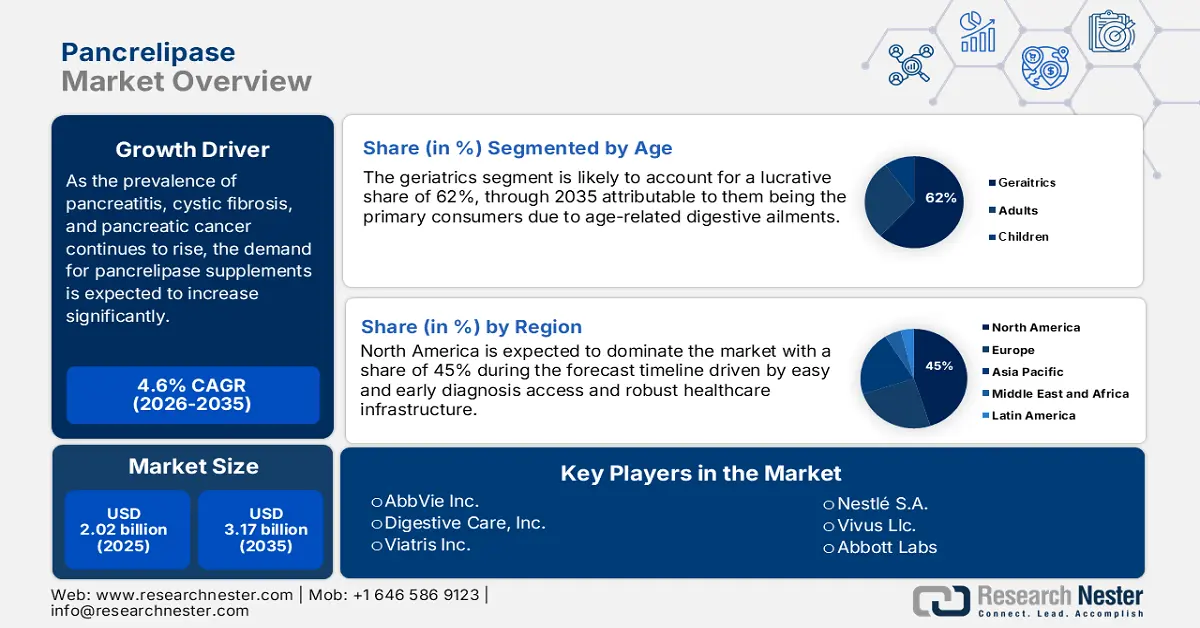

Pancrelipase Market size was valued at USD 2.02 billion in 2025 and is set to exceed USD 3.17 billion by 2035, registering over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pancrelipase is estimated at USD 2.1 billion.

The pancrelipase market shows vigorous growth being propelled by over the base increase in EPI incidence. For instance, in January 2023, as per the data from NIH, for the assessment and treatment of exocrine pancreatic insufficiency, an activity was examined. This revealed that, between 60% and 90% of people with chronic pancreatitis within 10 to 12 years of diagnosis have EPI. The prevalence of chronic pancreatitis, ranges from 42 to 73 per 100,000 people in the U.S. to 36 to 125 per 100,000 people in China, India, and Japan. This rising incidence of chronic pancreatitis, cystic fibrosis, and most especially pancreatic cancer at all ages that propels demand predominantly.

Moreover, improved diagnostic tests and physician education account for prior and more precise EPI diagnoses, which have driven up prescription levels. Continued research and development activity is providing newer products improved enzyme activity, stability, and patient tolerance, such as enteric-coated products and new delivery systems, thus maximizing therapeutic efficacy and patient compliance. For instance, in February 2025, by using a small blood sample, researchers at Oregon Health & Science University have created a test known as PAC-MANN, which stands for protease activity-based assay using a magnetic nanosensor. Such multi-dynamic growth is likely to be maintained during the projected timeline.

Key Pancrelipase Market Insights Summary:

Regional Highlights:

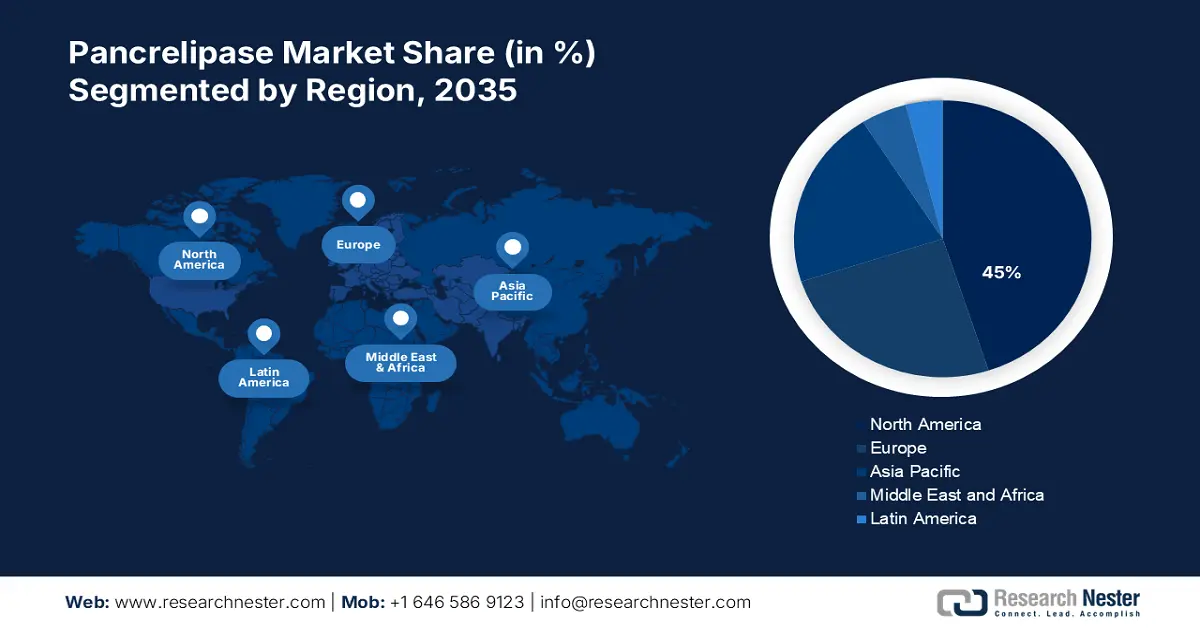

- North America dominates the Pancrelipase Market with a 45% share, fueled by a rise in gastrointestinal disorders due to changing lifestyles, ensuring robust growth through 2026–2035.

- The Pancrelipase Market in Asia Pacific is poised for the fastest growth by 2035, driven by rising awareness, improved hospital facilities, and increasing cancer incidence.

Segment Insights:

- The Chronic Pancreatitis Segment is expected to dominate by 2035, propelled by the rising incidence of chronic pancreatitis requiring enzyme replacement therapy.

- The Geriatrics segment is projected to hold a 62% share by 2035, fueled by the increasing incidence of exocrine pancreatic insufficiency in the aging population.

Key Growth Trends:

- Post-surgical EPI

- Development of biosimilar products

Major Challenges:

- Variability in product efficacy

- Complexity of biological patents

Key Players: Digestive Care, Inc., Viatris Inc., Nestlé S.A., Vivus LLC., Abbott Labs, Beijing Geyuantianrun Biotech Co., Organon Canada Inc., Scientific Protein Laboratories, and more.

Global Pancrelipase Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.02 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 3.17 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Pancrelipase Market Growth Drivers and Challenges:

Growth Drivers

- Post-surgical EPI: Postoperative exocrine pancreatic insufficiency (EPI), an overdiagnosed and underdiagnosed syndrome responsible for growth in the pancrelipase market. The resulting maldigestion and malabsorption require pancreatic enzyme supplementation with pancrelipase to enhance nutrition status and alleviate steatorrhea and weight loss symptomatology. For instance, in February 2024, a novel first-line therapy for people with metastatic pancreatic cancer has received FDA approval. NALIRIFOX, a combination chemotherapy, has been licensed for use in patients who have never had treatment before after a clinical trial shown a good survival benefit.

- Development of biosimilar products: Manufacturing of biosimilar products will serve as the major growth driver in the pancrelipase market. The biosimilars offer a cost-saving option over comparator-branded pancrelipase, improving patient access, especially in frugal healthcare systems. For instance, in March 2025, a novel medication for the treatment of pancreatic neuroendocrine tumors, known as PNET received approval from the US FDA. The improved affordability will be capable of driving the total treated patient population, thus driving market growth and making treatment more accessible.

Challenges

- Variability in product efficacy: The prime issue within the pancrelipase market is the product variability and its efficacy. The result of the intrinsic biological variability and porcine origin of the enzyme blend pose a significant challenge. The source in its native state results in batch-to-batch variation in the exact composition and activity of the lipase. The direct bearing on the predictability and uniformity of therapeutic outcomes in patients with exocrine pancreatic insufficiency hinders the market growth. Therefore, practitioners are confronted with attempting to attain consistent symptom control and nutrient utilization across various pancrelipase products.

- Complexity of biological patents: It is a formidable task to gain rapid traction in the pancrelipase market due to the existing complexity of biological patents. In contrast to conventional drugs with well-established chemical structures, products of porcine pancreas-derived pancrelipase consist of intricate combinations of enzymes, and hence proper patent claims and infringement analysis become immensely difficult. This intrinsic biological difference and the resulting impact that it is virtually impossible to positively identify the active constituents generate colossal uncertainty to innovators in terms of protection and generic producers seeking to penetrate the market.

Pancrelipase Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 2.02 billion |

|

Forecast Year Market Size (2035) |

USD 3.17 billion |

|

Regional Scope |

|

Pancrelipase Market Segmentation:

Age (Children, Adults, Geriatrics)

The geriatrics segment in the pancrelipase market is anticipated to dominate with 62% by the end of 2035. This population group is a typical population within the market owing to the growing incidence of exocrine pancreatic insufficiency (EPI) associated with progressive aging as well as pancreatic changes that accompany progressive aging. For instance, in September 2023, the UNFPA showcased that by 2050, the proportion of India's geriatric population is expected to quadruple to more than 20% of the entire population, with the decadal growth rate at 41%. This patient group is most frequently affected by diseases such for which replacement with pancrelipase to digest and absorb nutrients is necessary, and thus reflect a strong and increasing need.

Application (Chronic Pancreatitis, Cystic Fibrosis)

Based on application, the chronic pancreatitis segment is likely to dominate the pancrelipase market. The incidences of chronic pancreatitis is on rise worldwide, hence sales of effective pancreatic enzyme replacement therapy, i.e., pancrelipase, are sure to gain from its rising tide. For instance, as per the data unveiled from the NIH in April 2024, the annual incidence of acute pancreatitis was 34 cases [95% CI 23–49] per 100,000 people worldwide, while the annual incidence of chronic pancreatitis was 10 cases (95% CI 8–12) per 100,000 people. It is anticipated that the proportion of older adults would rise from 9% in 2019 to 16% in 2025, and the number of older persons will double to 1.5 billion by 2050. This establishes the crucial role of pancrelipase in treating the digestive insufficiency of this chronic and frequently incapacitating disease.

Our in-depth analysis of the global pancrelipase market includes the following segments:

|

Age |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pancrelipase Market Regional Analysis:

North America Market Statistics

The pancrelipase market in North America is expecting its dominance during the forecast timeline i.e. from 2025 to 2035 with a notable share of 45%. A shift towards unhealthy lifestyle that involves eating poorly or adulterated food add fuel to the market growth. Furthermore, many problems connected to the digestive system can be treated with pancrelipase to improve poor digestion. Thus, the market is growing rapidly in the region as a result of the rise in gastrointestinal disorders brought on by people's changing lifestyles.

In the U.S. pancrelipase market is experiencing robust growth mainly due to the surge in pancreatic cancer instances around the country. For instance, in January 2025, the American Cancer Society released its projections for pancreatic cancer in the US. It unveiled that an estimated 67,440 individuals inclusive of 34,950 men and 32,490 women will receive a pancreatic cancer diagnosis. In addition, it will claim the lives of about 51,980 people (27,050 men and 24,930 women). Moreover, for men and women, the average lifetime risk of pancreatic cancer is around 1 in 56 and 1 in 60, respectively.

In Canada, the pancrelipase market is expected to grow significantly attributed to the rising awareness amongst healthcare professionals and regulatory bodies to probe into taking effective measures in combating the rising pancreatic disease. For instance, in October 2024, the pancreatic adenocarcinoma ranked 12th in terms of cancer diagnoses, but with a 5-year survival rate of 10%, it was the 3rd most common cause of cancer-related mortality. The 2023 National Pancreas Conference (NPC), held in Montreal, Quebec, was the first NPC to address contemporary developments in PC therapy, care, and prospective research. The Canadian Association of General Surgeons co-developed the event, accredited by the Royal College of Physicians and Surgeons to address pancreatic enzyme replacement therapy (PERT) and better patient outcomes.

Asia Pacific Market Analysis

The Asia Pacific is expected to be the fastest-growing pancrelipase market throughout 2035. This growth is attributed to the rising knowledge regarding the use of pancrelipase and the existence of important and reliable hospital facilities in the region. In addition, because of the rise in pancreatic cancer incidence, the expansion of healthcare infrastructure, and the rise in investment projects in the region, Asia-Pacific is expected to see substantial growth.

China is set to gain a plethora of opportunities in the pancrelipase market owing to the revolutionary steps taken by the companies to transform the efficacy landscape of the oncology segment. For instance, in April 2022, the National Medical Products Administration (NMPA) of China formally approved the use of a Servier's medication for patients with metastatic pancreatic cancer. With this approval, Servier played a significant role in Chinese oncology and delivering better patient care.

In India, the market will grow significantly as a result of the effortless approval procedures that fuel the demand for innovative therapeutic drugs. For instance, in May 2024, Cantex Pharmaceuticals, Inc., announced that its well-tolerated once-daily pill, azeliragon, has been designated as an Orphan Drug by the U.S. FDA for the treatment of pancreatic cancer. Thus, early detection and treatment of pancreatic problems have been made possible by increased awareness of these disorders and the availability of sophisticated diagnostic methods.

Key Pancrelipase Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Digestive Care, Inc.

- Viatris Inc.

- Nestlé S.A.

- Vivus Llc.

- Abbott Labs

- Beijing Geyuantianrun Biotech Co.

- Organon Canada Inc.

- Scientific Protein Laboratories

The competitive landscape in the pancrelipase market is driven by the cut-throat competition that transforms the treatment modalities and efficacy in outcome. For instance, in January 2021, Healx announced its Rare Treatment Accelerator Programme (RTA) collaboration with Mission Cure, which is expediting the large-scale discovery and development of medicines for rare diseases. In order to find and expedite new treatments for chronic pancreatitis, the initiative combined Mission Cure's patient insights, scientific research, expertise, and networks with Healx's tech-driven drug repurposing methodology.

Here's the list of some key players:

Recent Developments

- In August 2024, Immunovia announced improved performance for its next-generation test for identifying high-risk individuals with stage 1 and stage 2 pancreatic ductal adenocarcinomas (PDAC), which may be curable with surgery and contemporary treatments.

- In February 2024, Pharus Diagnostics LLC. introduced OncoSweep, pancreas spotlight, a liquid biopsy screening test that helps identify Pancreatic Ductal Adenocarcinoma (PDAC) in individuals at high risk.

- Report ID: 7625

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pancrelipase Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.