Oryzenin Market Outlook:

Oryzenin Market size was valued at USD 136.7 billion in 2025 and is projected to reach USD 300.3 billion by the end of 2035, rising at a CAGR of 7.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of oryzenin is assessed at USD 149.3 billion.

The oryzenin market is poised for extensive growth in the upcoming years, owing to the heightened consumer demand for plant-based proteins in terms of functional foods, sports nutrition, and clinical applications. Also, consumers are highly aware of health, wellness, and allergen-free diets, which is driving enhanced adoption, whereas manufacturers are seeking high-quality rice protein with consistent nutritional profiles. In this regard, the Journal of Nutrition in December 2024 revealed that in a span of two decades, the U.S. witnessed a significant transformation in adults consuming a plant-based diet, which is defined as obtaining ≥50% of protein from plants, increasing from 14.4% to 17.2%. On the other hand, the overall quality of plant-based diets displayed a modest improvement from 52.1 to 55.8 over the study period. Therefore, these findings suggest that while a plant-based diet is becoming more common positively impacting oryzenin market growth.

Furthermore, on the supply chain dynamics, the process has become more streamlined, wherein certified organic and non-GMO rice sources are gaining enhanced prominence. Also, the pricing trends in this field reflect a balance between high demand and limited supply, wherein the premium-quality and verified organic variants command higher prices. USDA in May 2024 introduced new programs, partnerships, and a substantial USD 10 million in funding to support producers involved in organic production, thereby aiming to expand domestic organic industries and reduce reliance on imports. It also stated that the initiatives include financial assistance through the Organic Certification Cost Share Program, enabling coverage up to 75% of certification expenses. Therefore, these efforts strengthen the supply chain in this field, enhance production capacity, and increase access to high-demand organic products for both producers and consumers.

Top Rice Producing Countries (2024 - 2025)

|

Country |

% of Global Production |

Production (Million MT) |

|

India |

28% |

150 |

|

China |

27% |

145.28 |

|

Bangladesh |

7% |

36.6 |

|

Indonesia |

6% |

34.1 |

|

Vietnam |

5% |

26.75 |

|

Thailand |

4% |

20.55 |

|

Philippines |

2% |

12.37 |

|

Burma |

2% |

11.9 |

|

Pakistan |

2% |

9.72 |

|

Cambodia |

2% |

8.47 |

Source: USDA

Key Oryzenin Market Insights Summary:

Regional Highlights:

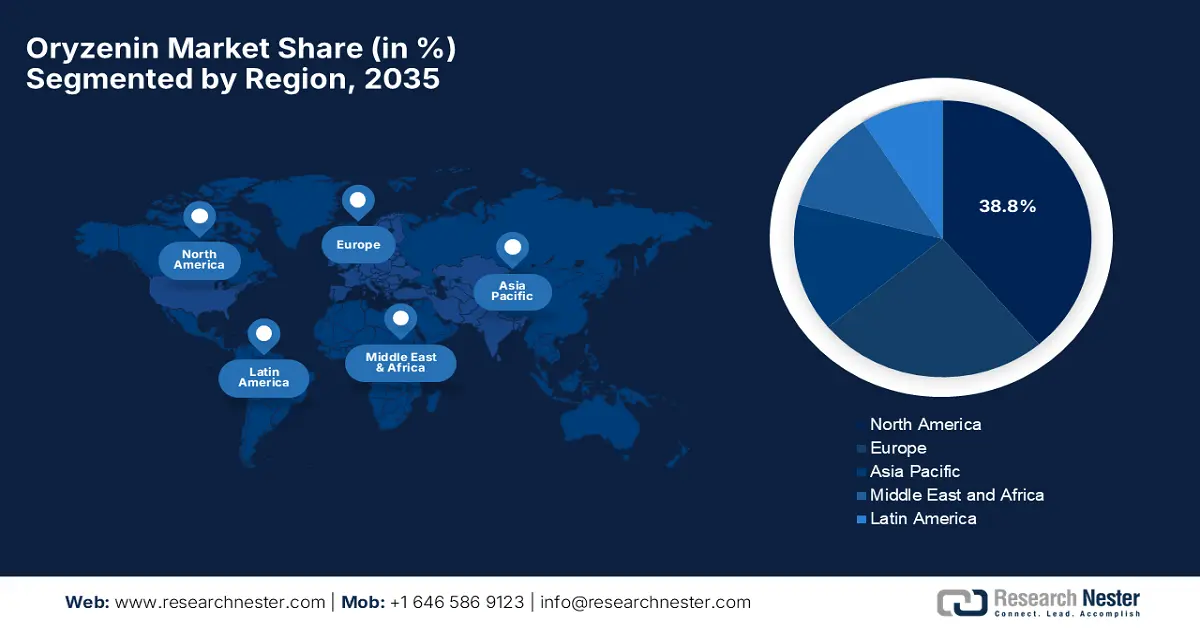

- North America is forecast to secure a 38.8% share of the oryzenin market by 2035, supported by the accelerating adoption of plant-based and allergen-free nutrition.

- Asia Pacific is projected to expand at the fastest pace during 2026-2035 as its abundant rice production and processing infrastructure bolster regional growth.

Segment Insights:

- The dry form segment is projected to command a 65.4% share by 2035 in the oryzenin market, underpinned by its extended shelf life and logistical advantages.

- The sports nutrition segment is expected to capture a 35.8% share by 2035 as demand strengthens for plant-based hypoallergenic protein supplements.

Key Growth Trends:

- Growth in functional, sports, and nutritional applications

- Sustainability and rice‐based supply benefits

Major Challenges:

- High production and processing costs

- Raw material price volatility

Key Players: AIDP, Inc. (U.S.), Axiom Foods, Inc. (U.S.), Ribus, Inc. (U.S.), RiceBran Technologies (U.S.), Kerry Group plc (Ireland), Roquette Frères (France), BENEO GmbH (Germany), TOP Health Ingredients Inc. (U.S.), Shafi Gluco-Chem Pvt. Ltd. (India), Bioway Organic Ingredients (China), Golden Grain Group Ltd. (Thailand), Agrawal Oil & Biochems (India), Jiangxi Golden Agriculture Biotech Co., Ltd. (China), Pure Food Company, LLC (U.S.), Nutraonly (Xi’an) Nutritions Inc. (China), Hubei Wanrong Modern Agriculture Co., Ltd (China), ABF Ingredients (Associated British Foods) (UK), Hilmar Ingredients (U.S.), Amino GmbH (Germany), Green Lab Inc. (South Korea).

Global Oryzenin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 136.7 billion

- 2026 Market Size: USD 149.3 billion

- Projected Market Size: USD 300.3 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Vietnam, Australia

Last updated on : 5 November, 2025

Oryzenin Market - Growth Drivers and Challenges

Growth Drivers

- Growth in functional, sports, and nutritional applications: Due to the beneficial properties of oryzenin, it is being incorporated into sports nutrition, functional foods, dairy alternatives, bakery, and beverage formats, which is a major driving factor for this landscape. The extraction technologies, such as high-purity isolates, better solubility, and enhanced functional performance, readily accelerate its utilization in various applications. For instance, in August 2024, Axiom Foods reported a major surge in the demand for its organic oryzatein rice protein, followed by the USDA’s new organic enforcement rules, which ended the circulation of fake organic rice proteins in the U.S. The company also stated that it has tripled production to meet the needs of food and beverage manufacturers who are seeking verified organic protein sources, especially as organic pea protein, hence ensuring transparency and authenticity for manufacturers and consumers as well.

- Sustainability and rice‐based supply benefits: When compared to animal-based proteins, oryzenin comprises a sustainability benefit since it has a lower environmental impact. On the other hand, rice is widely produced across Asia, due to which the supply chain can be scaled, supporting the idea of a more streamlined value chain. For instance, in July 2025, BENEO announced that it is partnering with Rikolto and CarbonFarm on a three-year sustainable rice farming project in Vietnam, which was funded by the Government of Flanders. The company also stated that the initiative offers training to farmers on sustainable rice platform standards and develops SRP-certified rice ingredients for food and pet food applications. Therefore, the existence of such projects ensures a reliable, traceable, and environmentally responsible supply of rice, supporting functional proteins such as oryzenin. Further, the increased focus on sustainability and high-quality sourcing is expected to drive oryzenin market growth in the years ahead.

- Technological advances & ingredient innovation: The global oryzenin market has benefited extremely from the improvements in terms of extraction, purification, processing, and formulations such as isolates, concentrates, and hydrolysates. This in turn makes oryzenin more competitive with better taste, solubility, and functional behavior, thus contributing to market expansion. For instance, in June 2022, Roquette reported that it had launched rice protein isolates and concentrates, marking a major expansion of its NUTRALYS plant protein range, which is a non-GM, gluten-free, and nutritious alternative for plant-based foods and beverages. The company also stated that the new rice proteins comprise fine particle size, smooth texture, and good dispersibility, making them suitable for specialized nutrition, sports, and dairy or meat alternative applications.

Recent Investments and Innovations in Plant-Based Proteins

|

Year |

Company / Brand |

Activity |

Key Details |

|

2024 |

BENEO |

Product showcase |

Demonstrated hybrid and fully plant-based solutions at Fi Europe 2024 using Meatless texturates and faba bean protein; focused on speeding development |

|

2022 |

Planting Hope / RightRice |

Acquisition |

Acquired RightRice from Betterer Foods, Inc. for USD 7 million all-cash; expanded plant-based portfolio into the rice category |

Source: Company Official Press Releases

Challenges

- High production and processing costs: This is the major hurdle for the oryzenin market, hindering the enthusiasm of small-scale manufacturers to make investments in this field. The production process of oryzenin involves complex extraction processes such as enzymatic hydrolysis, wet milling, and multiple purification stages, which in turn necessitate considerable energy investment. Also, when compared to soy or pea protein, this increases the overall costs, hence creating hesitation among investors, wherein the equipment used for filtration and drying adds further operational expenses. Therefore, manufacturers face challenges in maintaining both profitability and competitive pricing, which creates an obstacle to oryzenin market expansion.

- Raw material price volatility: The pricing volatility associated with the raw materials remains yet another restraint for the international oryzenin market. The industry relies on rice production, which is significantly influenced by a combination of factors such as seasonal yields, climate fluctuations, and trade policies. Besides the droughts, floods, and persistent export restrictions in large rice-producing countries such as India, Thailand, and Vietnam, price instability, thereby negatively influences upliftment in this field. Therefore, these fluctuations directly impact the cost of raw rice used in oryzenin extraction, creating uncertainty in production planning and long-term pricing strategies for manufacturers and formulators as well.

Oryzenin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 136.7 billion |

|

Forecast Year Market Size (2035) |

USD 300.3 billion |

|

Regional Scope |

|

Oryzenin Market Segmentation:

Form Segment Analysis

Based on form dry segment is expected to attain the largest revenue share of 65.4% in the oryzenin market during the forecast duration. The dominance of the segment is effectively attributable to its extended shelf life, which is encouraging manufacturers and distributors to store the product for longer periods without any degradation to quality and nutritional value. When compared to liquid forms, the dry oryzenin powders are lighter, which in turn aids in reducing shipping and transportation costs, especially for long-distance or international logistics. As per an article published by NIH in July 2022, the rice protein comprises glutelin, albumin, globulin, and prolamin fractions, which offer a superior amino acid profile and hypoallergenic properties, making it suitable both for gluten-free and infant formulations. Hence, this reflects its properties as a versatile, hypoallergenic, and sustainable plant-based protein, denoting a wider segment scope.

Application Segment Analysis

In terms of application sports nutrition segment is likely to garner a significant revenue share of 35.8% in the oryzenin market by the end of 2035. The worldwide surge in health consciousness and the demand for plant-based hypoallergenic protein supplements are the key factors driving the leadership of this subtype. Testifying to such capabilities, in November 2024, NIH revealed that plant-based diets, which are rich in complex carbohydrates, fiber, antioxidants, and phytochemicals, enhance sports performance by improving glycogen availability, reducing oxidative stress, and supporting muscle recovery as well. It also stated that they can enhance blood flow and reduce plasma viscosity, positively influencing both endurance and strength performance. Therefore, a well-structured plant-based diet can support athletic performance, wherein these evidence-based studies are appreciably increasing demand for its plant-derived nutrition products, such as oryzenin.

Nature Segment Analysis

Based on the nature isolate segment is anticipated to capture a lucrative share of 28.5% in the oryzenin market during the analyzed timeframe. The growth in the segment is highly subject to its superior protein content and purity, which is highly essential for functional foods and clinical nutrition. Moreover, the neutral taste and excellent solubility also enhance product formulation, encouraging its utilization in broader applications such as beverages, protein bars, and dietary supplements. Therefore, the existence of all of these factors is readily enhancing the consumer acceptance, hence providing an optimistic opportunity for manufacturers to adopt oryzenin isolates, positively impacting oryzenin market growth. Simultaneously, the heightened demand for high-purity, versatile protein sources positions the segment at the forefront of revenue generation in the coming years.

Our in-depth analysis of the oryzenin market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Application |

|

|

Nature |

|

|

Source |

|

|

Function |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oryzenin Market - Regional Analysis

North America Market Insights

North America is predicted to hold the highest share of 38.8% in the oryzenin market throughout the discussed tenure. The rise of plant-based diets and allergen-free nutrition is the key factor behind the region’s pace of progress in this field. The region also benefits from a strong base of ingredient manufacturers and increasing consumer awareness around protein quality and nutrition. Most of the industrial players are expanding their production capabilities to meet growing demand for plant-based and alternative proteins. Kerry Group in March 2022 declared that it invested €125 million (USD 137 million) in a new facility in Rome, Georgia, which enhances its capacity to supply nutrition solutions across poultry, seafood, and alternative protein markets. It spans 316,000 sq ft and marks Kerry’s largest-ever capital investment, focusing on providing taste and nutrition solutions for alternative protein across the U.S. and Canada. Hence, such developments reflect the increasing industrial focus on scalable, sustainable protein ingredients such as rice protein.

The U.S. has gained enhanced recognition in the oryzenin market owing to the presence of sports nutrition and food & beverage sectors, which are extensively seeking alternatives to conventional proteins such as soy and whey. The market is also fueled by a regulatory environment which is supporting rice‑protein use and the presence of major ingredient producers that can scale extracts and isolates with improved functional properties, such as solubility and taste. Testifying to this USDA in January 2025 stated that the U.S. rice sector plays a small but significant role in global trade, wherein it is producing less than 2% of the world’s rice yet maintaining a strong export position. The country exports nearly half of the nation's crop across major markets of America, Asia, and the Middle East by making imports of aromatic rice varieties. Therefore, this trade aspect supports the oryzenin market through supply stability, export opportunities, and cost efficiency, making rice protein a stronger contender in the alternative protein industry.

Key Data on U.S. Rice Production, Exports, and Imports

|

Aspect |

Details |

|

Global Production Share |

<2% of global rice production |

|

Global Export Share |

~5% of world rice exports |

|

Annual Export Volume |

40-45% of the U.S. crop is exported |

|

Major Export Types |

Rough (30%), parboiled, brown, and fully milled rice |

|

Top Export Destinations |

Mexico, Central & South America, Caribbean, Japan, South Korea, Taiwan, Iraq, Saudi Arabia |

|

Largest Import Region (Global) |

Sub-Saharan Africa |

|

U.S. Import Volume |

~1.3 million tons annually |

|

Main Import Varieties |

Aromatic (Jasmine from Thailand, Basmati from India & Pakistan), long-grain from South America |

|

Import Share of the U.S. Market |

>25% in 2022 - 2023 |

Source: USDA

Canada is portraying stable growth in the oryzenin market, effectively influenced by a combination of factors such as health-conscious consumers and the growing sports‑nutrition segment, driving interest in hypoallergenic, plant-derived proteins. Also, the industry in this country is favored by increasing adoption of rice‑protein supplements and fortified foods, supported by ingredient innovation and geographic expansions. In August 2025, Protein Industries Canada announced that it had partnered with Nurasa to launch the Asia-Pacific market entry program, which is aimed at helping the country’s plant-based food and ingredient companies expand into the fast-growing Asia-Pacific market. In addition, this initiative supports Canada’s vision to grow its plant-based sector to USD 25 billion by the end of 2035 while strengthening global trade partnerships. Furthermore, the program has received a USD 1 million investment and supports a regional network to accelerate export readiness and localize offerings.

APAC Market Insights

Asia Pacific is recognized as the fastest growing oryzenin market over the analyzed timeframe. The region’s prominence in this field is effectively catered to by the abundant rice production and established processing infrastructure. Also, the key countries such as China, India, and Vietnam are leaders in terms of reliable supply of raw materials, which reduces production costs and facilitates regional expansion. Consumer trends are displaying a major shift towards plant-based and allergen-free proteins, where the manufacturers are capitalizing on that with the introduction of rice protein isolates, concentrates, and other functional formats. Since rice is culturally familiar in most parts of this region, the derived protein oryzenin is benefiting from consumer acceptance and further supports broader food‑and‑beverage applications, such as snacks to dairy alternatives.

China is augmenting its leadership in the oryzenin market on account of strong rice production as a raw material manufacturing base and a growing consumer demand for plant‐based, hypoallergenic protein ingredients. Also, the end-use applications consist of food & beverages, sports nutrition, and even healthcare purposes, reflecting how ingredient utilization is broadening. In March 2025, Healthgen Biotechnology announced that it had achieved large-scale production of rice-derived human serum albumin, using genetic engineering to turn rice into a protein production workshop. The company also stated that this innovation can produce HSA equivalent to five liters of plasma from just 25 kg of rice, addressing China’s significant reliance on imported HSA. Furthermore, the firm has an annual production capacity of 10 tonnes, which is set to expand to 130 tonnes by the end of 2026, hence boosting confidence in rice proteins for food and nutraceutical applications.

India represents the most prominent landscape for the oryzenin market, wherein it hosts a large vegetarian population, rising health awareness, and urbanization mean that rice-based proteins are seen as attractive for health. In addition, the country’s massive rice‑production base offers a major advantage for rice-derived protein extraction. In November 2021, the ICAR-National Rice Research Institute announced the release of CR Dhan 310, which is a high-protein rice variety with 10.3% protein in milled rice, developed by improving the popular high-yielding variety Naveen. The organization further underscored that this variety comprises a higher glutelin content and essential amino acids such as lysine and threonine, combating the issue of protein malnutrition in rice-dependent populations. The variety reports a national average yield of 4483 kg/ha, wherein its nutritional profile makes it suitable for protein-enriched rice products, hence positively impacting market growth.

Europe Market Insights

Europe is representing a steady growth in the international oryzenin market owing to the increased consumer awareness about the benefits offered by this element and evidence-based research. On the other hand, the region also benefits from innovation in product formulations, combined with regulatory support for novel proteins, which is driving adoption across its vast geography. The region is also witnessing a strong shift towards sustainable protein sources, which is encouraging both startups and established entities to explore rice-derived proteins as alternatives. Healy Group, in January 2023, announced the launch of PrimaPro, which is a range of micronized pea and rice protein ingredients that are especially designed to upgrade functionality in plant-based, sports nutrition, and high-protein foods. These are produced using a novel mechanical milling process, PrimaPro reduces protein particle size to under 25 microns, offering a very smooth texture. Each one contains around 80% protein and is suitable for beverages, protein shakes, high-protein bakery, snacks, and emulsified sauces.

Germany has a complete potential to capitalize on the regional oryzenin market owing to its extensive food-processing industry and increasing awareness of product quality, traceability, and nutritional benefits. The country is also witnessing a growing interest in functional foods, sports nutrition, and plant-based diets, which is providing an encouraging opportunity for rice protein to be used in bakery products, dairy alternatives, and protein-enriched snacks, prompting a profitable business environment. In November 2023, Nordzucker reported that it is expanding into plant-based proteins with a new production plant at its Groß Munzel site in Lower Saxony. The company also stated that the facility will focus on producing pea protein concentrates and texturates for industrial food and animal feed applications for a sustainable and reliable supply, hence, strengthening its portfolio and long-term growth.

The U.K. is set to grow exponentially in the oryzenin market, efficiently backed by the strong popularity, which is facilitated by increasing adoption of flexitarian, vegan, and plant-based lifestyles. Besides, the demand for health nutritional supplements is also an asset for this landscape, which is prompting a profitable business for both domestic and international players. On the other hand, consumers in the country are highly aware of health, wellness, and sustainability, encouraging the entities to innovate with rice-derived proteins. Further, the advanced retail ecosystem, combined with growing interest in functional and nutritional foods, is also increasing the pace of progress in the country. Therefore, all of these factors responsibly create an extremely favorable environment for oryzenin market expansion.

Key Oryzenin Market Players:

- AIDP, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Axiom Foods, Inc. (U.S.)

- Ribus, Inc. (U.S.)

- RiceBran Technologies (U.S.)

- Kerry Group plc (Ireland)

- Roquette Frères (France)

- BENEO GmbH (Germany)

- TOP Health Ingredients Inc. (U.S.)

- Shafi Gluco-Chem Pvt. Ltd. (India)

- Bioway Organic Ingredients (China)

- Golden Grain Group Ltd. (Thailand)

- Agrawal Oil & Biochems (India)

- Jiangxi Golden Agriculture Biotech Co., Ltd. (China)

- Pure Food Company, LLC (U.S.)

- Nutraonly (Xi’an) Nutritions Inc. (China)

- Hubei Wanrong Modern Agriculture Co., Ltd (China)

- ABF Ingredients (Associated British Foods) (UK)

- Hilmar Ingredients (U.S.)

- Amino GmbH (Germany)

- Green Lab Inc. (South Korea)

- Axiom Foods, Inc. is considered to be the global leader in the oryzenin industry, which is best known for its patented protein called Oryzatein protein. The company's strategy lies in extensive research and development to optimize the functionality of rice protein, which achieves a neutral taste and better solubility when compared to whey protein. Therefore, this technical superiority has positioned the company as a key ingredient supplier for major food and beverage corporations and sports nutrition brands across all nations.

- Kerry Group plc is one of the most prominent players whose presence in this industry is part of its broader, comprehensive plant protein portfolio. The company also leverages its huge scalability, R&D capabilities, and customer relationships across over 140 countries. On the other hand, the company has demonstrated great financial performance, wherein its total revenue surpassed €7,981 million (~USD 8,670 million) in 2024, supported by both continuing and discontinued operations. EBITDA from continuing operations increased to €1,188 million (~USD 1,290 million), reflecting strong operational efficiency.

- Roquette Frères is based in France and is a strong force in this market, which has an extensive portfolio other than pea and wheat proteins. The competitive advantage of this firm emerges from considerable investments in terms of production capacity and its commitment to vertical integration, ensuring a reliable supply of raw materials. Also, the primary focus of the company lies in providing high-purity, high-quality oryzenin isolates for specialized nutrition, such as clinical and performance nutrition, where purity and digestibility are highly essential.

- BENEO GmbH is identified as the regional growth engine of Germany, which has a huge focus on health and nutritional functionality, leveraging its expertise in other well-known ingredients such as chicory root fibers and rice-derived carbohydrates. The firm also leverages clean label moves, aligning well with the consumer demand for transparency and wellness.

- RiceBran Technologies is one of the central players headquartered in the U.S., which readily adopts a unique, vertically integrated model focused exclusively on deriving value from rice bran. The company is the primary processor of stabilized rice bran, which positions it at the very beginning of the oryzenin supply chain. Besides, their strategy lies in maximizing the extraction and purification of valuable components, including protein, oil, and fiber, from this once-underutilized byproduct.

Below is the list of some prominent players operating in the global oryzenin market:

The global oryzenin market represents a fragmented and extremely competitive landscape, which hosts both specialized ingredient suppliers and large diversified food conglomerates. The pioneers in this field are pursuing distinct strategies to secure their global oryzenin market positions. R&D to enhance solubility and mergers & acquisitions to expand the product portfolios are a few key strategies implemented by the key players, making them suitable for a wide range of applications. For instance, in May 2023, ADM and Air Protein announced that they entered into a strategic development agreement to advance research and production of Air Protein, which is a novel landless protein made from air, water, and energy without traditional agriculture. Therefore, the partnership aims to expand the future protein ecosystem, readily enhancing food security and reducing reliance on conventional farming, hence boosting demand and innovation in the oryzenin rice protein industry.

Corporate Landscape of the Oryzenin Market:

Recent Developments

- In February 2025, Axiom Foods announced the launch of Oryzatein 2.0, which is a rice protein designed for food and beverage formulators with enhanced purity, solubility, and a gritless texture, addressing concerns about heavy metals in plant proteins.

- In June 2023, BENEO introduced a new toolbox of plant-based proteins for pet food, including rice protein, vital wheat gluten, and faba bean protein concentrate. The company also stated that rice protein, with ~80% protein content, high digestibility, hypoallergenic nature, and essential amino acids, is suitable for natural formulations.

- Report ID: 8219

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oryzenin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.