Global Orthopedic Implant Market Outlook:

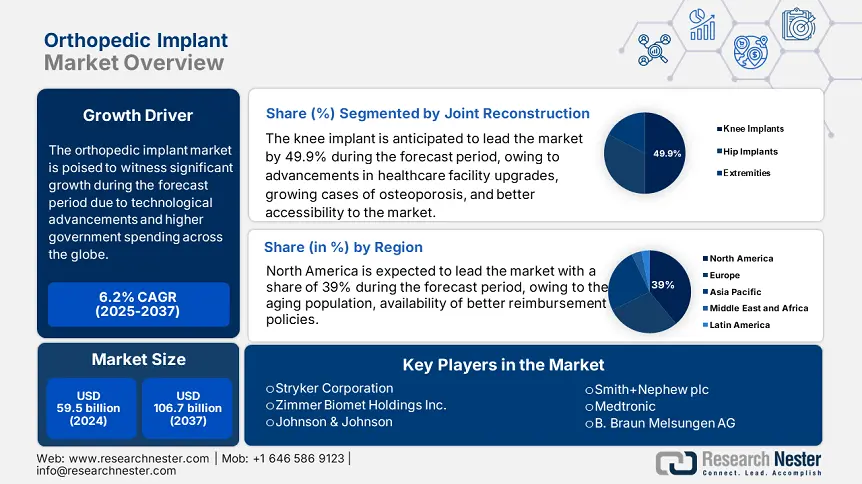

Orthopedic Implant Market size was valued at USD 59.5 billion in 2024 and is expected to reach around USD 106.7 billion by 2037, registering at a CAGR of 6.2% during the forecast period from 2025 to 2037. In 2025, the industry size of orthopedic implants is assessed at USD 62.3 billion.

The ageing global population has resulted in growing health issues of osteoarthritis and osteoporosis. As per the report published by WHO, demand for joint replacement is likely to rise by 12.9% by 2037. This is an anticipated driving factor for the expansion of orthopedic implants within the global market. Technological advancement acted as a catalyst within the orthopedic implant market and elevated the success rate and quick relief from severe pain. Customization and elevated outcomes are efficient aspects in pooling a large throng within the specified health care market.

The affordable and easily accessible price structure of the treatment procedure within the orthopedic implant has created an inclusive environment. The data published by the Bureau of Labor Statistics, Producer Price Index (PPI), increased by up to 5.01%, and CPI escalated to 5.2% in 2024. The insurance company plays a leading role in collaborating with the government to foster the market. The developed nations are likely to provide 100% insurance coverage, resulting in widespread access to treatment and expansion of the market.

Orthopedic Implant Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancement: Technological advancement is a leading driving factor in the expansion of the orthopedic implant market. 3D printing has elevated the specified implementation procedure and better outcomes within the treatment procedure. According to the report published by the Food and Drug Administration, the Orthopedic Device Program has ensured better safety and better performance as per the regulatory science research. The initiative has led to establishing evaluation strategies like preclinical mechanical, biological assessment with the help of novel devices of orthopedic. Driving demand within the market and better outcomes for patients are achieved through technological advancement.

- Government Spending: Growth of the orthopedic implant market is largely dependent on the government support and assertive initiatives for better R&D. For instance, the U.S. allocated approximately USD 8.2 billion in 2023 as government spending on orthopedic implants. Heavy investment is conducted within Germany through its public health insurance system for orthopedic care, which estimates approximately 2.2 billion annually. Accessibility in the market of orthopedic implantation has increased due to higher insurance spending and government funding for better infrastructure development.

Manufacturing Strategies for Orthopedic Implant Market Expansion

The market of orthopedic implants has gradually increased from 2010 to 2020 due to relevant driving factors and enhancements. For instance, advanced health care infrastructures resulted in the growth of orthopedic implants in the U.S. market. Incorporation of latest technologies like 3D printing has enabled Stryker to conduct cost-effective and customized complex implantation in the hip and spine. Supply chain management through vertical integration is the most strategic move by Zimmer Biomet that ensured a constant supply of titanium and cobalt-chrome. Collaborating with the potential suppliers and maintaining consistency of the product inflow is maintained to align with the growing demand within the market.

|

Company |

Strategy Implemented |

Projected Revenue Impact (USD) |

Implementation Year |

|---|---|---|---|

|

Stryker |

Implementation of 3D printing and cost-effective service to their patients |

1.2 billion |

202o |

|

Zimmer Biomet |

Vertical integration in the supply chain management. |

951 million |

2021 |

|

Smith+Nephew |

The usage of automation and robotics to elevate manufacturing precision and reduce errors. |

1.07 billion |

2023 |

|

Johnson & Johnson DePuy Synthes |

Alignment of the production with the regulations of the FDA, MDR and EU to ensure ethical credibility and safety of the process |

421 million |

2022 |

Key Feasibility Models for Orthopedic Implant Market Upliftment

Amalgamating the strategies like regional market insight, technological integration, and many more strategic expansion models established and implemented in the market. For instance, market of India experienced an escalation through collaborating with the suppliers and regional healthcare providers, which delivered a revenue surge by 13% from 2022 to 2024. Implementing the joint venture market expansion strategy with the domestic manufacturer has enabled the market of China to earn an escalation of 15% in revenue generation. Enrichment of the research and development within North America has expanded the scope of market growth. As per the published data of the U.S. National Institute of Health budget of more than USD 190 million has been vested for advancement in scientific research and technological integration within the orthopedic implantation process.

The following is a display of global revenue increased based on expansion models between 2022-2024

|

Region |

Expansion Model |

Revenue Impact (%) |

|

India |

Partnership with local healthcare providers |

+280 million |

|

U.S. |

Higher investment for better innovation |

+ 3 billion |

|

Germany |

Integration with national health initiatives |

+500 million |

|

Europe |

Acquisition policy implementation and partnership |

+1.2 billion |

Challenges

- Regulatory hurdles: Complexity in regulatory protocol and reimbursement limitations are the prime barriers for the market worldwide. High cost of orthopedic plant face barrier in achieving the targeted revenue generation from the market due to government intervention in price control. Lack of adequate awareness of the device's price among physicians in the U.S. has created a gap in market performance. According to the regulation implemented by the Medical Device Regulation of Europe, a higher clinical assessment and critical evaluation of post-market surveillance is mandatory. This has delayed the approval procedure to launch a new product in the concerned market and raised the compliance cost.

- Access disparities: Patients who possess a low to medium scale of income face higher barriers to accessing the treatment with orthopedic transplant. Collaboration of nonprofit organization and government agencies has not yet taken the higher initiatives to enhance the accessibility which cripples the market expansion equally. Accessing the treatment for joint and bone issues with the help of an orthopedic implant requires adequate eligibility criteria. Fulfilling the range of BMI, hemoglobin presence, and many more aspects ensures a proper success rate of the orthopedic replacements. This often limits access within the population and creates disparities within the market.

Orthopedic Implant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.2% |

|

Base Year Market Size (2024) |

USD 59.5 billion |

|

Forecast Year Market Size (2037) |

USD 106.7 billion |

|

Regional Scope |

|

Orthopedic Implant Market Segmentation:

Joint Reconstruction Segment Analysis

Based on joint reconstruction, the knee implant dominating the market, it is projected to achieve a market share of 49.9% in 2037. Advances in the implantation procedure and higher accessibility rates have expanded the market on a wide scale within the global platform. Leading position of the segment within the global market is significant due to growing cases of osteoarthritis and keen injuries. Technological advancements like robotic knee replacement are considered to be the most highly adopted driving factor for the concerned market.

Spinal Implants Segment Analysis

Based on spinal implants, the thoracolumbar fusion most demanding sub-segment that possesses higher revenue-generating ability. The projected market share accumulation by the concerned segment in 2037 is 12.8%. Cases of spinal disorder, spinal deformities, and many more have resulted in a growing demand for spinal implant treatment in the market. The leading companies, like Stryker and Medtronic, provide the services, and a drastic switch to minimally invasive surgery is offered.

Our in-depth analysis of the global orthopedic implant includes the following segments:

|

Segment |

Subsegments |

|

Joint Reconstruction |

|

|

Spinal Implant |

|

|

Trauma Implant |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthopedic Implant Market Regional Analysis:

North America Market Insights

North America is considered to be the leading region within the global platform that possesses the largest market share within orthopedic implants. A projection to achieve a market share of 39% with a growth of CAGR 5.9% in 2037 is anticipated for North America within the orthopedic implant market. Ageing population and reimbursement policies of medical insurance, along with advanced technology, have expanded the market of orthopedic implants in North America. Leading technological innovations like 3D implantation and AI assessment reduce the cost of knee transplantation by approximately 60%, which expands the accessibility rate of the market.

The orthopedic implantation market of the U.S. is projected to achieve a 38.9% market share by 2037. Government allocated more than USD 4.9 billion in 2024, according to the data published by the National Institute of Health. This has allowed the healthcare services to adopt orthopedic implantation and elevate their infrastructure. Expansion of patient accessibility within the market orthopedic implantation is ensured through the allocation of USD 1.4 billion by Medicaid. Furthermore, technologically development within the concerned market is fostered through fund allocated by NIH which is approximately more than USD 450 million.

A projected market expansion of Canada in orthopedic implants is predicted to achieve a market share of 7.01% by 2037. The federal government has taken a sincere approach to allocate a budget of more than USD 3 billion, which is almost 8% of the total healthcare financial allocation for the development of orthopedic implants. Specifically, the extraordinary decision of Ontario to invest approximately USD 70 million in 2023 to minimize the waiting hours for surgical operations is highly commendable. This has resulted in resolving more than 26,000 cases suffering from musculoskeletal issues.

Europe Regional Market Insights

A relevant growth is addressed within the market of Europe. it is predicted to achieve a market share of 28.7% by 2037. As per the statistical data of the European Union, an anticipated growth in the ageing population is approximately 26% by 2037. The adult population is likely to have the complication of joint back pain, which creates significant demand for orthopedic implants. Robotic and AI-assisted technology has achieved a higher success rate and expanded the market. A fund of more than €2 is invested by the EU Health Fund for research and development to enhance the service of orthopedic implants.

Germany is identified as one of the highest revenue accumulation markets and is expected to be a leading player with a market share of .32.8% by 2037. Advanced healthcare infrastructure and procedures to conduct orthopedic surgical processes have expanded the market. According to report published by the Federal Ministry of Health, allocation of €4.2 billion for the enhancement of orthopedic infrastructure and the integration of robotic system. The robotic knee implant trend in Germany is considered to be the key driver for market escalation, with a market penetration of approximately 52%.

The growing ageing population within the territory of the UK has created a suitable environment for the business conduct of orthopedic implants. An expectation to achieve a market share of 23.2% by 2037 is predicted for the market of UK. As per the information published by the National Health Service of the UK, approximately 5 billion British Pounds is allocated for hip and knee transplant treatment. As per the market analysis by the NHS, High demand in the orthopedic market is expected to achieve more than 670K joint replacements annually by 2037.

Key Orthopedic Implant Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Strategic expansion strategies and inclusion of digital technology have resulted in a massive expansion of the market and established a highly competitive nature of market. Possession of 45% of the market share by dominant companies like Stryker, Zimmer Biomet, and many more is experienced within the global market. Innovation is the key strategy for companies like Smith+Nephew to gain market position through the incorporation of minimally invasive procurement of surgery. Penetration within the Asia-Pacific region is the keen focus of the dominant companies because of their growing possibilities.

Here is a list of key players operating in the global market:

|

Company Name |

Country of Origin |

Market Share (2024) |

|

Stryker Corporation |

U.S. |

14.8% |

|

Zimmer Biomet Holdings, Inc |

U.S. |

11.9% |

|

Johnson & Johnson |

U.S. |

10.7% |

|

Smith+Nephew plc |

UK |

5.8% |

|

Medtronic |

|

4.9% |

|

B. Braun Melsungen AG |

Germany |

xx% |

|

Medacta International SA |

Switzerland |

xx% |

|

Wright Medical Group N.V |

Netherland |

xx% |

|

Exactech, Inc. |

U.S. |

xx% |

|

Biosense Webster |

India |

xx% |

|

Corin Group |

Australia |

xx% |

|

Osteopore International |

Malaysia |

xx% |

|

AK Medical Holdings Limited |

China |

xx% |

|

NuVasive, Inc. |

U.S. |

xx% |

|

NuVasive, Inc. |

U.S. |

xx% |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In August 2023, Zimmer Biomet incorporated the Persona IQ Smart Knee Implant. This is addressed as the first smart knee within the global platform, which can track key metrics of monitoring like walking speed, range of motion and many more.

- In February 2025, Stryker launched the Mako 4 Robotics Platform, which will be an innovative solution for treatment within Total Hip, Knee and Spinal implant treatment. Workflow efficiency as well as surgical precision have been elevated through fourth-generation Q assistance.

- Report ID: 7778

- Published Date: Jun 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orthopedic Implant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert