Orthopedic Power Tools Market Outlook:

Orthopedic Power Tools Market size was valued at USD 1.81 billion in 2025 and is expected to reach USD 2.71 billion by 2035, registering around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of orthopedic power tools is evaluated at USD 1.88 billion.

The growth of the market can be attributed to the rising demand for orthopedic devices across the world, backed by the increasing prevalence of orthopedic impairment and related diseases, including muscular dystrophy, and Duchenne muscular dystrophy. For instance, the orthopedic device market was expected to reach a total value of USD 45 billion by 2022. Furthermore, if these diseases worsen over time, they can lead to degenerative disease and orthopedic limitation. Additionally, conditions that result in a gradual loss of muscle mass and increasing weakness are rising significantly among various age groups and are predicted to drive market growth.

In addition to these, the rising cases of bone fractures is predicted to fuel the market growth. A survey from the National Library of Medicine (NLM) showed that approximately 1.5 million people worldwide experience bone fractures as a result of a bone illness each year. Further, the increasing cases of bone fractures owing to falls, accidents, and trauma which require immediate surgeries are anticipated to propel the market growth over the upcoming years. It was noted that in 2021, around 33% of bone fractures resulted owing to trauma and around 21% on account of car accidents. Additional factors that are anticipated to drive the orthopedic power tools market expansion during the projected period include an increase in the number of product launches and regulatory approvals for orthopedic power tools that are precise, powerful, and accurate when performing significant orthopedic operations. For instance, Sonicision, a curved jaw cordless ultrasonic dissection device, was introduced by Medtronic Private Limited in September 2020. It offers surgeons performing orthopedic procedures better convenience and accuracy.

Key Orthopedic Power Tools Market Insights Summary:

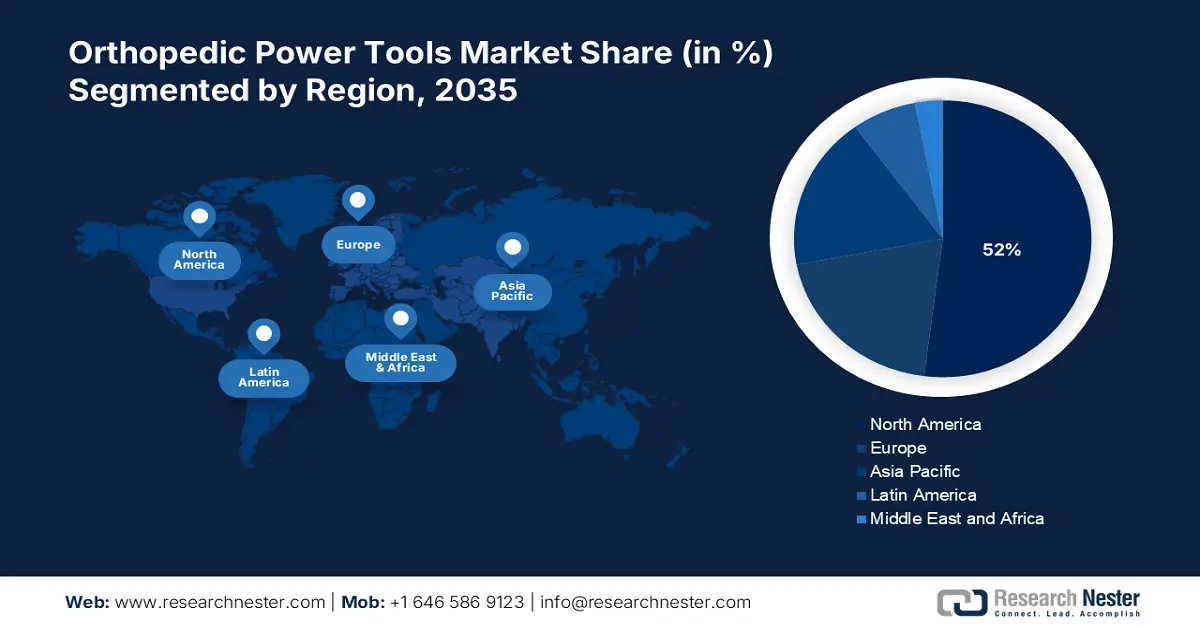

Regional Highlights:

- The North America orthopedic power tools market will dominate over 52% share by 2035, driven by the high rate of amputations and advanced healthcare infrastructure.

Segment Insights:

- The hospitals segment in the orthopedic power tools market is projected to secure a significant share by 2035, influenced by the growing geriatric population and higher investment in hospital facilities with dedicated orthopedic sections.

- The battery powered devices segment in the orthopedic power tools market is projected to hold the largest share by 2035, driven by increasing demand for battery-operated devices and rising R&D investment in medical technology.

Key Growth Trends:

- Growing Prevalence of Musculoskeletal Condition

- Rising Cases of Bone Fractures

Major Challenges:

- High Risk of Contamination

- Requirement for Higher Initial Investment

Key Players: NSK/Nakanishi Inc., Stryker Corporation, CONMED Corporation, India Medtronic Private Limited, Zimmer Biomet, Inc., Kaiser Medical Technology Ltd, Johnson & Johnson Services, Inc., Allotech Co., Ltd, B. Braun SE, Medtronic PLC.

Global Orthopedic Power Tools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.81 billion

- 2026 Market Size: USD 1.88 billion

- Projected Market Size: USD 2.71 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Orthopedic Power Tools Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Prevalence of Musculoskeletal Condition – Muscles, ligaments, tendons, and bones can all experience musculoskeletal pain. The wear and tear of everyday routines can harm muscle tissue. The prevalence of musculoskeletal disorders is rising as a result of sitting employment that disrupts body posture, injuries from auto accidents, and other factors, all of which are expected to have a positive impact on market growth. According to data issued by the World Health Organization (WHO), 1.71 billion persons worldwide have been diagnosed with musculoskeletal disease.

- Rising Cases of Bone Fractures – For instance, approximately 160 million new cases of bone fractures were observed across the globe in 2019. There can be several reasons for bone fracture and it takes a particular procedure the fix the broken bone. Bone fractures are very painful and discomforting but with the assistance of upgraded tools, the pain and discomfort can be avoided. Orthopedic power tools are highly used by orthopedics to fix bones. These devices are osteotomes, plate blenders, bone-cutting forceps, Gigli saws, surgical spoons, suture anchors, and others. Therefore, such a higher requirement is anticipated to hike the growth of orthopedic power tools market during the forecast period.

- Increasing Health Spending – With rising disposable income and growing awareness about orthopedic diseases people are willing to spend more on orthopedic surgeries and overall healthcare. According to the most recent expenditure data, global health spending has grown over the past 20 years, doubling in real terms and reaching around USD 8.5 trillion in 2019 and it is predicted that this boom would continue over the projected time period.

- Growing Incidences of Spinal Cord Injuries – It is expected that patients with chronic illnesses and disabilities, including spinal cord injuries, need to undergo spinal surgery more frequently and which is anticipated to drive the market growth. It was discovered that between 300,000 and 500,000 people worldwide experience spinal cord injuries every year.

- Escalating Prevalence of Bone Cancer – In 2022, there were around 4000 new cases of bone and joint cancer, and 1 in 100,000 people die from the disease each year. Bone cancer weakens the bone and if diagnosed at an early stage physician often recommend to go under orthopedic surgery and which in turn is estimated to drive the market growth.

Challenges

-

High Risk of Contamination - The high risk of contamination owing to the chances of accumulation of bacteria on the surface of the tool which increase the possibility of infection and which can cause serious complications during and after the surgeries. Hence, this factor is predicted to hamper the market growth during the forecast period.

-

Requirement for Higher Initial Investment

-

Lack of Requisite Technology and Skilled Medical Professionals

Orthopedic Power Tools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 1.81 billion |

|

Forecast Year Market Size (2035) |

USD 2.71 billion |

|

Regional Scope |

|

Orthopedic Power Tools Market Segmentation:

Technology Segment Analysis

The global orthopedic power tools market is segmented and analyzed for demand and supply by technology into battery, electric, and pneumatic powered devices. Out of these, the battery powered devices segment is predicted to gain a largest market share during the forecast period. The growth of the segment can be attributed to the increasing demand for battery operated devices, supported by the rising investment by major manufacturers into this segment. In addition to this, the rising investment in research and development in the field of medical devices to make them more durable, power-efficient, and cost efficient is estimated to propel the market growth. For instance, in 2019, the entire amount spent on medical technology worldwide reached around USD 30 billion, while the sector's income reached approximately USD 450 billion.

End-user Segment Analysis

The global orthopedic power tools market is also segmented and analyzed for demand and supply by end-user into hospitals, clinics, and other specialty clinics. Among these, the hospitals segment is anticipated to capture significant market share during the forecast period. The growth of the segment can be attributed to the rising cases of bone related disease, growing geriatric population with disability who requires the fulltime assistance and generally admits in to hospitals. Moreover, increasing investment in the hospitals, rising healthcare expenditure, and the availability of the dedicated orthopedic section in the hospital are predicted to fuel the segment growth over the ensuing years. It was noted that spending on health care in the United States increased 2.7 percent in 2021 to USD 4.3 trillion, or USD 12,914 per person. Total expenditure on healthcare accounted for more than 18 percent of the region's GDP.

Our in-depth analysis of the global orthopedic power tools market includes the following segments:

|

By Orthopedic Power Tools |

|

|

By Product Type |

|

|

By Technology |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthopedic Power Tools Market Regional Analysis:

North American Market Insights

North America region is expected to account for more than 52% market share by 2035, due to the high rate of amputations and advanced healthcare infrastructure. It is estimated that in the United States, every year, nearly 170,000 amputation procedures take place and around 3.5 million people are estimated to be with limb loss by the year 2050. Furthermore, the presence of key market players in the region and growing investment by them in the leading medical devices to make surgeries more easy and cost efficient is predicted to propel the orthopedic power tools market growth. Additionally, the availability of patient friendly healthcare policies and the rising government campaigns promoting the healthcare awareness among the people in the region is anticipated to support the market expansion over the upcoming years.

Orthopedic Power Tools Market Players:

- NSK/Nakanishi Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- CONMED Corporation

- India Medtronic Private Limited

- Zimmer Biomet, Inc.

- Kaiser Medical Technology Ltd

- Johnson & Johnson Services, Inc.

- Allotech Co., Ltd

- B. Braun SE

- Medtronic PLC

Recent Developments

-

Stryker Corporation to unveil its new product, Pulse Intelligent Delivery Platform. This product was launched at the 2022 American Orthopedic Foot & Ankle Society annual meeting. The product, Pulse Intelligent Delivery Platform, is developed to provide assistance in foot & ankle surgeries in ambulatory surgery center (ASC) settings.

-

Zimmer Biomet, Inc. to go into a strategic collaboration with Surgical Planning Associates, Inc. The collaboration has taken place to commercialize HipInsight, a mixed reality navigation system for total hip replacement. The system has also been approved by the U.S. Food and Drug Administration.

- Report ID: 4433

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orthopedic Power Tools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.